The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

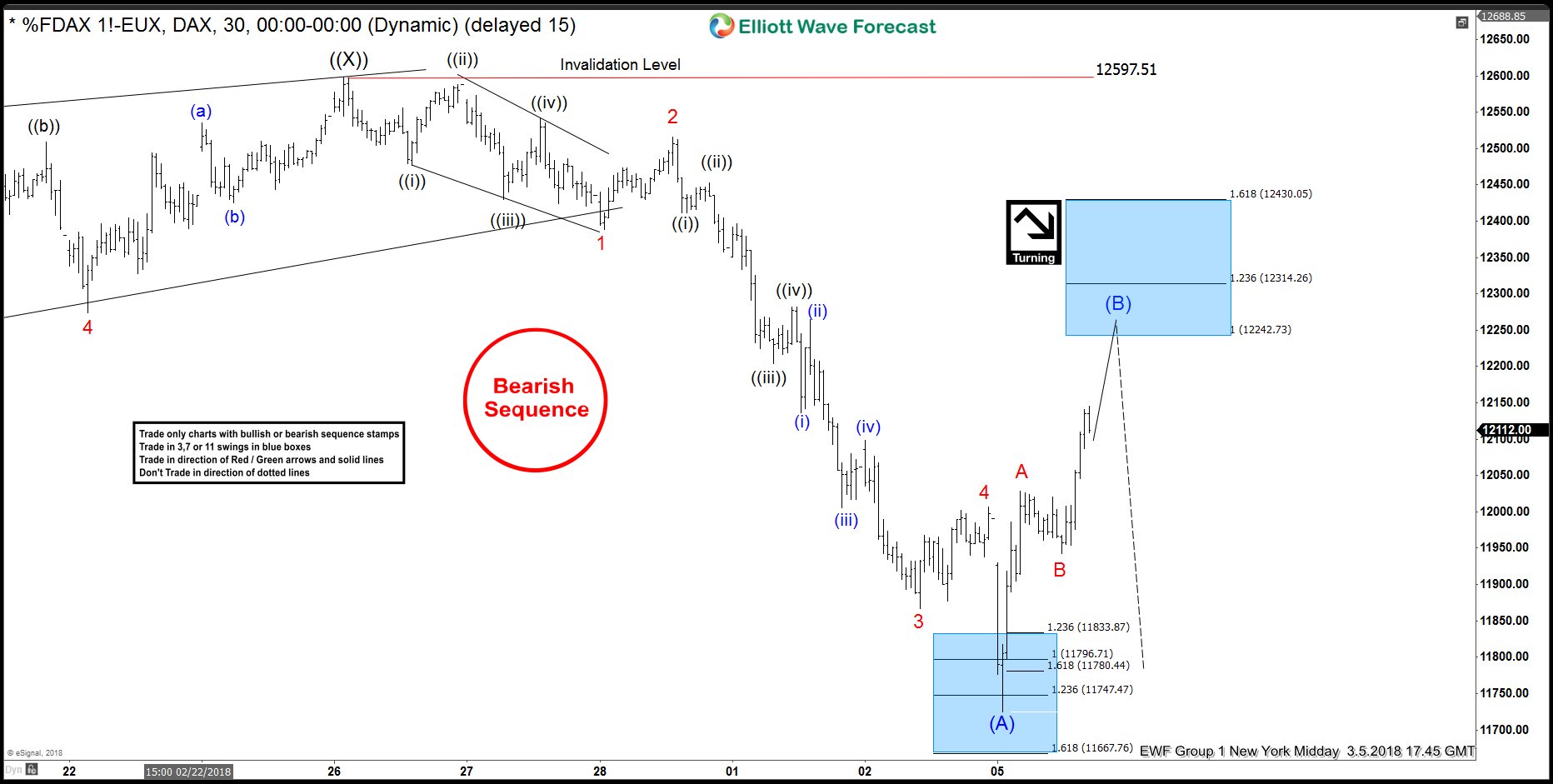

DAX Elliott wave view: Calling for another extension lower

Read MoreDAX, the index from Germany, is correcting higher degree cycle from February 2016. Short-term Elliott Wave view suggests that the rally to 12597.51 at February 26.2018 ended Primary wave ((X)). Down from there, the decline unfolded as a 5 waves Elliott Wave Impulse Sequence which ended at 11730.50 and this 5 waves ended Intermediate wave (A) of a Zigzag structure in the […]

