The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Nikkei ( NKD_F) Elliott Wave View: Diagonal Structure

Read MoreShort term Elliott wave view in Nikkei suggest that the cycle from August 29.2017 low (19055) is unfolding in 5 waves pattern. However looking at the internal subdivision of each wave the bounce looks corrective in nature with upside extensions. Thus suggesting that the Nikkei cycle from August 29 low (19055) could be following a leading Diagonal […]

-

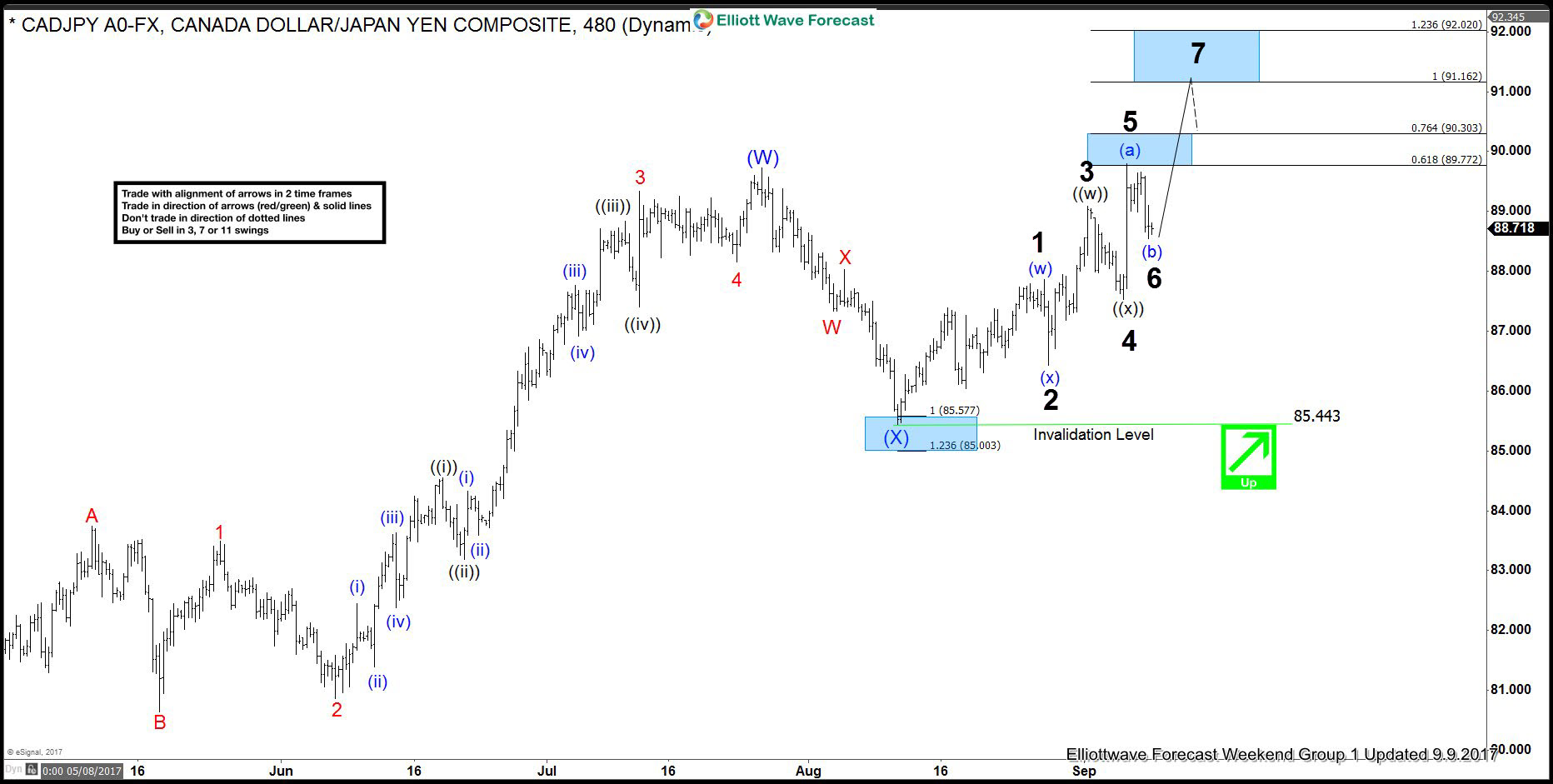

CADJPY Forecasting the Rally using Swings Sequences

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of CADJPY published in members area of www.elliottwave-forecast.com. In further text we’re going to count the swings, explain the Elliott Wave view and trading strategy. Let’s start with 4 hour update. CADJPY Elliott Wave 4 Hour […]

