The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

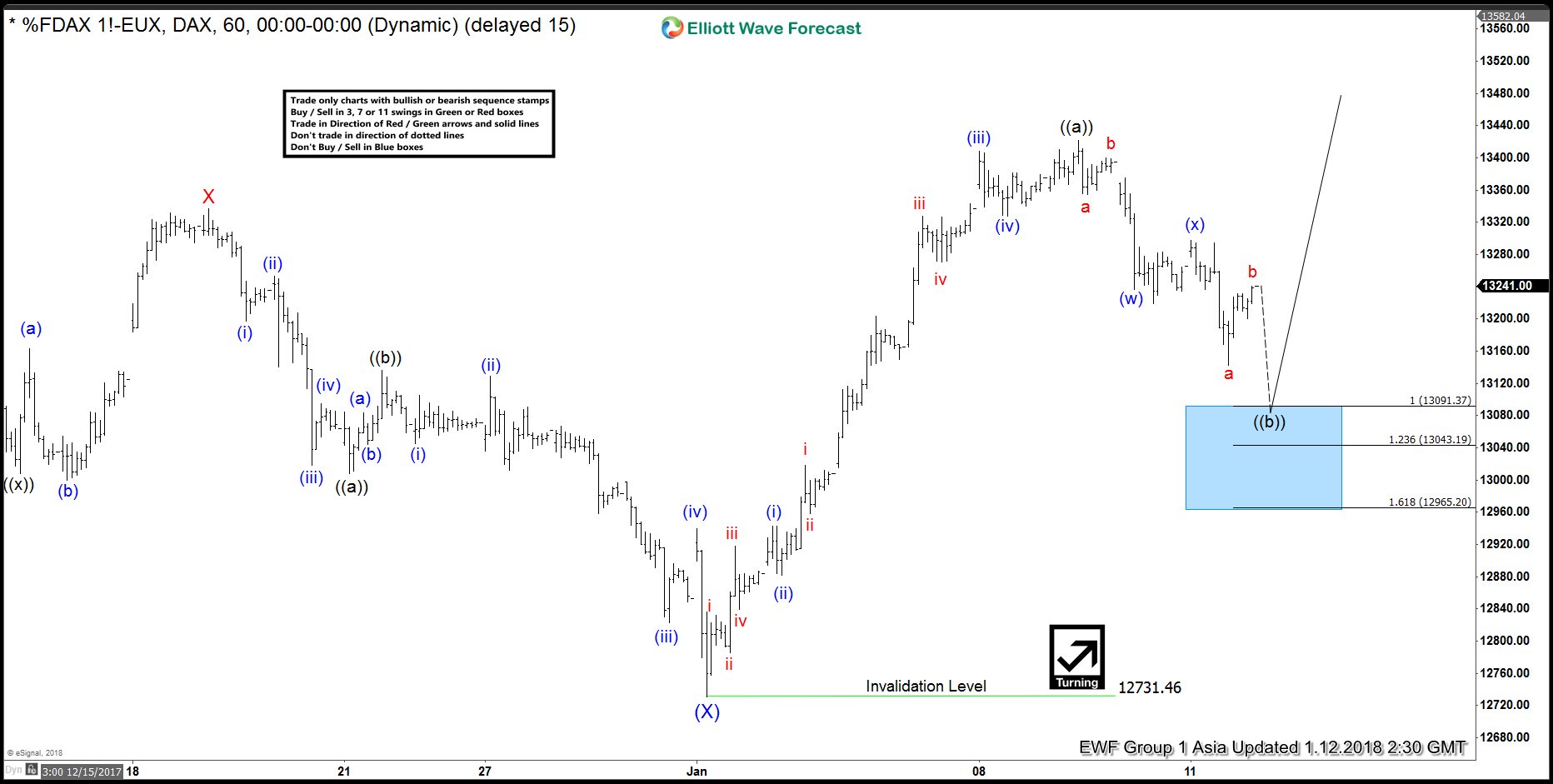

Elliott Wave Analysis: DAX Looking to End Correction

Read MoreDAX Short Term Elliott Wave view suggests that the decline to 12731.46 ended Intermediate wave (X). Up from there, rally is unfolding as a 5 waves impulsive Elliott Wave structure where Minutte wave (i) ended at 12943, Minutte wave (ii) ended at 12881.5, Minutte wave (iii) ended at 13408.5, Minutte wave (iv) ended at 13328.5, and Minutte […]

