-

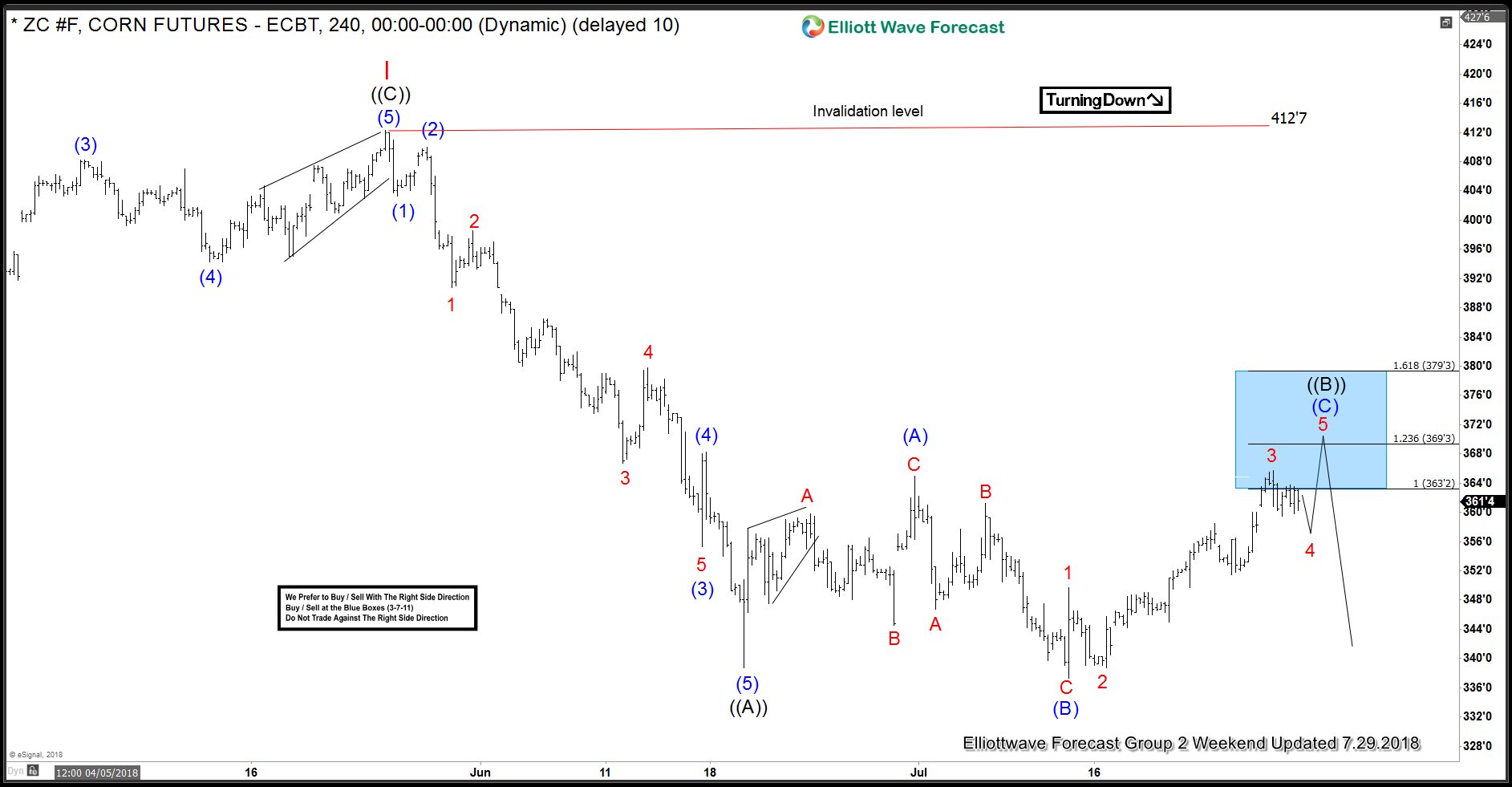

Corn Futures Forecasting The Decline After Elliott Wave Flat

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Corn Futures published in members area of the website. As our members know, the Commodity has corrected the cycle from the 412’7 peak. Proposed recovery has been unfolding as Expanded Elliott Wave Flat structure. In […]

