The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

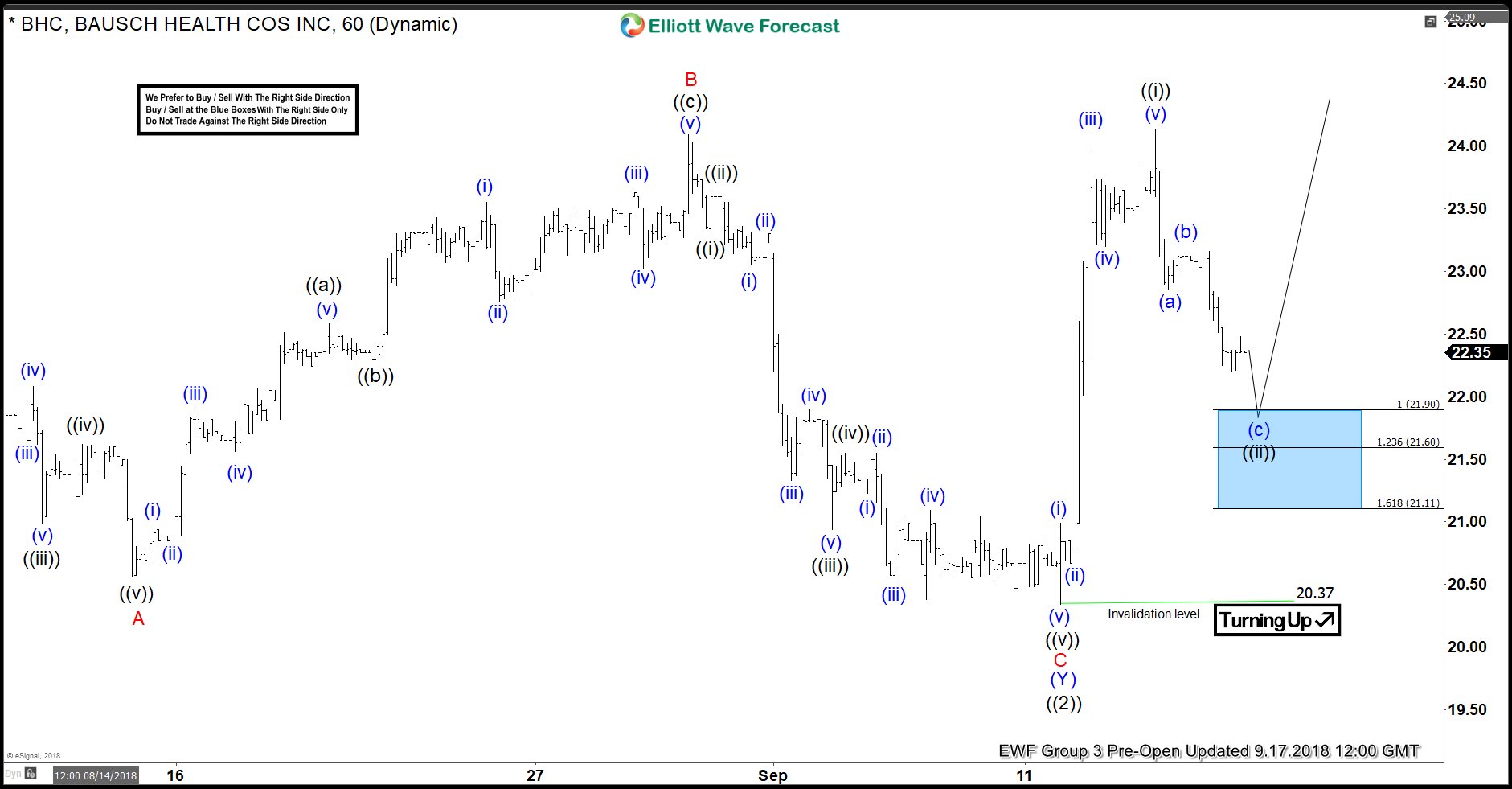

BHC Elliott Wave Analysis: Inflection Area Called The Bounce

Read MoreIn this blog, I want to share some short-term Elliott Wave charts of the BAUSCH Health stock which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 09/17/18 indicating that BHC ended the cycle from 06/13 peak low in black wave ((2)). As BHC ended the […]

