The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

$EURAUD forecasting the path & selling the rallies

Read MoreOn August 10th $EURAUD broke the previous low from April 21st @1.4425 , making the bearish cycle from the Febrtary peak still alive. Our Elliott Wave analysis suggested for at least another big swing lower below 1.44037 low, so we recommend our members to avoid buying the pair and keep selling the rallies against the […]

-

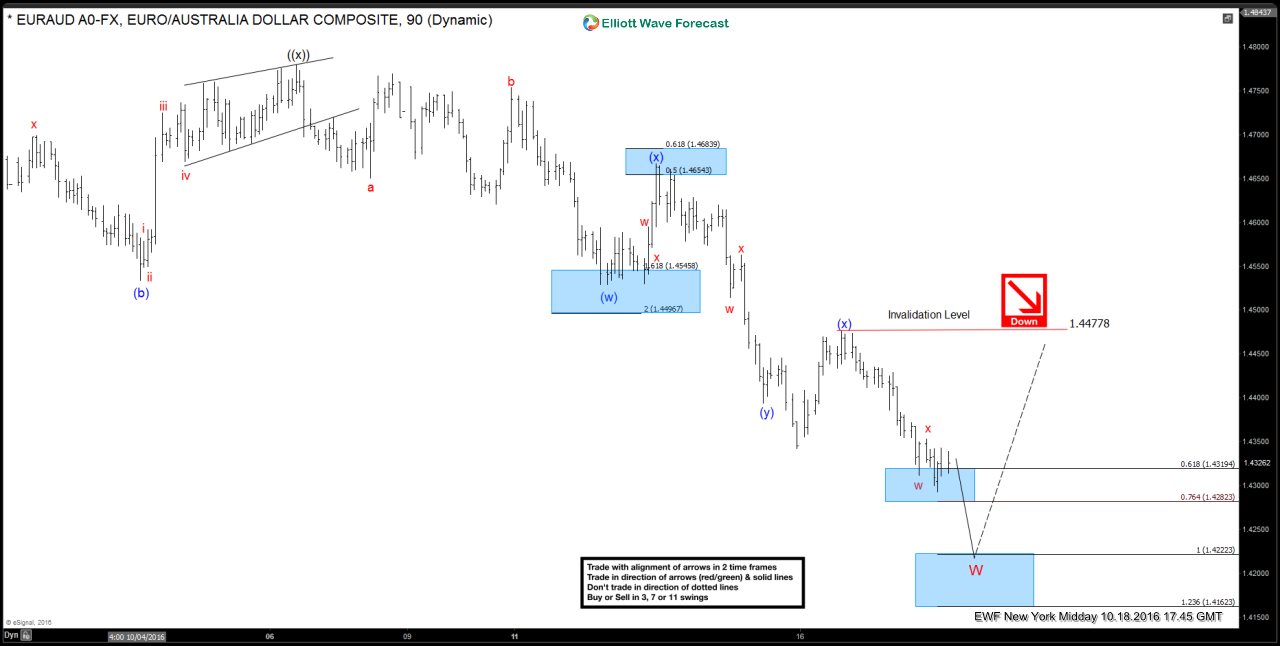

EURAUD Short-term Elliott Wave Analysis 10.21.2016

Read MoreBest reading of Elliott wave cycles suggests EURAUD is in a triple three Elliott wave structure from 10/6 (1.4779) high and this cycle is proposed complete with wave W at 1.418. Pair is currently in wave X bounce to correct the cycle from 9/15 (1.5096) peak or at least from 10/6 (1.4779) peak before the decline resumes. We don’t like buying […]

-

EURAUD Short-term Elliott Wave Analysis 10.19.2016

Read MoreBest reading of Elliott wave cycles suggests EURAUD is in a triple three Elliott wave structure from 10/6 (1.4779) high. Pair has got enough number of swings in place to call the cycle in wave W completed and soon a bounce would be expected to correct the cycle ideally from 9/15 (1.5096) peak and at least from 10/6 (1.4779) […]

-

EURAUD Short-term Elliott Wave Analysis 10.18.2016

Read MoreBest reading of Elliott wave cycles suggests EURAUD is in a triple three Elliott wave structure from 10/6 (1.4779) high. While below 1.4353 and more importantly below 1.4477 high, pair has scope to make another push lower towards 1.4222 – 1.4162 area and then bounce in minimum 3 waves to correct the cycle from 10/6 (1.4779) peak […]