The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

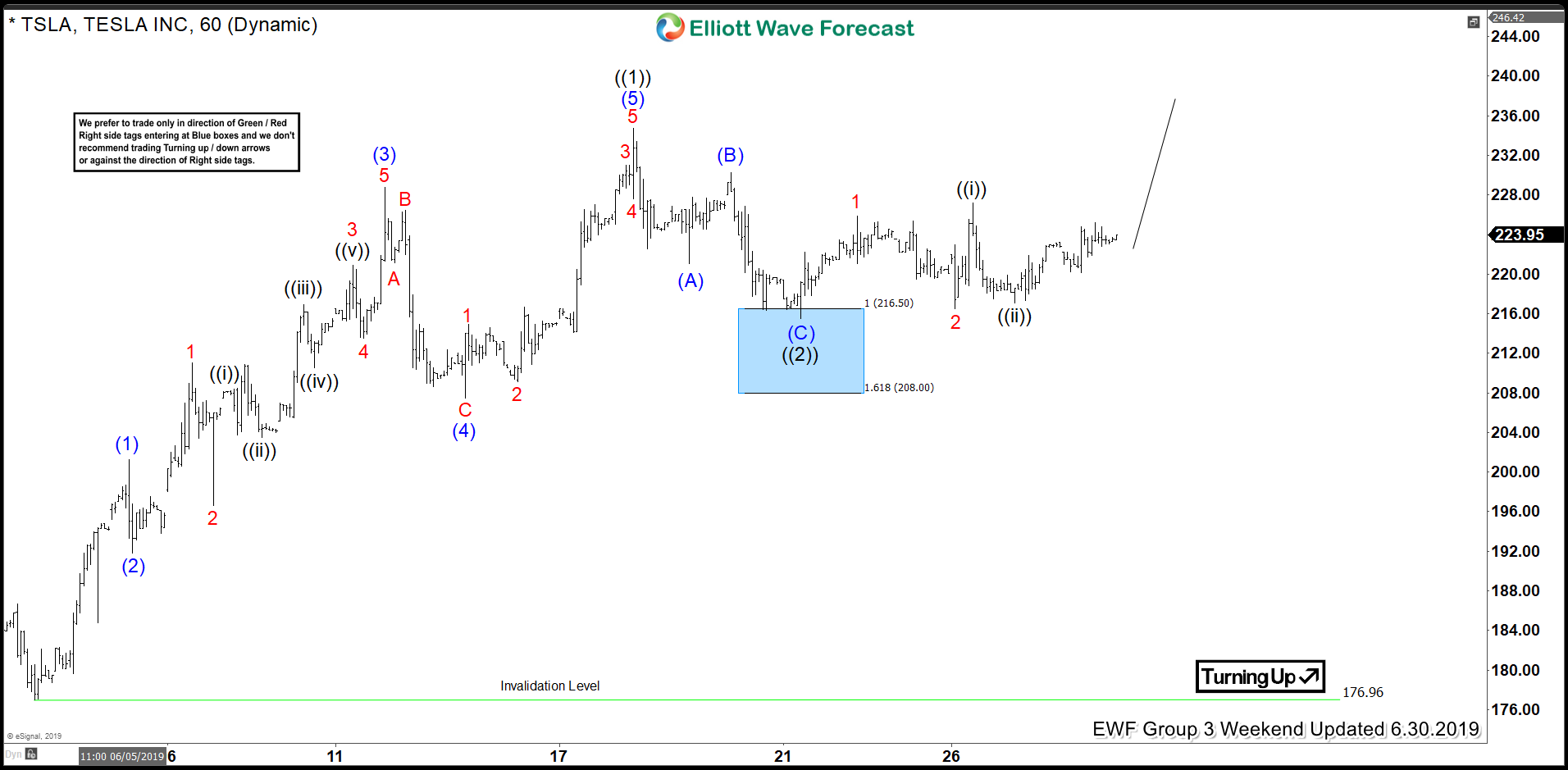

Tesla Elliott Wave Analysis Calling The Rally From Blue Box

Read MoreToday, I want to share some Elliott Wave charts of the Tesla stock which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 06/30/19. Tesla short-term cycle ended in a black wave ((1)). Below from there, we advised members that it should see the equal […]

