The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: GBPJPY Recovery Nearing Completion

Read MoreShort term Elliott Wave View on GBPJPY shows the decline to August 12, 2019 low (126.52) ended wave 3. From there, pair is doing the recovery in wave 4 with the internal unfolding as an Elliott Wave Zigzag structure. This suggests the current rally takes the form a corrective structure and the bias remains to […]

-

USDNOK Buying The Elliott Wave Blue Box Areas

Read MoreIn this technical blog, we take a look at the past performance of 1 hour Elliott Wave charts of USDNOK, which our members took the advantage of blue boxes.

-

GLD Longer Term Cycles and Elliott Wave Analysis

Read MoreGLD Longer Term Cycles and Elliott Wave Analysis Firstly the GLD ETF fund is one of the largest as well as one of the oldest Gold tracking funds out there since it’s inception date of November 18, 2004. From there on up into the September 2011 highs it ended a larger bullish cycle as did […]

-

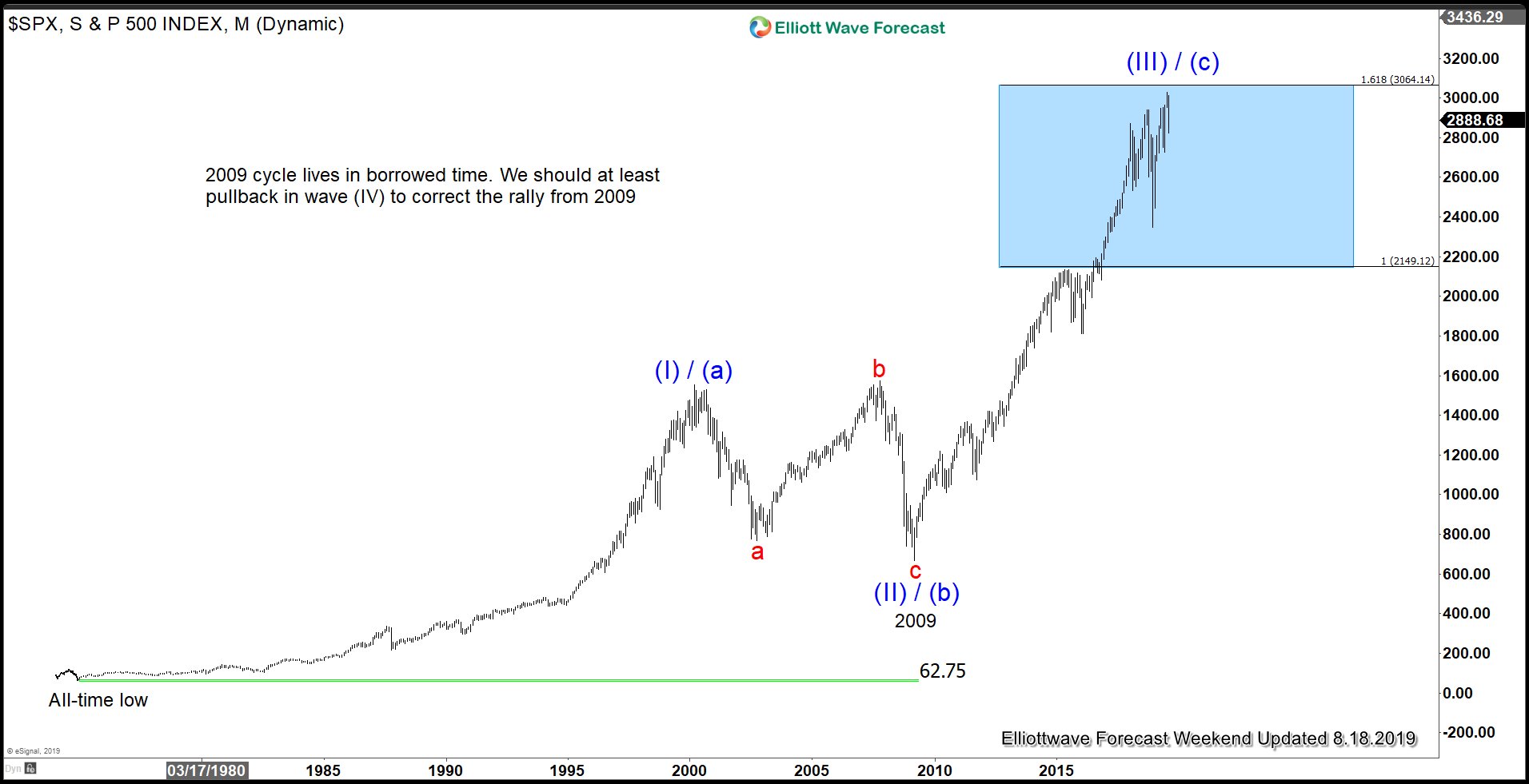

Inverted Yield Curve and What It May Mean to the Indices

Read MoreLast week, traders got spooked by the yield curve inversion of the most closely watched 2 year vs 10 year bonds. Yield curve inversion between 2 year and 10 year bond is a powerful predictor of recession. The 2-10 yield curve inversion preceded the past seven recessions from 1969. This means that the interest rates […]