The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

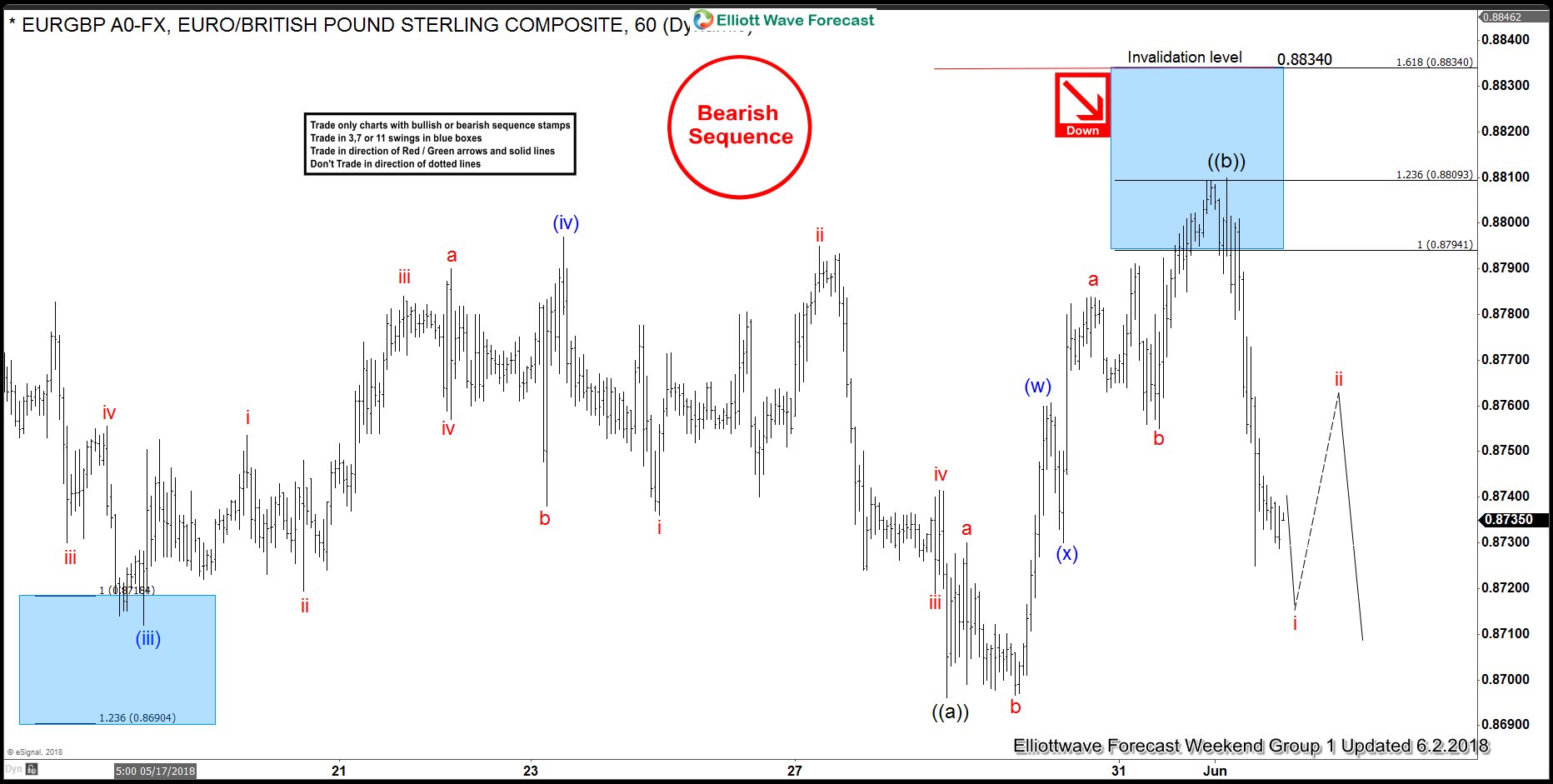

EURGBP Elliott Wave Analysis: Selling The Rally

Read MoreToday, we will have a look at some Elliott Wave charts of the EURGBP which we presented to our members in the past. Below, you can find our 1-hour updated chart presented to our members on the 05/31/18 calling for more downside after a Double Elliott wave correction in blue wave (w)-(x). EURGBP ended the cycle from […]

