The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

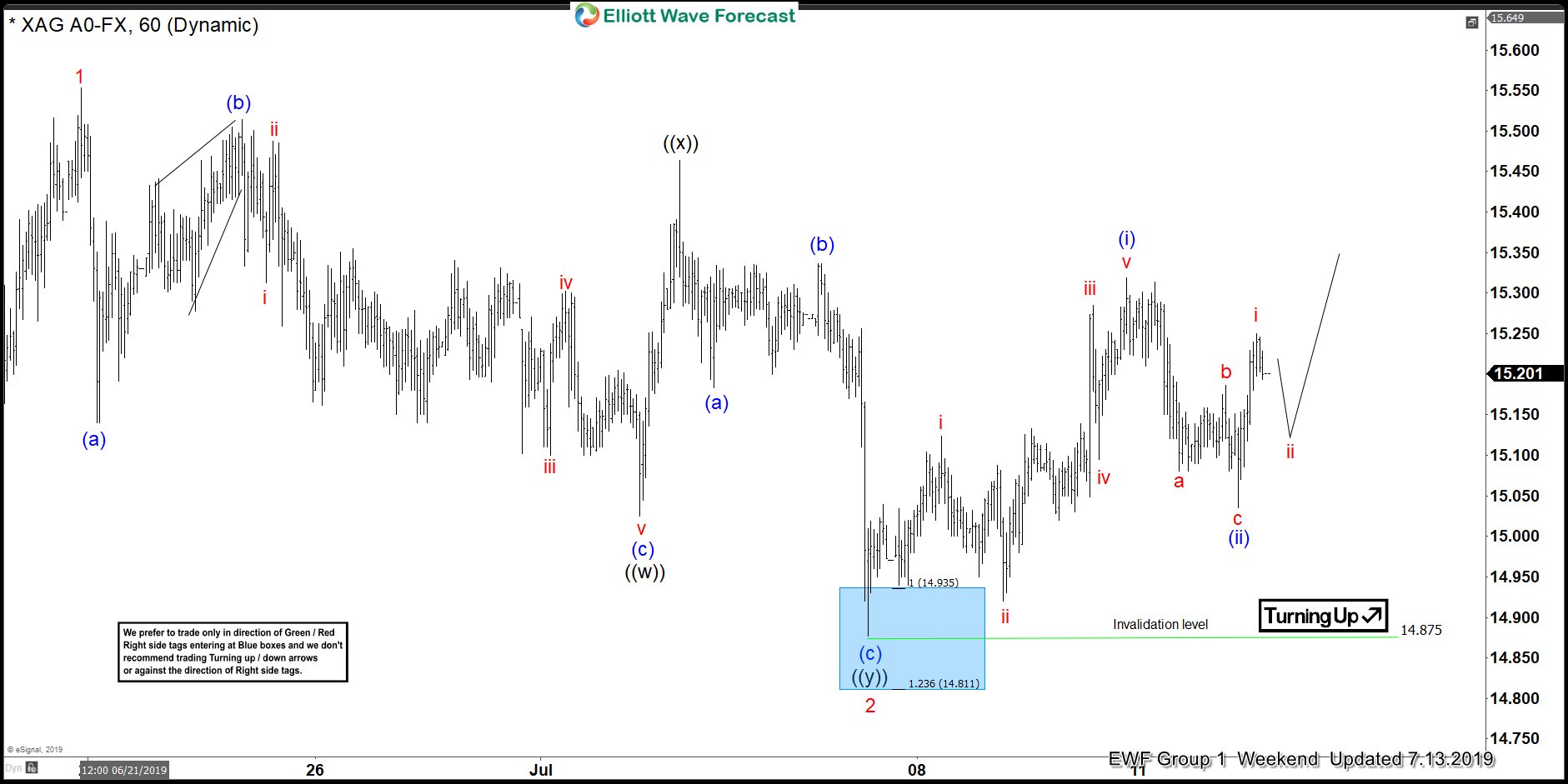

SILVER ( $XAGUSD ) Forecasting The Rally

Read MoreHello fellow traders. Recently we were forecasting the rally in commodities like SILVER and GOLD. As our members know, GOLD has been showing an incomplete sequence from August 16, 2018 low. Consequently, we were expecting SILVER to follow the same path due to strong correlation they have. We advised members to avoid selling those commodities […]

-

Can Binance Coin (BNB) Price Reach 100$ in 2020 ?