-

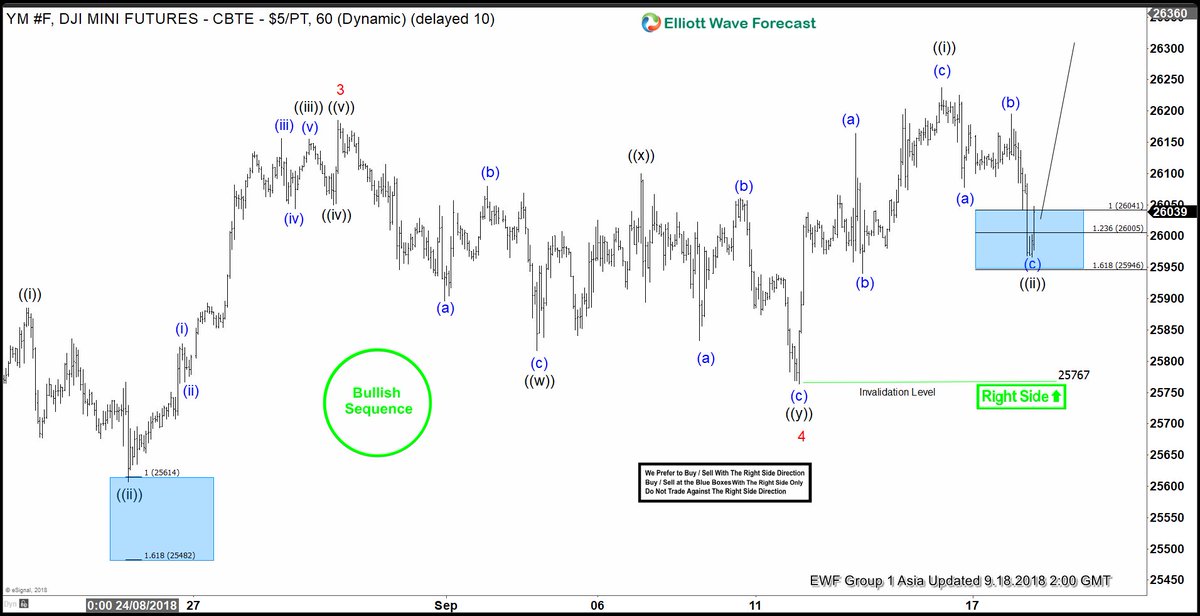

$DJI ( YM #F) Buying The Intraday Dips in 3,7,11 Swings

Read MoreAnother trading opportunity we have had lately is long trade in $DJI Mini Futures. In this technical blog we’re going to take a quick look at the Elliott Wave charts of $DJI published in members area of the website. As our members know, the right side in $DJI is long side. Futures has incomplete bullish […]

