The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

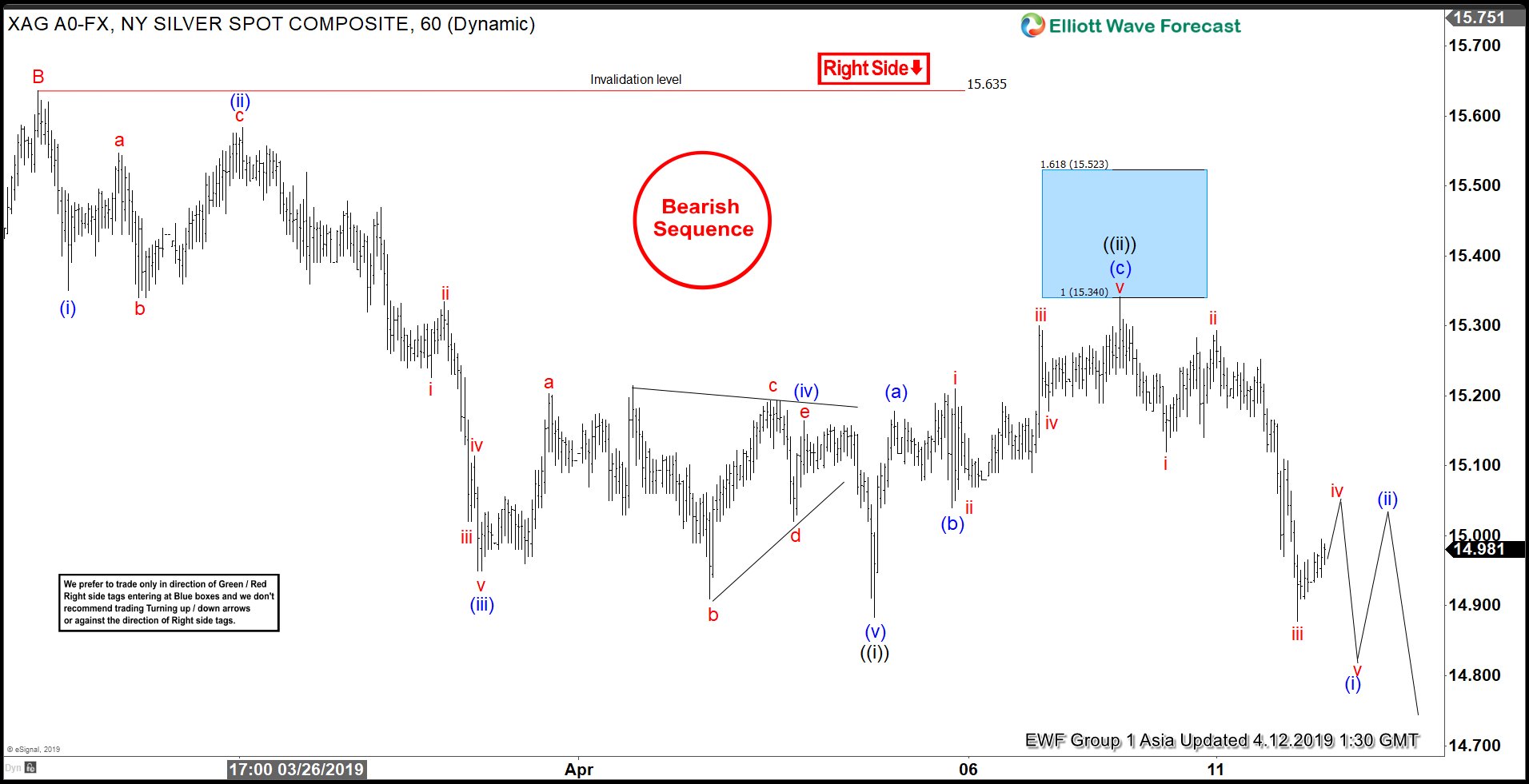

Elliott Wave View: Silver Extending Lower

Read MoreSilver continues to show incomplete sequence from Feb 21. This article and video explains the short term Elliott Wave path for the metal.

