The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

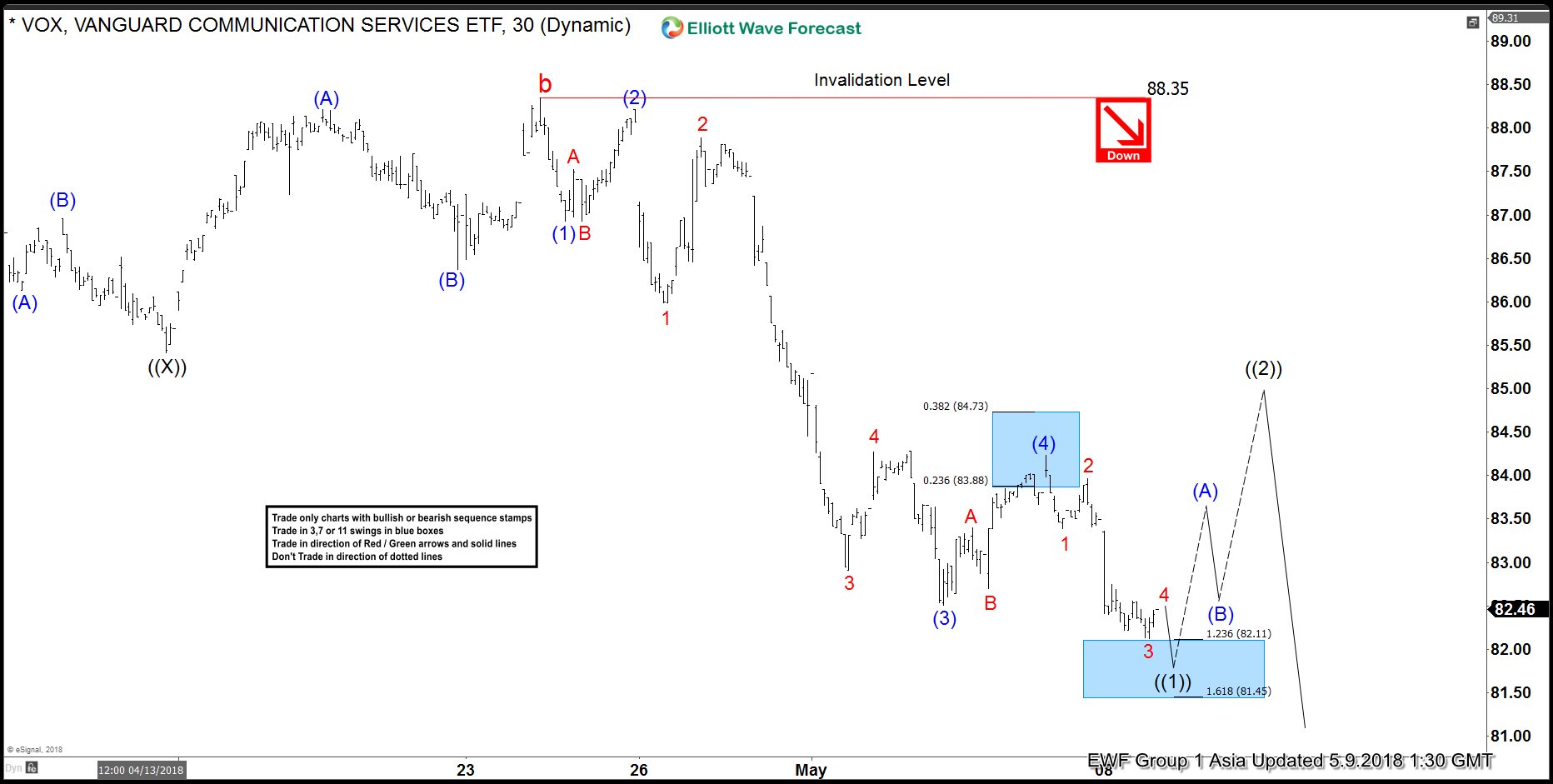

VOX Elliott Wave View: Calling For A Bounce Soon

Read MoreVanguard communication services ETF ticker symbol: VOX short-term Elliott Wave view suggests that the bounce to 88.35 on 4/24/2018 high ended cycle degree wave “b”. Below from there, the cycle degree wave “c” remain in progress as an Impulse Elliott Wave structure looking for more downside extensions. Down from 88.35 high, Primary wave ((1)) is in progress as […]

