The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

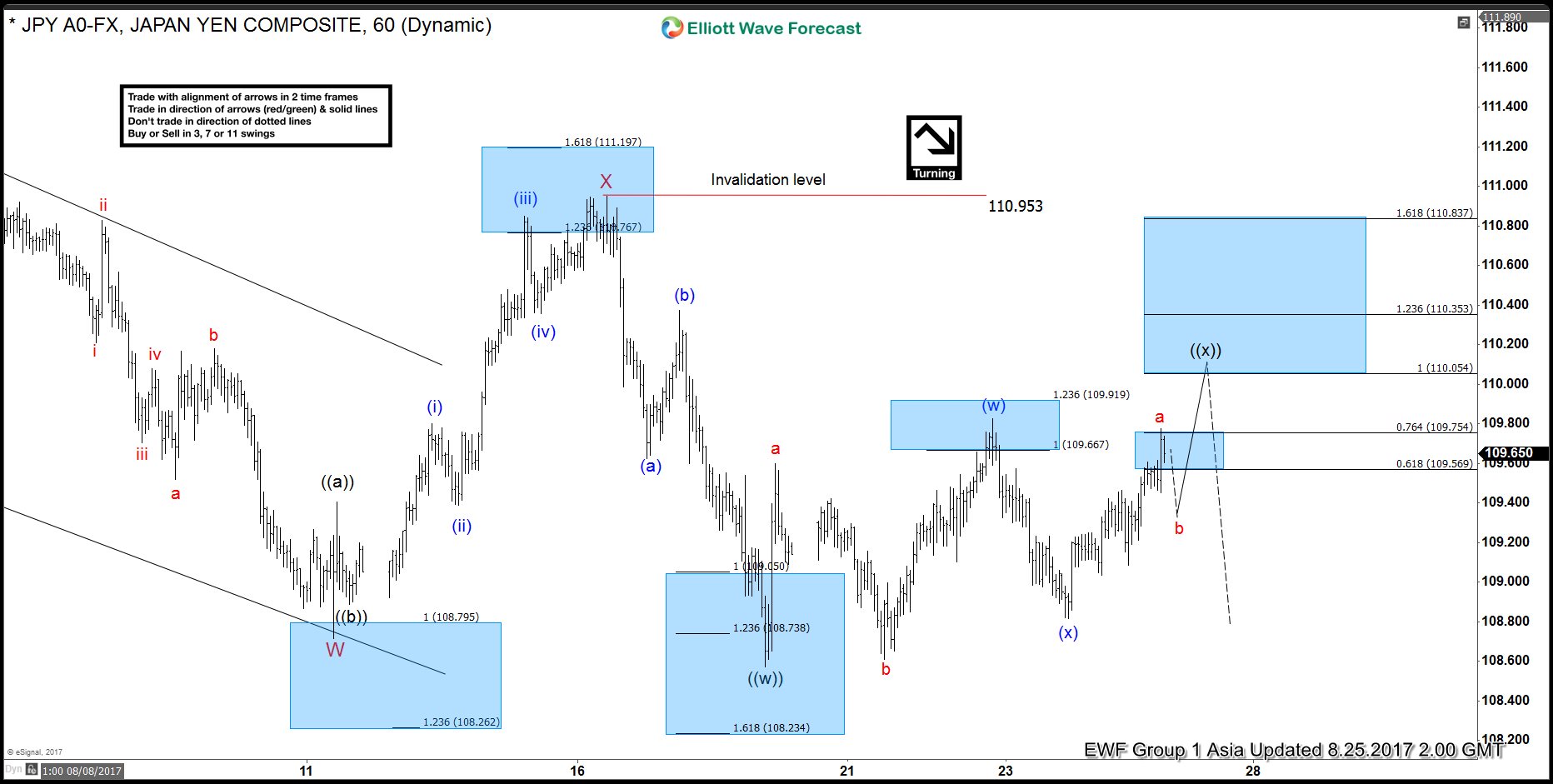

USDJPY Elliott Wave view: Double Correction

Read MoreShort term USDJPY Elliott wave view suggests the decline from 7/11 peak is unfolding as a double three Elliott wave structure. Decline to 108.71 low ended Minor wave W and Minor wave X bounce ended at 110.95 peak. Subdivision of Minor wave Y is unfolding as another double three structure of a lesser degree. Minute wave ((w)) […]

