The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Nike Providing Buying Opportunity Soon?

Read MoreNike ticker symbol: $NKE short-term Elliott wave view suggests that the decline to $75.06 low ended intermediate wave (2). Above from there, the stock has rallied to new all-time highs confirming the next extension higher in intermediate wave (3) higher. The internals of intermediate wave (3) is unfolding as Elliott wave impulse structure with the […]

-

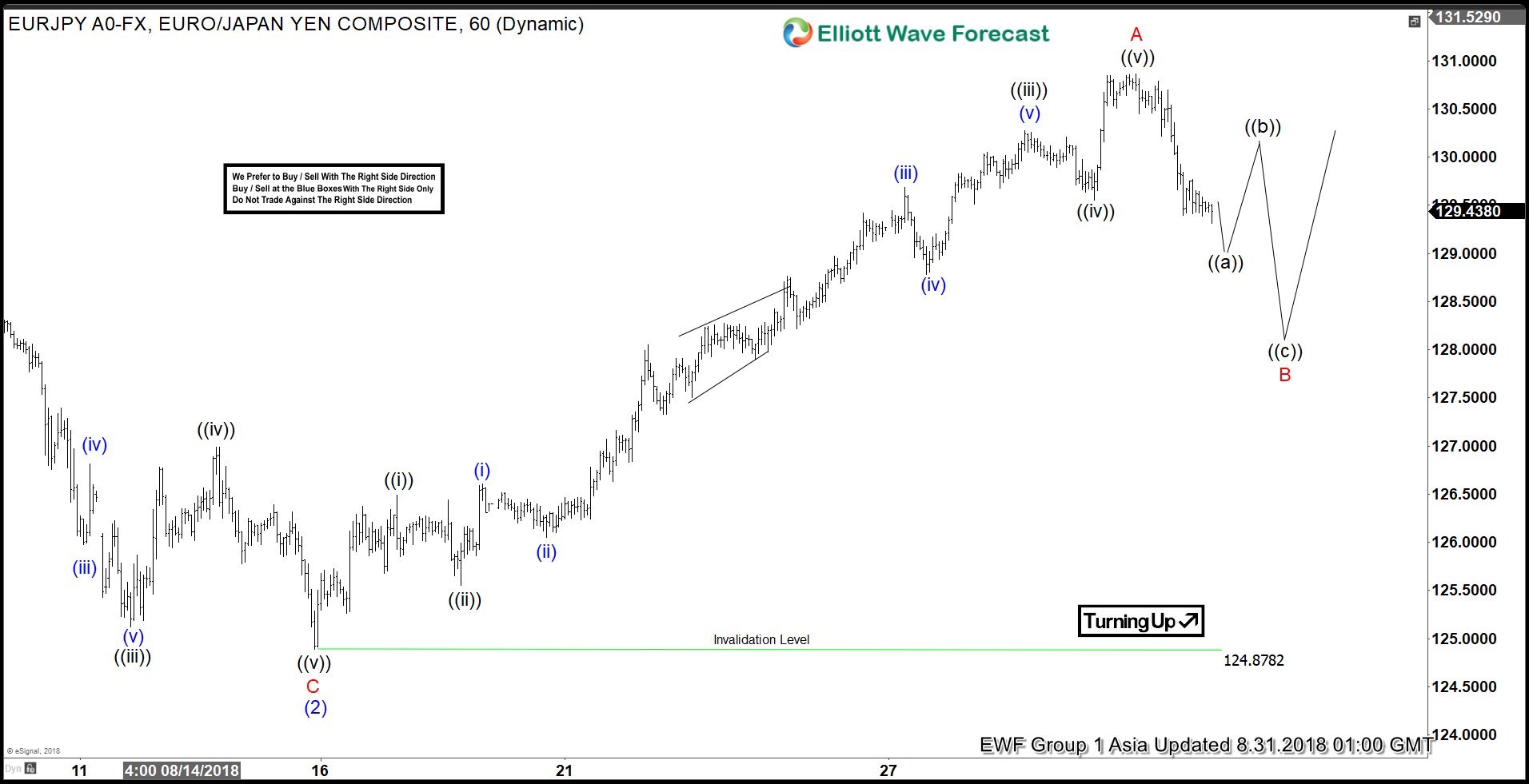

EURJPY Elliott Wave View: Ended 5 Waves Advance

Read MoreEURJPY short-term Elliott wave view suggests that the decline to 124.87 low ended intermediate wave (2) pullback of a leading diagonal structure from 5/29/2018 cycle. Above from there, the rally higher is taking place as Elliott wave zigzag structure within intermediate wave (3) of a diagonal. In a zigzag ABC structure, lesser degree cycles should […]

