The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

RWE Electric Utilities Stock Looking for More Recovery

Read MoreHello fellow traders. In today’s blog, we will have a look at the RWE AG stock. The stock is listed in the DAX 30. RWE AG is a German electric company which has its Headquarter in Essen Germany. It is one of the biggest electricity producers in Germany. Over the last couple of years, the stock almost lost […]

-

Elliott Wave View: Impulsive Rally in Amazon (AMZN)

Read MoreRally in Amazon (AMZN) from Aug 26 low appears impulsive and incomplete. This article & video talks about the short and medium term Elliottwave path.

-

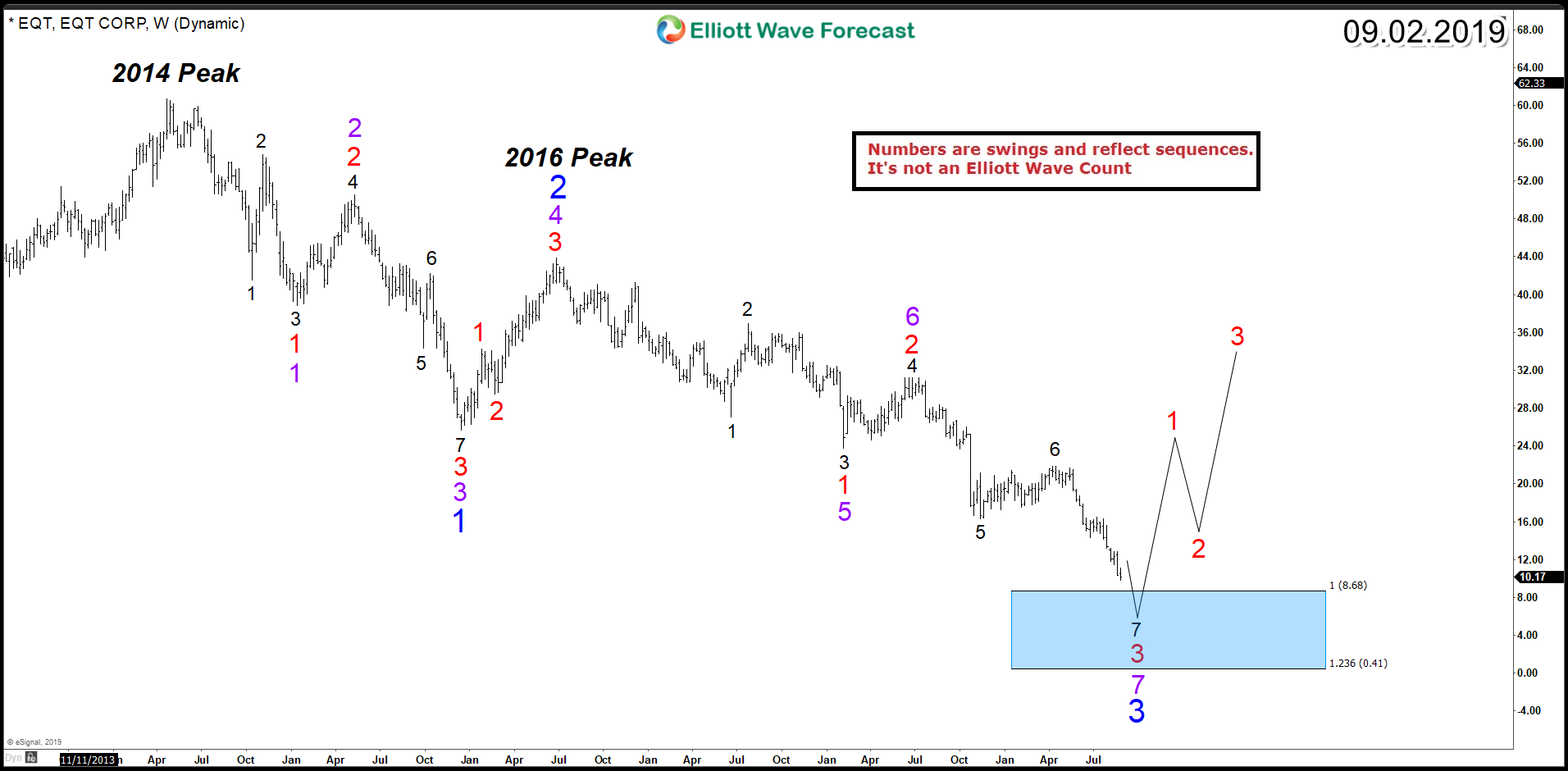

EQT Corporation (NYSE: EQT) – Ending a Corrective Decline

Read MoreEQT Corporation is one of the largest natural gas exploration and pipeline companies in United State. The Energy giant has more than 130 years of experience and it continues to be a leader in the use of advanced horizontal drilling technology . It’s also an integrated energy company with emphasis on natural gas exploration, production, gathering, […]

