-

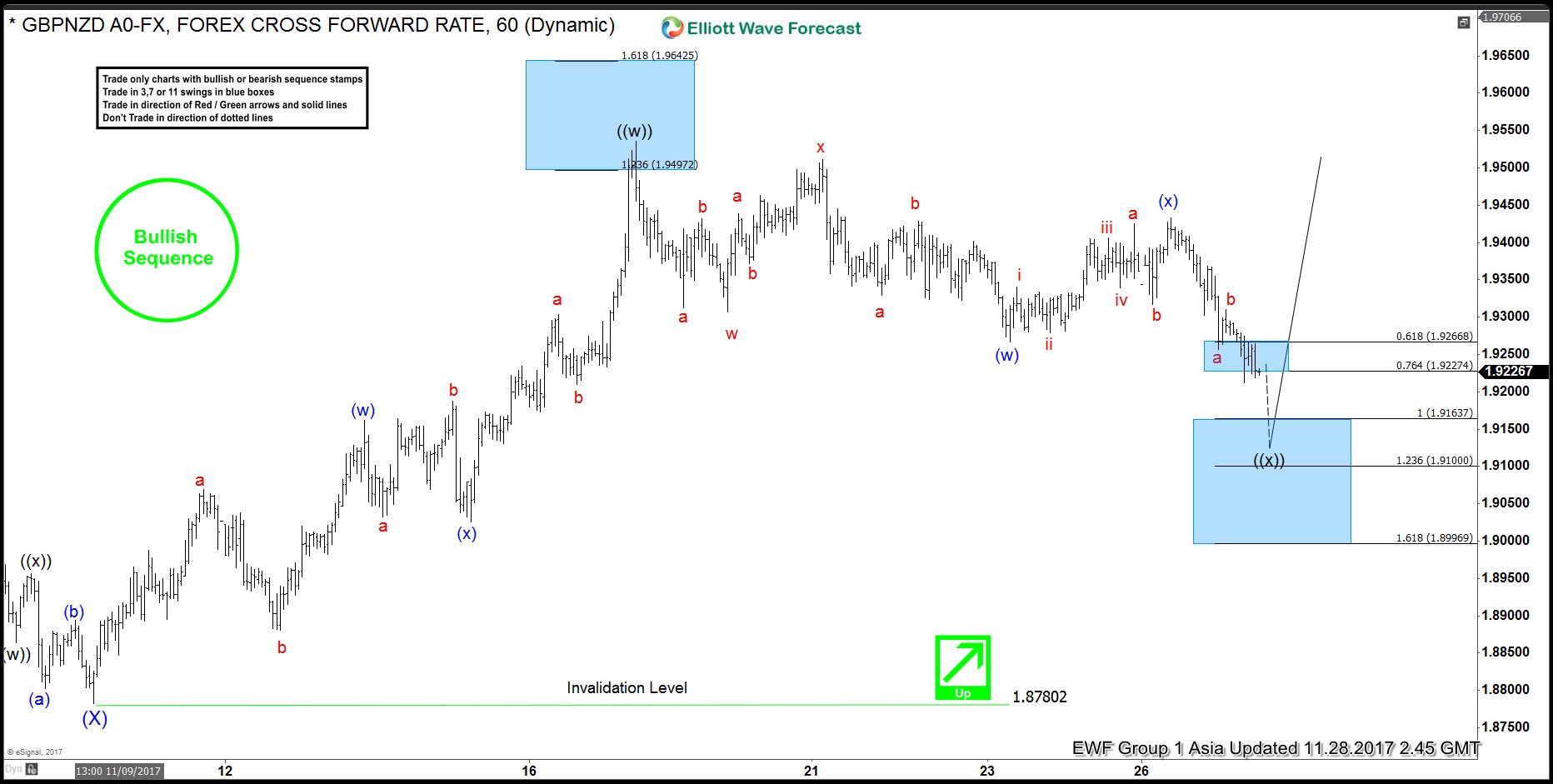

GBPNZD Forecasting Rally Based on Bullish Sequence

Read MoreIn this technical blog we’re going to take a quick look at the past Elliott Wave charts of GBPNZD published in members area of www.elliottwave-forecast.com. We’re going to explain the Elliott Wave forecast and our trading strategy As our members know , we were pointing out that GBPNZD is trading within larger bullish trend. The pair […]

