The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

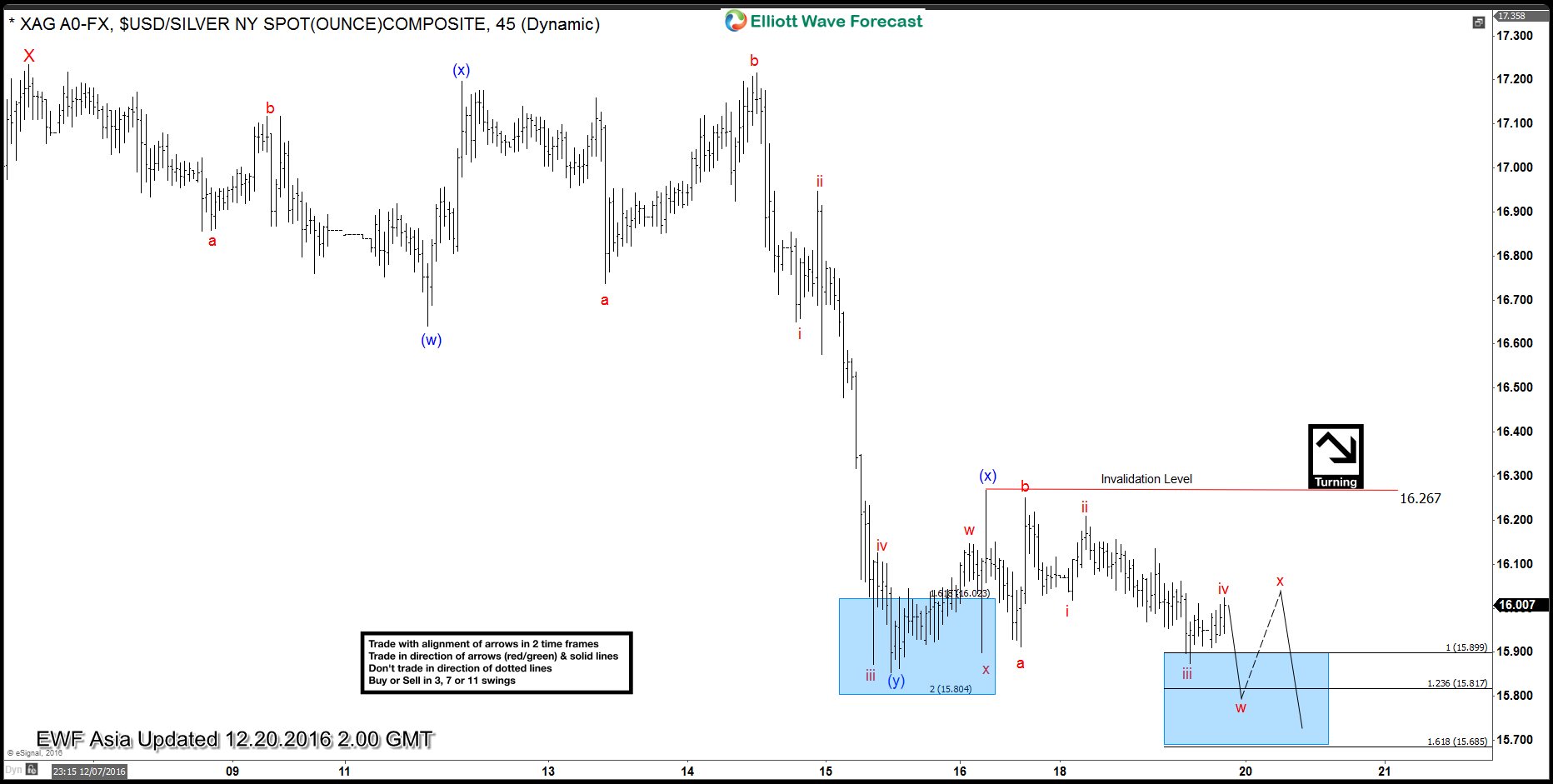

SI_F (Silver) Elliott Wave Forecast 12.19.2016

Read MoreSI_F (Silver) is showing an incomplete Elliott Wave sequence from 11.9.2016 peak. There are 5 swings down from 11.9.2016 peak which makes short-term sequence bearish against 12.7.2016 (17.25) peak. Decline from 18.99 – 16.14 was a 3 wave move labelled wave W followed by a 3 wave bounce to 17.25 that completed wave X. Down […]

