The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

USDJPY Short-term Elliott Wave Analysis 11.25.2014

Read MoreDaily cycle in the pair is very stretched and a decent pull back could start at any moment but there is no confirmation yet that daily cycle has ended so trading strategy ns the shorter cycles is still to buy the dips in the sequence of 3, 7 and 11 swings. Pair has already done […]

-

USDJPY Elliott Wave Setup Video

Read MoreWe take a look at USDJPY in today’s video. Daily cycle in the pair is very stretched and a decent pull back could start at any moment but there is no confirmation yet that daily cycle has ended so trading strategy in the shorter cycles is still to buy the dips in the sequence of […]

-

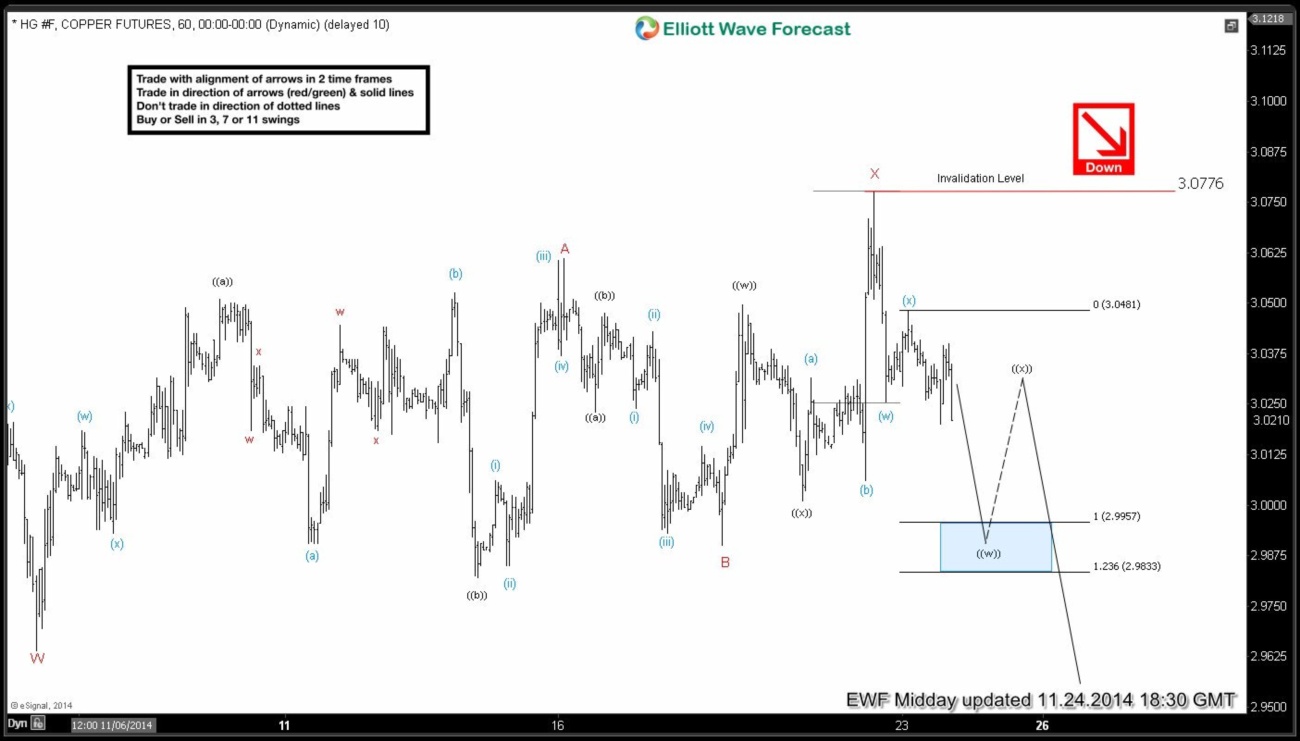

$HG_F (Copper) Elliott Wave Video

Read More$HG_F (Copper) has been rejected in every rally and we maintain our bearish Elliott Wave view on Copper for at least another extension lower. We think new high & failure seen on Friday completed wave X and next leg lower has started. Near-term focus is on 2.995 – 2.983 area to complete wave (( w )) […]

-

$HG_F (Copper) Short-term Elliott Wave Analysis 11.24.2014

Read More$HG_F (Copper) has been rejected in every rally and we maintain our bearish Elliott Wave view on Copper for at least another extension lower. We think new high & failure seen on Friday completed wave X and next leg lower has started. Near-term focus is on 2.995 – 2.983 area to complete wave (( w )) […]