The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

$USDCAD Building Permits and BOC Governor Speaks on 12/08

Read MoreWe have 2 important news events for Canadian Dollar tomorrow on 12/08 2015 : -Building Permits at 1:30 PM GMT(UK Time) / 8:30 AM EST -Bank Of Canada Governor Stephen Poloz Speaks at 5:50 PM GMT(UK Time)/ 12:30 PM EST Both news events should ideally bring some volatility into CAD pairs, so they could finally complete current cycles. […]

-

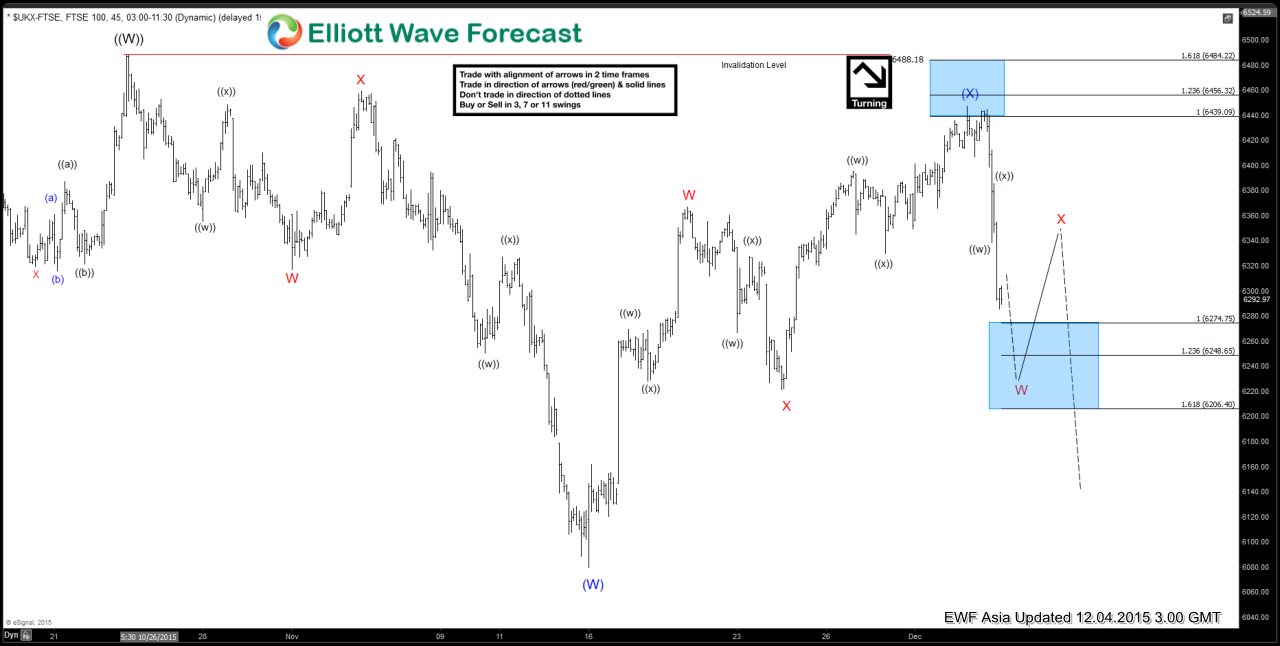

FTSE Short Term Elliott Wave Update 12.4.2015

Read MoreRevised short term reading of the Elliott Wave cycle suggests the decline from 10/23 peak at 6488.18 is unfolding as a double three where wave (W) ended at 6079.8, wave (X) ended at 6447.34, and wave (Y) is in progress. Internal of wave (Y) is also in a double three where wave W is expected to complete at 6206.4 […]

-

$GBPUSD Elliott wave forecast and Services PMI

Read MoreServices PMI December 3 at 9:30 AM GMT/ UK Time PMI (Purchasing Managers’ Index ) is one of the leading indicators of economic health and this announcment could bring some volatility in the GBP pairs on Thursday. Many retail traders will be looking the announcment at 9:30 AM GMT/ UK Time. As we know so […]

-

FTSE Short Term Elliott Wave Update 12.3.2015

Read MoreShort term reading of the Elliott Wave cycle suggests the rally from wave (4) low at 6079.8 is unfolding in a double three structure where wave W ended at 6366.8, wave X ended at 6221.04, and wave Y is in progress. Internal of wave Y is unfolding also in a double three where wave ((w)) ended at 6395.3, […]