-

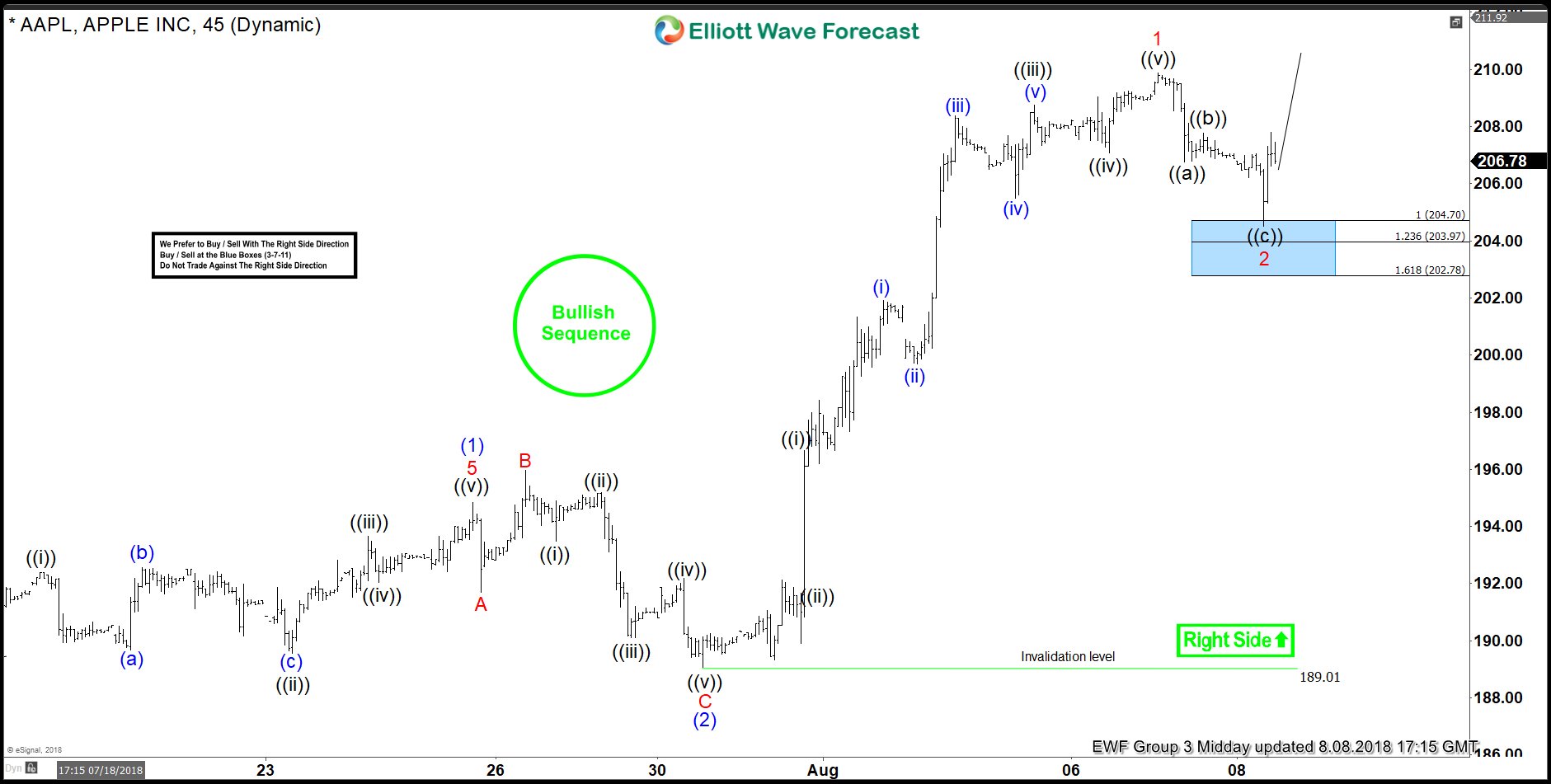

APPLE Buying The Dips in 3-7-11 Swings

Read MoreHello fellow traders. Another trading opportunity we have had lately is long trade in APPLE . In this technical blog we’re going to take a quick look at the Elliott Wave charts of APPLE published in members area of the website. As our members know, the stock has had incomplete bullish sequences in the cycle […]

