The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

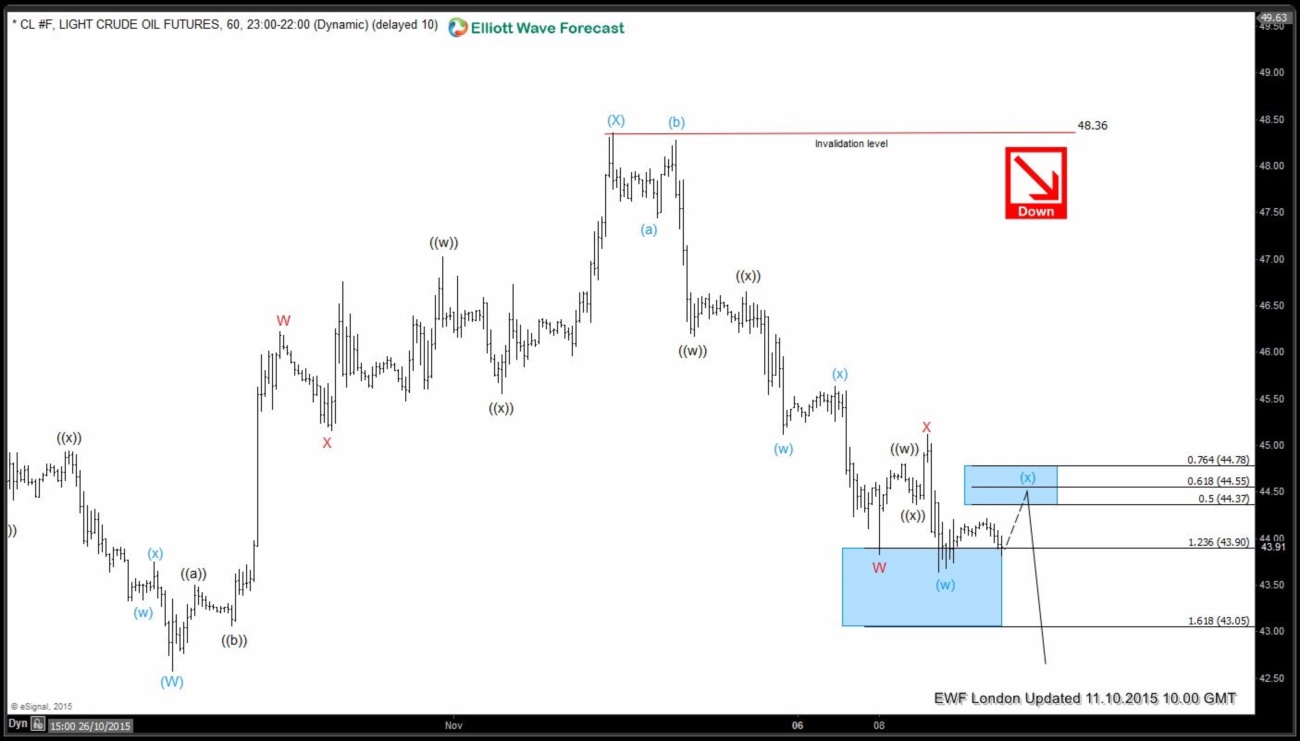

$OIL: Elliott Waves Forecasting the decline

Read MoreIn this blog we’re going to take a qucik look at the $OIL Elliott Wave chart from the 11.10.2015 to explain the structure and our view. We were forecasting the decline in $OIL from marked 50-76.4 fib ret zone: 44.37-77.78 toward h4 equal legs (W)-(X) : 40.13 area $OIL 11.10.2015 London As we can see […]

