The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

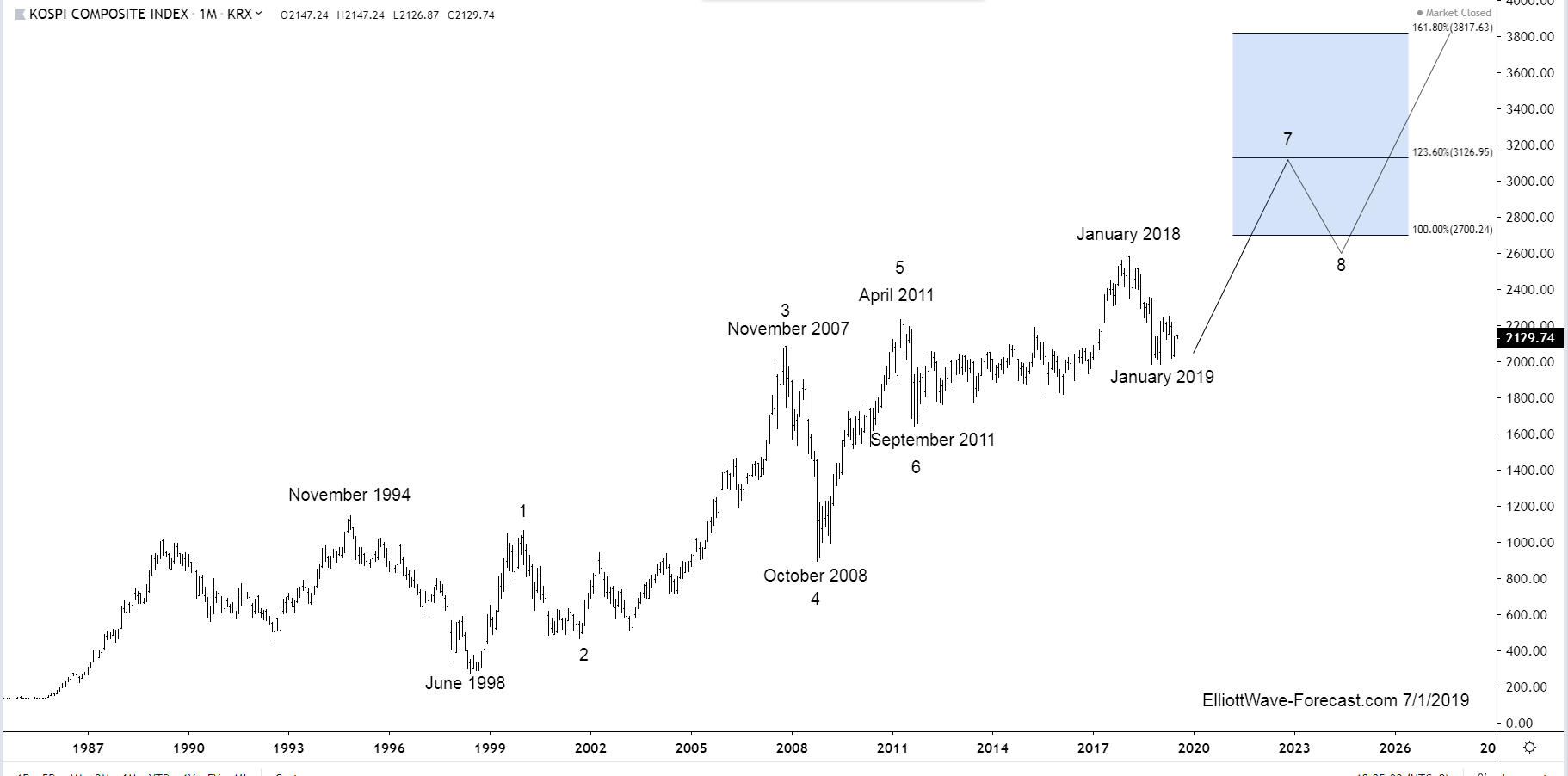

Kospi Long Term Cycles Remain Bullish

Read MoreKospi Long Term Cycles Remain Bullish The KOSPI Index in the long term has been trending higher with other world indices since inception in 1983. The index began with a base value set at 100 and trended higher until it ended that cycle in 1994. The index then corrected that cycle with the dip into 1998 […]

