The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

The FXB Longer Term Bearish Cycles

Read MoreThe FXB Longer Term Bearish Cycles Firstly the British Pound Sterling tracking ETF fund FXB inception date was 6/21/2006. The bearish cycle lower from the November 2007 highs in FXB is the focus of this analysis where it begins on the monthly chart. The British Pound Sterling has been the currency of the Bank of England since 1694. […]

-

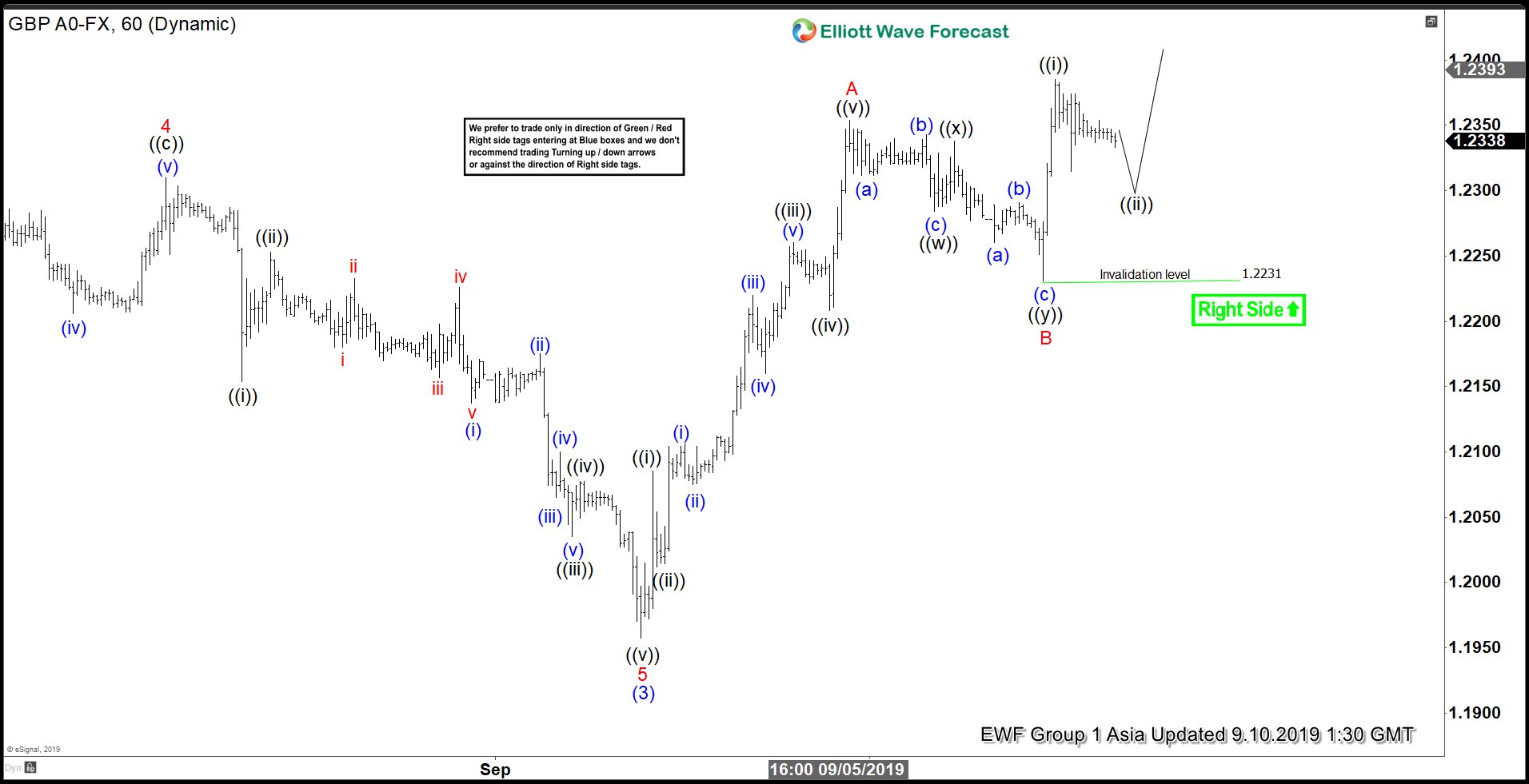

Elliott Wave View: Further Rally in GBPUSD in Zigzag Structure

Read MoreShort term Elliott Wave view in GBPUSD suggests that the decline to 1.1957 on September 3 ended wave (3). Wave (4) bounce is in progress as a zigzag Elliott Wave structure. Up from 1.1957, wave A ended at 1.235 and subdivides as a 5 waves impulse. Wave ((i)) of A ended at 1.2085, wave ((ii)) […]