-

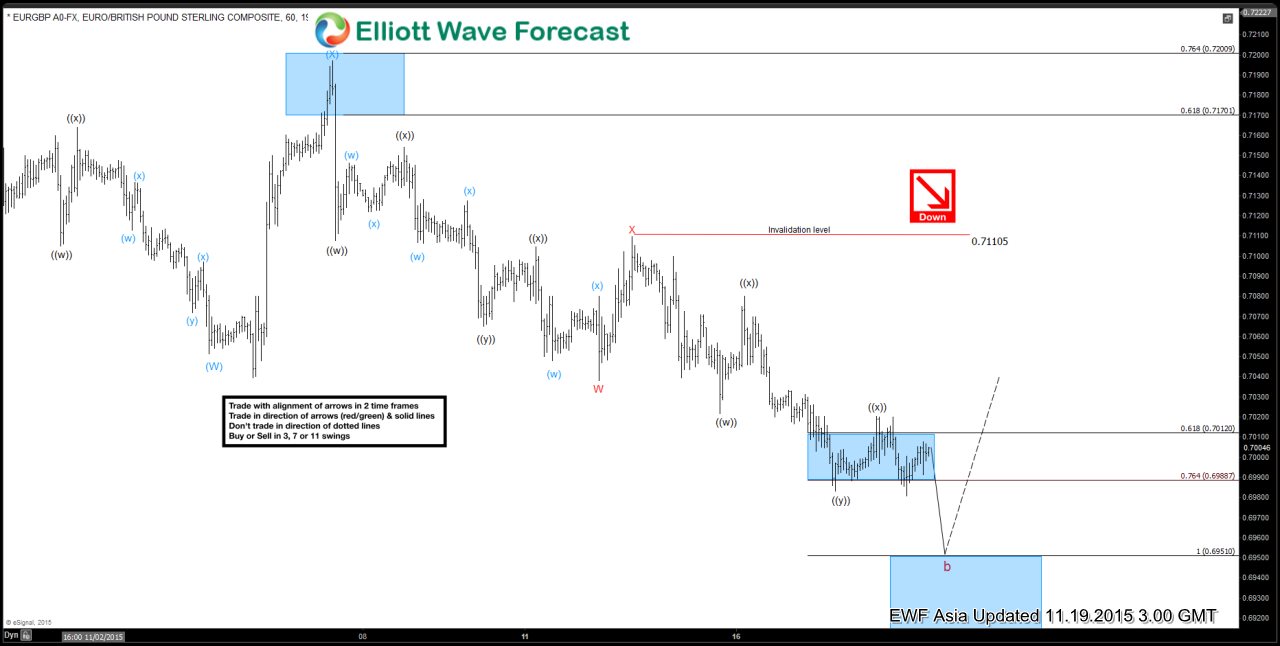

EURGBP Short Term Elliott Wave Update 11.20.2015

Read MoreShort term reading of the Elliott Wave cycle suggests decline to 0.705 ended wave (W) and bounce to 0.7197 ended wave (X). From this level, pair has resumed the decline lower in a double three structure where wave W ended at 0.7038, wave X ended at 0.711, and wave Y is in progress. Internal of wave Y is unfolding as a […]

-

EURGBP Short Term Elliott Wave Update 11.19.2015

Read MoreShort term reading of the Elliott Wave cycle suggests decline to 0.705 ended wave (W) and bounce to 0.7197 ended wave (X). From this level, pair has resumed the decline lower in a double three structure where wave W ended at 0.7038, wave X ended at 0.711, and wave Y is in progress. Internal of wave Y is unfolding as a […]

-

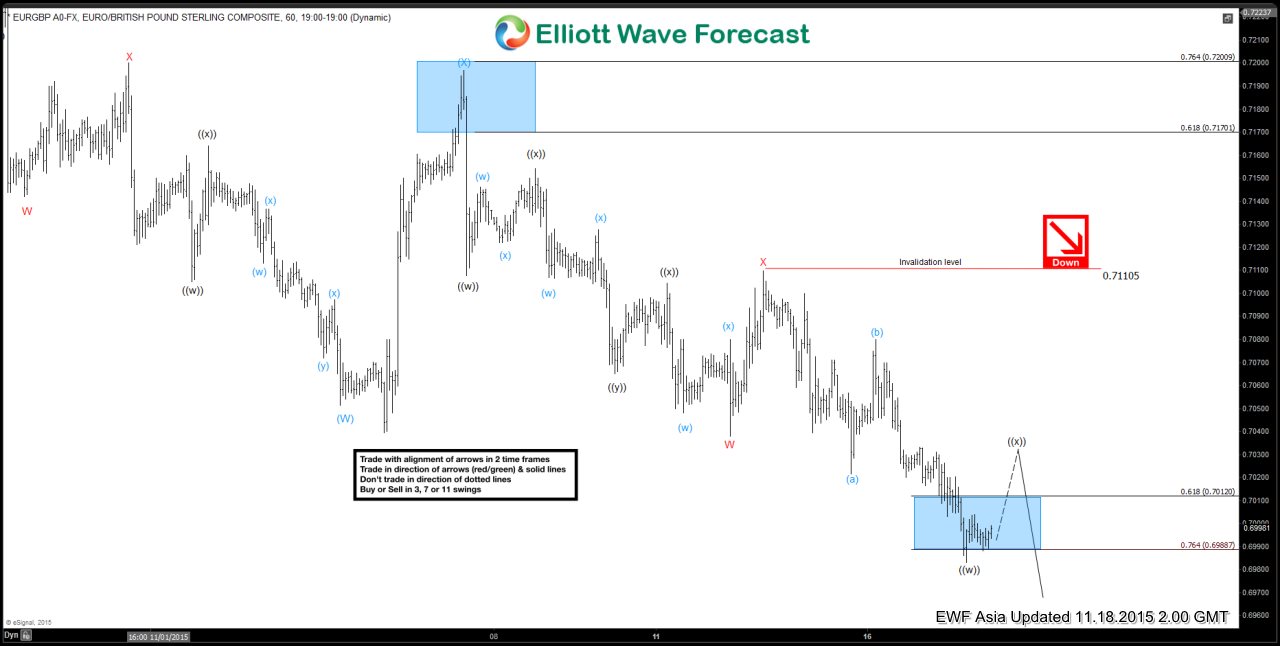

EURGBP Short Term Elliott Wave Update 11.18.2015

Read MoreShort term reading of the Elliott Wave cycle suggests decline to 0.705 ended wave (W) and bounce to 0.7197 ended wave (X). From this level, pair has resumed the decline lower in a double three structure where wave W ended at 0.7038, wave X ended at 0.711, and wave Y is in progress. Internal of wave Y is unfolding as a […]