The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

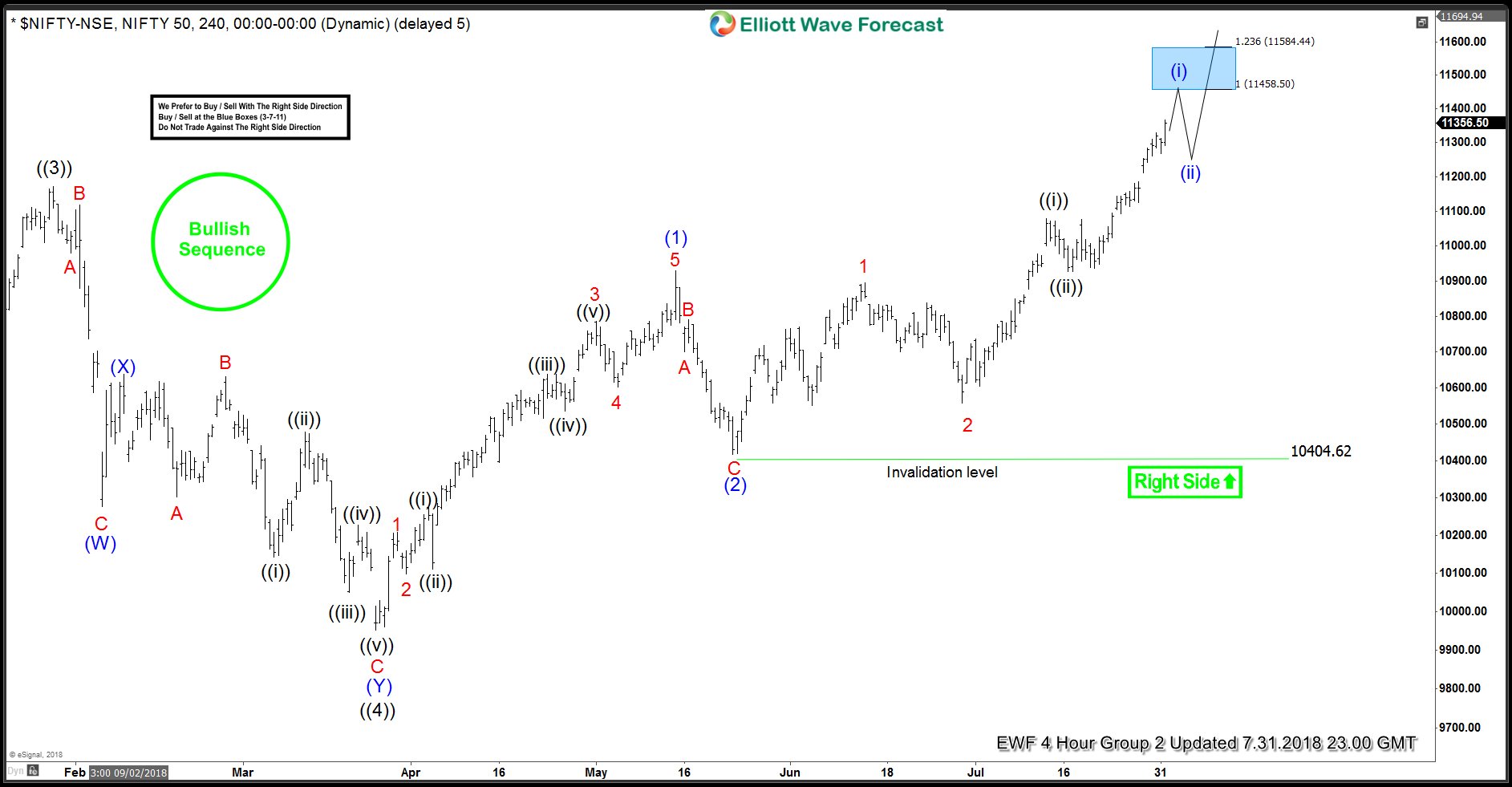

Nifty Elliott Wave Analysis: Rallying Higher as Impulse

Read MoreNifty Elliott wave analysis suggests that the rally to 11171.55 high ended primary wave ((3)). Down from there, the decline to 9951.9 low ended primary wave ((4)) pullback. The internals of that pullback unfolded as Elliott wave double three structure with sub-division of 3-3-3 corrective swings in each leg. Down from 11171.55 high, the initial decline […]

-

SPX Elliott Wave Analysis: Buying Opportunity Soon

Read MoreSPX Short-term Elliott Wave analysis suggests that the pullback to $2691.80 low on 6.28.2018 ended intermediate wave (2). Above from there, the rally higher to $2848.03 peak ended Minor wave 1. The internals of that rally higher took the form as impulse Elliott wave structure where Minute wave ((i)), ((ii)) & ((iii)) unfolded in 5 waves structure […]

-

Amazon Elliott Wave Analysis: Forecasting And Buying The Rally

Read MoreIn this blog, I want to share some short-term Elliott Wave charts of Amazon which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 07/23/18 indicating that Amazon ended the cycle from 06/25 low in red wave 1. As Amazon ended the cycle from 06/25 […]

-

Market Nature And The Art Of Trading It

Read MoreNature, in the broadest sense, is the natural, physical, or material world or universe. “Nature” can refer to the phenomena of the physical world, and also to life in general. The study of nature is a large, if not the only, part of science. Although humans are part of nature, human activity is often understood […]