-

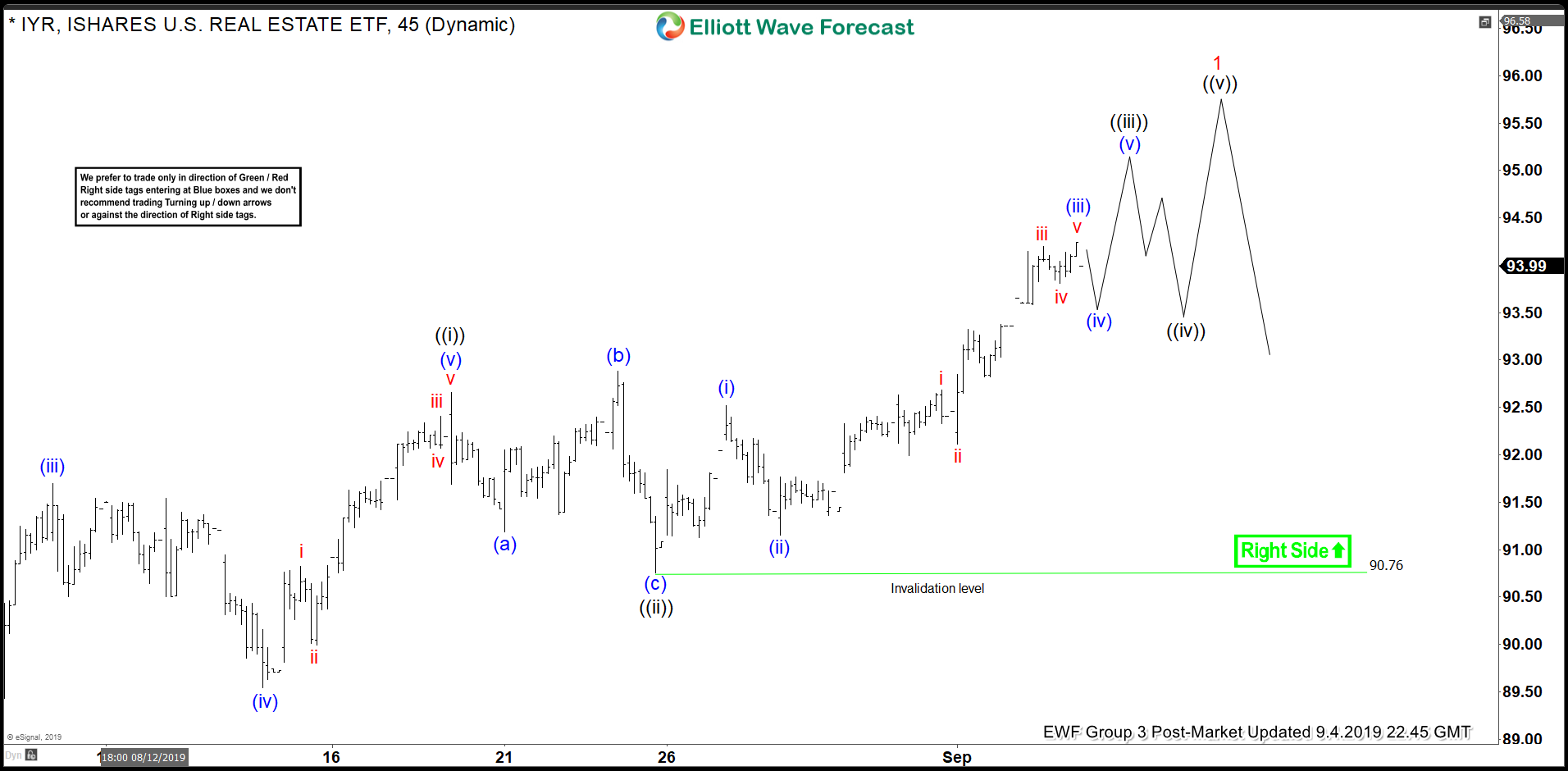

Elliott Wave View: IYR New All-Time-High in Sight

Read MoreIYR is near the 2007 all-time high and looking to break above it. This article & video explains the short term Elliott Wave path.