-

Dow Jones (YM #F) Made New All Time High

Read MoreIn this technical blog we’re going to take a quick look at the past Elliott Wave charts of YM #F (Dow Jones DJI Mini Futures) published in members area of www.elliottwave-forecast.com. We’re going to take a look at the price structure and explain Elliott Wave forecast. As our members know , we were pointing out that […]

-

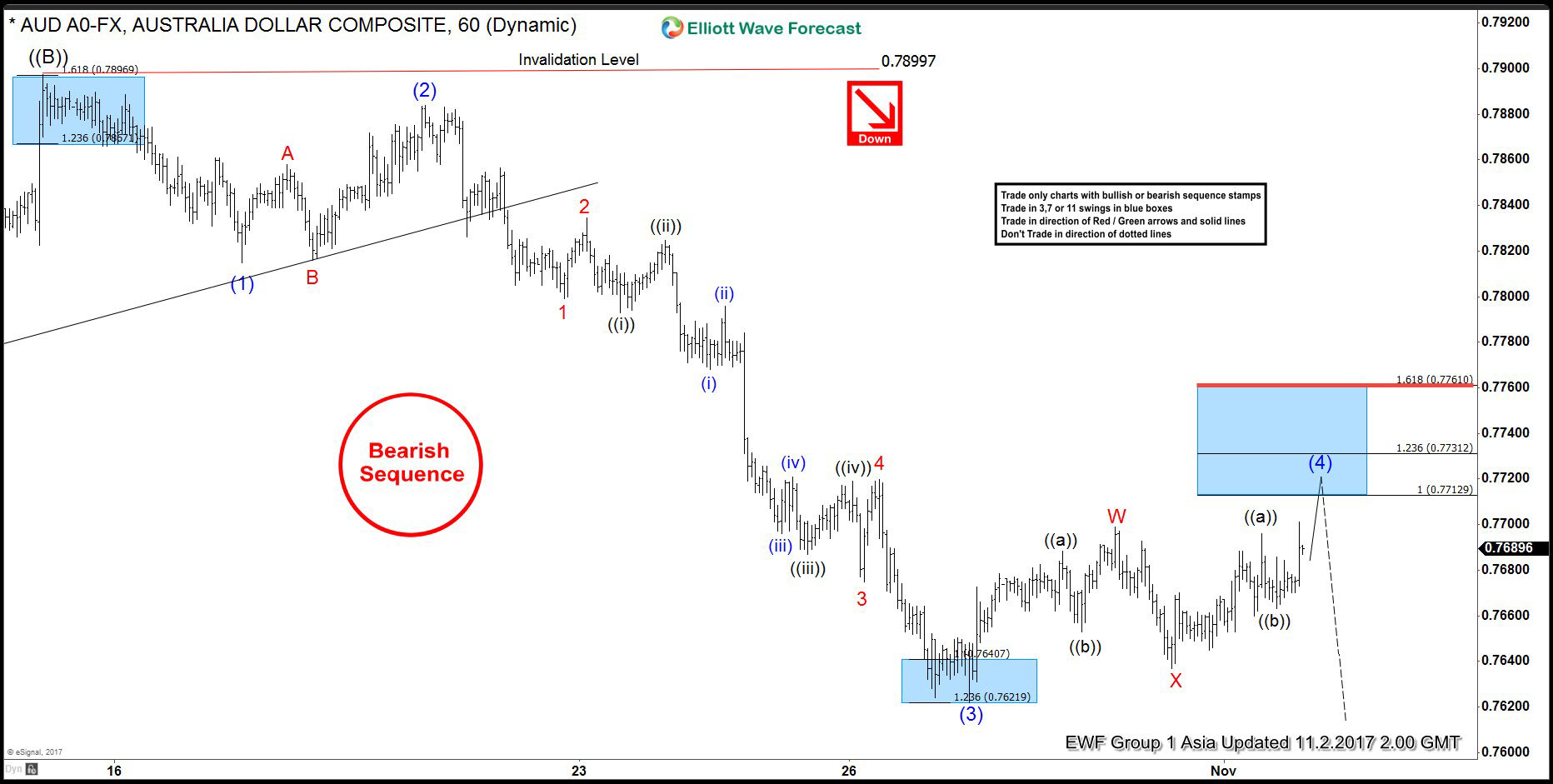

AUDUSD Swings Sequences Calling The Decline

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of AUDUSD published in members area of www.elliottwave-forecast.com. In further text we’re going to explain the short term Elliott Wave view. AUDUSD Elliott Wave 1 Hour Chart 11.02.2017 As our members know, AUDUSD has had incomplete […]