-

BAC Elliott Wave View: Found Buyers in Blue Box and Rallied

Read MoreHello fellow traders. Today, I want to share some Elliott Wave charts of the Bank of America (BAC) stock which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 06/23/19. BAC ended that short-term cycle in red wave 1. Below from there, we advised members […]

-

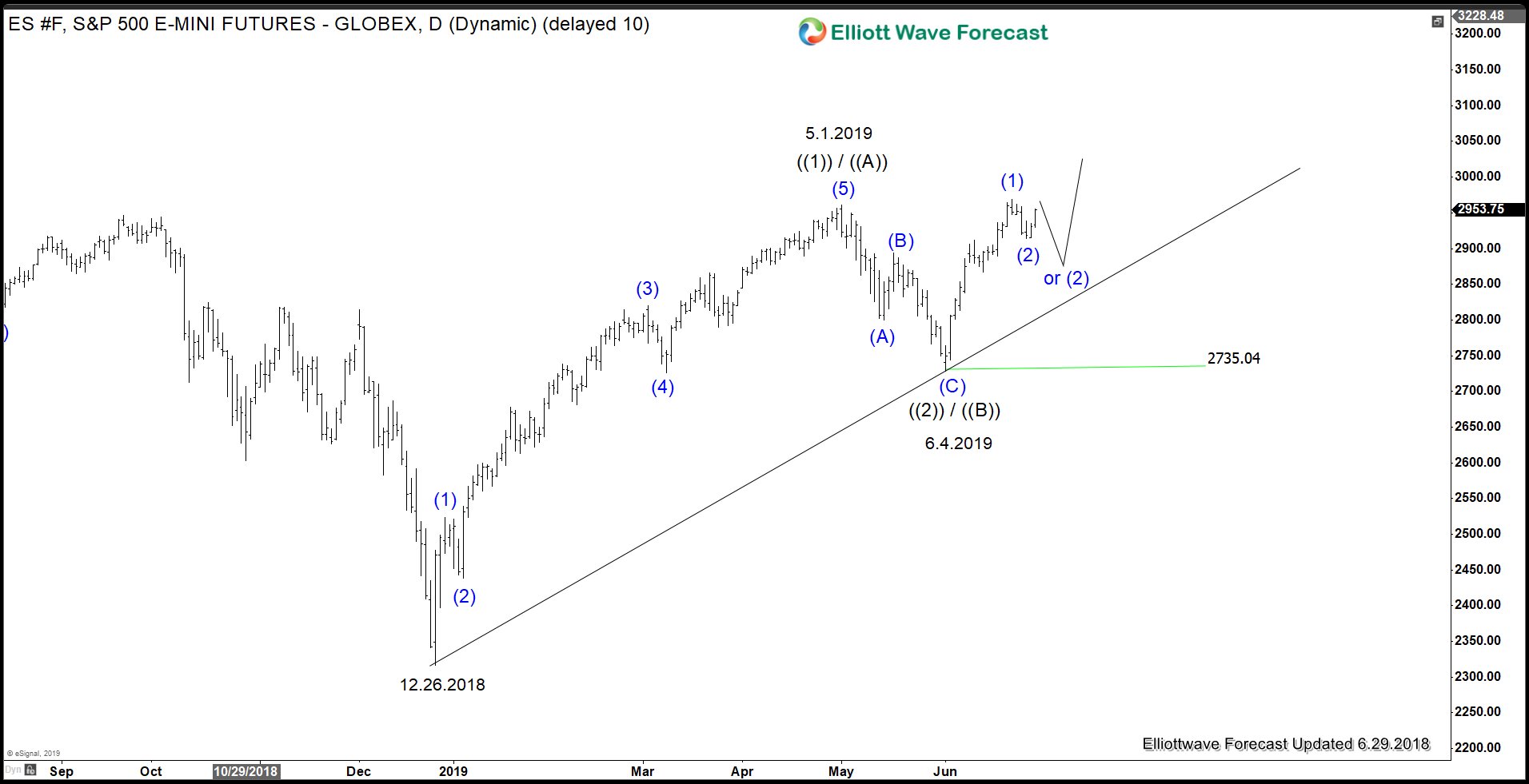

G20 Temporary Truce between USA and China May Boost Market Sentiment

Read MoreThe highly anticipated meeting between the U.S. and China during G20 meeting in Japan has concluded. Both parties agree to resume the trade talks and the U.S also agreed to put on hold additional tariffs on $325 billion Chinese goods for the time being. The U.S. previously has threatened to slap 25% tariffs on all […]

