The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

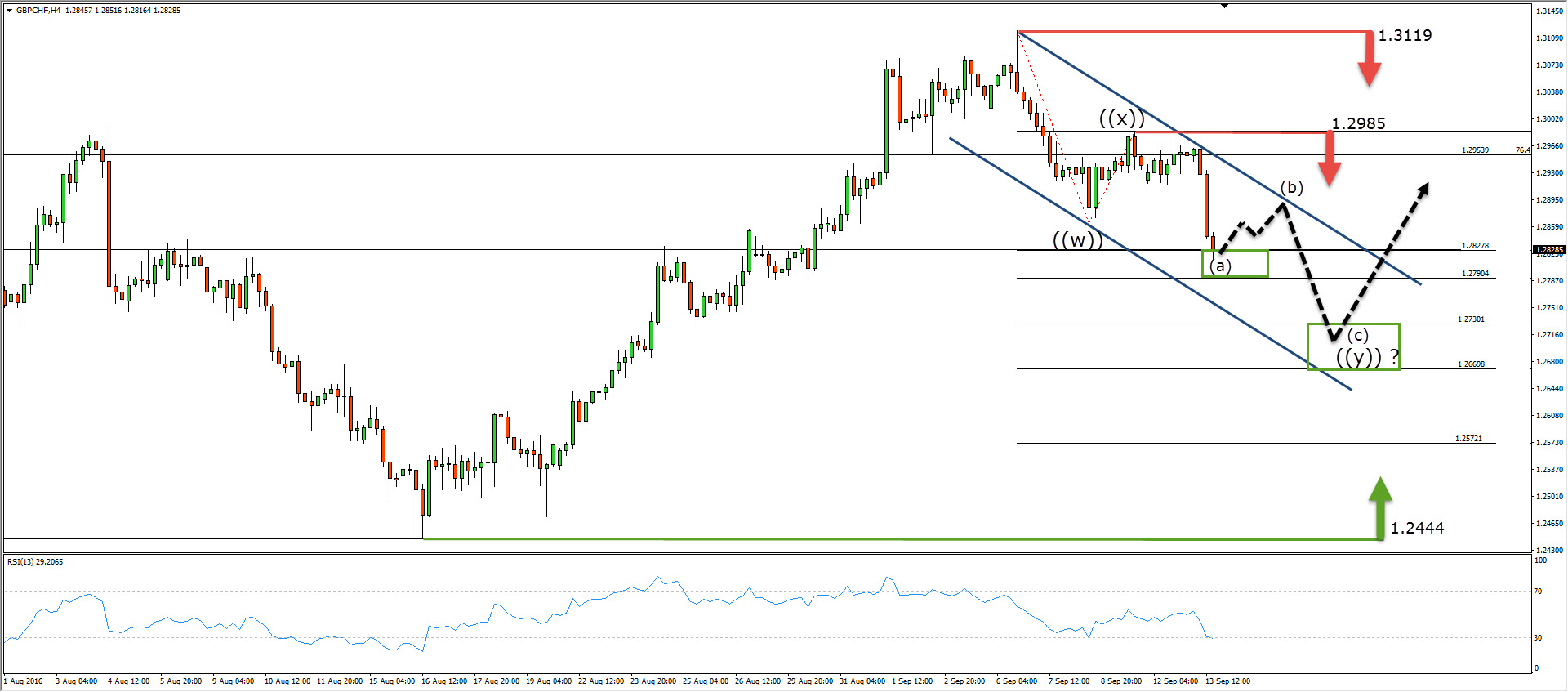

A technical look at $GBPCHF

Read More$GBPCHF Hello fellow traders, in this technical blog we’re going take a look at the short term Elliott Wave analysis of $GBPCHF currency pair. In the larger time frames we see the pair reached the extreme area in the daily cycle from the last year’s peak (19th November). It hit the important tech zone at 1.2444 […]

