The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

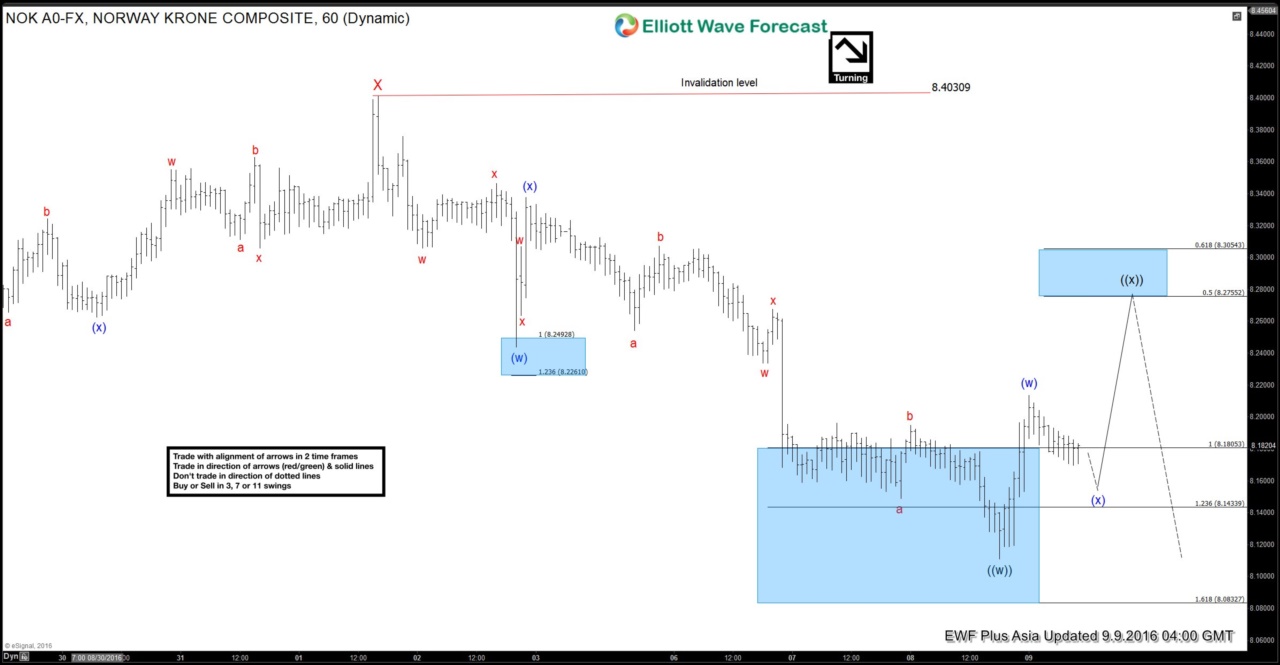

$USDNOK Short-term Elliott Wave Analysis 9.9.2016

Read MoreShort term Elliott wave count suggests that rally to to 8.403 ended wave X. Decline from there is unfolding as a double three where wave ((w)) ended at 8.11 and wave ((x)) bounce is in progress towards 8.275 – 8.305 area to correct the decline from 9/1 peak (8.403). As far as 9/1 pivot at 8.403 stays intact […]

