The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

GBPUSD Live Trading Room – Trade Plan Recap

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily from 12:30 PM EST (5:30 PM BST), join Dan there for more insight into these proven methods of trading. GBPUSD […]

-

DAX Short Term Elliott Wave Analysis 6.3.2015

Read MoreDecline to 11167.55 completed wave W, and subsequent bounce in wave X took the form of a double correction ((w))-((x))-((y)) where wave ((w)) ended at 11710.41, wave ((x)) ended at 11218.54, and wave ((y)) of X was completed at 11916.17. From this level, the Index declines in wave ((w)) and the decline is taking the […]

-

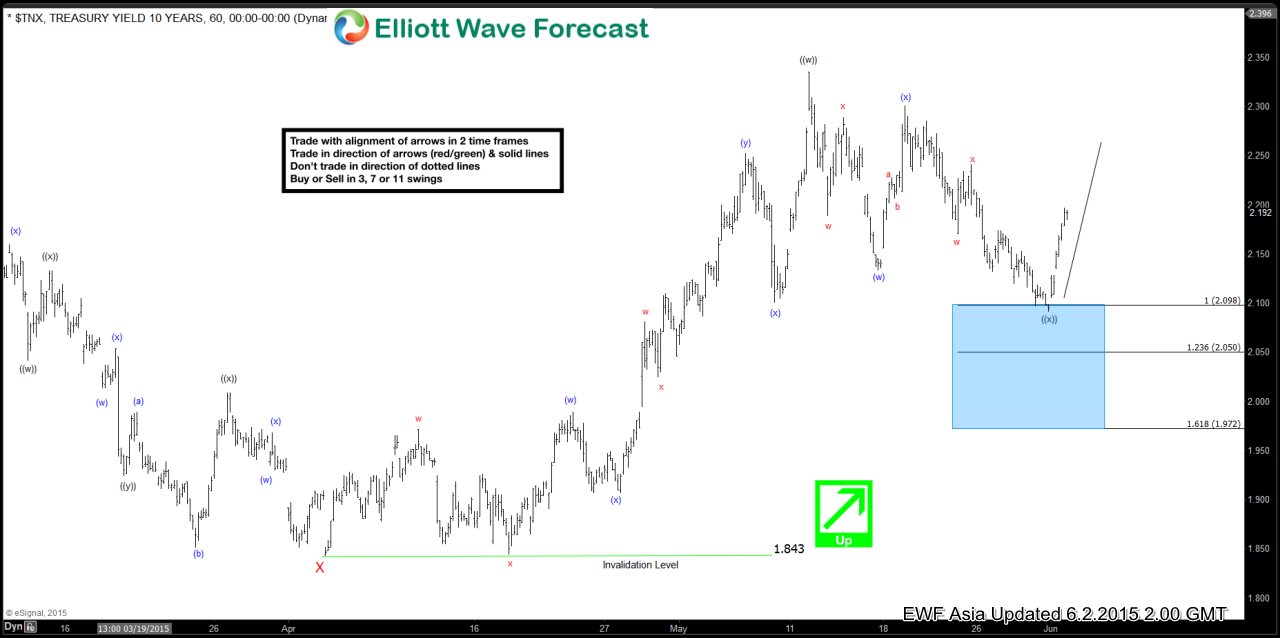

$TNX Short Term Elliott Wave Analysis 6.2.2015

Read MoreDecline to 1.843 completed wave X. From this level, $TNX rallied in wave ((w)) in the form of a triple correction (w)-(x)-(y)-(x)-(z) where wave (w) ended at 1.989, wave (x) ended at 1.907, wave (y) ended at 2.252, second wave (x) ended at 2.101, and wave (z) of ((w)) ended at 2.335. From the high of 2.335, $TNX declined […]

-

NZDCAD Long Term Elliott Wave Analysis 5.30.2015

Read MoreBelow are weekly and daily Elliott Wave analysis on $NZD/CAD, a pair that is not part of the 42 instrument currently covered by EWF, but the same Elliott Wave Principle and technique will be applied to analyze the pair. After watching the videos and reading the commentary below, if you are interested to learn more about Elliott Wave or how we […]