-

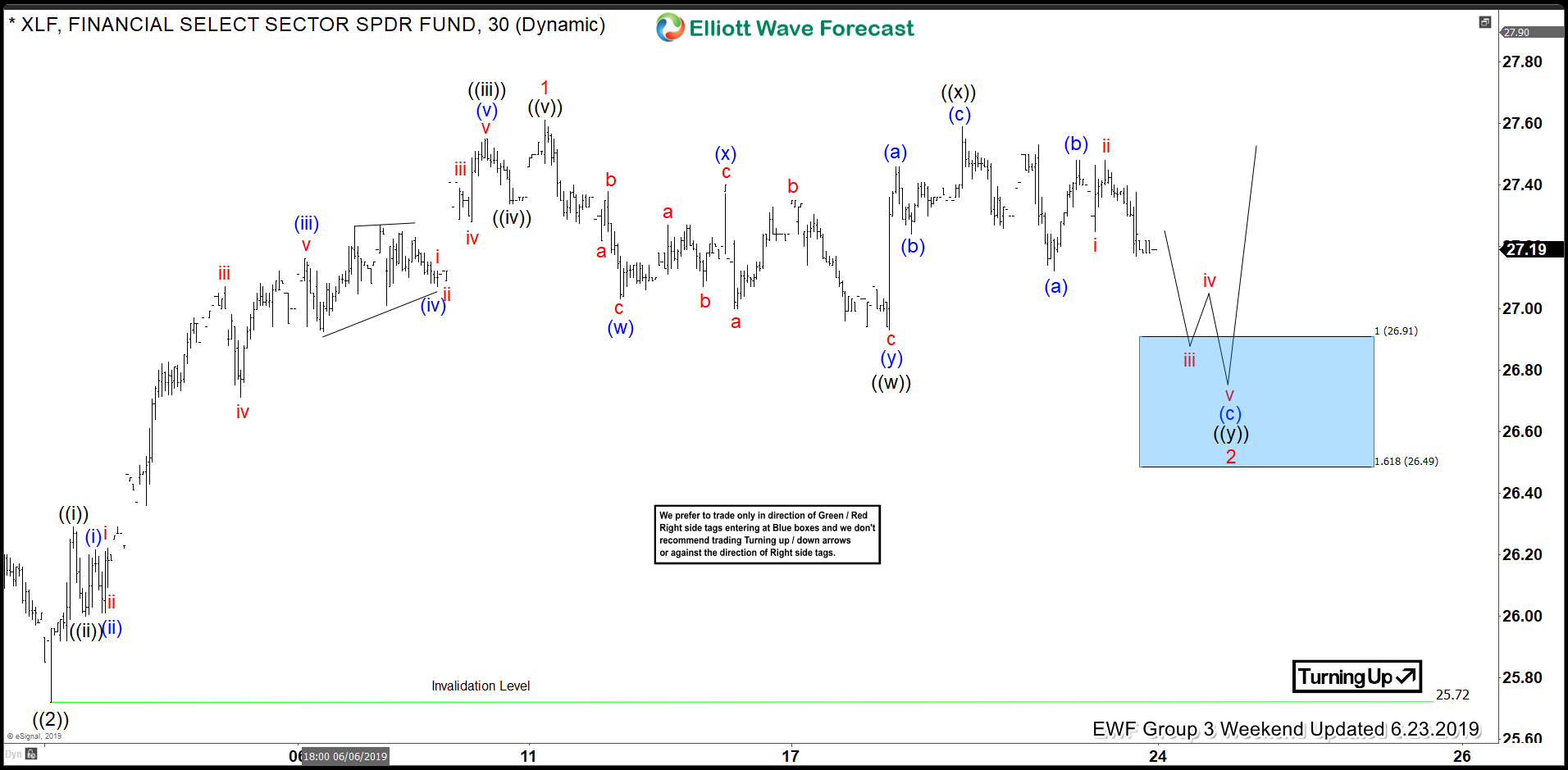

Elliott Wave Analysis: XLF Sector Rallying from Blue Box Target

Read MoreWelcome traders. In this technical analysis we will look at a couple of XLF sector charts. This will show you how profitable and efficient it can be to trade with our philosophy and basic Elliott Wave application. We start on June 23rd with a 30-minute chart presented to our members. At the time, we maintain […]