-

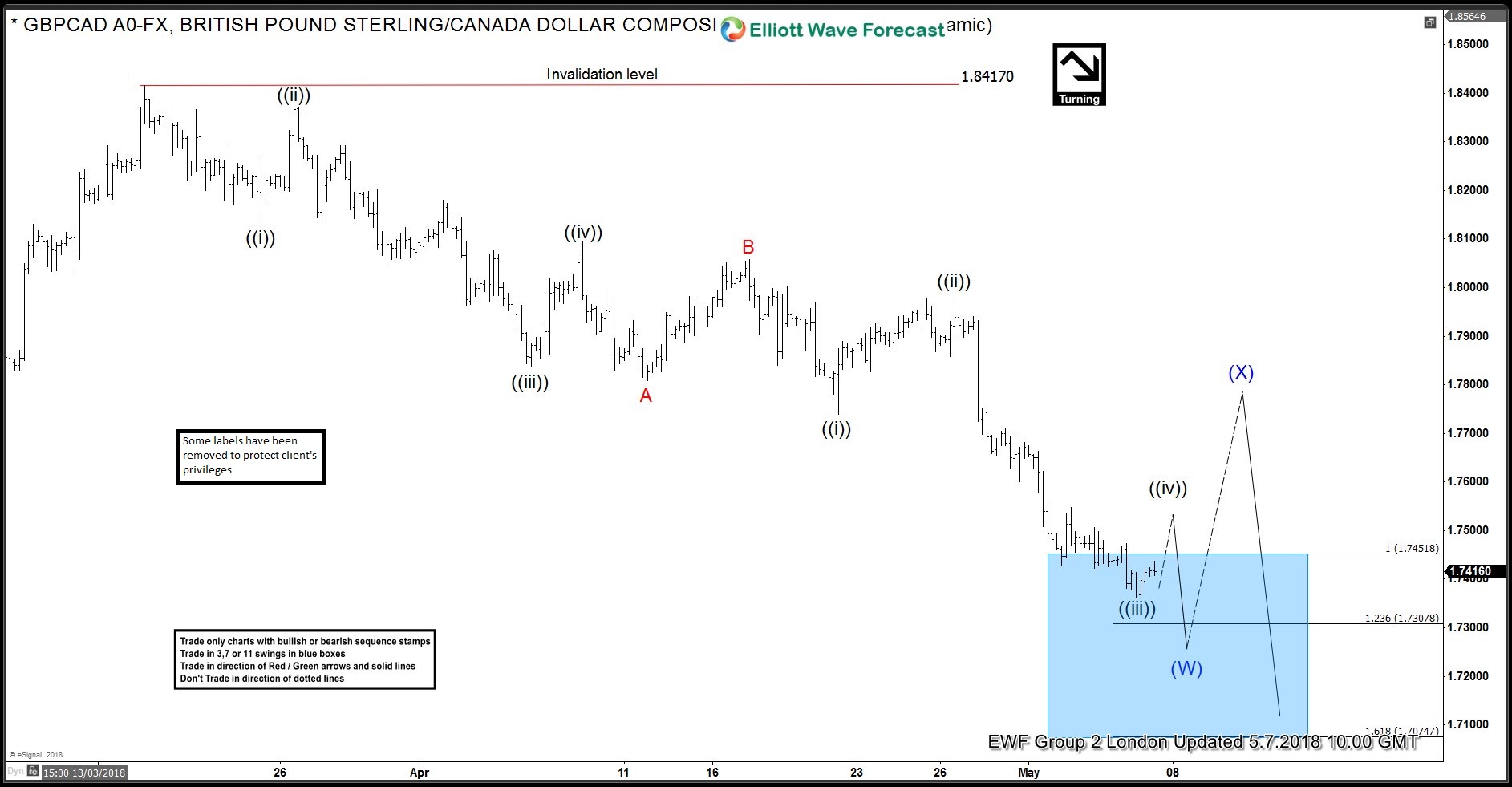

GBPCAD Elliott Wave View: Calling The Bounce Soon

Read MoreGBPCAD Elliott wave view in shorter cycles suggests that the decline from 3/19/2018 high 1.8417 is unfolding as a Zigzag structure in intermediate wave (W) lower. The internals of a zigzag structure unfolds with sub-division of 5-3-5 wave structure when wave A & C consists of 5 waves structure, which can be labeled as impulse […]

