The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

-

BBY Best Buy Earnings Report 08/29/17 – Weekly ElliottWave Count

Read MoreBBY Best Buy Inc. earnings report due to this week, the 29th of August. Before we get into the details few words about the company we are about to analyze. According to Wikipedia, Best Buy Co. (NYSE: BBY), Inc. is an American multinational consumer electronics corporation headquartered in Richfield, Minnesota, a Minneapolis suburb. Internationally, it also operates in Canada and Mexico. It […]

-

Royal Gold Bullish Structure Calling Higher

Read MoreRoyal Gold (NASDAQ: RGLD) is one of the world’s leading precious metals royalty & stream companies, it’s engaged in the acquisition and management of gold, silver, copper, lead and zinc. The Company owns interests on 194 properties in over 20 countries, including interests on 39 producing mines and 21 development stage projects. During last week, Royal Gold announced fourth […]

-

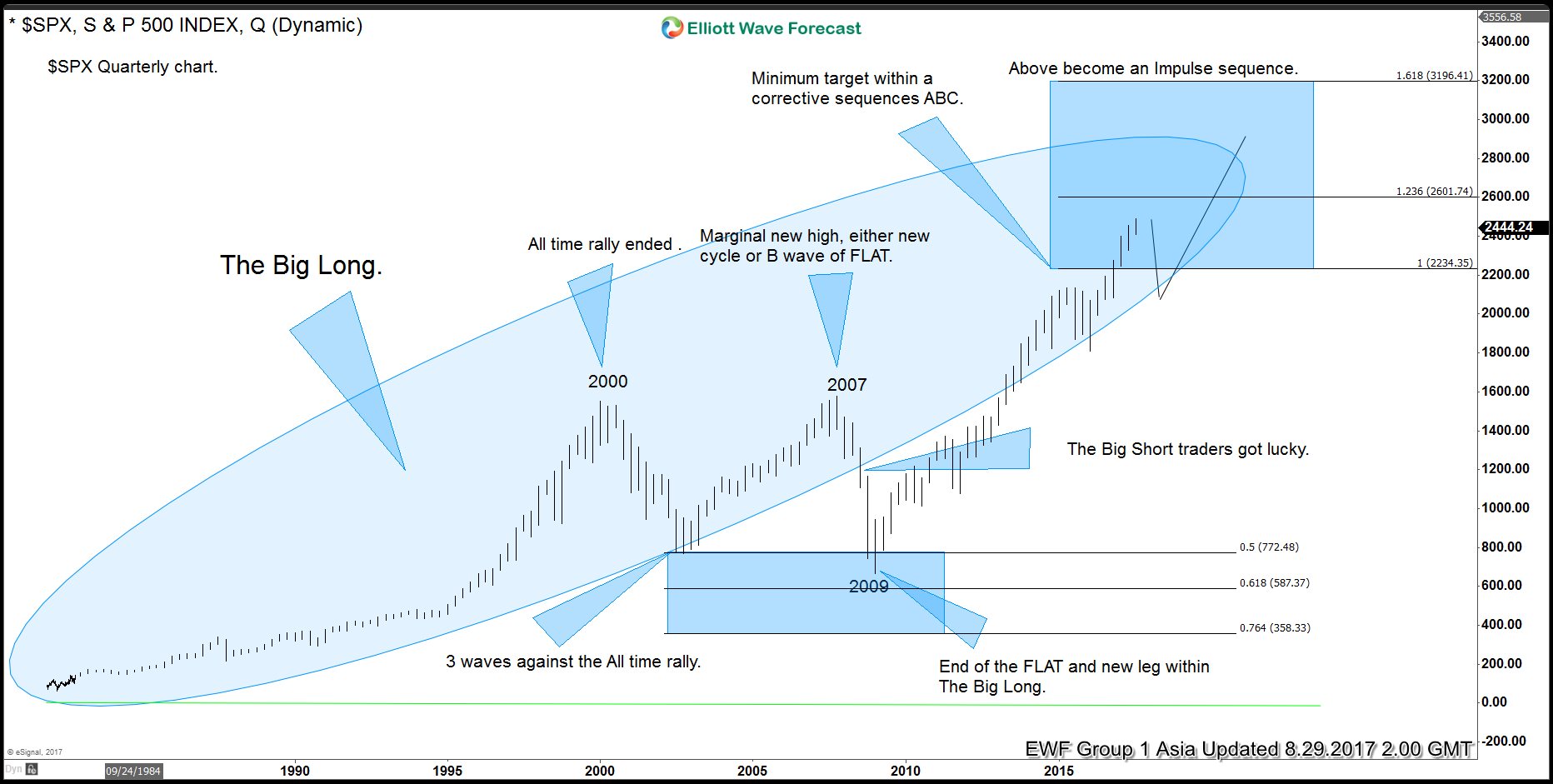

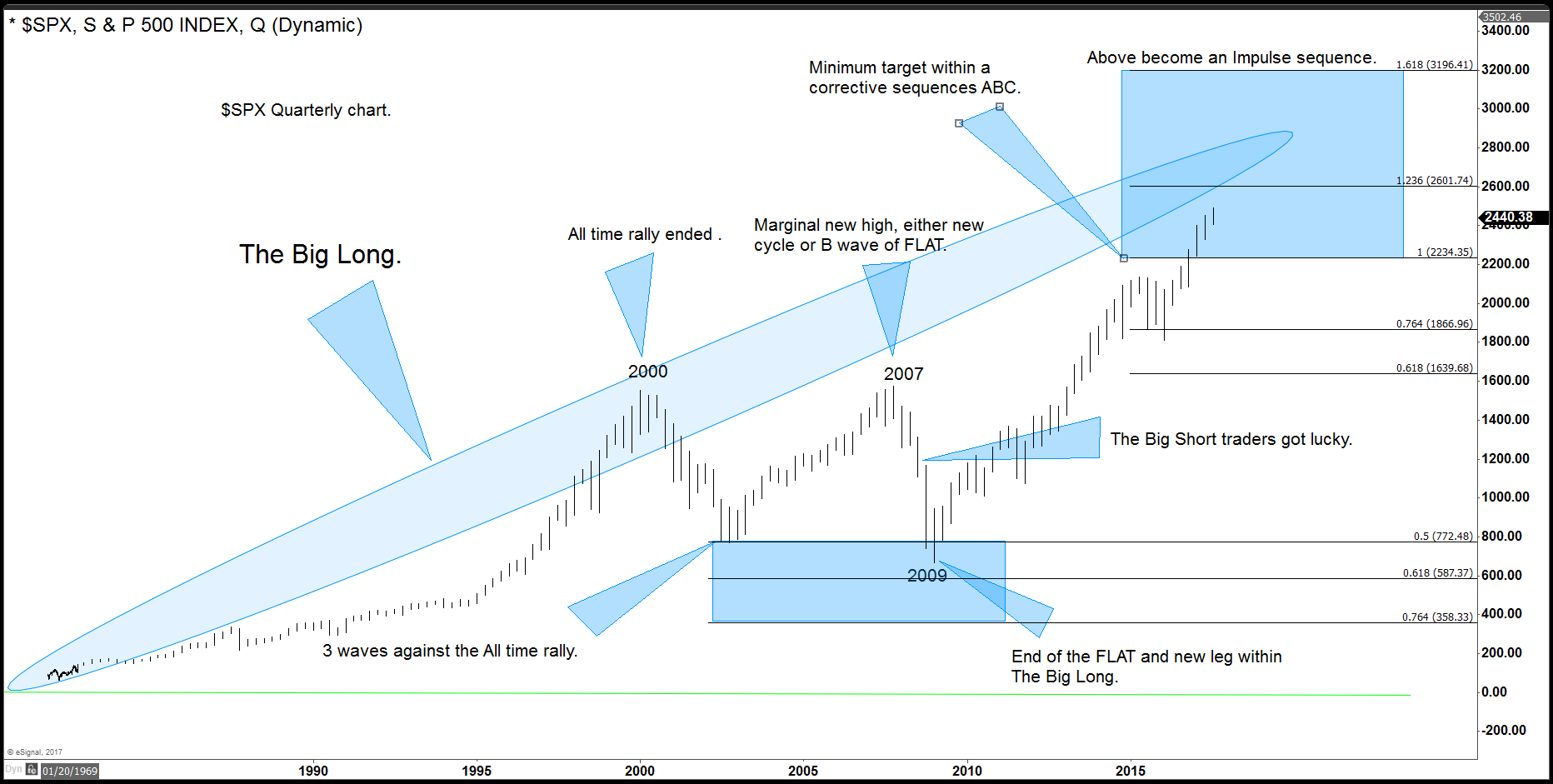

The Big Long in World Indices

Read MoreSince the decline starting from year 2000, the world has been calling for a huge crash in world indices. The world indices did in fact corrected nicely in the year 2000 and 2009. The correction took the form of a FLAT Elliott wave structure and reached 50%-61.8% of the all-time rally in most of the world […]