-

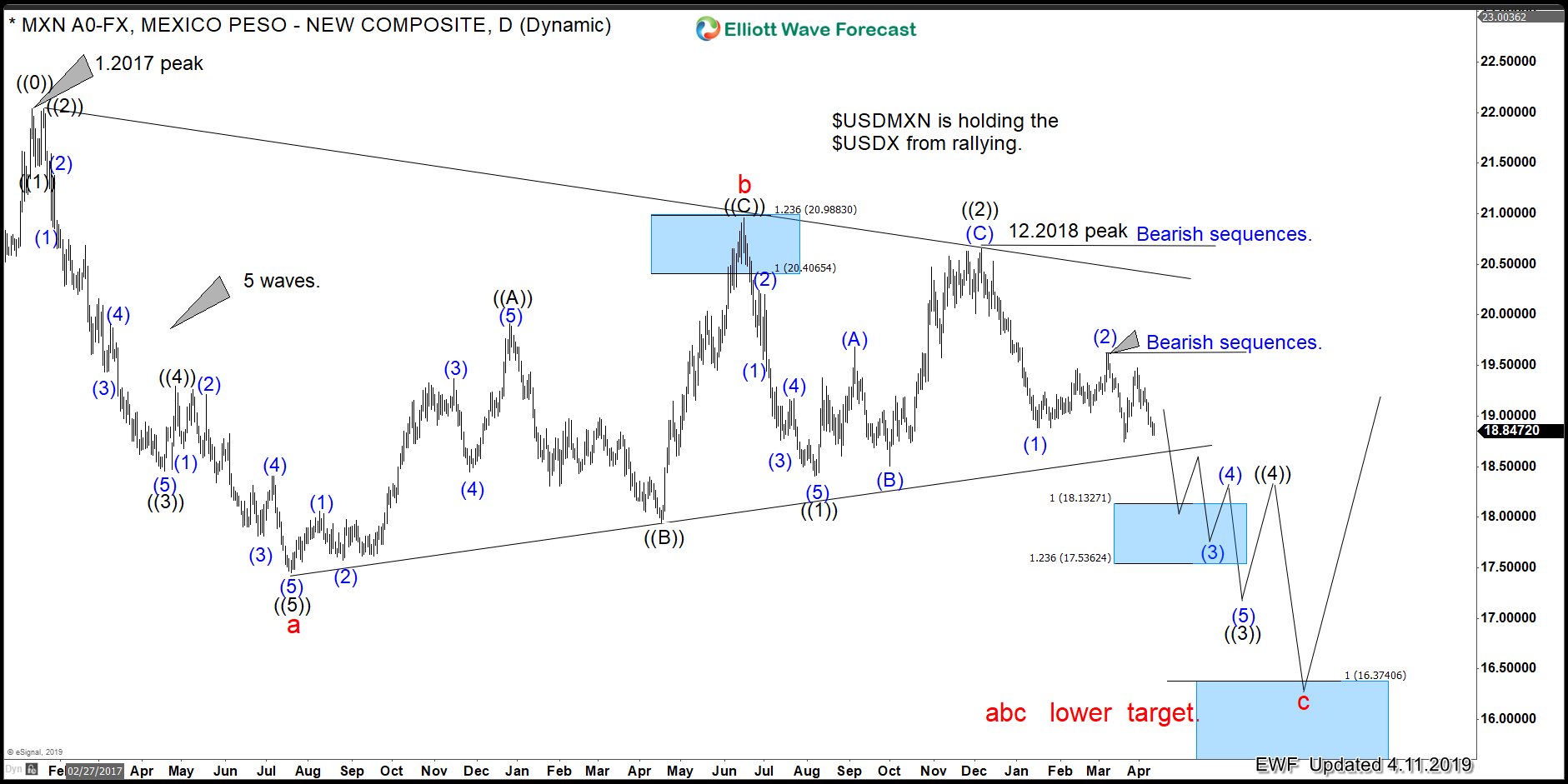

USDMXN Is Holding Down the USDX from Rallying

Read MoreIn today’s blog, we will have a look between the relationship of the Dollar Index and the Mexican Peso. The USDMXN has been trading in the same direction as the Dollar Index and both have peaked in January 2017. As you can see in the following chart below. Dollar Index vs USDMXN 04/11/2019 Weekly Chart […]

