The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

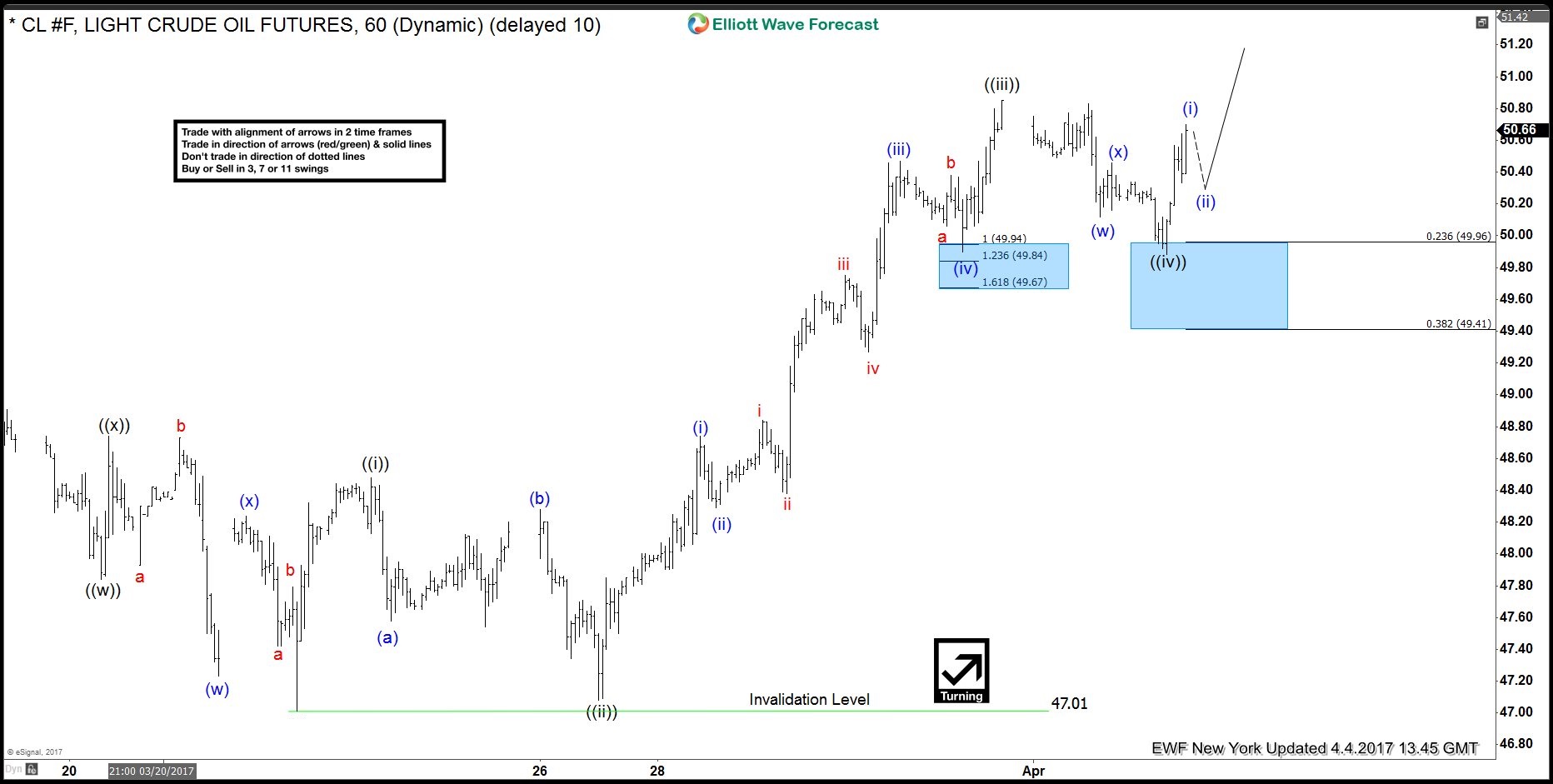

Crude Oil (CL_F) Elliott Wave View: 5 Wave Impulse

Read MoreCrude Oil (CL_F) started rallying from 03/22 low in a bullish structure which still needs another leg higher to become 5 impulsive waves. The instrument ended the minute wave (( iv )) at the 23.6% Fibonacci retracement area 49.96 from which it managed to bounce higher to resume the move to the upside looking to reach the […]

