-

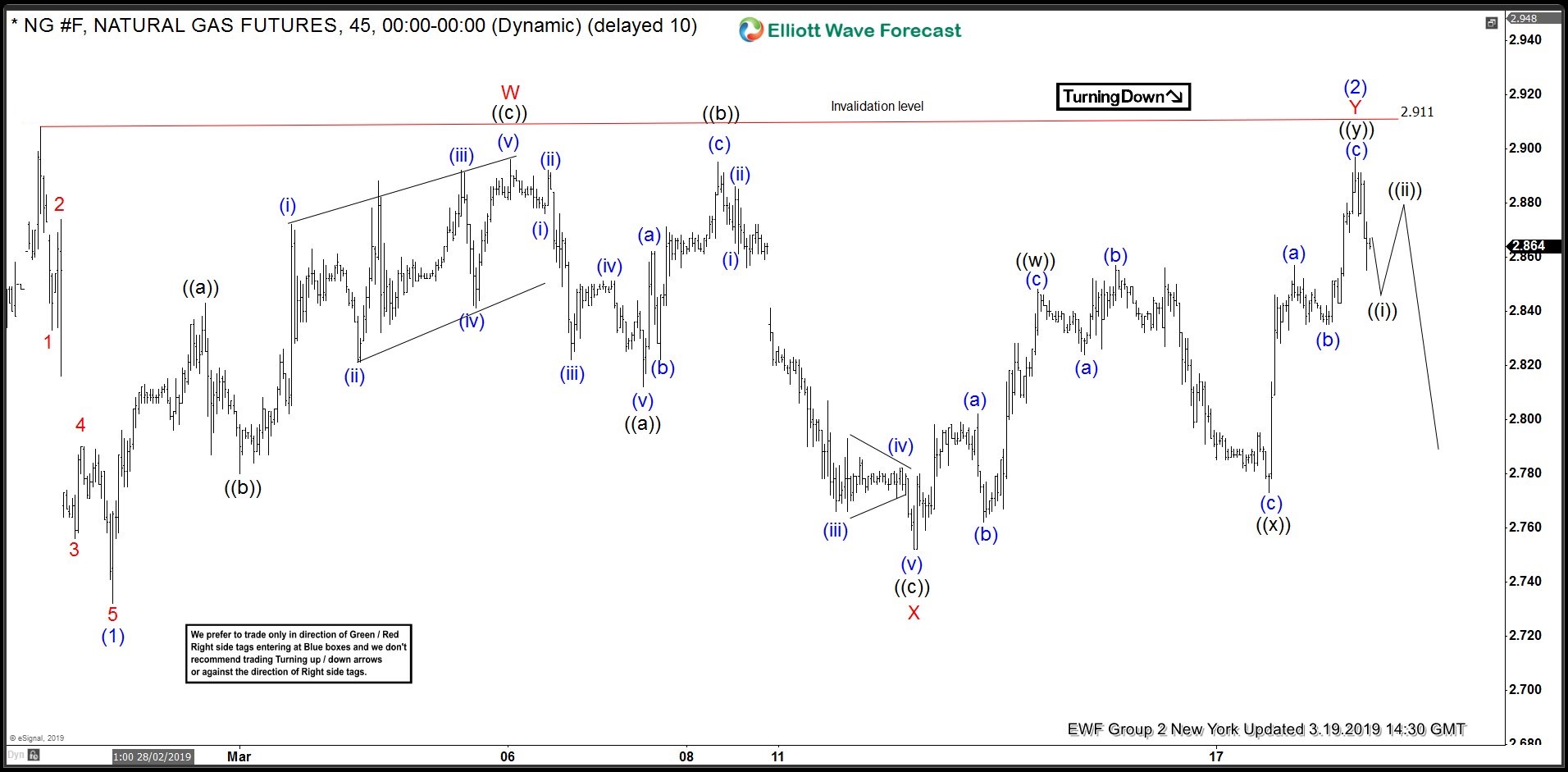

Natural Gas ( NG #F) Calling The Decline After Double Three Pattern

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the charts of Natural Gas published in members area of the website. As our members know, we were calling February cycle completed at the 2.911 peak. The Futures made very sideways recovery against the mentioned peak, that unfolded as Elliott […]