-

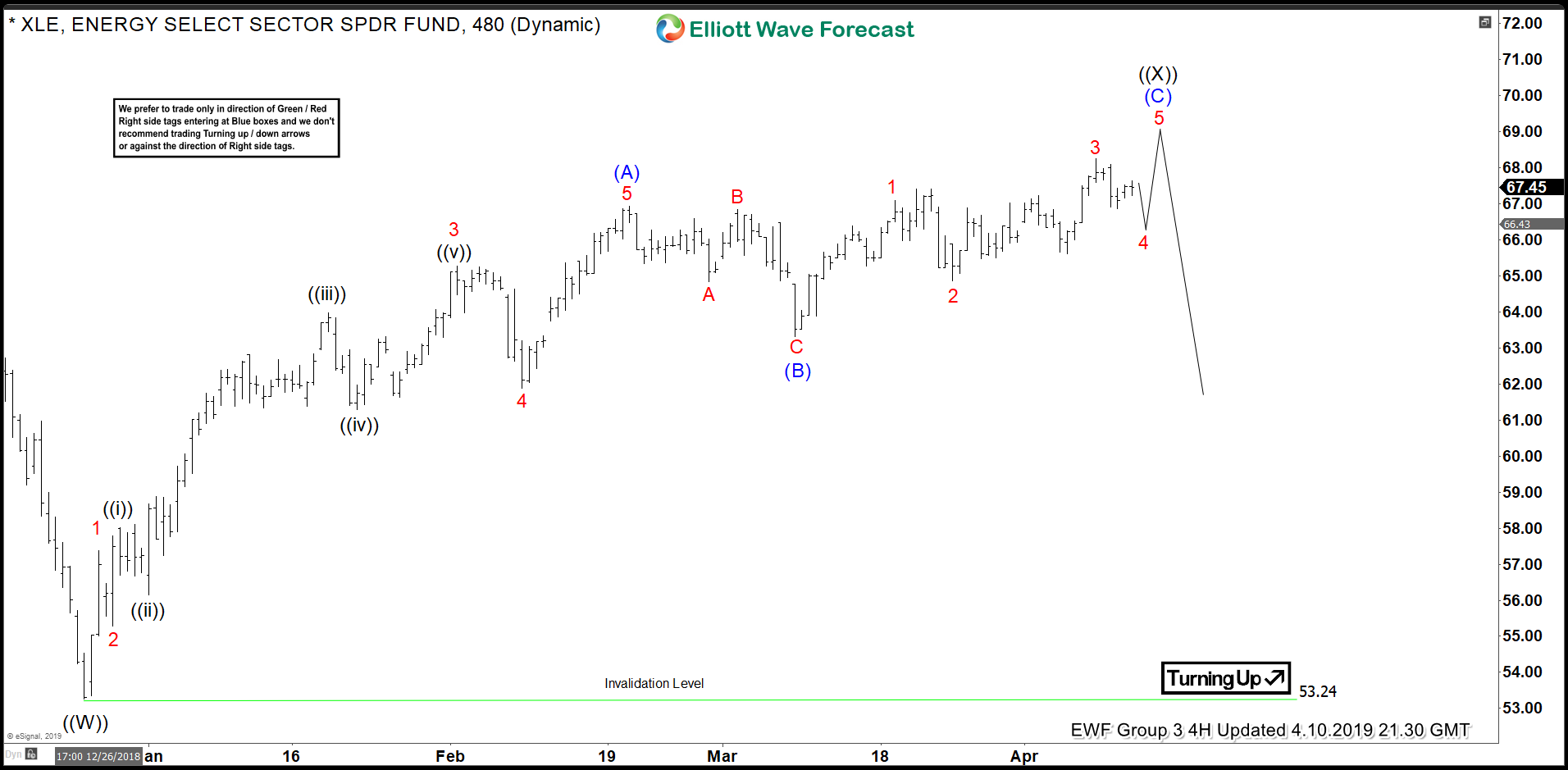

Elliott Wave Structure Suggests XLE Topping Soon

Read MoreXLE Topping Soon Taking a look at the recent Elliott wave structure in XLE suggests a top may be near. Starting from the 12/24/18 low at $53.25 the energy ETF shows a 5 wave impulse in wave (A) to $66.93 on 2/20/19. From there we count a 3 wave correction to the (B) wave low […]