-

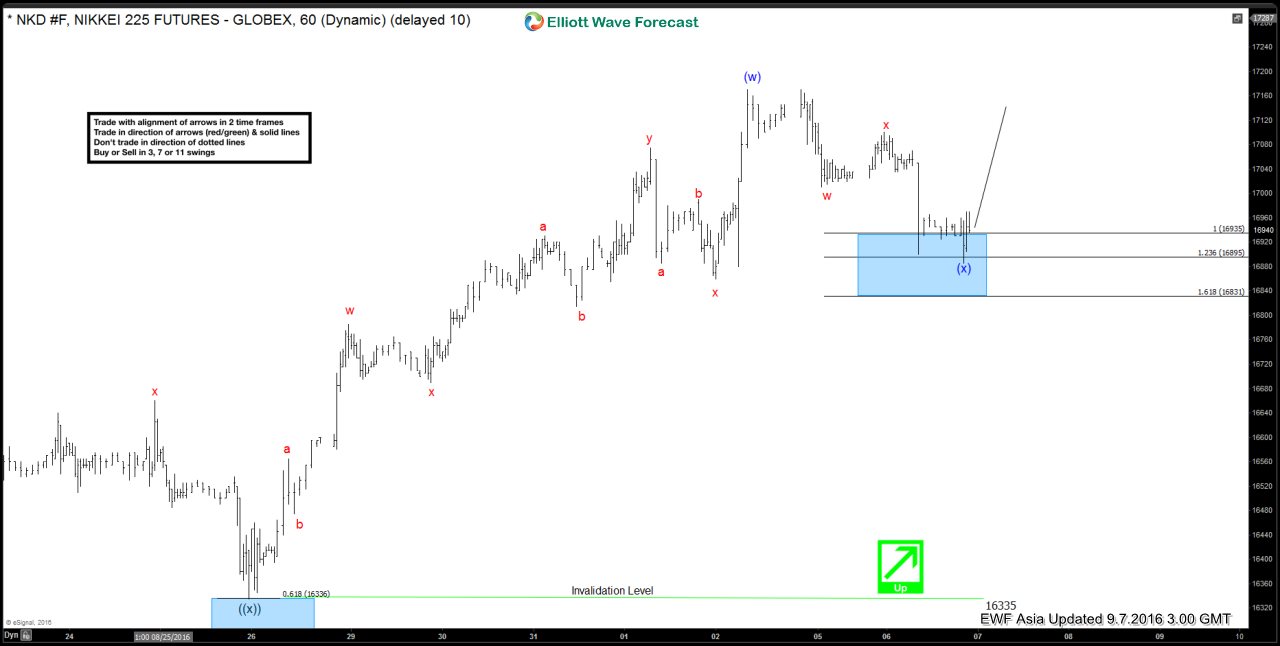

Nikkei $NKD_F Short-term Elliott Wave Analysis 9.7.2016

Read MoreShort term Elliott wave count suggests that decline to 16335 ended wave ((x)). Rally from there is unfolding as a double three where wave (w) ended at 17170 and wave (x) pullback is proposed complete at 16885. While Index remains above 16885, and more importantly as far as wave ((x)) pivot at 16335 stays intact, expect more upside in […]