-

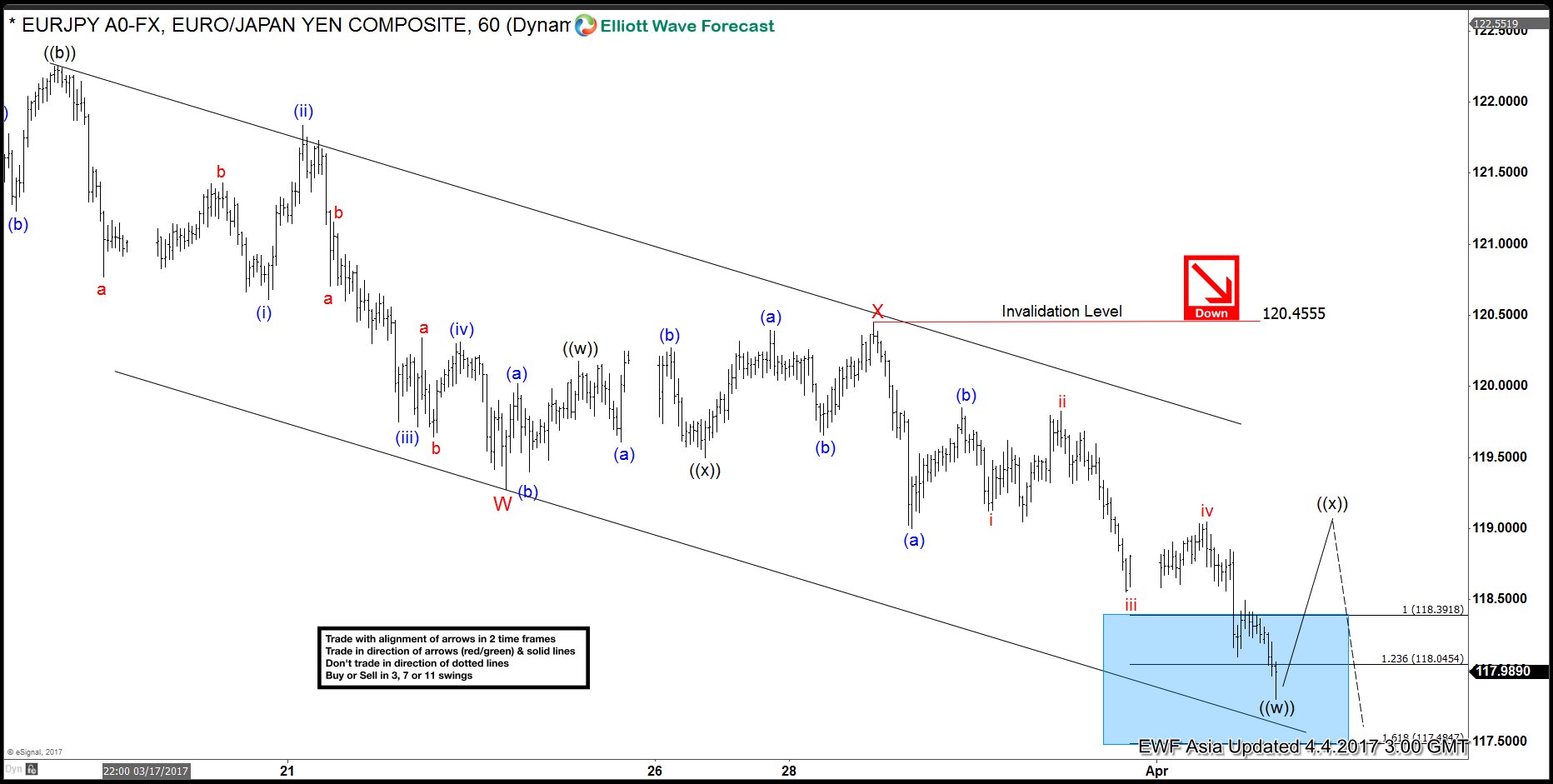

EURJPY Elliott wave View: More downside

Read MoreShort term Elliott Wave view in EURJPY suggests that cycle from 3/12 peak (122.89) is unfolding as a double three Elliott wave structure where Minor wave W ended at 119.28 and Minor wave X ended at 120.45. Minor wave Y is in progress and the internal is unfolding also as a double three Elliott wave […]