-

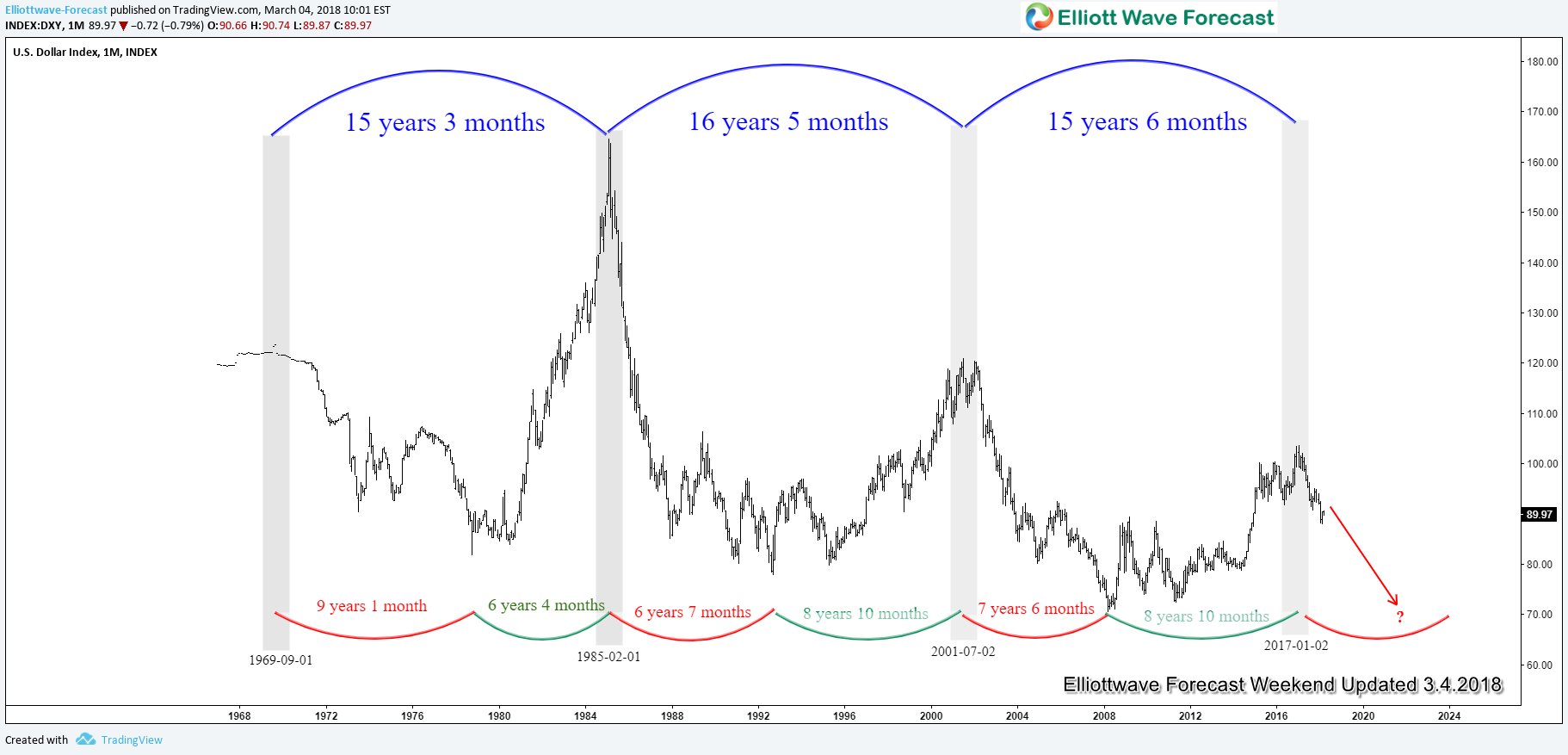

US Dollar at the Start of Multi-Year Downtrend

Read MoreSince the US Dollar trades freely in the 1970s, on average it has rallied and declined in a period of 7.5 years. The chart below shows short term and long term US Dollar cycle: Short Term and Long Term US Dollar Cycle From the chart above, we can see that since 1970s, the cycle in […]