Read MoreBinance Coin (BNB) is cryptocurrency that was issued in July 2017 with Binance ICO and it’s used to pay fees on the Binance cryptocurrency exchange. In 2018, the cryptocurrency market saw a significant correction causing the majority of coins to drop more than 70% and BNB wasn’t any difference with an 80% decline. However, since December 2018, the […]

-

S&P 500 Futures (ES_F) Elliott Wave View: Correction Ended

Read MoreElliott wave view in S&P 500 Futures (ES_F) shows a bullish sequence from December 26, 2018 low favoring the further upside. In the short-term chart below, the index ended the 5 waves rally from 6/13/2019 low within wave ((i)) at $3023.50 high. Down from there, the index corrected the rally from 6/13/2019 low in wave […]

-

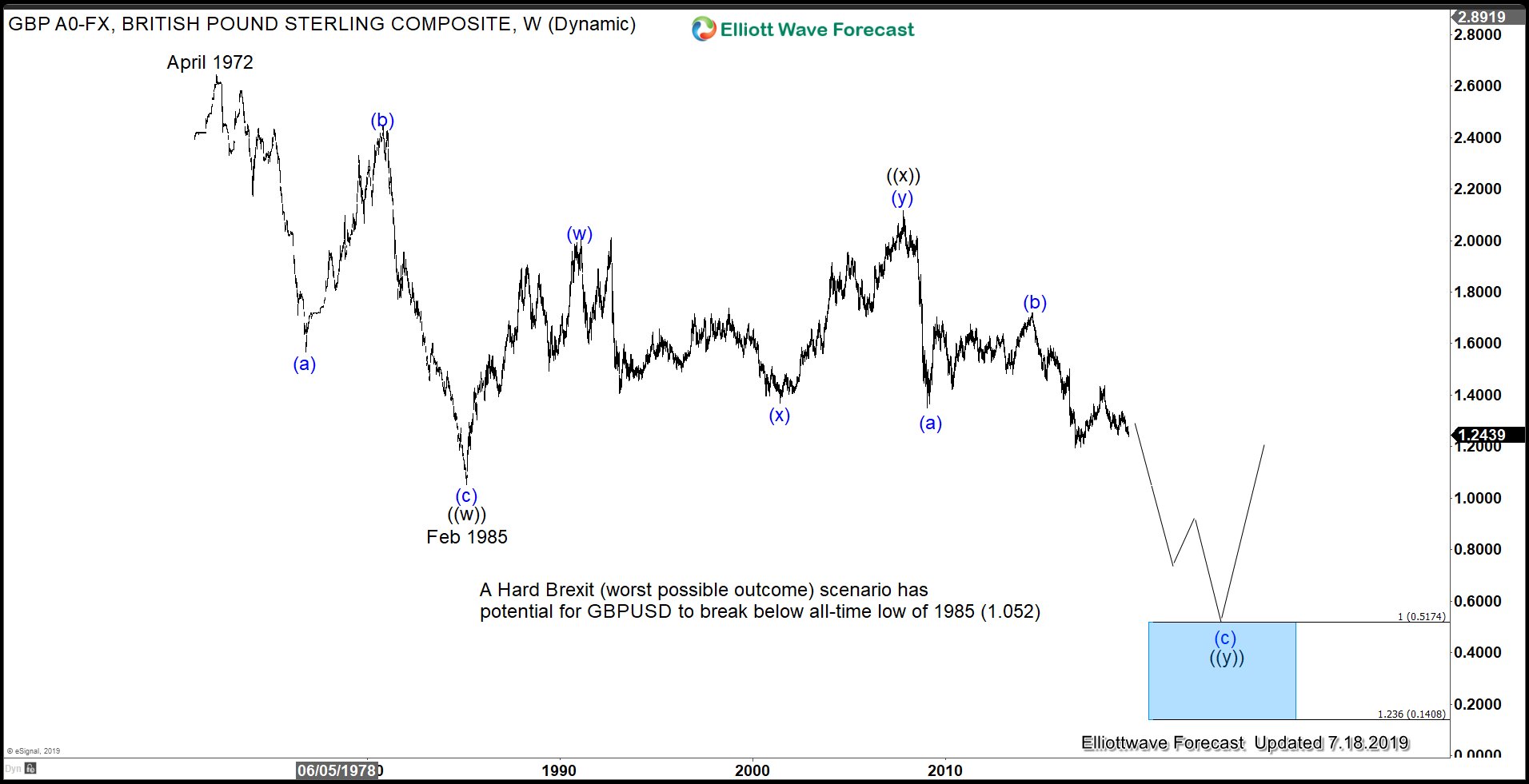

Fear of Hard Brexit Put Intense Pressure to Poundsterling

Read MoreSince Prime Minister Theresa May announced she stepped down from leadership position, the market has started to adjust the expectation for a hard Brexit scenario. Selling pressure on Poundsterling has intensified as the new prime minister hopefuls Boris Johnson and Jeremy Hunt adopted a hardline approach. Under the previous leadership of Theresa May, market previously […]