The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

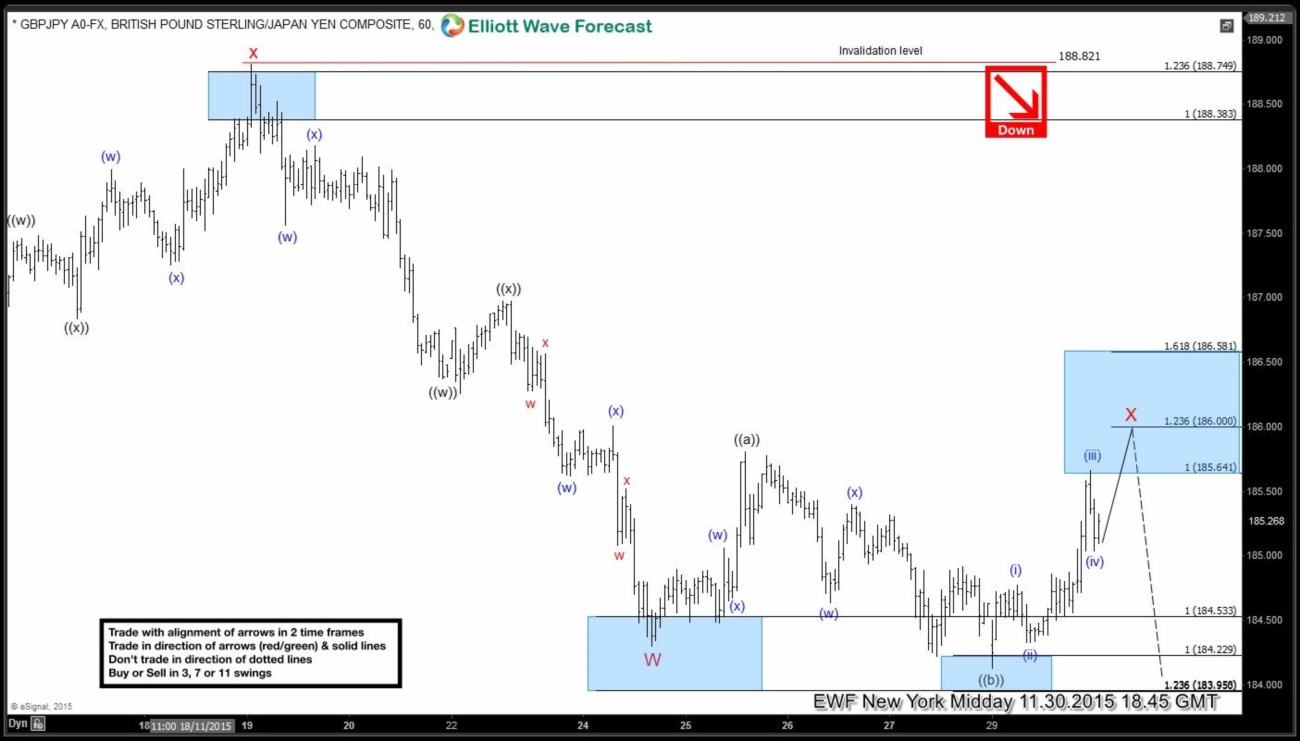

$GBPJPY Trading Plan Recap

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily at 8:00 AM EST , join Dan there for more insight into these proven methods of trading. GBP/JPY Live Trading […]

-

USDX and USDPLN | Technical & Fundamental Outlook

Read MoreThursday December 03 2015 – ECB Interest Rate Decision 14.45 – ECB Monetary Policy Statement and Press Conference 15.30 Friday December 04 2015 – European Gross Domestic Product (Q3 and YoY) – US Average Hourly Earnings – US Unemployment Rate – US Non-Farm Payrolls Wednesday December 16 2015 – FOMC ECB Monetary Policy Statement and […]