-

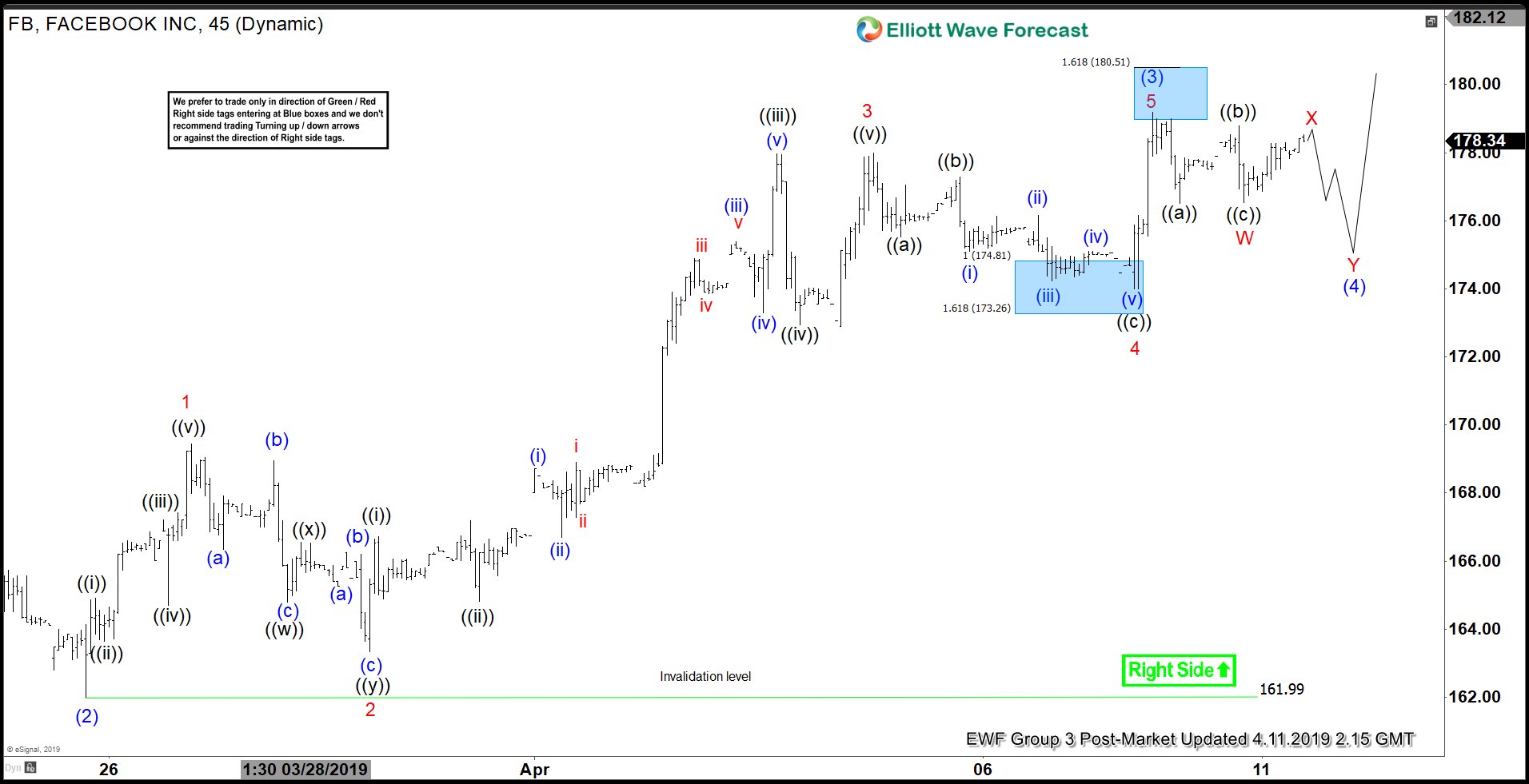

Elliott Wave View Favors More Upside in Facebook

Read MoreFacebook shows incomplete sequence from December 2018 low. This article and video explains the short term Elliott Wave path.