-

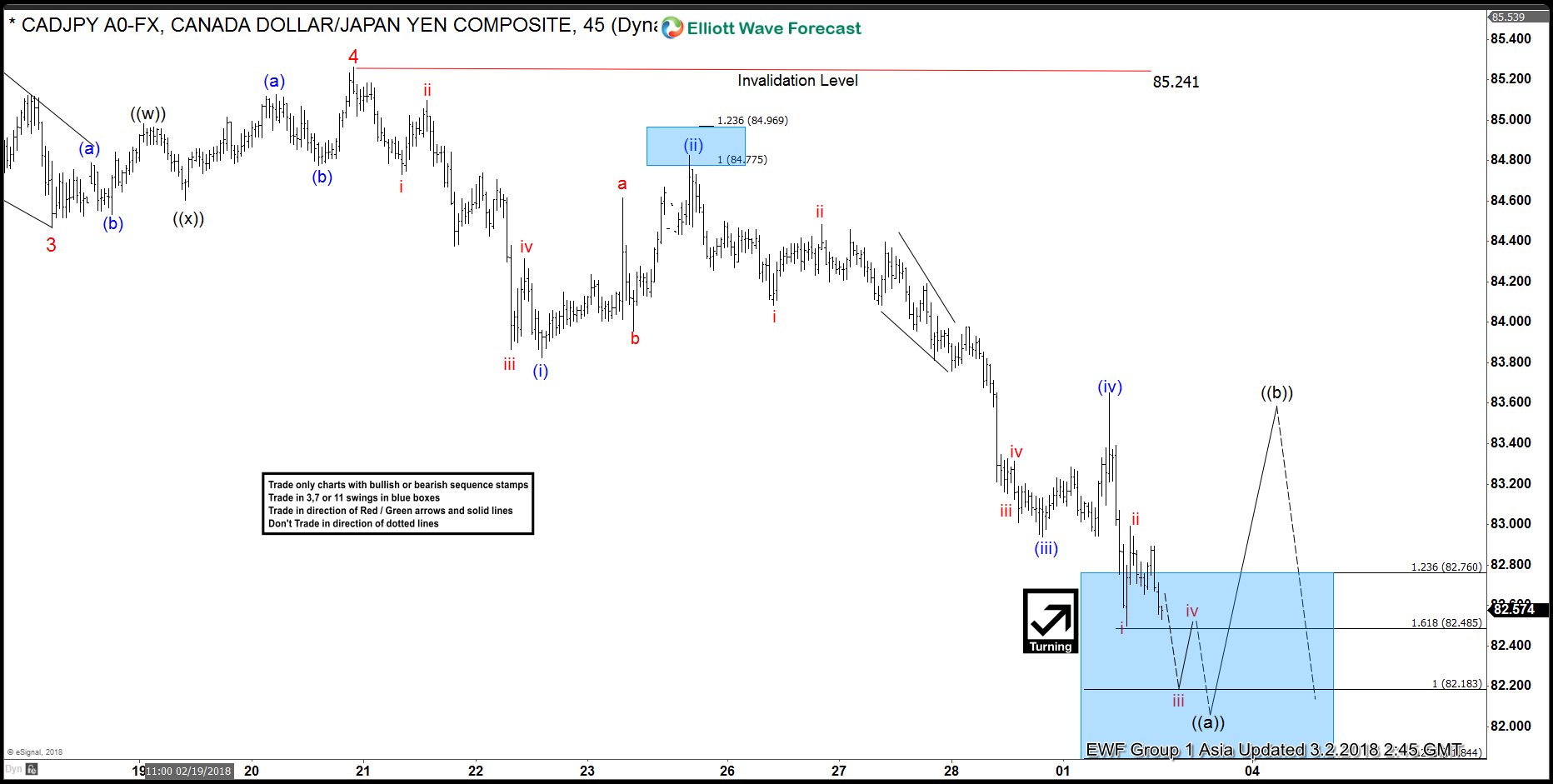

CADJPY Elliott Wave Analysis: Correction Expected Before Lower Again

Read MoreShort Term CADJPY Elliott Wave view suggests that the decline from 1/5/2018 high (91.58) is unfolding as an impulse Elliott Wave Structure where Minor wave 1 ended at 87.785, Minor wave 2 ended at 89.439, Minor wave 3 ended at 84.468, and Minor wave 4 ended at 85.24. Minor wave 5 remains in progress as […]