-

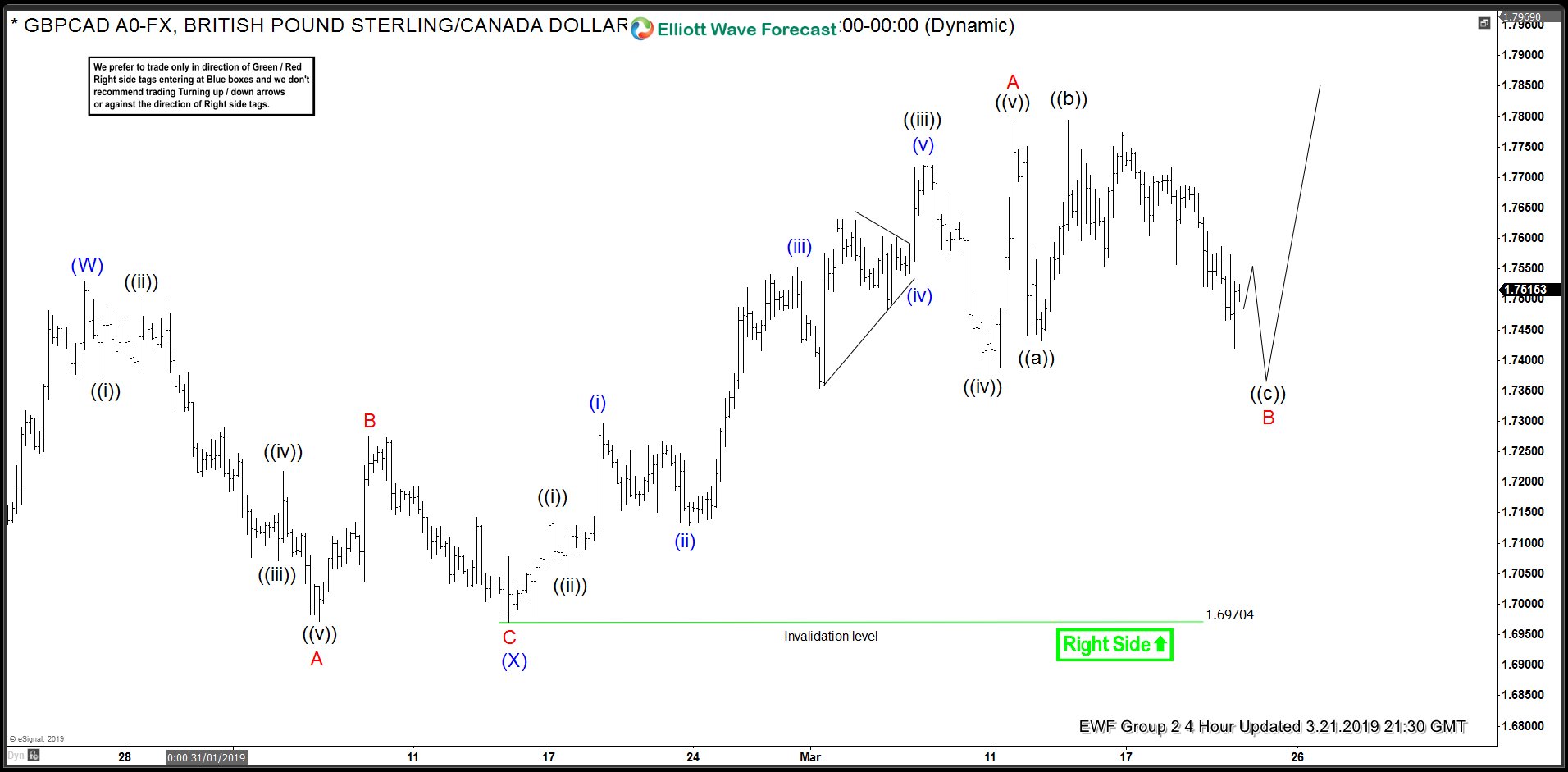

GBPCAD Found Buyers In Blue Box And Rallied

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GBPCAD. As our members know GBPCAD is showing incomplete bullish sequences in the cycle from the August 15th 2018 low. Break of the 01/25 peak made the pair bullish against the 1.697 pivot. Consequently, we advised […]