-

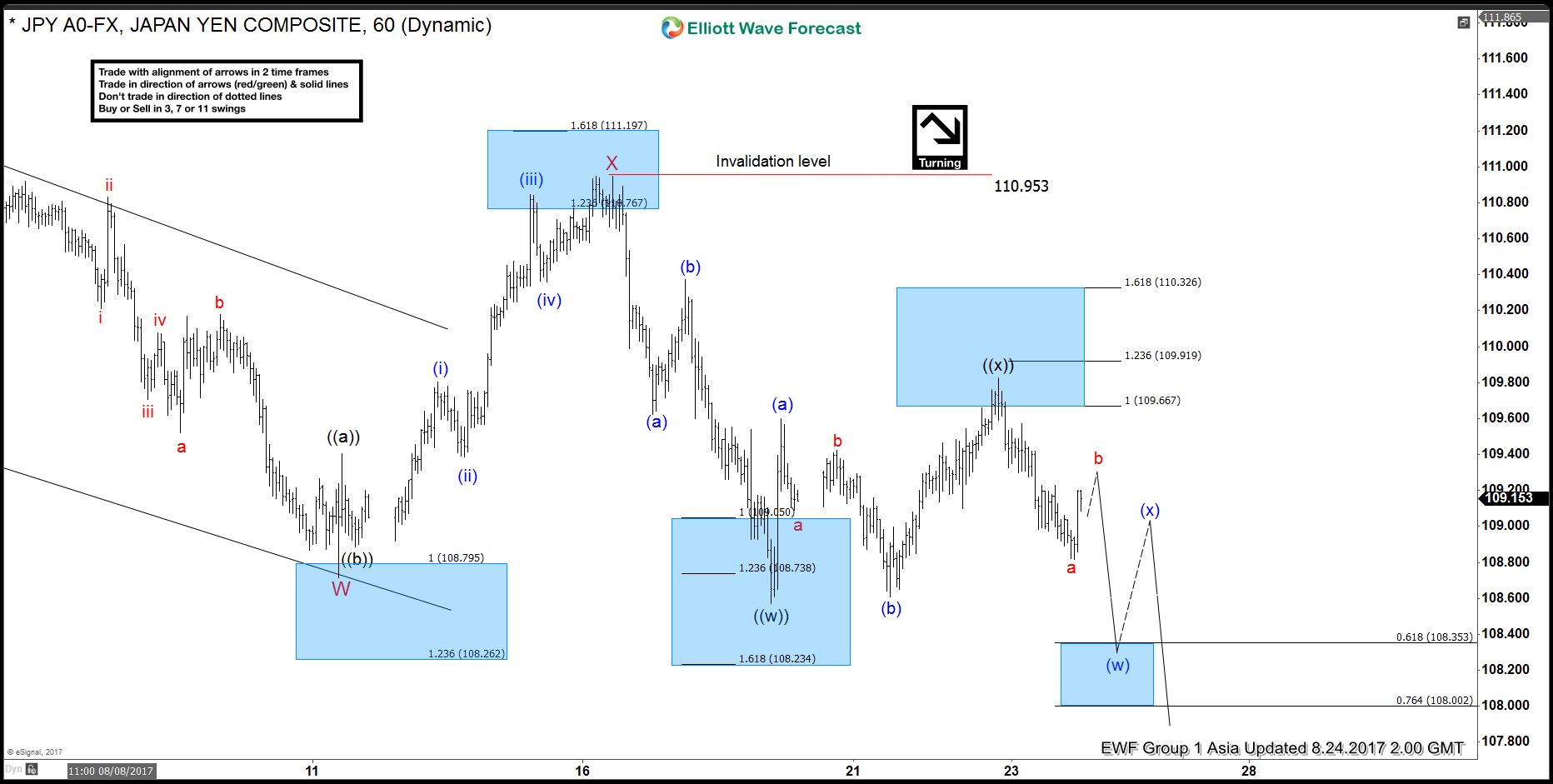

USDJPY Elliott Wave view: Resuming lower

Read MoreShort term USDJPY Elliott wave view suggest the decline from 7/11 peak is unfolding as a double three Elliott wave structure. Decline to 108.71 low ended Minor wave W and Minor wave X bounce ended at 110.95 peak. Subdivision of Minor wave Y is unfolding as a Zigzag structure. Minute wave ((w)) of ((Y) ended at 108.59 low […]