-

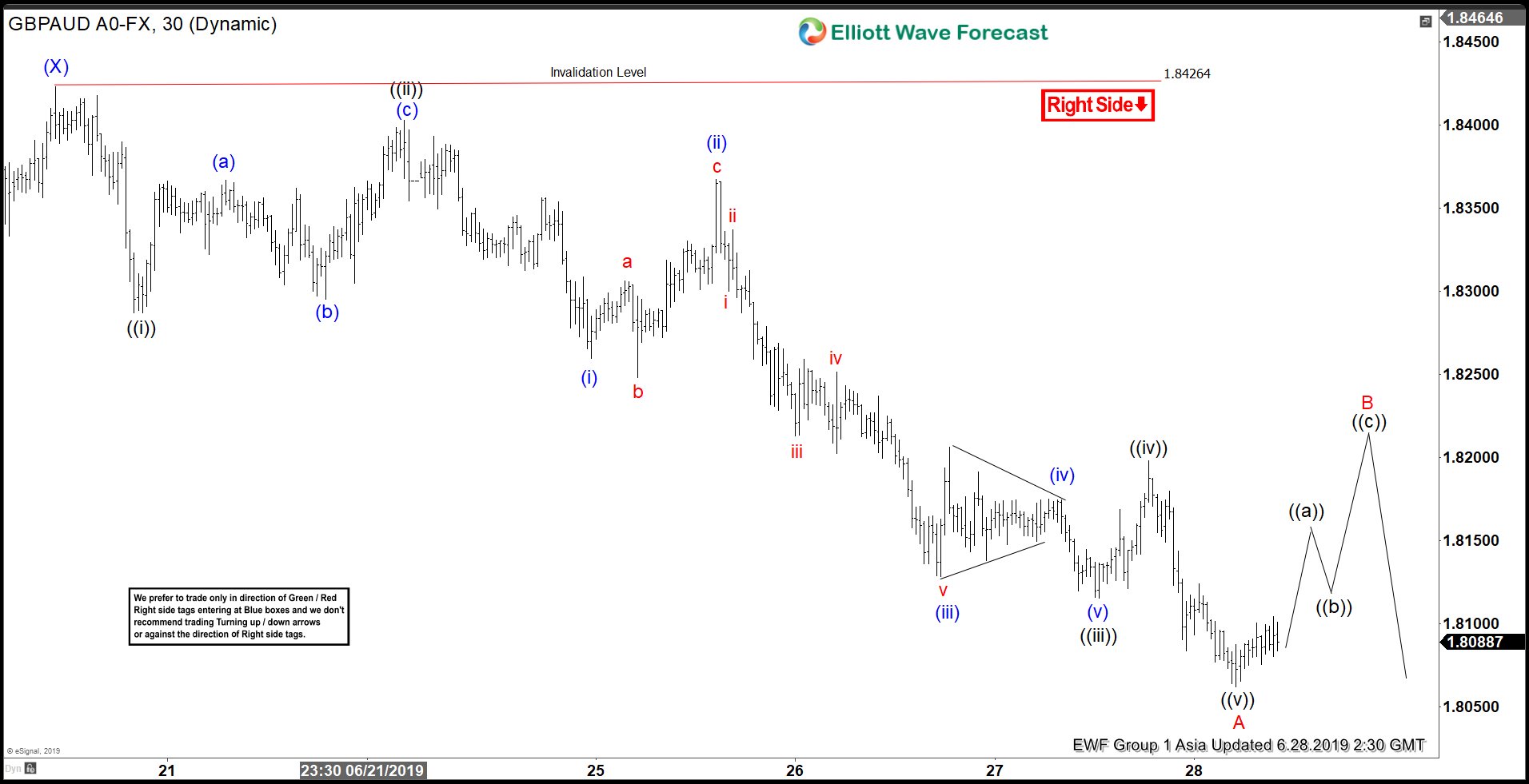

Elliott Wave View: GBPAUD Rally Should Find Sellers

Read MoreGBPAUD shows 5 swing bearish sequence from May 6 high, favoring more downside. This article and video show the Elliott Wave path.