-

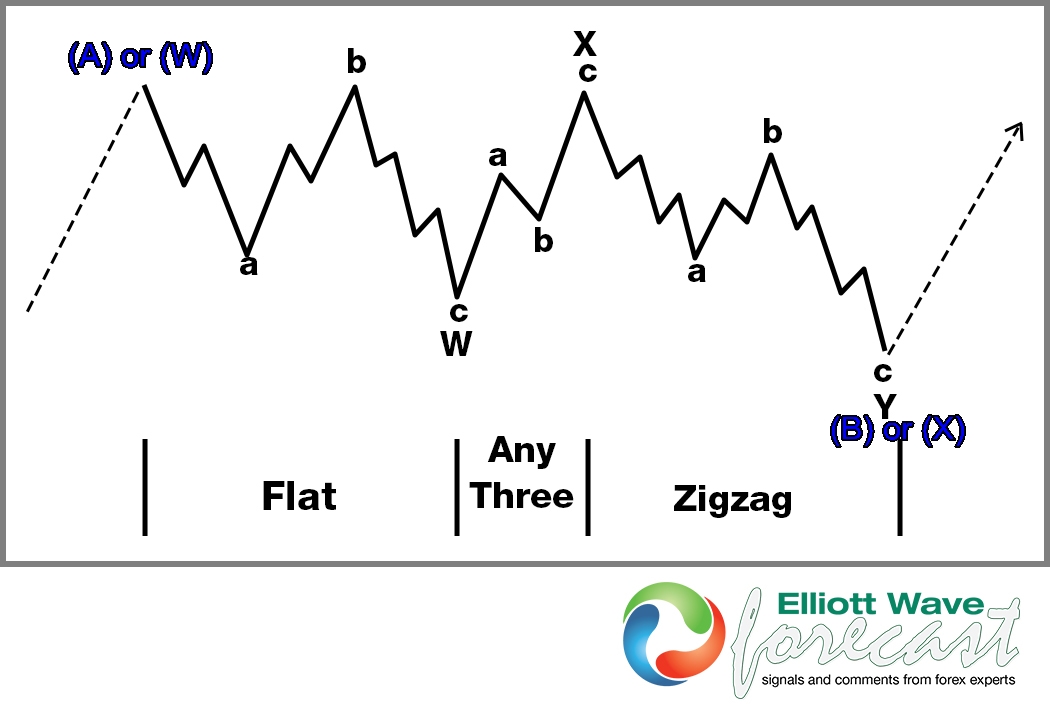

Elliott Wave Theory Structure : A Double Three Combination

Read MoreDouble three structures are common occurrences in the market and as it has been pointed out before they can also be the Elliott wave formation that a particular market instrument is trending within the larger degrees and time frames. As pointed out here before, it is simply impossible in some markets to get a legitimate […]

-

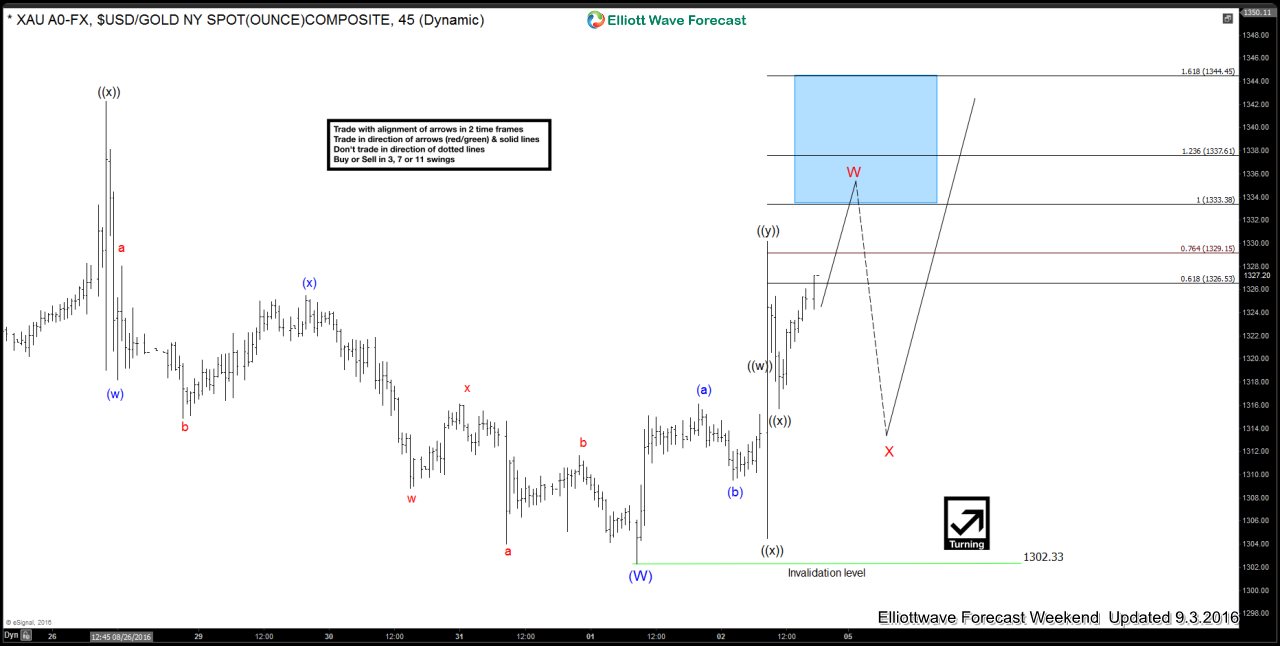

Gold $XAUUSD Short-term Elliott Wave Analysis 9.5.2016

Read MoreShort term Elliott wave count suggests that decline to 1302.33 on 9/1 low ended wave (W). Rally from there is unfolding as a triple three where wave ((w)) ended at 1315.23, wave ((x)) ended at 1304.5, wave ((y)) ended at 1330.2, and second wave ((x)) ended at 1315.7. While the metal stays above 1315.7 and more […]