-

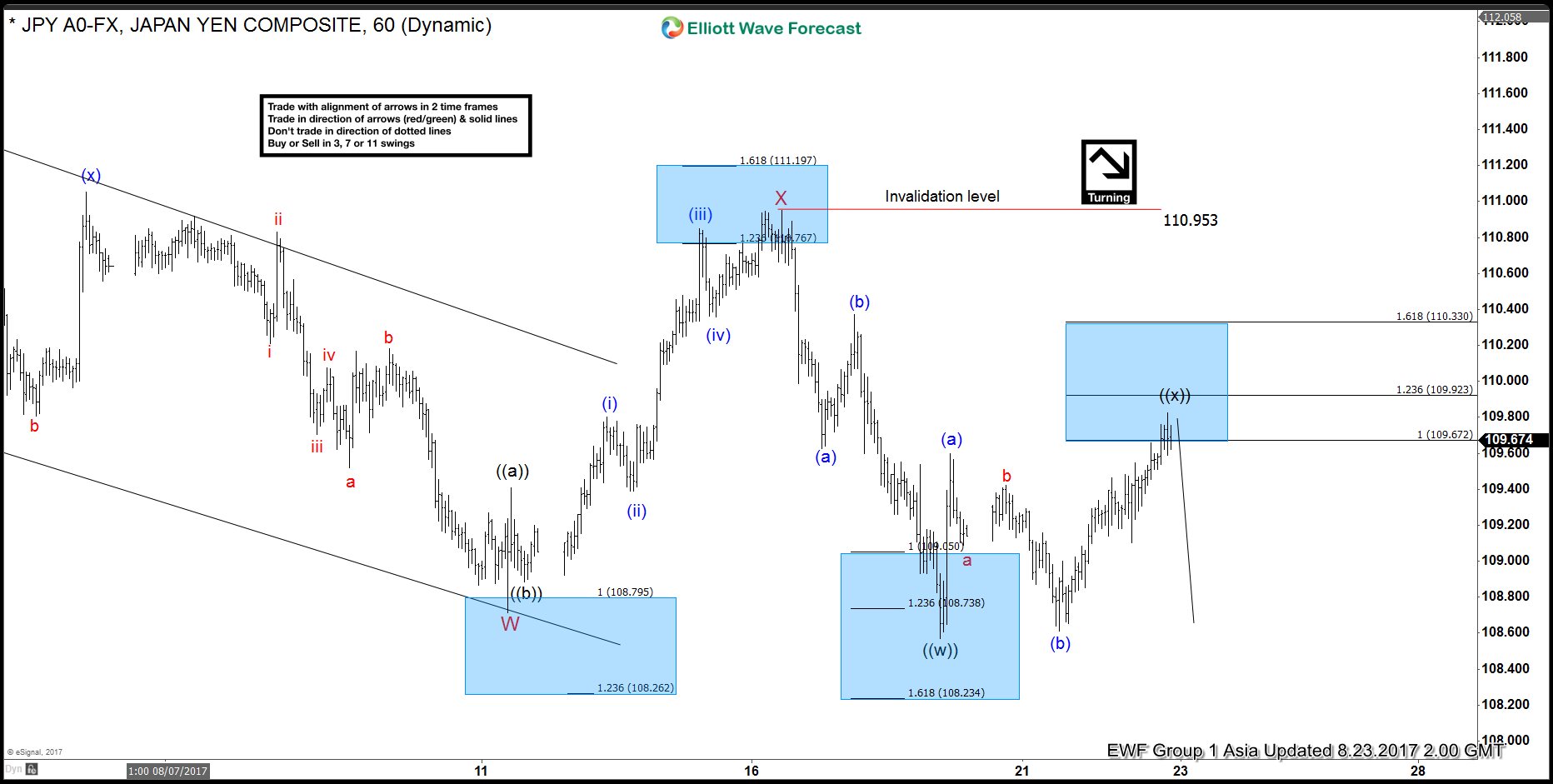

USDJPY Elliott Wave View: Turning Lower

Read MoreShort term USDJPY Elliott wave view suggest that the decline from 7/11 peak is unfolding as a double three Elliott wave structure. Decline to 108.71 low ended Minor wave W and Minor wave X bounce ended at 110.95 peak. Subdivision of Minor wave Y is unfolding as a Zigzag structure. Minute wave ((w)) of ((Y) ended at 108.59 […]