-

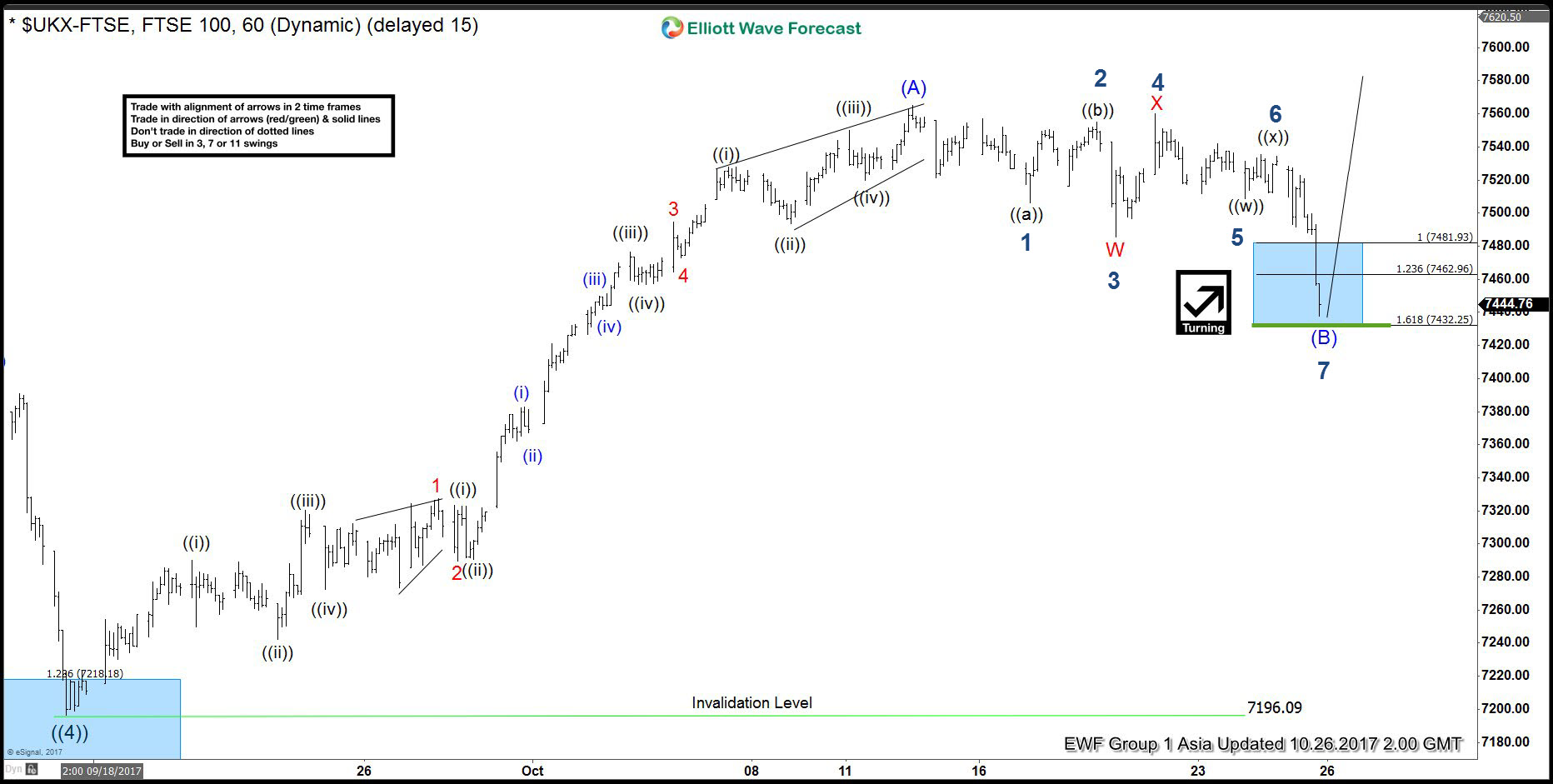

FTSE Forecasting The Path using Elliott Wave

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of FTSE published in members area of www.elliottwave-forecast.com. In further text we’re going to count the swings, explain the Elliott Wave view. As our members know, we were explaining that FTSE is having incomplete bullish swings […]

