The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Prosperity Period for Airline Sector

Read MoreAir travel has become so commonplace that it would be hard to imagine life without it which made the airline industry is vital to our world. It contributes to global economy by connecting cities / countries and it enables the flow of goods / people. In the past, the airline industry was at least partly government […]

-

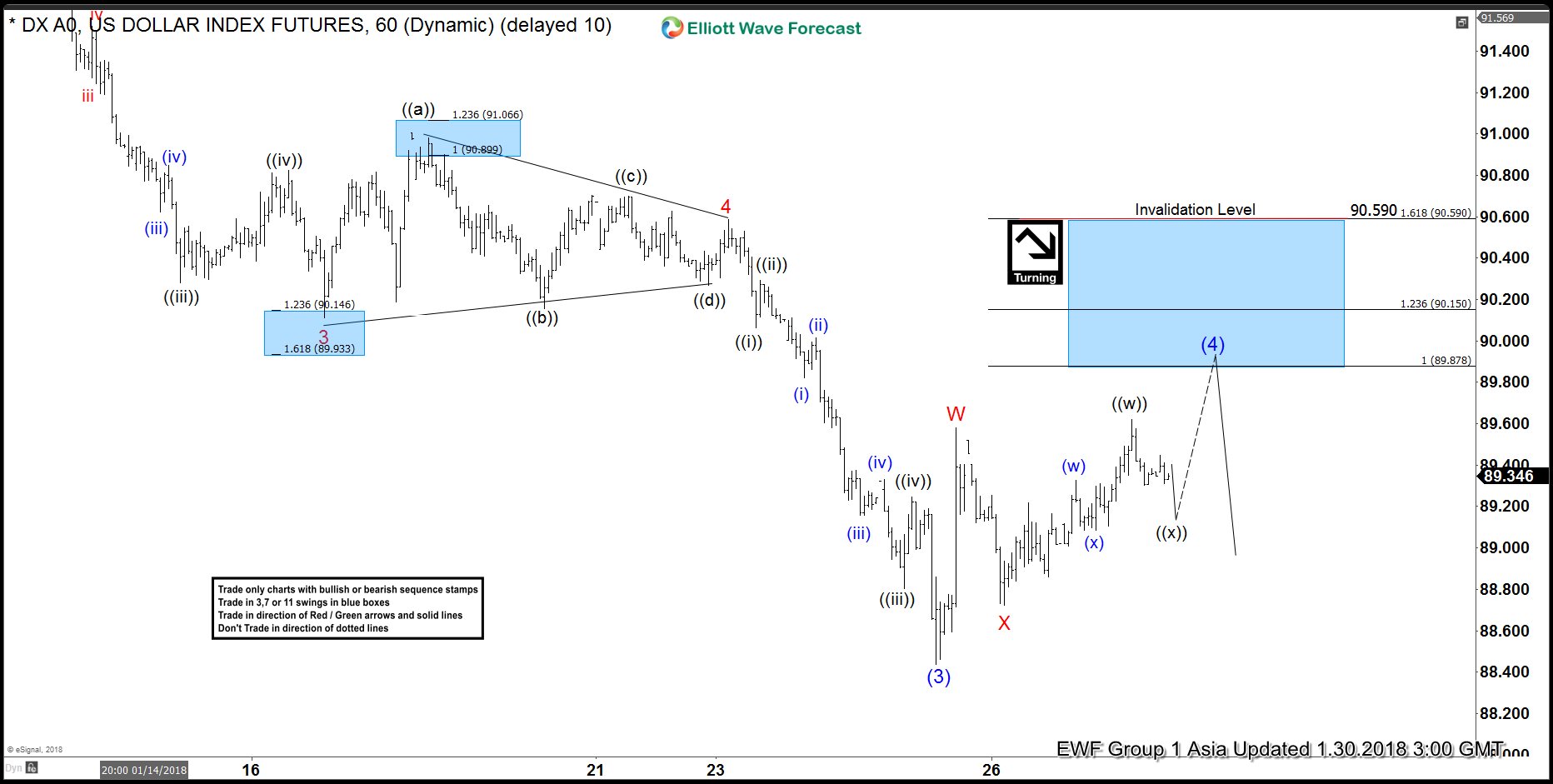

Elliott Wave Analysis: DXY in Double Correction

Read MoreDXY Dollar Index Short Term Elliott Wave view suggests that decline to 88.44 ended Intermediate wave (3). Up from there, Intermediate wave (4) bounce is unfolding as a double three Elliott Wave structure where Minor wave W ended at 89.58 and Minor wave X ended at 88.723. Minor wave Y is in progress with Minute wave ((w)) ended […]

-

High Frequency Box Provided 12% Profit in Russell

Read MoreIn this blog post, I want to discuss with you one of our recent High-Frequency box in the Russell Index which provided us with 12% in profit. We have been calling the Russell Index higher from the daily chart for a very long time. We are still bullish American indices, therefore, we have no other […]

-

Elliott Wave Analysis: GBPUSD ended wave (4) correction

Read MoreGBPUSD Short Term Elliott Wave view suggests that pair ended Intermediate wave (2) at 1.33 on 16 December 2017. Up from there, Intermediate wave (3) rally is unfolding as 5 waves impulse Elliott Wave structure where Minor wave 1 ended at 1.3613, Minor wave 2 ended at 1.3456, Minor wave 3 ended at 1.3943, Minor wave 4 […]