-

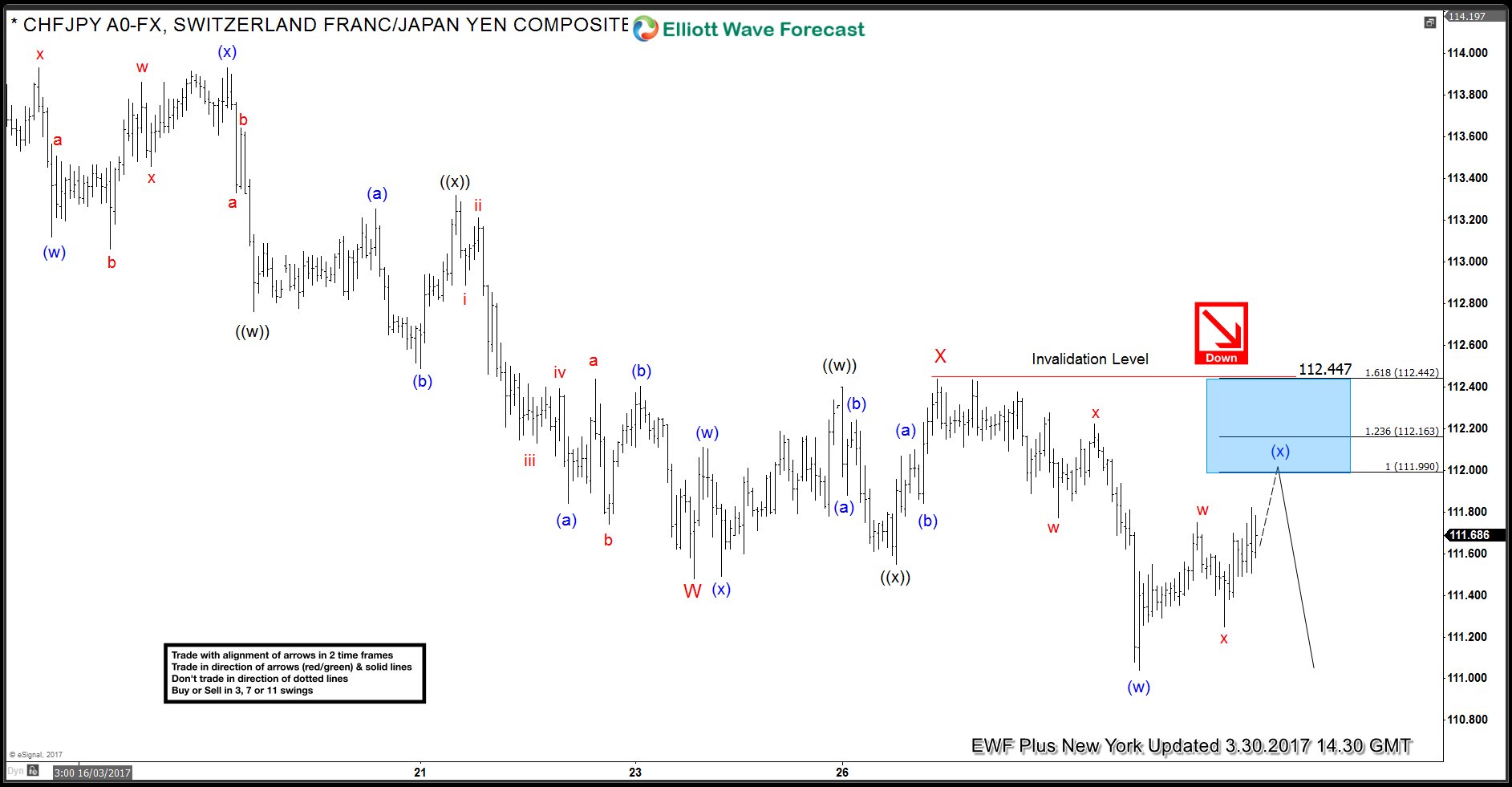

CHFJPY forecasting the decline and selling the rallies

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the another nice trading opporunity we have had lately. The instrument we traded is $CHFJPY. In further text we’re going to explain price structure and reasons why we forecasted the decline. Let’s start explanation by taking a look at past Elliott […]

