The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Crude Oil – CL – 240m Technicals and Trade Plan

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily from 12:30 PM EST (5:30 PM BST), join Dan there for more insight into these proven methods of trading. EURJPY – […]

-

$HG_F (Copper) Short-term Elliott Wave Analysis 2.4.2015

Read MoreMetal made a marginal new low below 2.423 and started recovering we are going with the idea of a double correction in wave (( X )) as per preferred Elliott Wave view and expected to test 2.633 – 2.684 region before decline resumes. Ideally expected price to stay below 1.618 ext at 2.766 for a turn lower. […]

-

EURGBP Short-term Elliott Wave Analysis 1.26.2015

Read MorePreferred Elliott wave view suggests wave (W) ended at 0.7593 and wave (X) ended @ 0.7714. Wave “W” is proposed to be over at 0.7403. Wave “X” bounce is in progress & could reach as high as 0.7558 – 0.7597 (50 – 61.8 fib) area before decline resumes. We don’t like buying the pair & expect sellers to keep […]

-

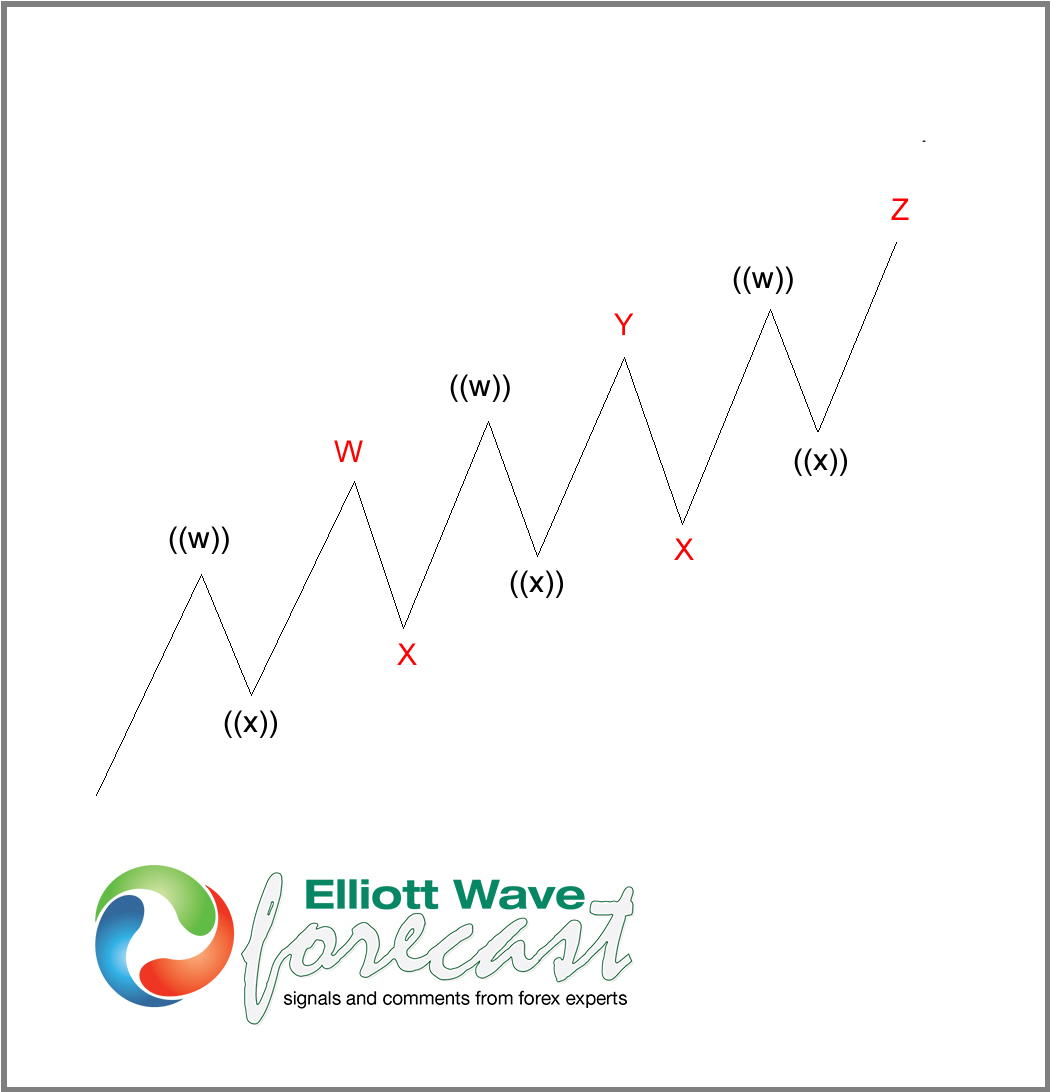

Triple Three Elliott Wave Structure

Read MoreIn this blog, we will take a look at Elliott Wave Triple Three structure wxyz. WXYZ is an 11 swing Elliott Wave structure which looks like below: From the chart above, we can see red W, red X, red Y, red X, and red Z. Each leg of WXYZ Elliott Wave structure has 3 swing subdivisions ((w)), ((x)), and ((y)). A […]