-

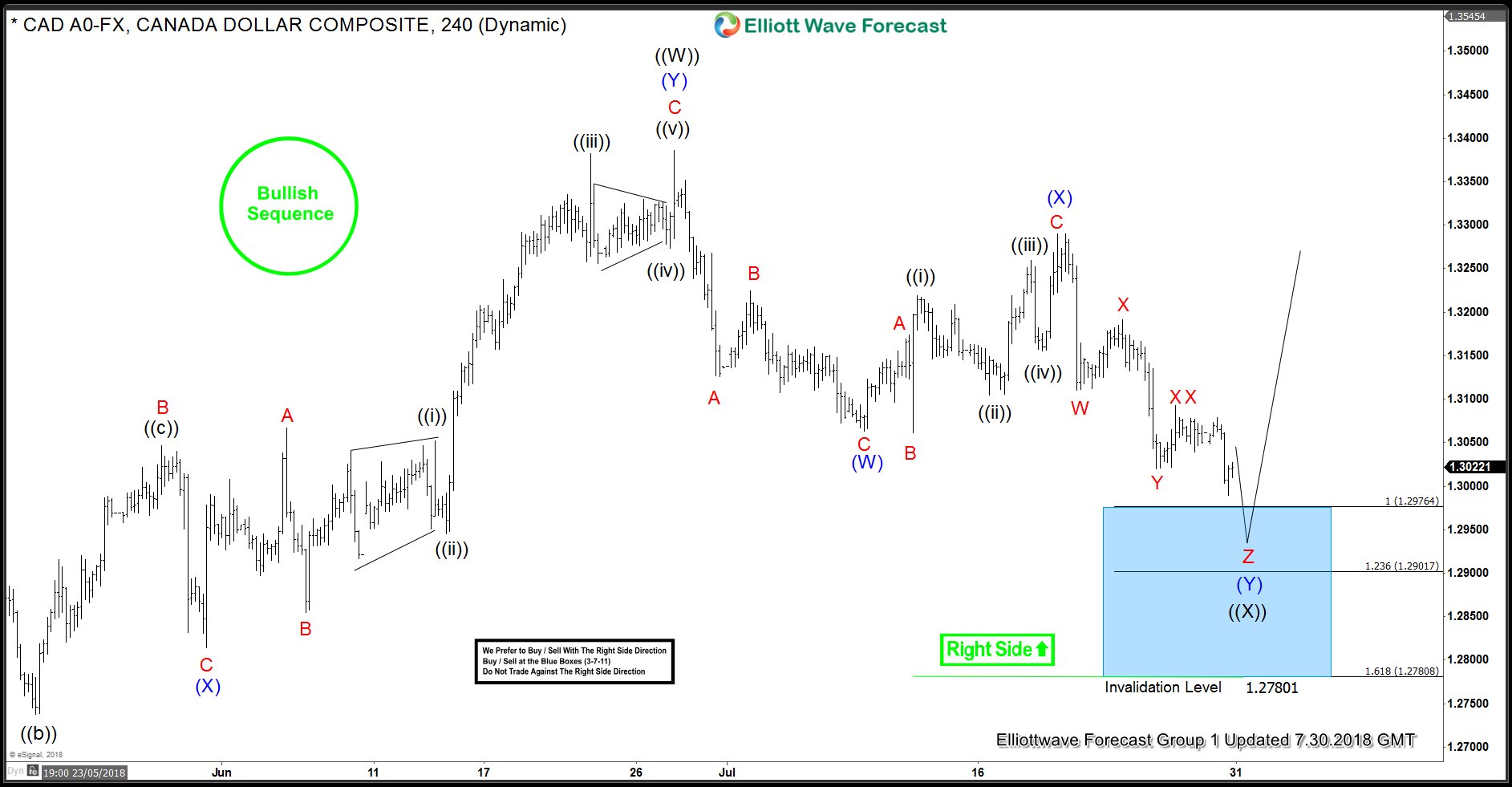

USDCAD: Found Buyers in Blue Box and Rallied

Read MoreHello fellow traders. Another trading opportunity we have had lately is USDCAD. In this technical blog we’re going to take a quick look at the Elliott Wave charts of USDCAD published in members area of the website. As our members and followers know, this pair has incomplete bullish sequences in the cycle from the September […]