-

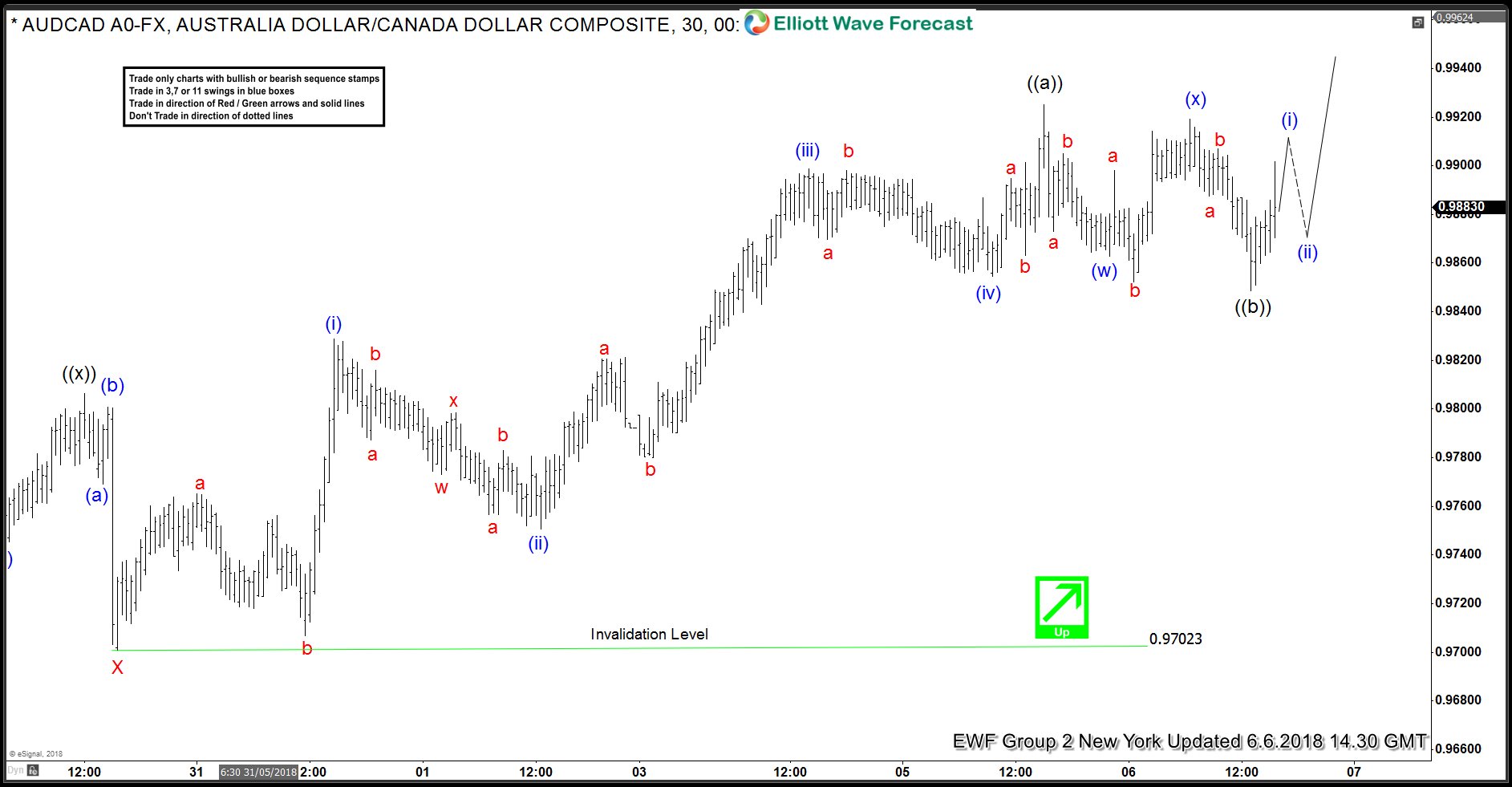

Australia Economy Beat Expectation

Read MoreAustralia Economy Posts Strong Q1 Growth Australia’s 1st quarter 2018 Gross Domestic Product is growing at 1.01%, beating the expectation of 0.9%. This is the largest increase since late 2011 and brings the year-on-year growth rate to 3.1%, up from 2.4% in the previous quarter. Chart below shows the year-on-year growth of Australia’s GDP: The […]

