The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

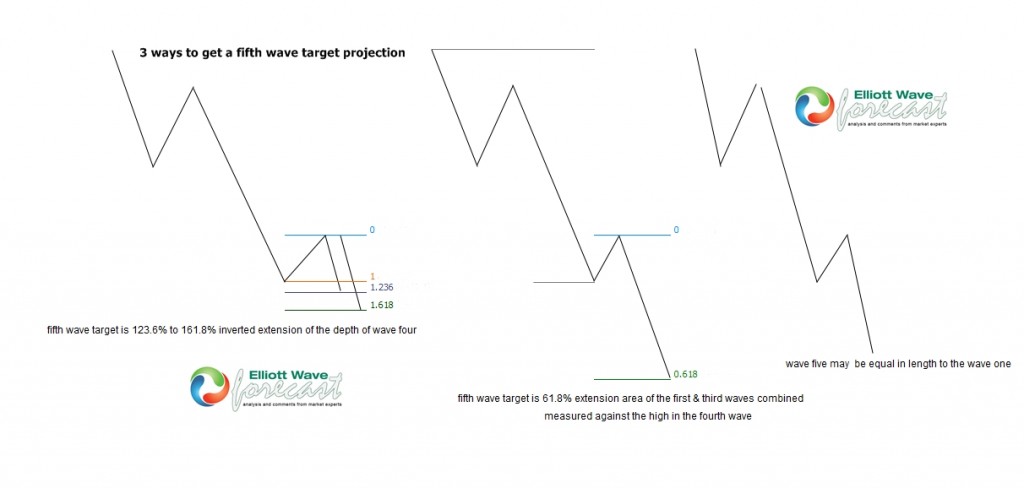

How to Get an Elliott Wave Fifth Wave Target

Read MoreIn either a bullish or bearish market, whether the Elliott Wave trend is up, down, or the cycle and degree of the wave is either bullish or bearish, wave five targets can be obtained these following three ways in any degree of trend. This list is not definitive in any particular order of preference because […]

-

$SI_F (Silver) 1 Hour Elliott Wave Analysis 6.17.2014

Read MorePreferred view is that cycle from 22.17 high is over i.e. wave ( A ) and wave ( B ) bounce is in progress. Following a pull back in wave B (which can reach as low as 19.09 – 19.25) metal is expected to turn higher in wave C which can reach as high as […]

-

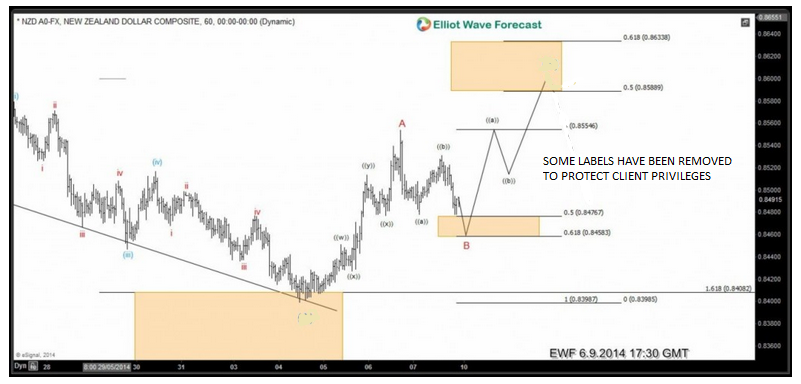

NZDUSD: Forecasting the bounce

Read MoreNZDUSD has been moving higher against USD for the last few days. Yesterday (11 June 2014), pair made a spike lower followed by a sharp move to the upside and then we heard people saying it was due to the rate decision from the Bank of New Zealand (and we still don’t know what they […]

-

$IBC-MAC IBEX 1 Hour Elliott Wave Analysis 6.11.2014

Read MorePreferred view suggests dip to 10667 completed wave B of Y. Index can reach as high as 11403 to complete wave ( W ). Index should then do a larger 3 wave pull back and resume the rally. Risk / Reward ratio is not great for longs here so we don’t like chasing strength at […]