-

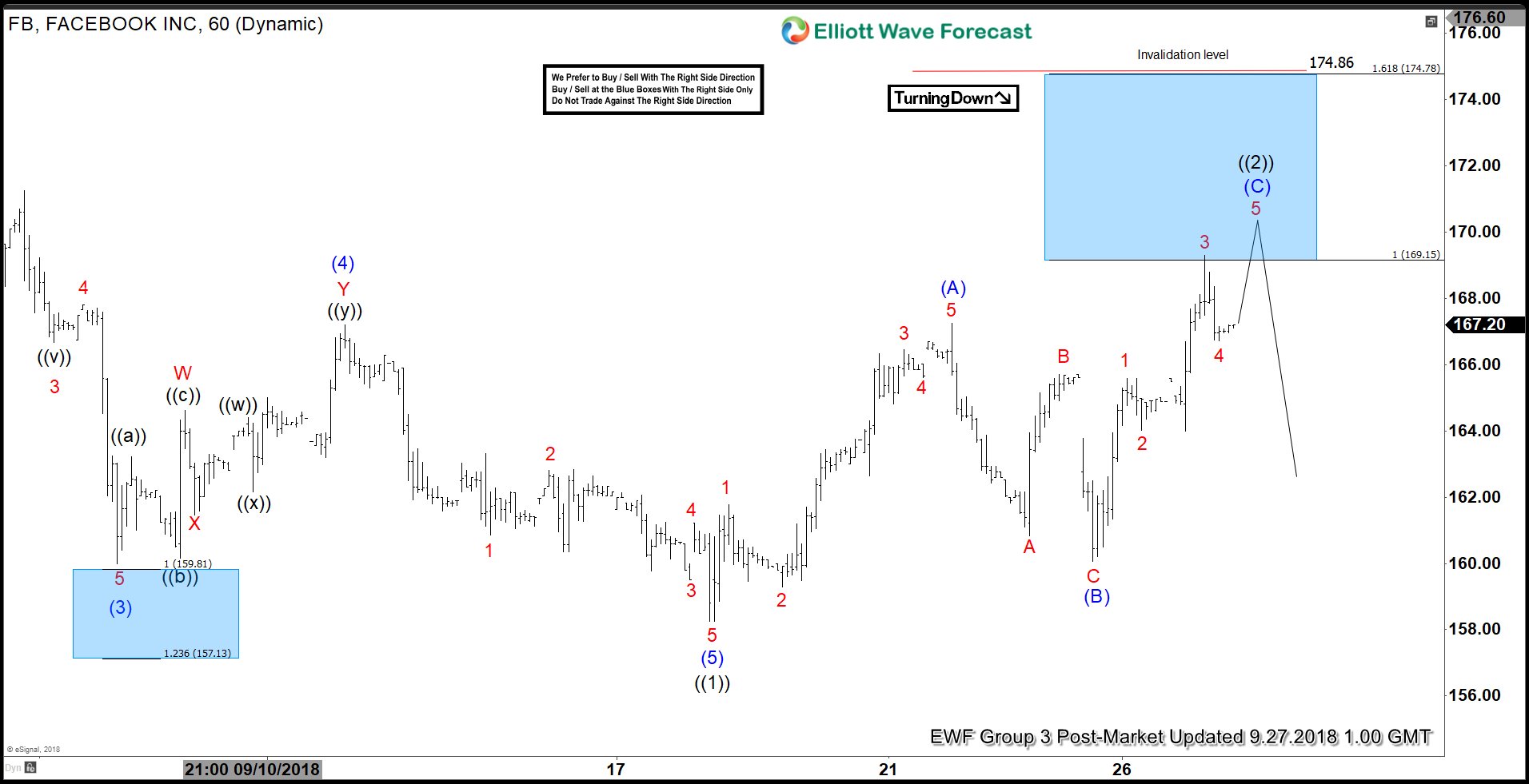

Facebook At Verge Of Rejection Again?

Read MoreFacebook ticker symbol: $FB short-term Elliott wave view suggests that the decline to $158.26 low ended the cycle from 8/07/2018 peak in primary wave ((1)). The internals of that decline unfolded in 5 waves impulse structure with lesser degree cycles showing the sub-division of 5 waves structure in it’s each leg lower i.e intermediate wave […]