-

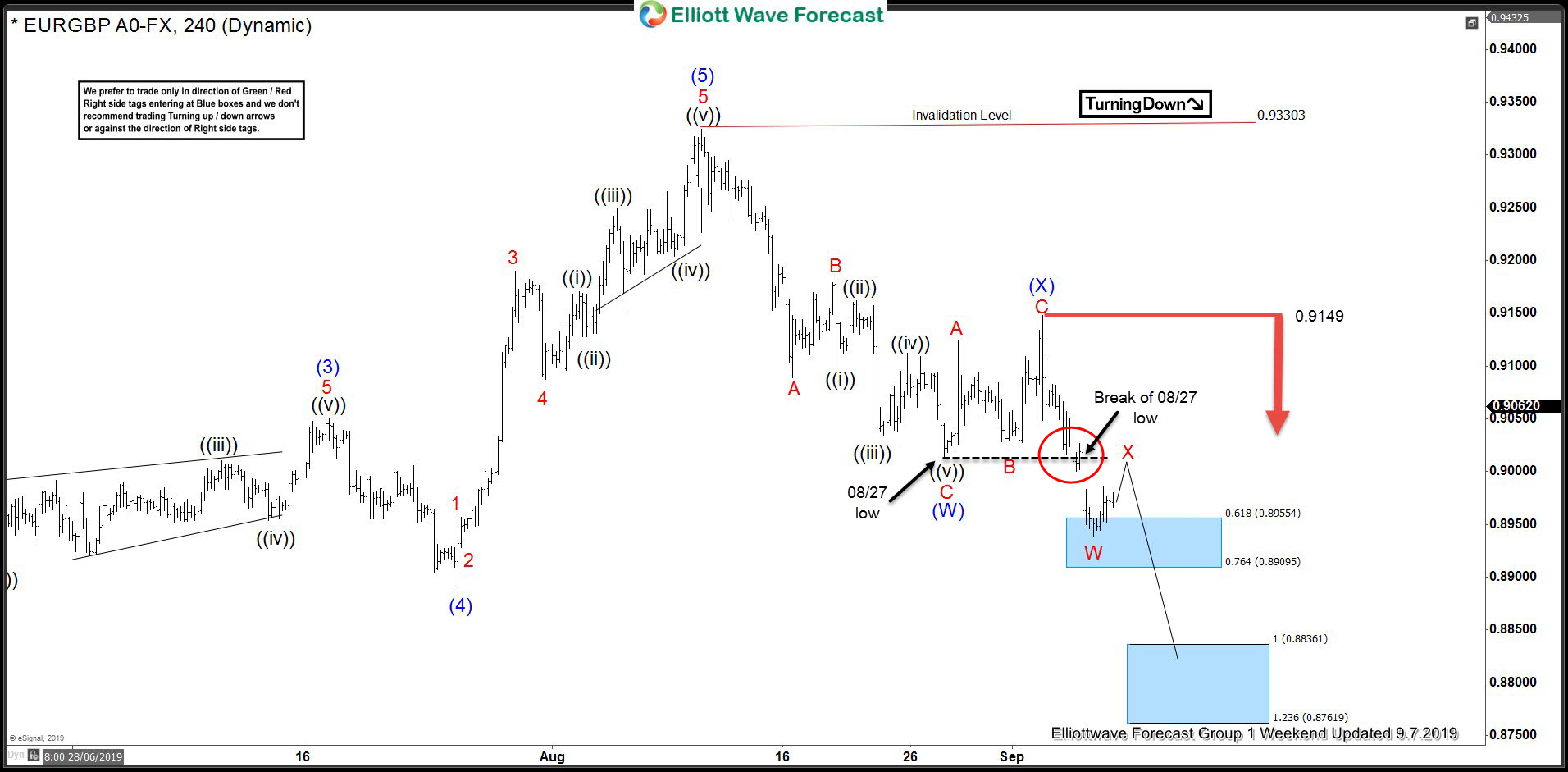

EURGBP Selling The Rallies At The Blue Box

Read MoreHello fellow traders. Another instrument that we have been trading lately is EURGBP. In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURGBP, published in members area of the website. As our members know, EURGBP has incomplete bearish sequences in the cycle from the 08/12 peak . […]

-

Profit Taking in Gold as Trade Talk Resumes

Read MoreLast week, China and the U.S. have agreed to resume face-to-face talk in Washington in early October. It’s however still unclear if both sides can make substantial, even if temporary, agreement to solve their disputes. Nonetheless, the news is a welcome relief to the market with the year-long conflict dampening 2020 growth forecasts. Prior to […]