-

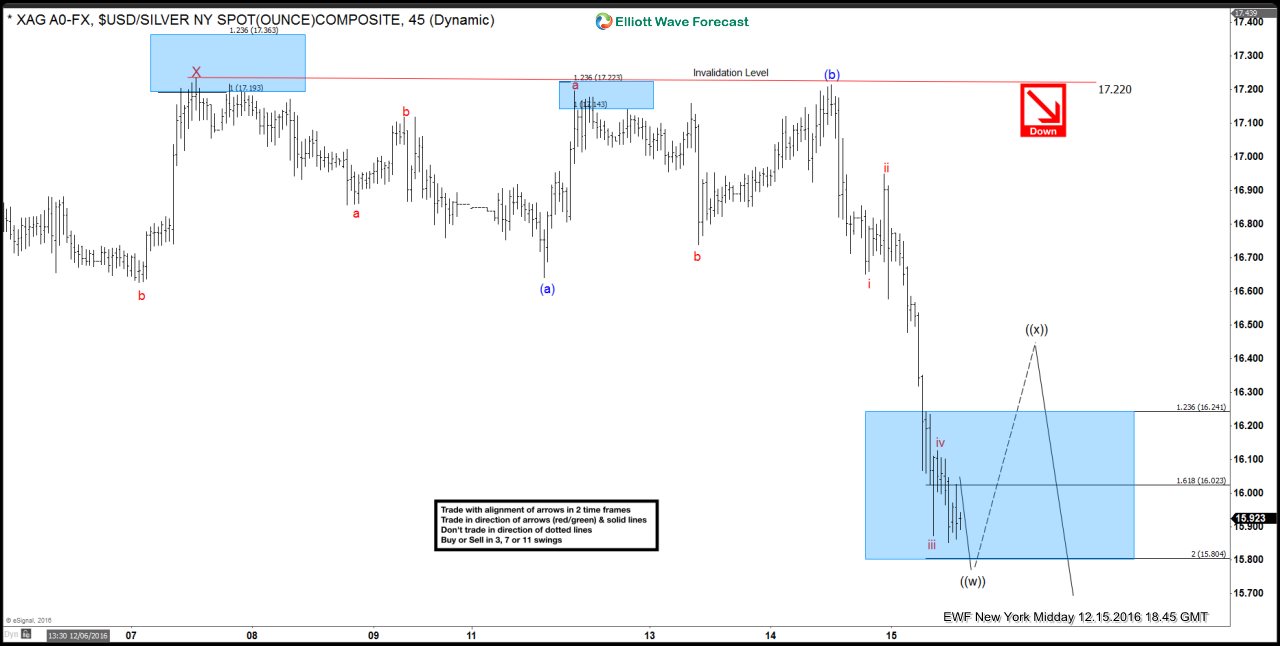

Silver XAGUSD Elliott Wave Forecast 12.16.2016

Read MoreShort Term XAGUSD Elliott wave forecast suggests that the rally to 17.25 ended wave X. Decline from there is unfolding as a FLAT where wave (a) ended at 16.64, wave (b) ended at 17.21 and wave (c) of ((w)) is expected to complete soon although marginal low is still expected towards as low as 15.8. Afterwards, […]

-

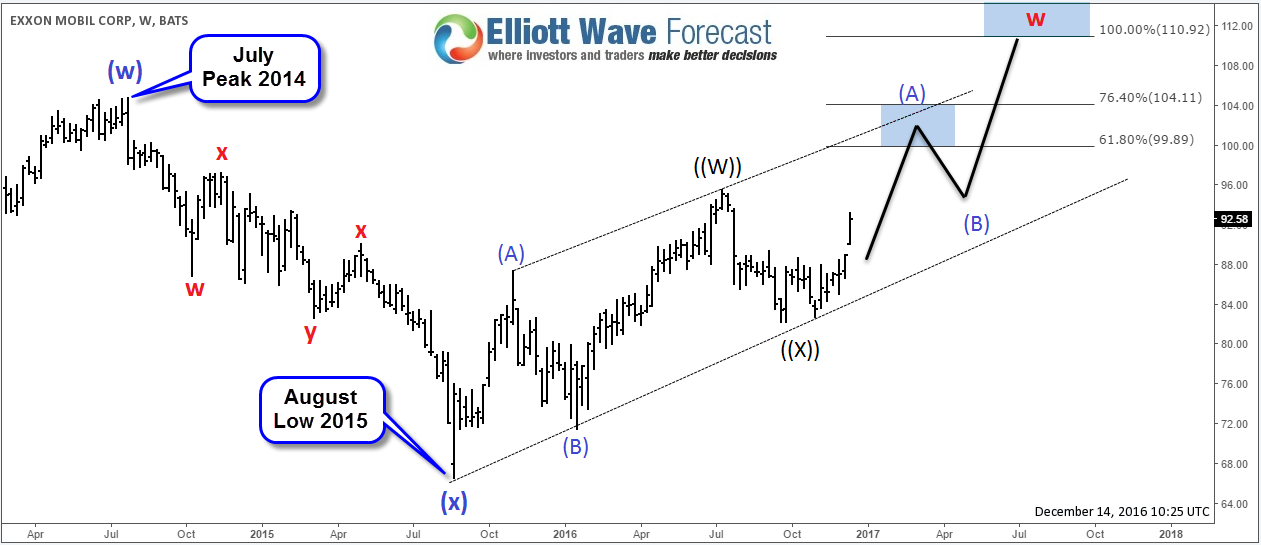

Exxon Mobil ( XOM ) Short Term Technical Analysis

Read MoreExxon Mobil Presentation & News Exxon Mobil Corporation the largest of the world’s super-majors Oil and Gas companies , it’s also the 8th largest company by revenue and 5th largest publicly traded company by market capitalization . The Corporation was formed on November 30, 1999 by the merger of Exxon (formerly Standard Oil Company of New Jersey) and […]