-

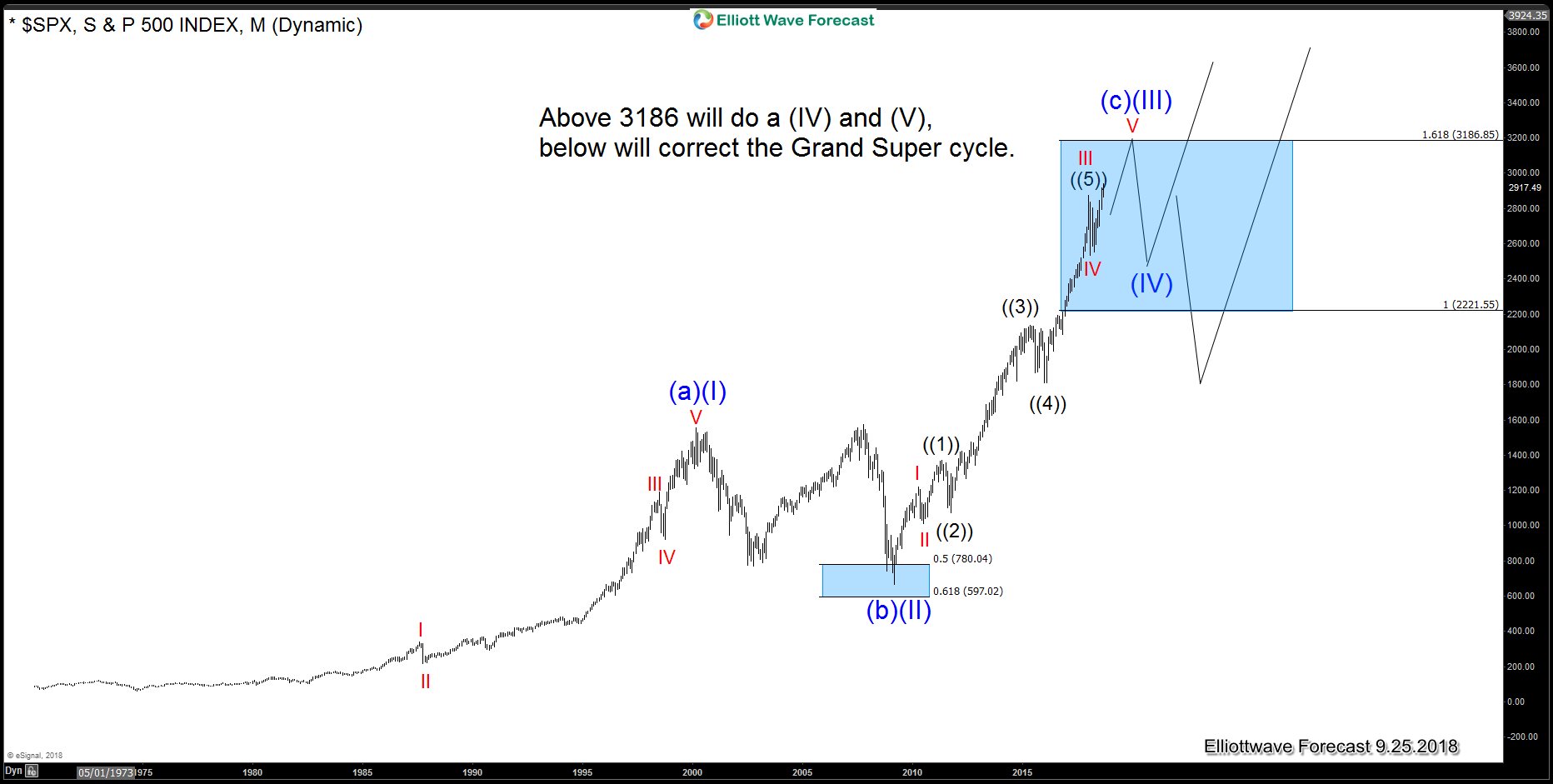

SPX500: The American Election and the Grand Supercycle

Read MoreMany traders and Presidents believe that the Market is a reaction of the agendas and even their own trades. The Reality is that the Market follows cycles, sequences and trades within extensions in both Time and Price. Therefore, we will have a look at the SPX500 monthly chart and some other relevant world indices. We believe […]