The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

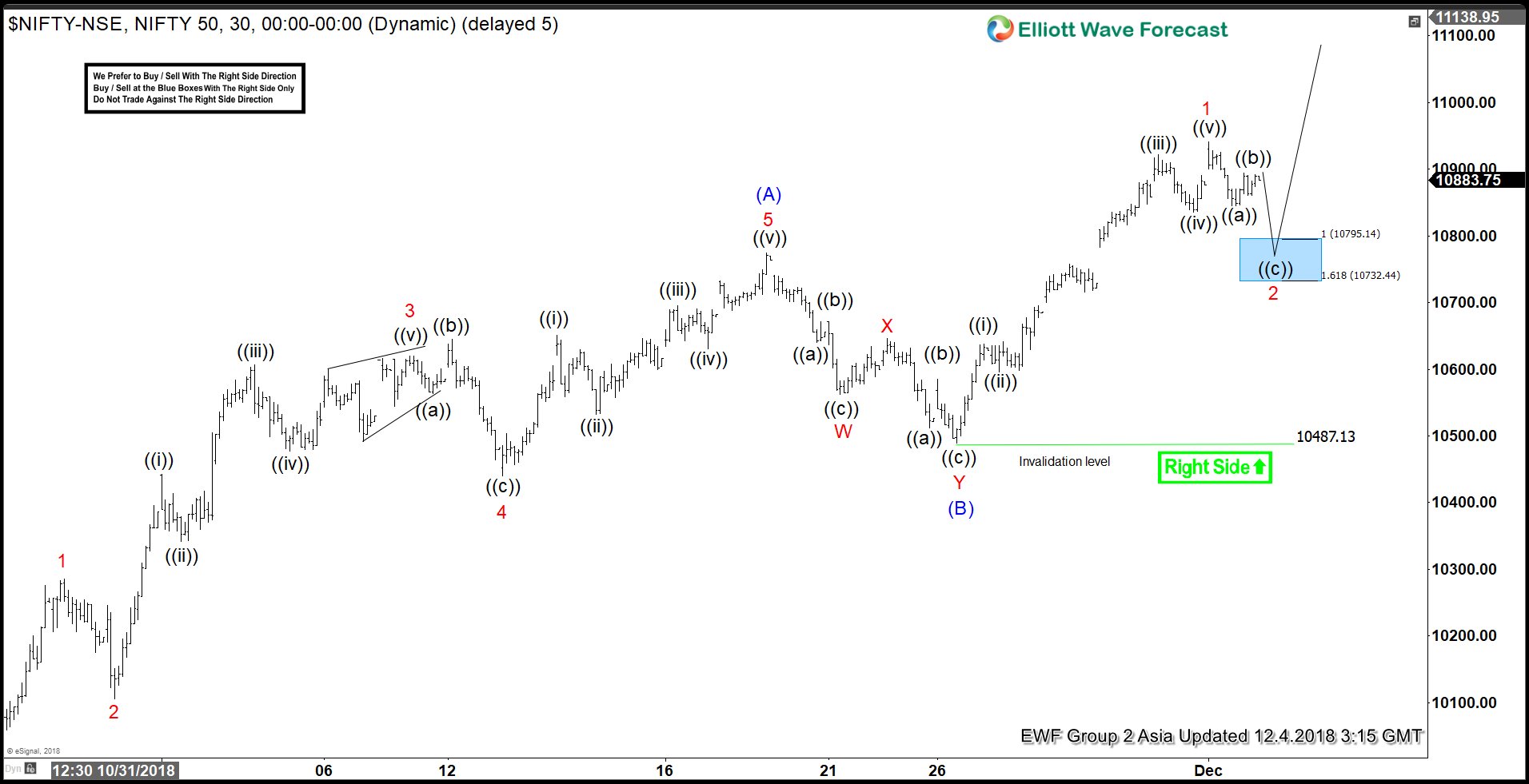

Elliott Wave View favoring more upside in NIFTY

Read MoreNIFTY is showing an incomplete sequence to the upside in the short term, favoring more upside while above 11/26 low (10487.1). Near term, cycle from 10/26 low (10004) remains in progress as a zigzag Elliott Wave structure. Intermediate Wave (A) ended at 10774.7 as 5 waves impulse Elliott Wave structure and Intermediate wave (B) ended […]

-

MSFT: In the Race for World’s Most Valuable Firm

Read More(RTTNews) – Microsoft Corp. (MSFT) has unseated Apple Inc. (AAPL) to rank as the world’s most valuable listed company. The software giant ended Friday with a market value of more than $851 billion compared with Apple’s $847 billion. Both companies remain well below the $1 trillion milestone that Apple and Amazon hit earlier this year. […]