-

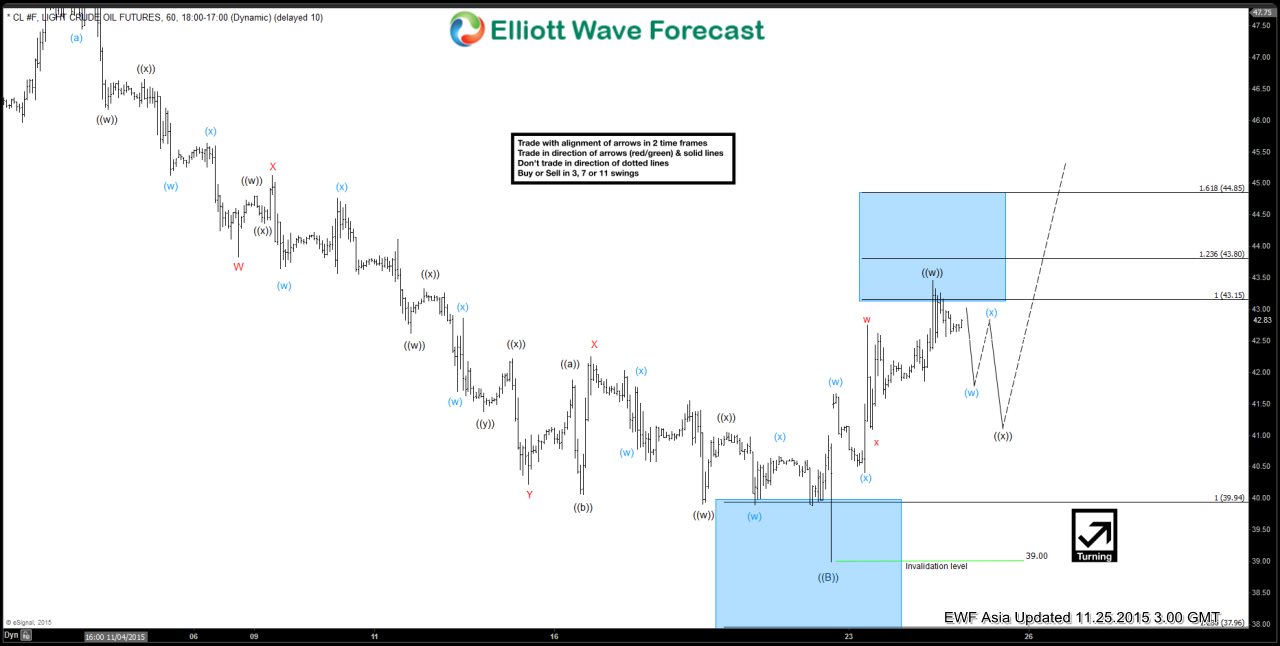

Oil Short Term Elliott Wave Update 11.25.2015

Read MoreShort term reading of the Elliott Wave cycle suggests the decline to 39 at 11/21 ended wave ((B)) and oil has turned higher in a double three structure where wave (w) ended at 41.66, wave (x) ended at 40.41, and wave (y) of ((w)) is proposed complete at 43.46. Wave ((x)) pullback is currently in progress to correct 11/21 cycle in […]

-

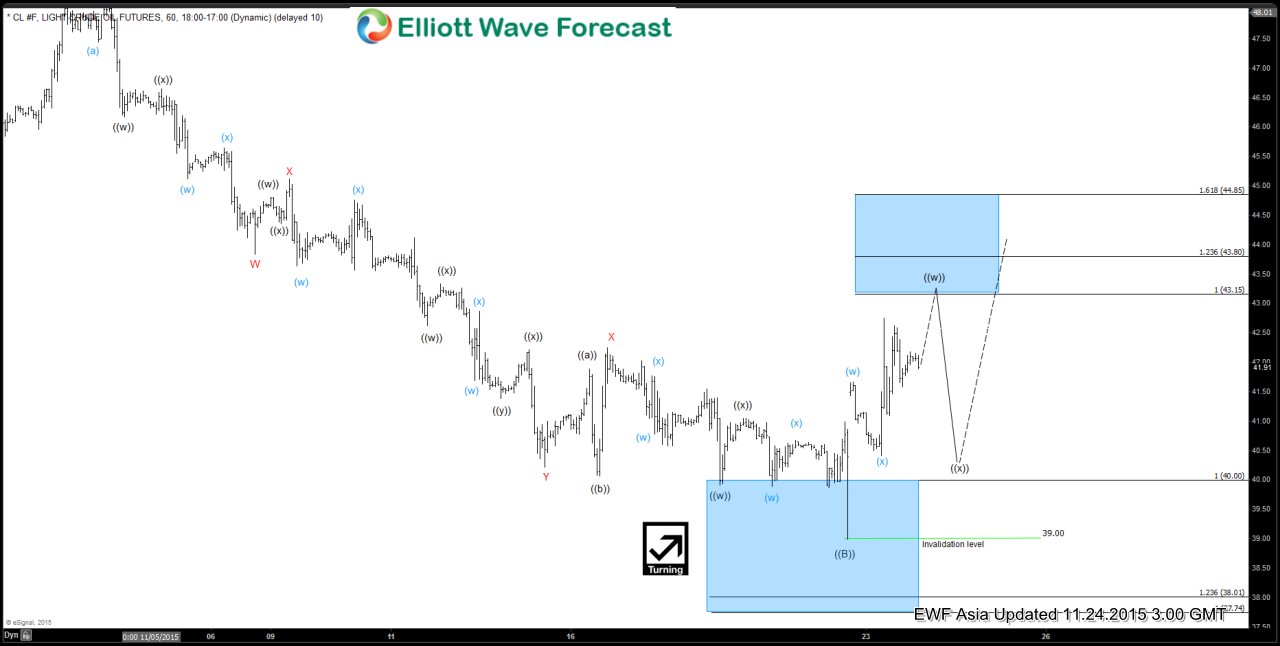

Oil Short Term Elliott Wave Analysis 11.24.2015

Read MoreShort term reading of the Elliott Wave cycle suggests the decline to 39 at 11/21 ended wave ((B)) and oil has turned higher in a double three structure where wave (w) ended at 41.66, wave (x) ended at 40.41, and wave (y) of ((w)) is in progress towards 43.15 – 43.8 to end the cycle from 11/21 low. Once […]