-

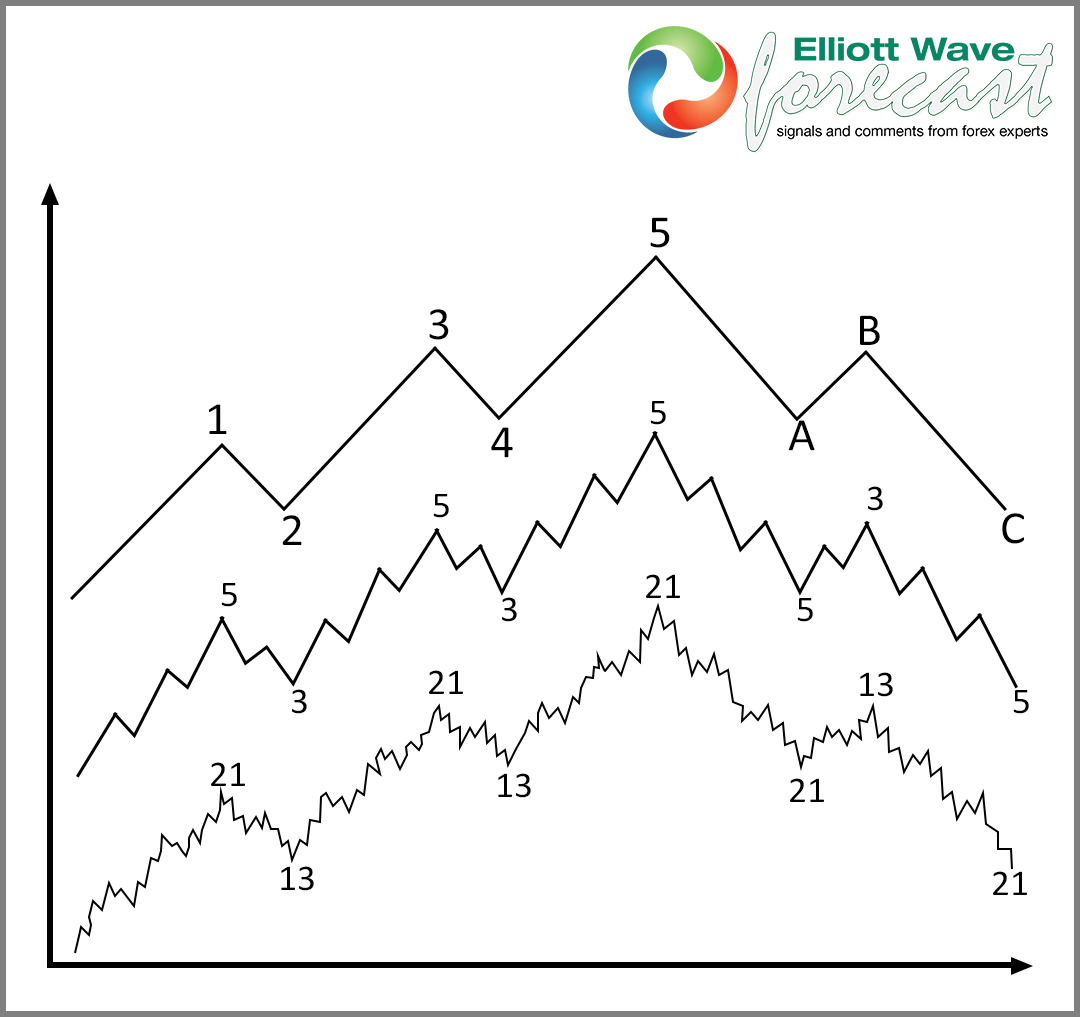

How to map the Market using Elliott wave Theory

Read MoreThe Importance of Trend Trading As many traders know, one of the most important aspects of the Trading profession is understanding the trend and how to develop a trend trading system. Many traders wants to trade every single line or move in the Market and that is the major reason why 95%-97% of the traders […]