-

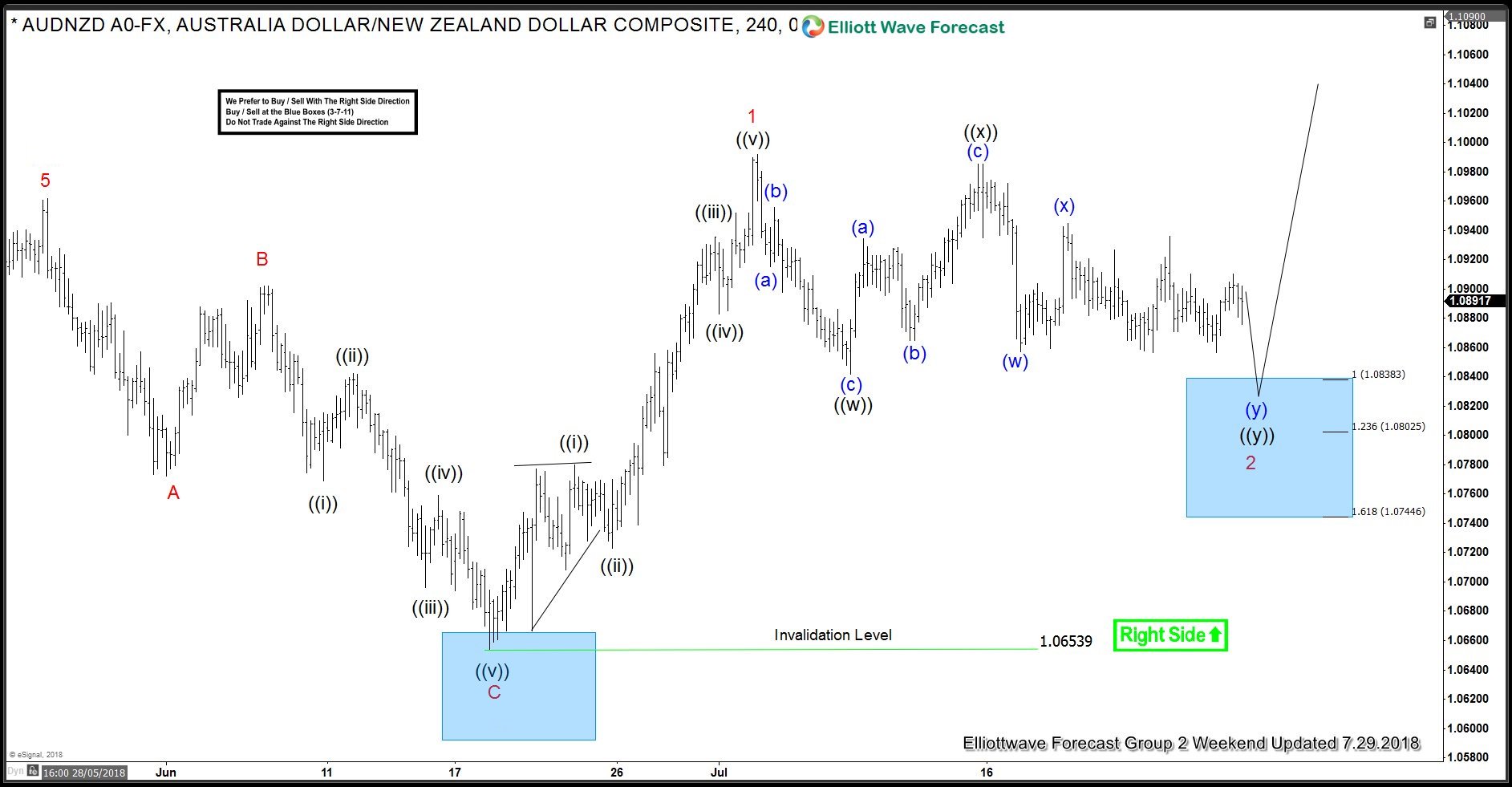

AUDNZD Forecasting The Rally & Buying The Dips

Read MoreHello fellow traders. Another trading opportunity we have had lately is AUDNZD. In this technical blog we’re going to take a quick look at the Elliott Wave charts of AUDNZD published in members area of the website. In further text we’re going to explain the forecast and trading setup. As our members know, AUDNZD have […]

-

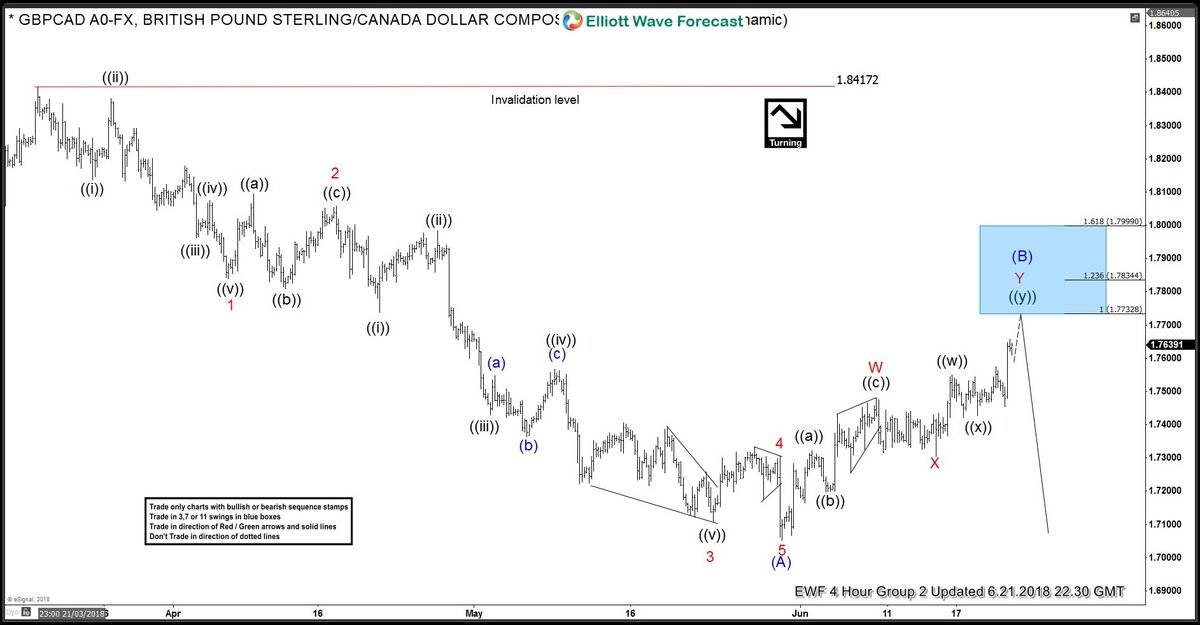

GBPCAD Elliott Wave Forecasting The Decline

Read MoreIn this technical blog we’re going to take a quick look at the past Elliott Wave charts of GBPCAD published in members area of the website. As our members know GBPCAD has ended the cycle from the 1.84172 peak on May 30th. Proposed cycle has ended as 5 waves structure while recovery against the mentioned […]

-

NIKKEI: Elliott Wave Forecasting The Rally

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of NIKKEI published in members area of the website. As our members know NIKKEI has been correcting the cycle from the 3/26 low (20190). We expected price to reach extreme zone at 21994-21377 to complete […]