-

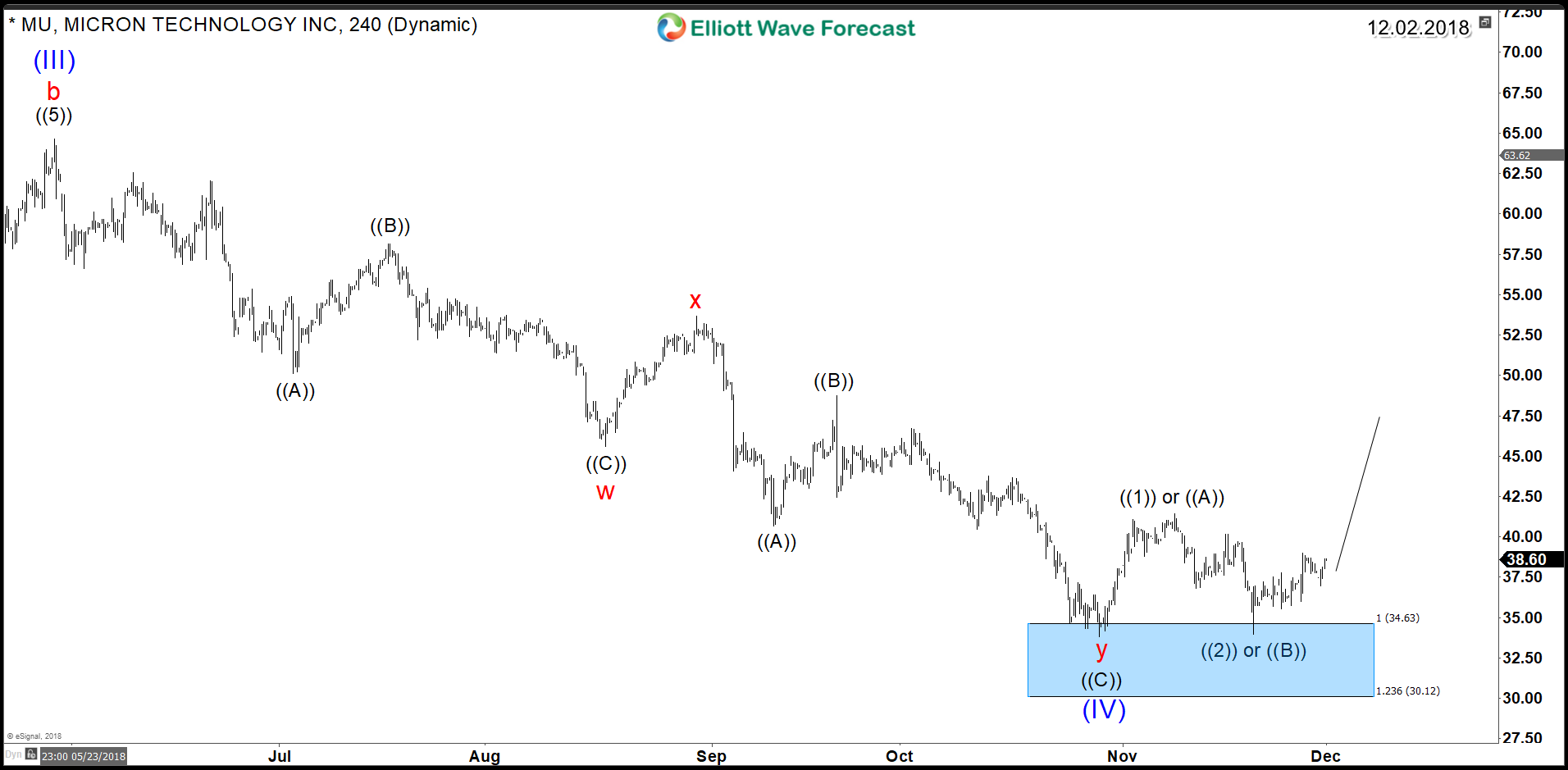

Micron Technology (MU) – Reversal Around the Corner

Read MoreIn the recent 2 years, Micron Technology (NASDAQ: MU) Investors were in the sky as the stock gained +500% in value since 2016 lows. The global corporation is one of largest semiconductor producer in USA behind giants like Intel & NVDIA. In the recent 6 months, the prices of dynamic random-access memory DRAM and NAND flash memory […]

-

Nvidia (NASDAQ:NVDA) – New Buying Opportunity in the Horizon?

Read MoreNvidia Corporation (NASDAQ:NVDA) has grown to become a leader in manufacturing graphic processing units (GPU) for computer and gaming devices as well as Artificial Intelligence (AI). In the recent 2 years, the American company benefited the most from the growth of cryptocurrency and artificial intelligence markets. However, back in October 2018, the stock made a major peak […]