-

Market Participants Betting on Nafta Deal between US and Canada

Read MoreThe Canadian Dollar strengthened to a two month high against US Dollar earlier this week. Market participants seem to bet on possible inclusion of Canada in a new Nafta pact. The U.S. has just concluded a successful bilateral talk with Mexico on Monday. Under the new agreement, cars need to have 75% of their content […]

-

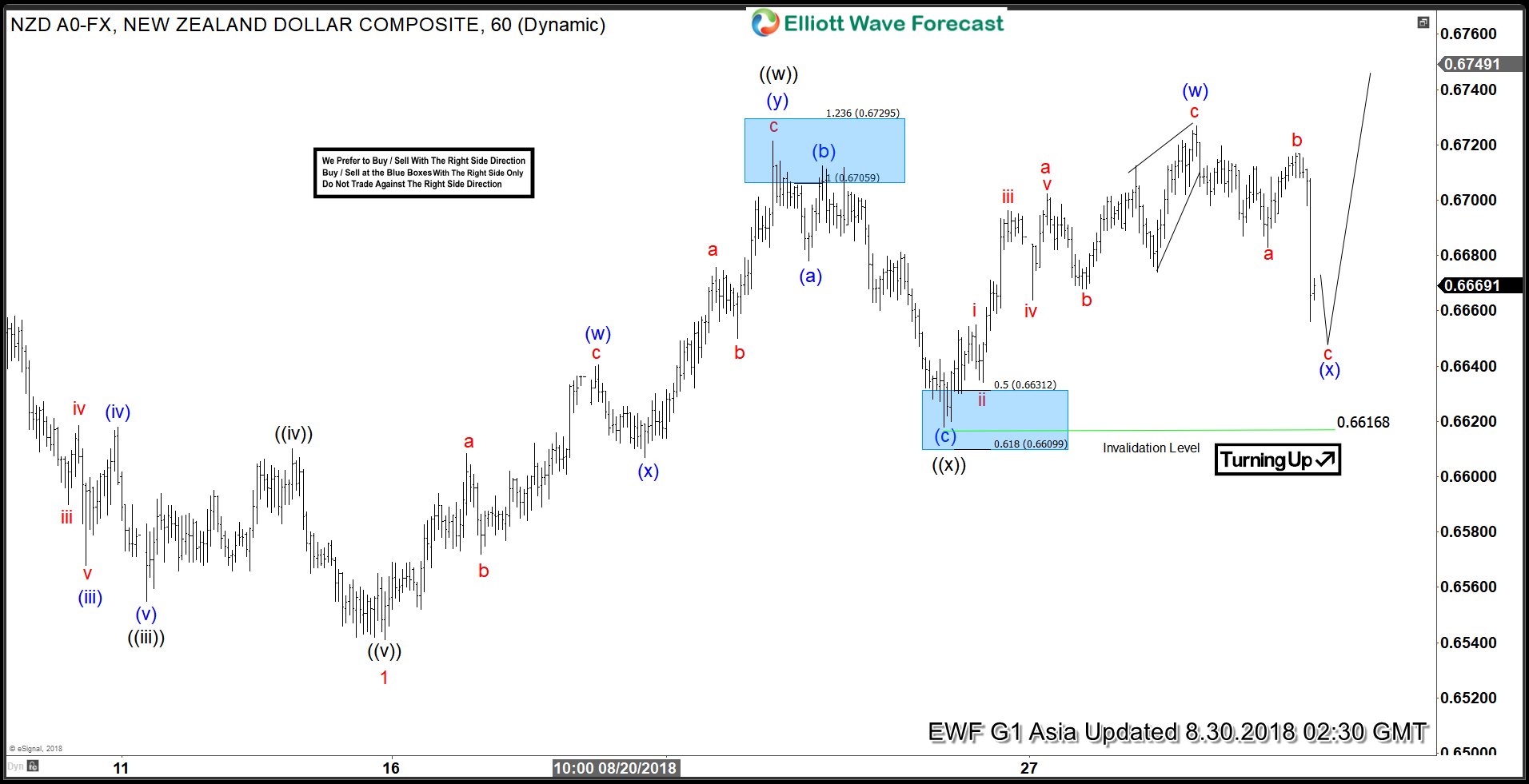

NZDUSD Elliott Wave Analysis: Double Correction Taking Place

Read MoreNZDUSD short-term elliott wave analysis suggests that the decline to 0.6543 low ended Minor wave 1. The internals of that decline unfolded as impulse structure with lesser degree Minute wave ((i)), ((iii)) & ((v)) unfolded in 5 waves structure. Above from there, Minor wave 2 bounce is taking place as double correction higher with lesser […]