-

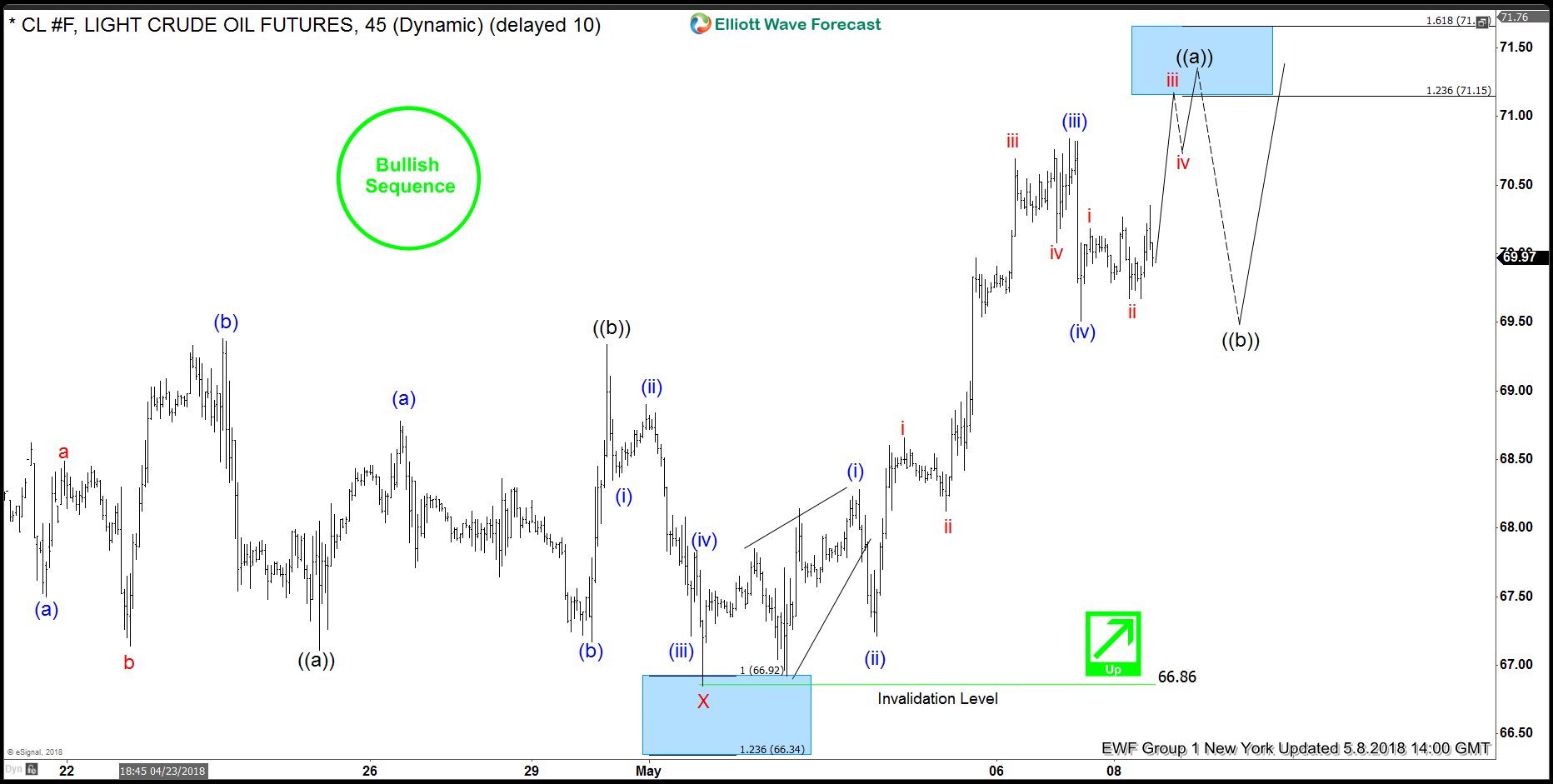

How US Decision on Iran Deal May Affect Crude Oil Price

Read MoreOn Tuesday at 2 PM Eastern Time, U.S President Donald Trump is expected to announce decision whether he will withdraw from the 2015 Iran nuclear deal. Trump has long been known to criticize the 2015 accord, known as JCPOA (Joint Comprehensive Plan of Action). The deal was originally signed by Iran, the Obama Administration., Russia, […]

-

FTSE Showing Impulse Elliott Wave Structure

Read MoreFTSE short-term Elliott Wave view suggests that the decline to 3/26/2018 low 6866.94 ended the cycle degree wave “b”. Above from there, the index is rallying higher in a strong Impulse Elliott Wave structure with extension in the 3rd wave. It’s important to note that an impulse structure should have internal subdivision of lesser degree 5 […]