-

Silver: Impulsive Elliott Wave Rally

Read MoreSilver Short term Elliott Wave view suggests that the decline to December 12.2017 low 15.60 ended Intermediate wave (X). A rally from there is unfolding as an impulse Elliott Wave structure with extension in 3rd swing higher, where each leg has internal oscillations of 5 waves thus favoring it to be an impulse. These 5 waves move higher, either ended Minor wave A in […]

-

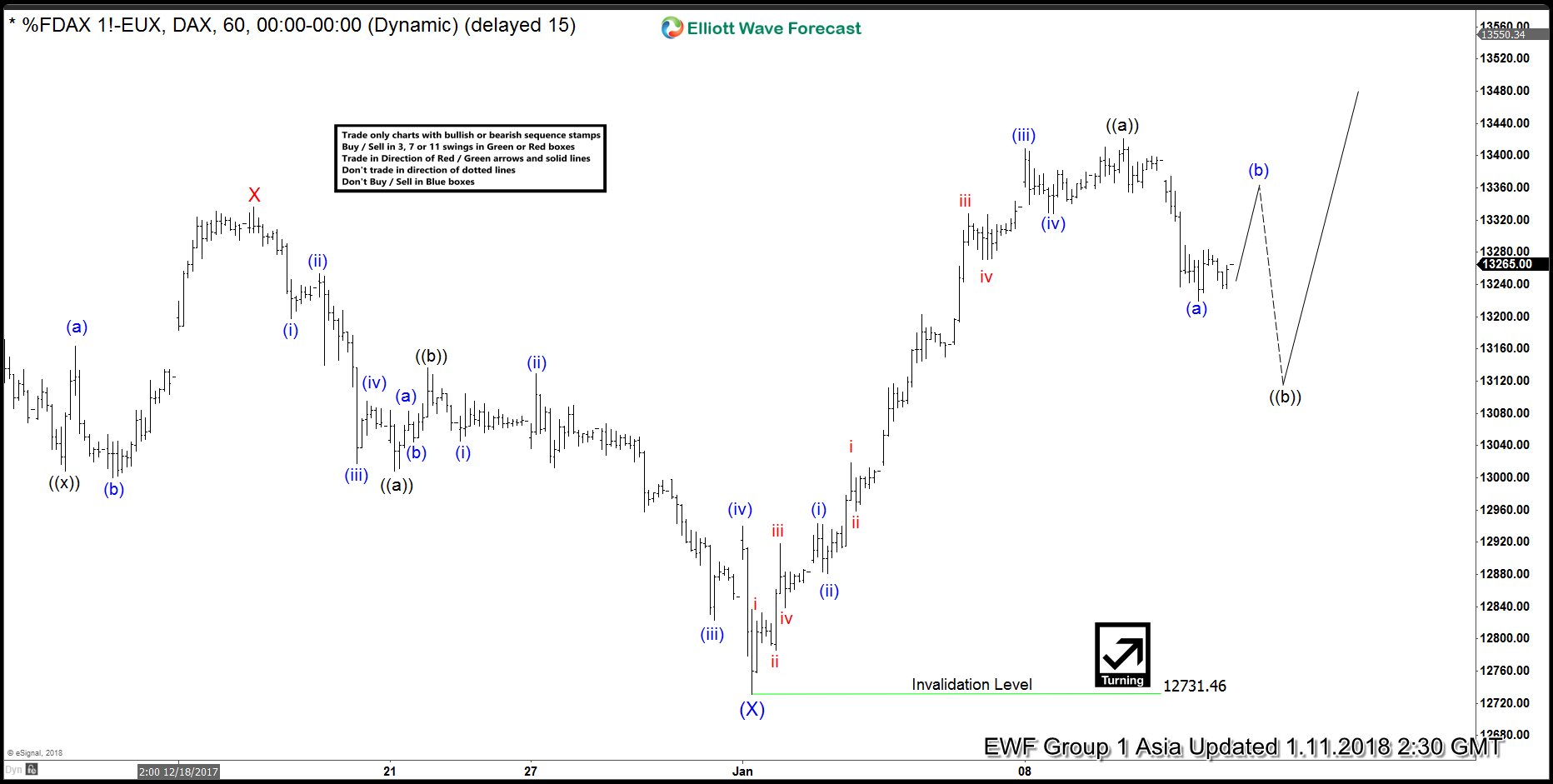

DAX Elliott Wave Analysis: Correction in Progress

Read MoreDAX Short Term Elliott Wave view suggests that Intermediate wave (X) ended at 12731.46. Rally from there is unfolding as a 5 waves impulsive Elliott Wave structure where Minutte wave (i) ended at 12943, Minutte wave (ii) ended at 12881.5, Minutte wave (iii) ended at 13408.5, Minutte wave (iv) ended at 13328.5, and Minutte wave (v) of […]

