The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

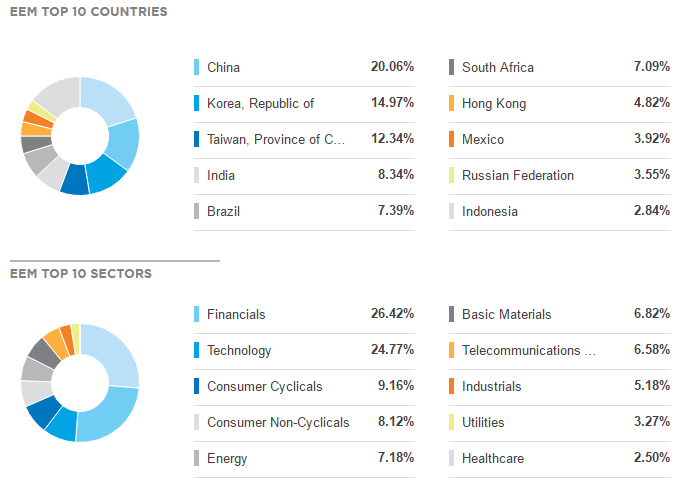

The Progress of Emerging Markets

Read MoreSince 2000 emerging markets and developing economies has grown rapidly becoming the driver of global growth , this progress is clearly confirmed in 2013 when emerging markets became the larger contributor in the global GDP and shifting the wheel of the world economy. A study based on projected GDP at purchasing power parities (PPP) for the G7 […]

-

The Case for Silver, Alexco, Hecla

Read MoreSilver rose to a new high of 2016 in the second quarter as a result of strong investor and speculative demand amid an environment macro support for precious metals. Overall this year silver has been a star performer. White metal ingots outshone well, marking an increase of 37 % compared to 22% increase in Gold. […]

-

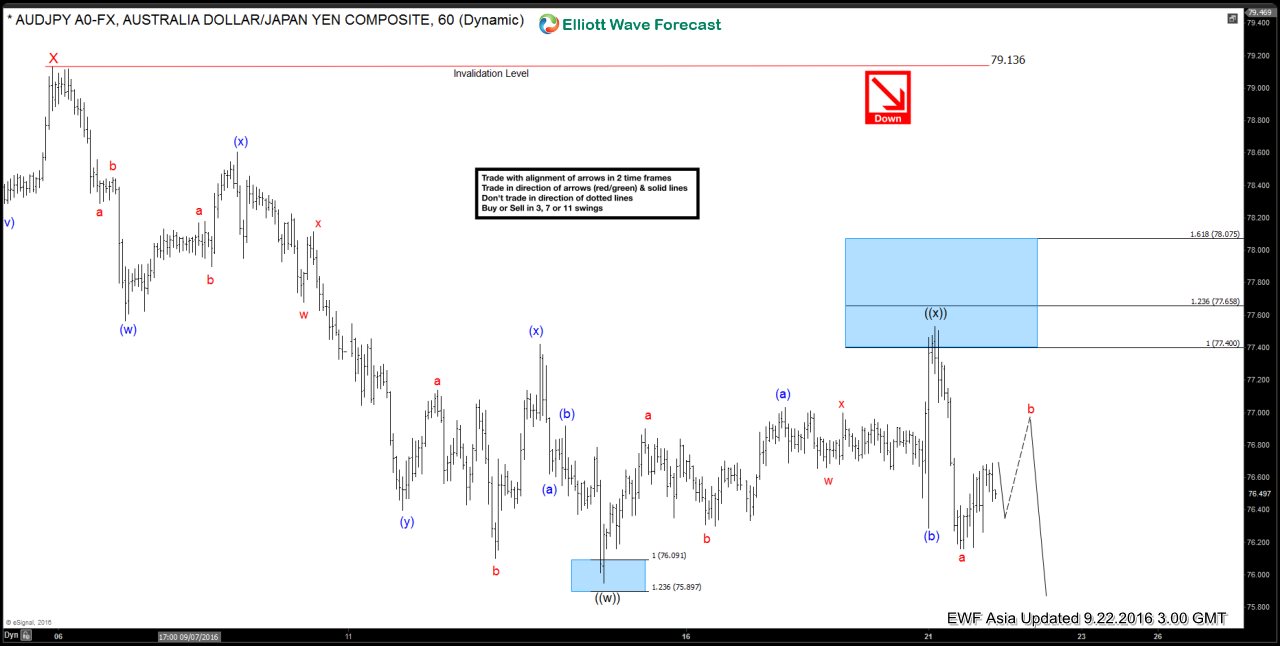

$AUDJPY Short-term Elliott Wave Analysis 9.23.2016

Read MoreShort term Elliott wave count suggests that rally to 79.13 ended wave X. Decline from there is unfolding as a double three where wave ((w)) ended at 75.95 and wave ((x)) bounce is in progress as a double three towards 77.77 – 78.15 area before the decline resumes. As far as pivot at 79.16 stays intact in the […]

-

$AUDJPY Short-term Elliott Wave Analysis 9.22.2016

Read MoreShort term Elliott wave count suggests that rally to 79.13 ended wave X. Decline from there is unfolding as a double three where wave ((w)) ended at 75.95 and wave ((x)) bounce is proposed complete at 77.53. While bounces stay below there, and more importantly below 79.13, expect the pair to extend lower towards 73.6 – 74.35 area. […]