-

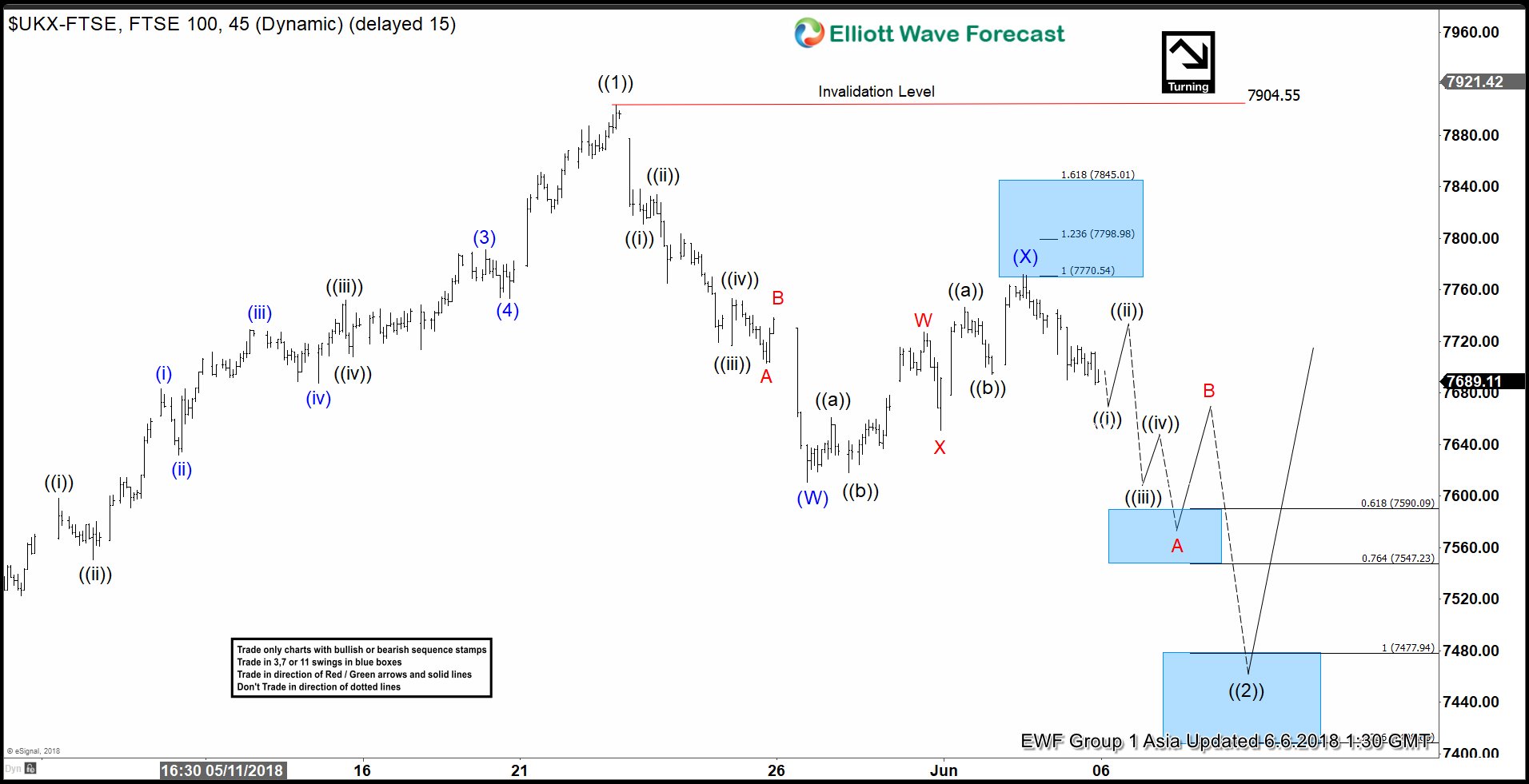

FTSE Elliott Wave View: Buying Opportunity Soon

Read MoreFTSE short-term Elliott wave view suggests that the rally to 7903.50 high on 5/22/2018 peak ended primary wave ((1)). This rally to 7903.5 starts from 3/23/2018 low and took the form of an impulse Elliott wave structure. The index is currently in Primary wave ((2) pullback to correct cycle from 3/23/2018 low. So far the […]

-

SPX Elliott Wave Analysis: Close To A Pullback?

Read MoreSPX short-term Elliott wave view suggests that the rally from 4/02/2018 low (2553.8) is extending higher in 5 waves structure. These 5 waves are expected to be part of a leading diagonal structure within intermediate wave (1) higher. The move higher from 2553.8 low has the characteristic of a diagonal where the internal distribution of each leg higher […]