-

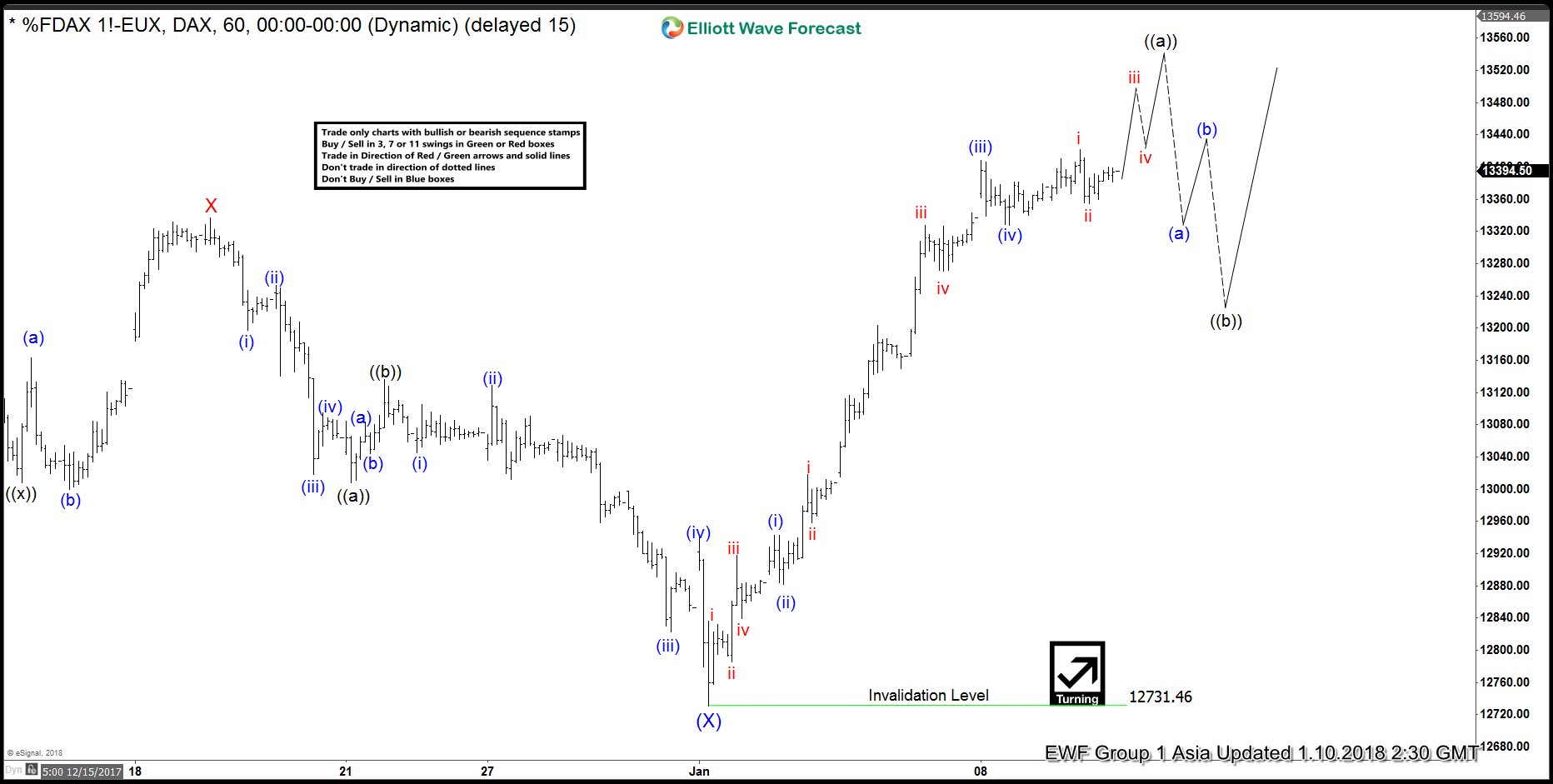

DAX Elliott Wave Analysis: Still In wave (v)

Read MoreDAX Short Term Elliott Wave view suggests that pullback to 12731.46 ended Intermediate wave (X). Up from there, rally is unfolding as a 5 waves impulsive Elliott Wave structure where Minutte wave (i) ended at 12943, Minutte wave (ii) ended at 12881.5, Minutte wave (iii) ended at 13408.5, and Minutte wave (iv) is proposed complete at 13328.5. […]