-

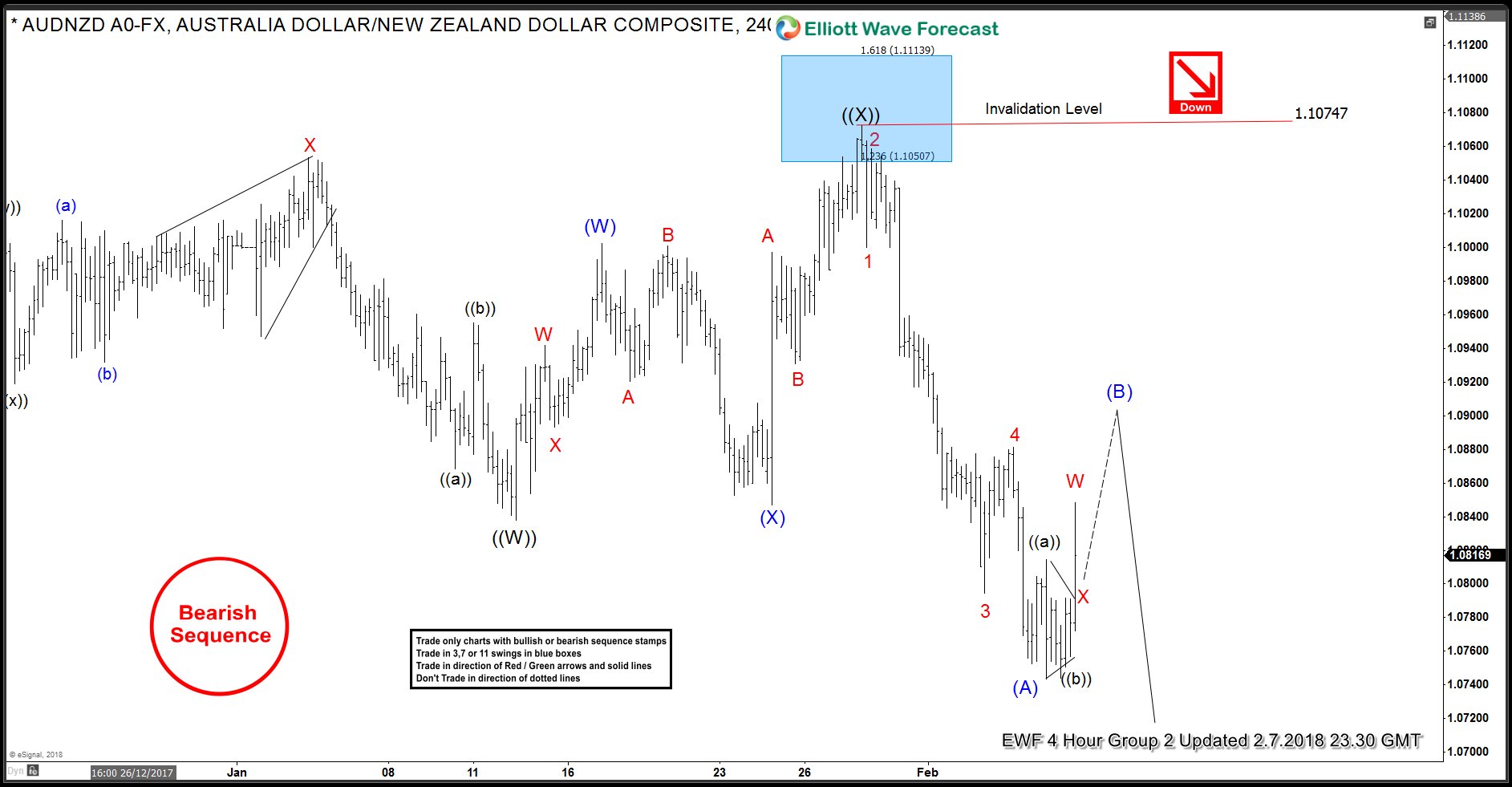

AUDNZD Selling the Elliott Wave bounces

Read MoreIn this Technical blog, we are going to take a quick look at the past Elliott wave chart performance of AUDNZD. Which we presented to our clients. We are going to explain the structure and the forecast. As our members know, we were pointing out that AUDNZD is having lower low bearish sequence from October 24.2017 peak. We advised […]