-

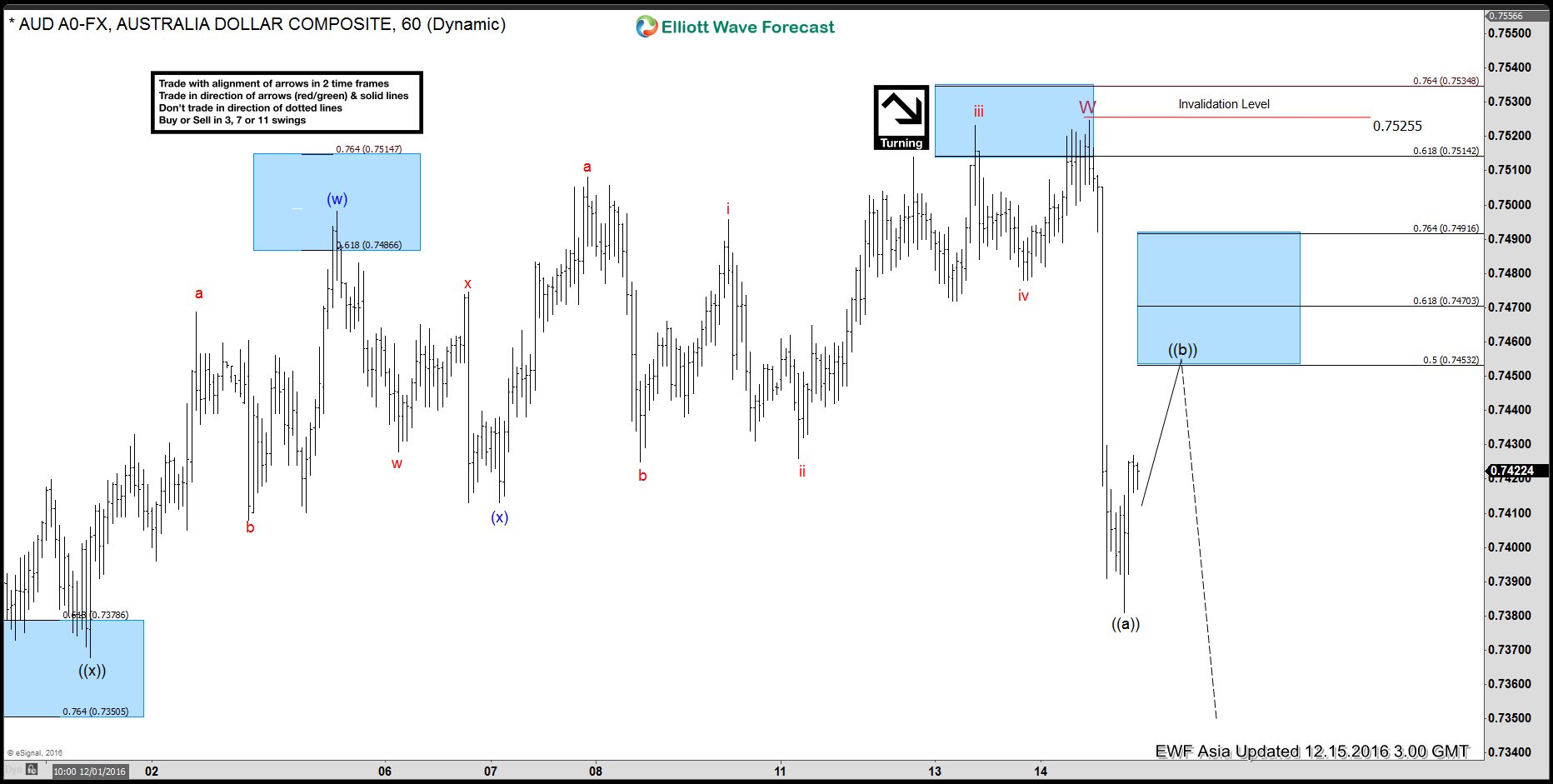

AUDUSD Elliott Wave Forecast 12.15.2016

Read MoreShort Term AUDUSD Elliott wave forecast suggests that the decline to 0.7306 on 11/21 low ended wave (X). Up from there, pair is rallying as a double three structure where wave ((w)) ended at 0.749, wave ((x)) ended at 0.736, and wave ((y)) of W is proposed complete at 0.7525. Pair is currently in wave X […]