-

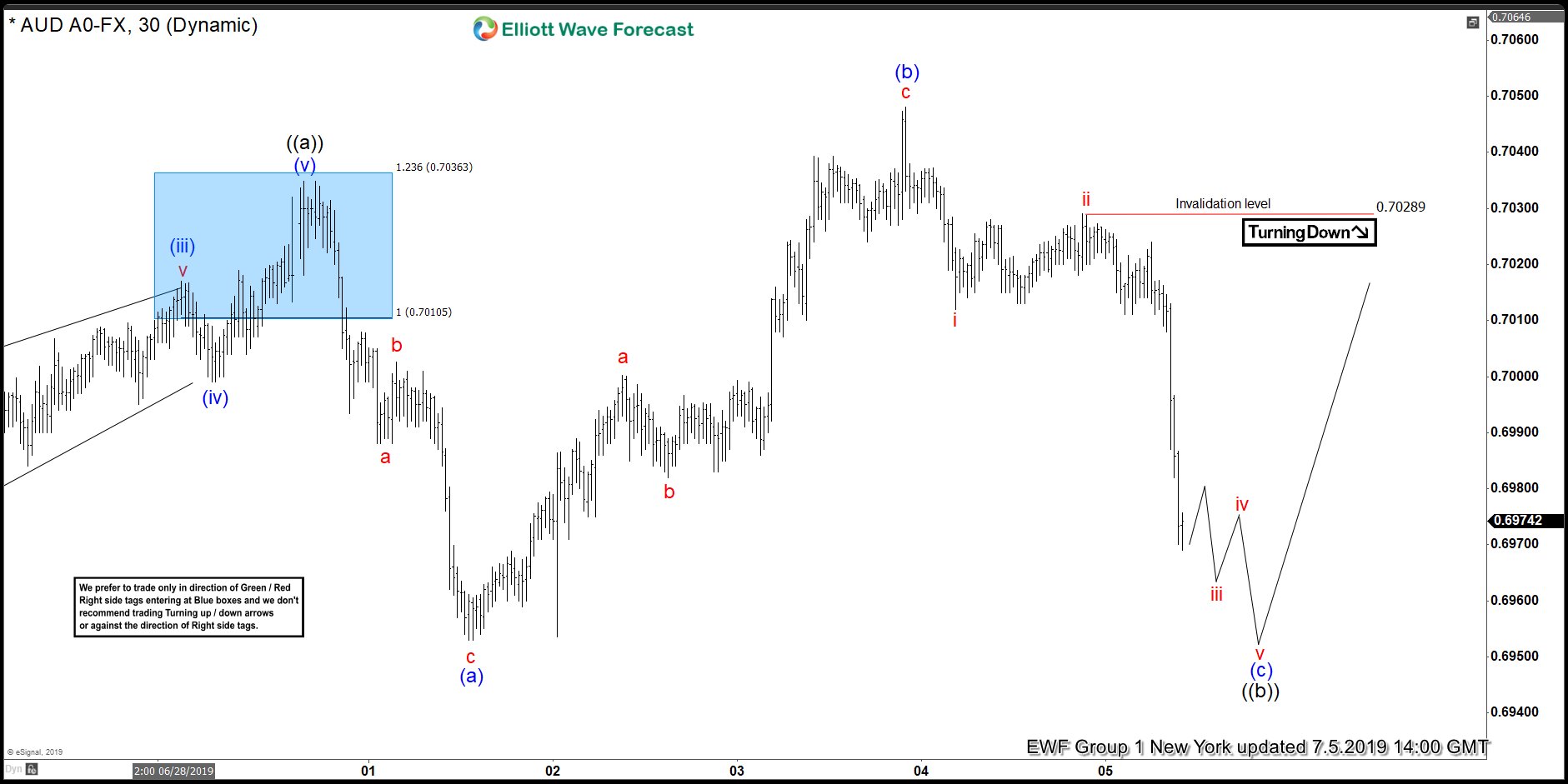

Elliott Wave View: AUDUSD Strength Should Resume

Read MoreAUDUSD is correcting the rally from June 18, 2019 low in a Flat structure. This article and video show the Elliott Wave path.

-

Elliott Wave View: More Upside in S&P 500 Futures (ES_F)

Read MoreS&P 500 Futures (ES_F) shows a bullish sequence from Dec 26, 2018 low favoring more upside.This article and video show the Elliott Wave path.