The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Trade Selection Process using Elliott Wave Theory

Read MoreMany traders overlook the process of selecting the right instruments to trade. Trading is a process which requires a lot of discipline and a good technique to be consistently profitable. Selection is one of the aspects which can define the life of a trader because without the right selection process, most traders are going to […]

-

EURGBP forecasting the decline into the Election day

Read MoreIn this technical blog we are going to take a quick look at the $EURGBP 4 hour chart dated: 7th of November 2016. Pair since the October 7th peak (0.9224) was showing lower lows & lower highs, also was missing the extreme from the peak favored another push lower in the pair to happens to […]

-

Amazon (AMZN) Short Term Correction

Read MoreAmazon is one of the fewest company that kept a strong portfolio during the recent decades even after 2 stock market crises . The company issued its initial public offering of stock on 1997, trading under the NASDAQ stock exchange symbol AMZN, at a price of $1.50 per share and since then the price just kept rising […]

-

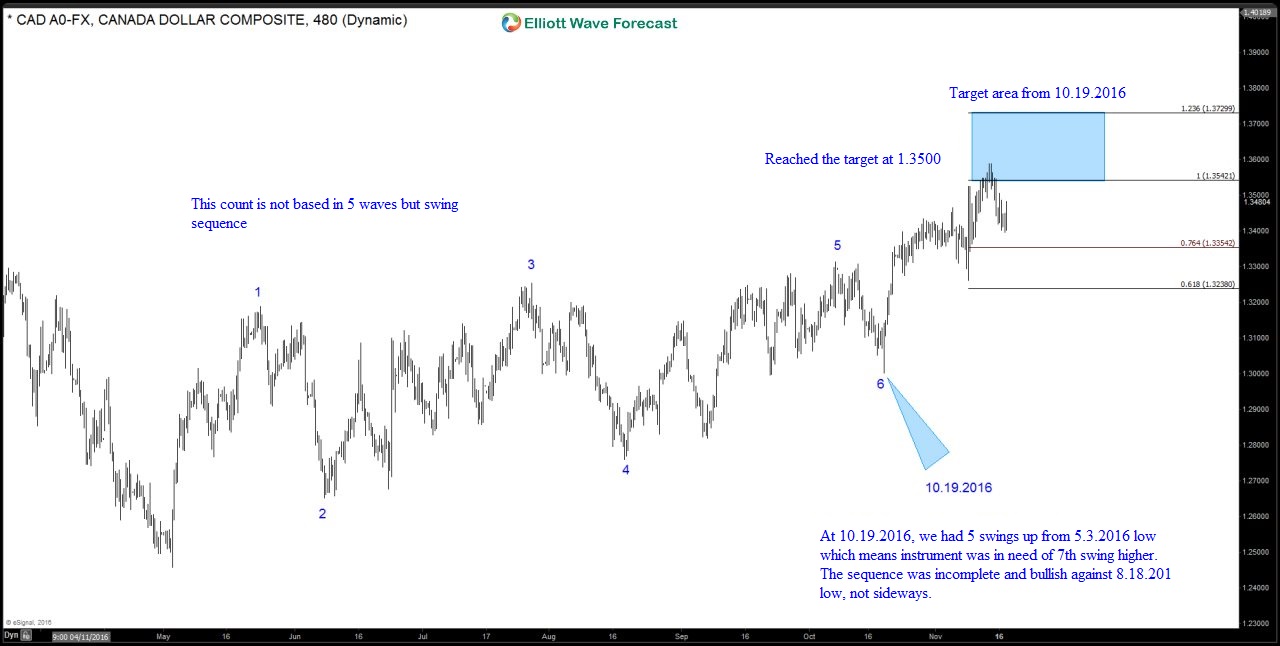

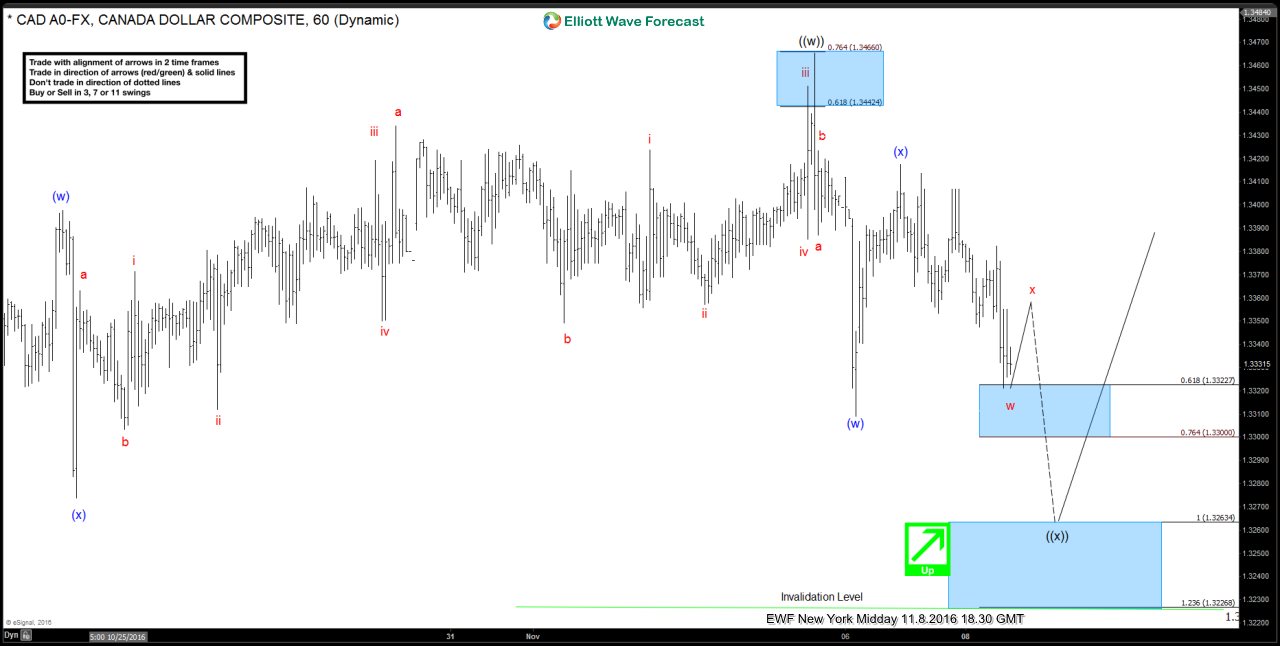

$USDCAD Elliottwaves Forecasting The Rally & Buying The Dips

Read MoreThe video below is a short capture from the NY Live Analysis Session held on November 8th by EWF Founder & Chief Currency Strategist Eric Morera. Eric presented Elliott Wave count of $USDCAD suggesting potential double in wave ((x)) pull back toward 1.2363-1.3226 before further rally takes place. Back then, $USDCAD was showing incomplete swings […]