-

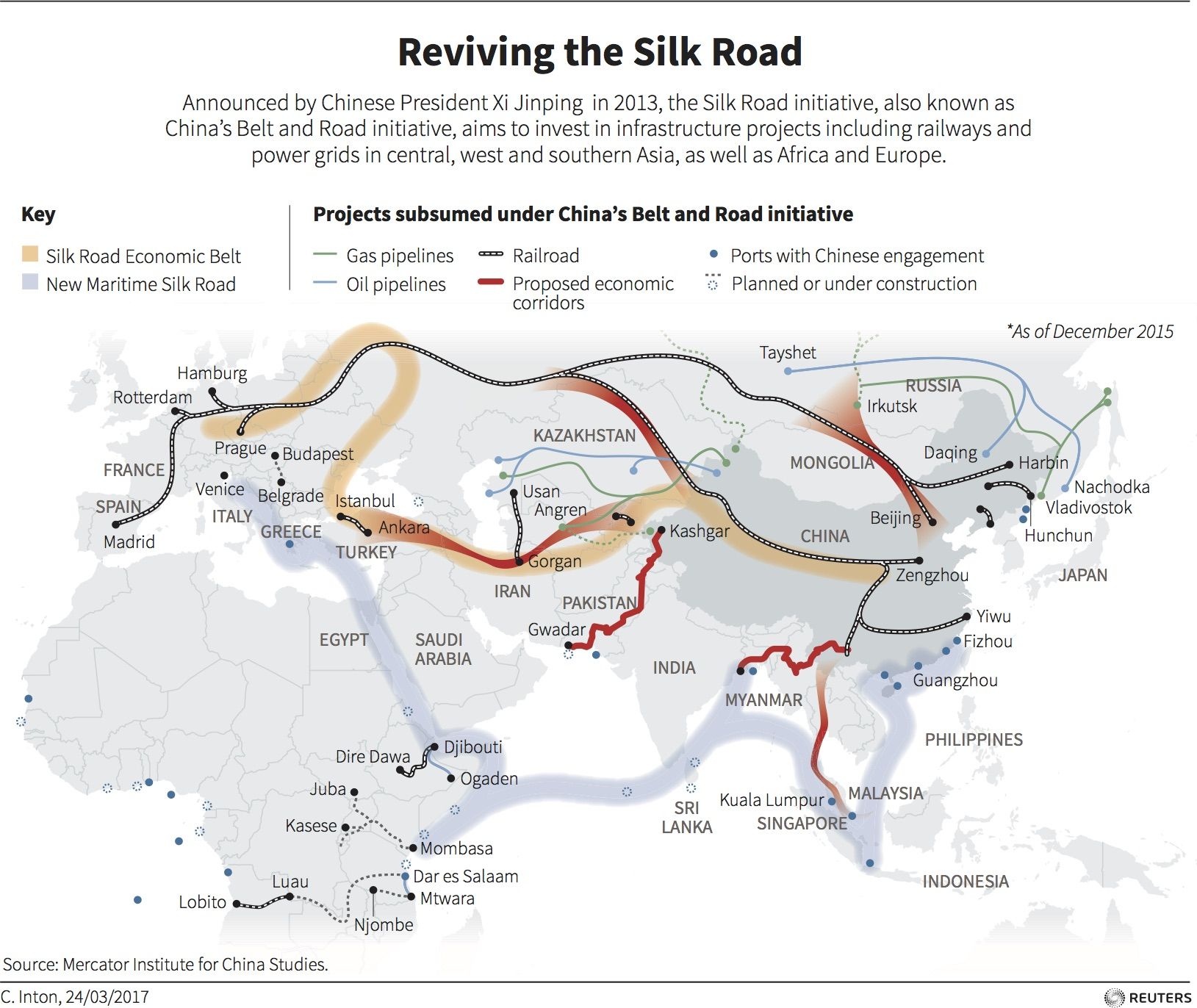

China’s One Belt One Road (OBOR) is Bullish Commodities

Read MoreWhat is OBOR (One Belt One Road) One Belt One Road (OBOR) is an initiative originally coming from China’s president Xi Jinping in 2013. The plan is the single biggest initiative since the opening up of China to foreign investment. President Xi called it a “project of the century”. In America, globalization has lost its […]

-

EURUSD Elliott Wave Analysis 10.5.2017

Read MoreEURUSD Short Term Elliott Wave structure suggests the decline from 9/8 peak is in progress as an expanded Flat Elliott Wave structure. From 9/8 high (1.2094), pair declined to 1.837 and ended Intermediate wave (A). Pair then bounced to 1.2034 and ended Intermediate wave (B). At present, Intermediate wave (C) remains in progress as 5 […]