-

Wheat $ZW_F Short-term Elliott Wave Analysis 9.13.2016

Read MoreShort term Elliott wave count suggests that decline to 386.6 ended wave ((w)). Rally from there is unfolding as a double three where wave (w) ended at 406.6 and wave (x) pullback ended at 396.6. Short term, while pullbacks stay above 402.6, and more importantly above 396.6, expect more upside towards 416.5 – 421.3 area to complete wave ((x)) […]

-

The rise of Crypto-Currency : Bitcoin

Read MoreBitcoin is a digital currency distributed worldwide in which encryption techniques are used to regulate the generation of units of currency and verify the transfer of funds. Unlike traditional currencies such as dollars, bitcoins are issued and managed without any central authority whatsoever : there is no government, company, or bank in charge of Bitcoin. […]

-

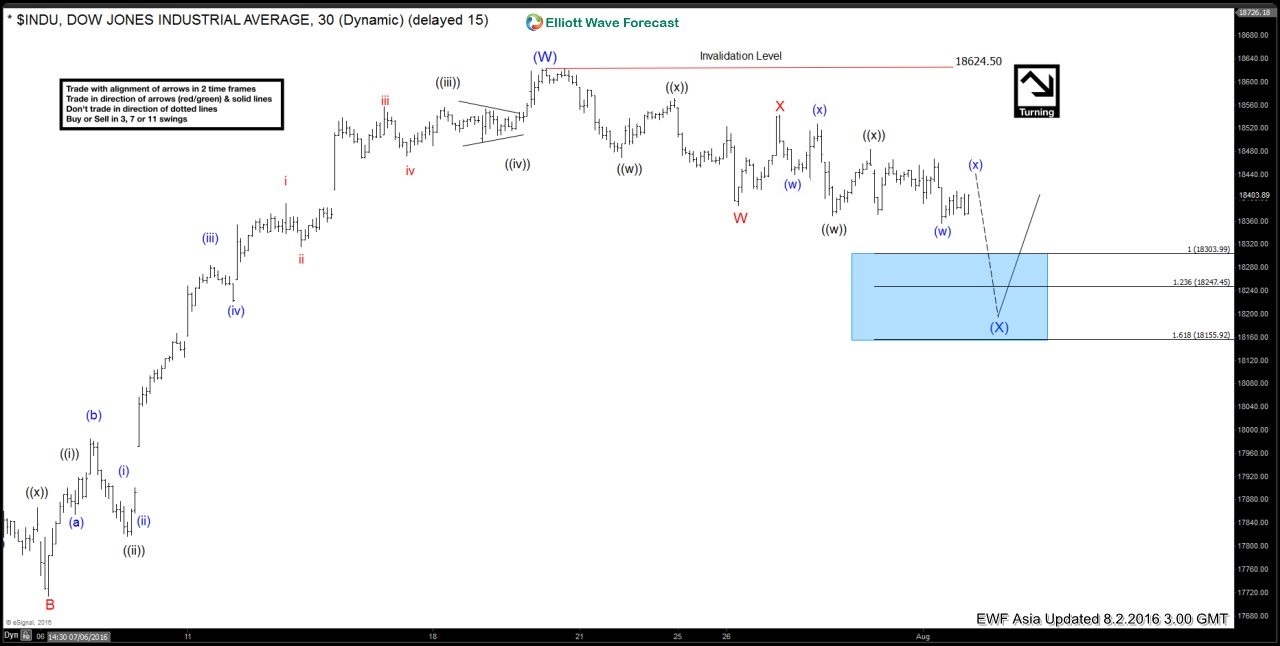

$INDU-DOW Double three Elliott Wave Structure

Read MoreGlobal Indices have seen an impressive start of Q3 as the major US indices are not tired of hitting new highs occasionally. With applause July dissemination among equity investors, capital bulls are flexing their muscles in August as well. At the beginning of last week, the indices hits fresh highs as US retail sales and […]