-

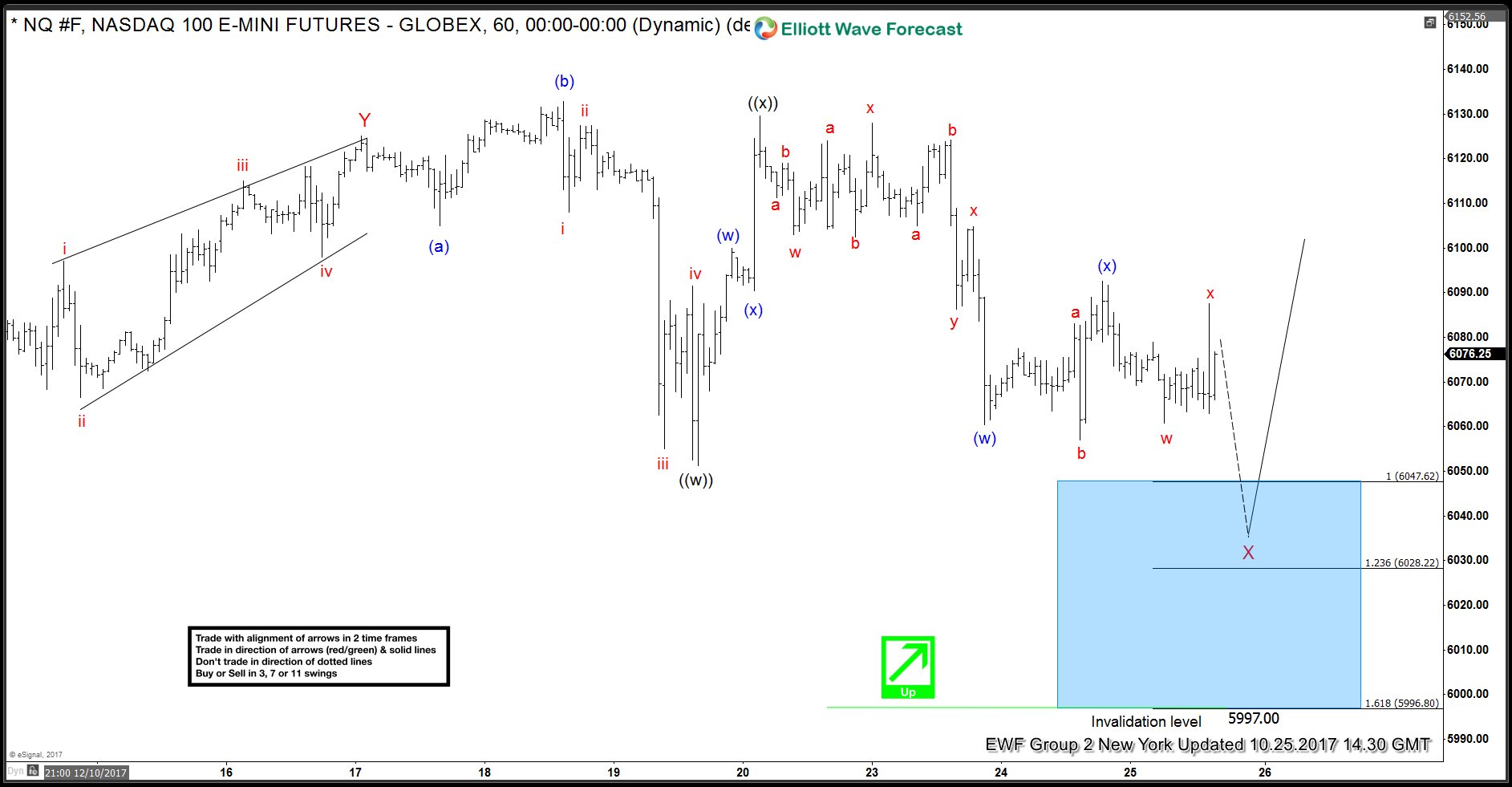

Nasdaq Forecasting The Rally After 7 Swings

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of Nasdaq index published in members area of www.elliottwave-forecast.com. We’re going to take a look at the price structures of the index and get through Elliott Wave forecast. As our members know , we were pointing […]

