The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

GBPNZD Short-term Elliott Wave Analysis 2.9.2015

Read MorePreferred Elliott Wave view suggests pair has ended a cycle from 1.9237 low as a triple three structure at 2.0935. We have labelled this wave “W” and a pull back in wave “X” is now in progress as a double three Elliott wave structure or a (( w )) – (( x)) – (( y […]

-

$INDU (Dow) and Elliott Wave Hedge

Read MoreIn this video we take a look at running FLAT Elliott Wave structure (3-3-5). In a running FLAT structure, wave C would fail to break the ending point of wave A. Dow (INDU) is showing an impulsive Elliott wave structure (5 wave move) up from 17037 (2/2) low and as far as RSI divergence remains […]

-

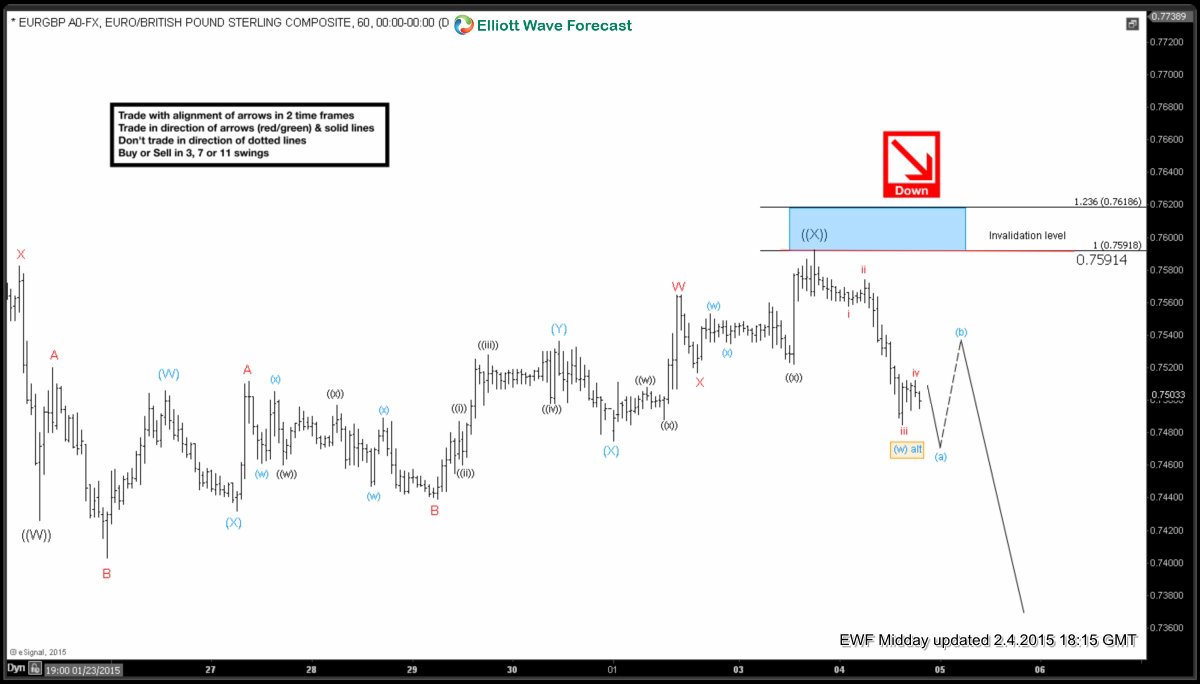

EURGBP Elliott Wave Setup Video

Read MoreOur mid-term Elliott Wave cycles remain firmly bearish in EURGBP. Pair tested the inflection area between 0.7591 – 0.7618, got rejected and turned lower as expected. Cycle from the lows is over so connector wave (( X )) is thought to be in place at 0.7591. Pair could test 0.7465 – 0.7449 area to finish […]

-

EURGBP Short-term Elliott Wave Analysis 2.4.2015

Read MoreOur mid-term Elliott Wave cycles remain firmly bearish in EURGBP. Pair tested the inflection area between 0.7591 – 0.7618, got rejected and turned lower as expected. Cycle from the lows is over so connector wave (( X )) is thought to be in place at 0.7591. Decline from this high is so far in 3 […]