-

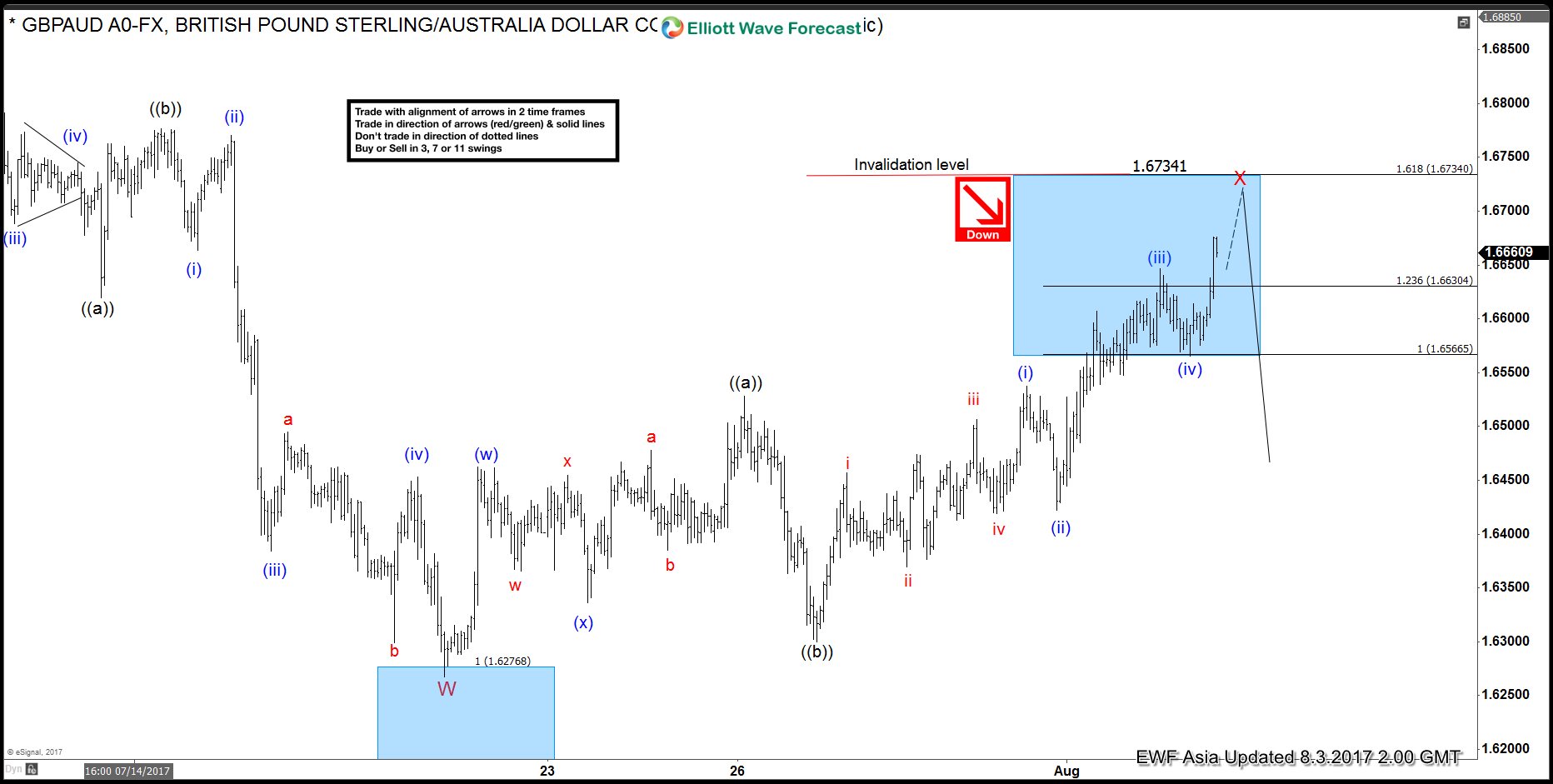

Elliott Wave Flat explained through GBPAUD example

Read MoreHello fellow traders. In this technical blog we’re going to see what Elliott Wave Flat structure looks like with real market example. We’re going to take a quick look at the past Elliott Wave chart of GBPAUD published in members area of www.elliottwave-forecast.com and explain the theory of Flat structure. Elliott Wave Flat Elliott Wave Flat […]