-

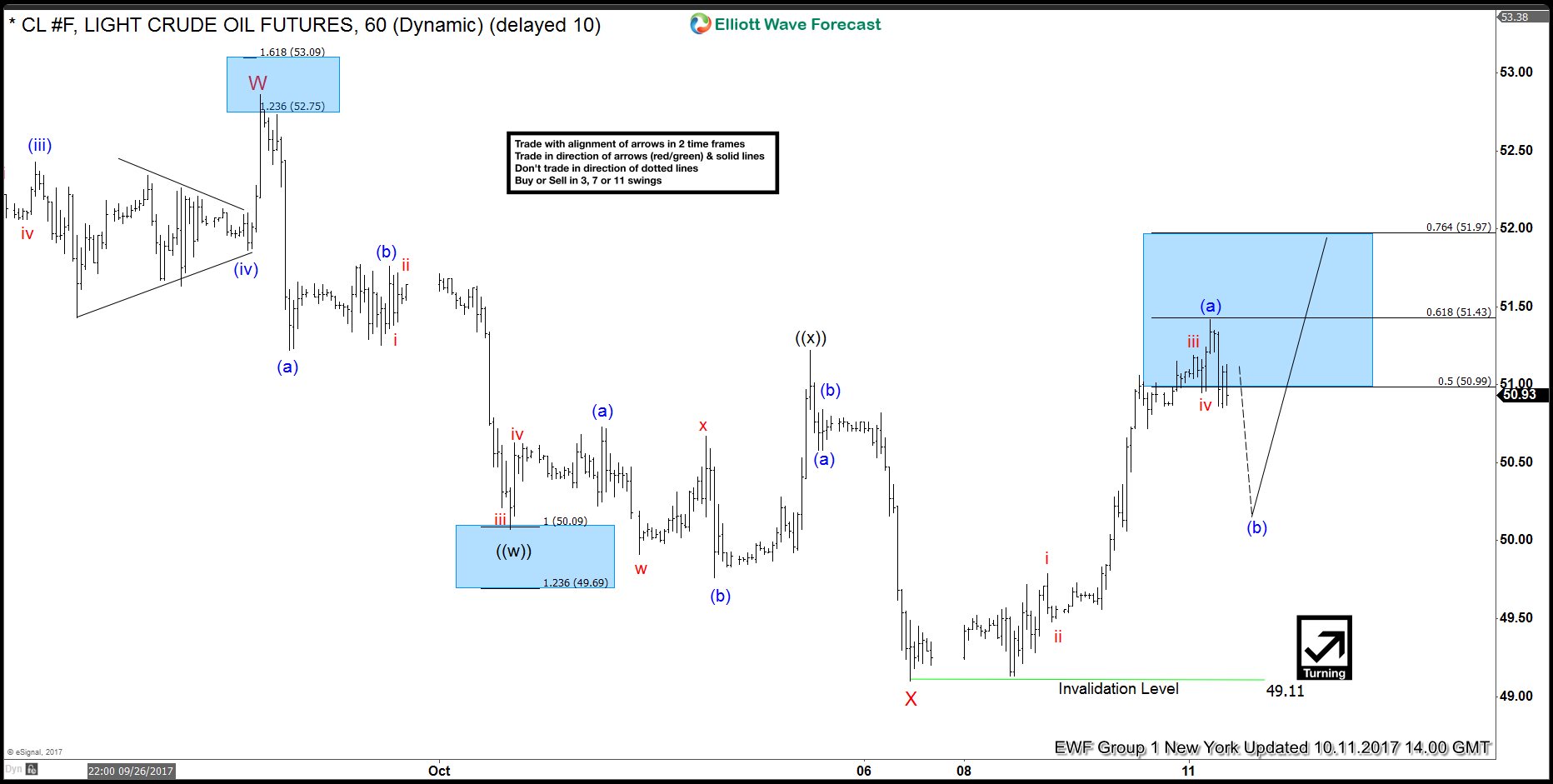

OIL (CL #F) forecasting the path

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of OIL ( CL #F ) published in members area of www.elliottwave-forecast.com. In further text we’re going to get through short term price structures and explain the Elliott Wave view. OIL Elliott Wave 1 Hour New […]