-

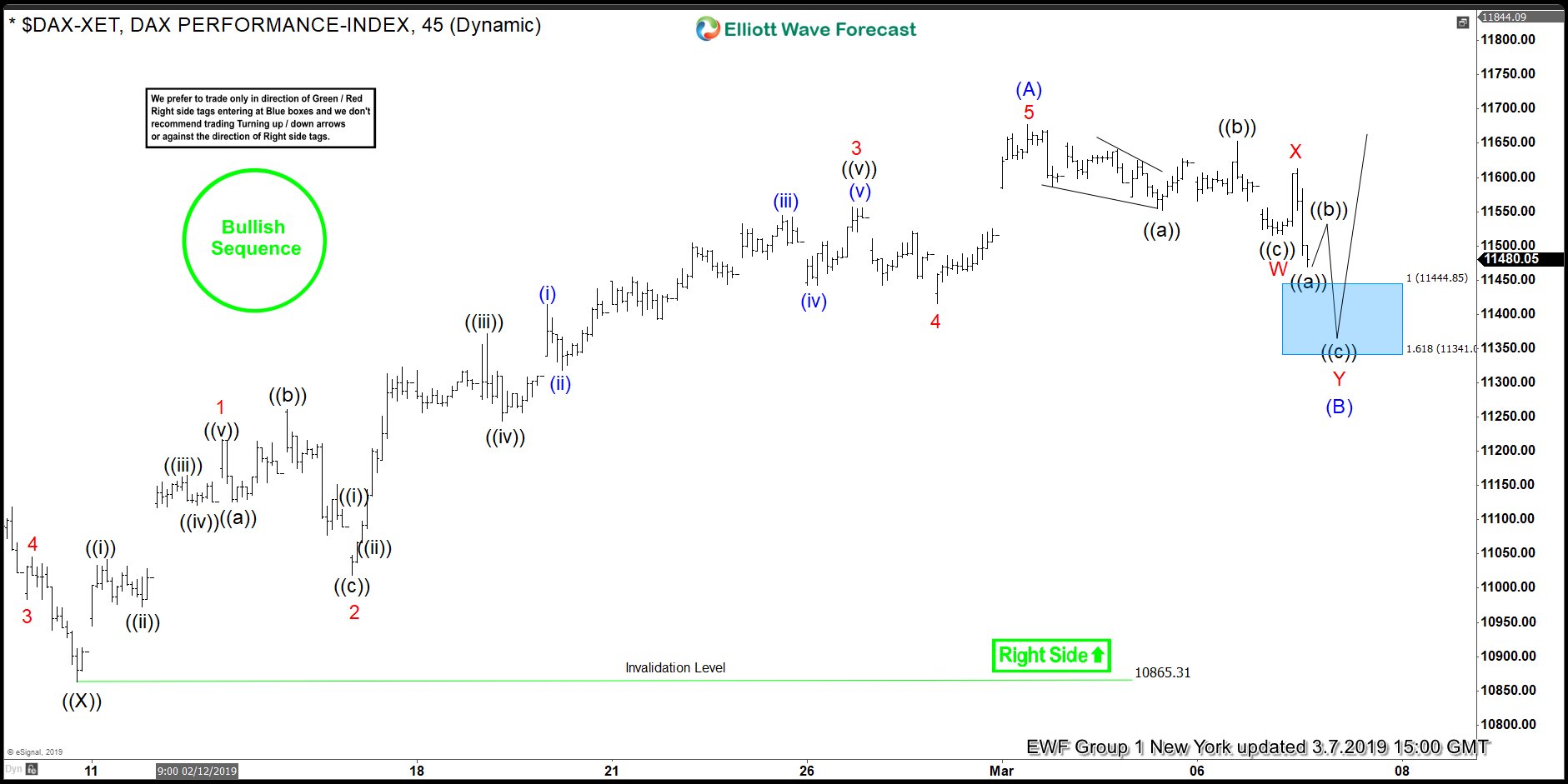

DAX Forecasting The Rally And Buying The Dips In Blue Box

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of DAX, published in members area of the website. As our members know, the Index has incomplete bullish sequence in the cycle from December’s low. The Elliott wave structure has been calling for further strength. Consequently, […]

-

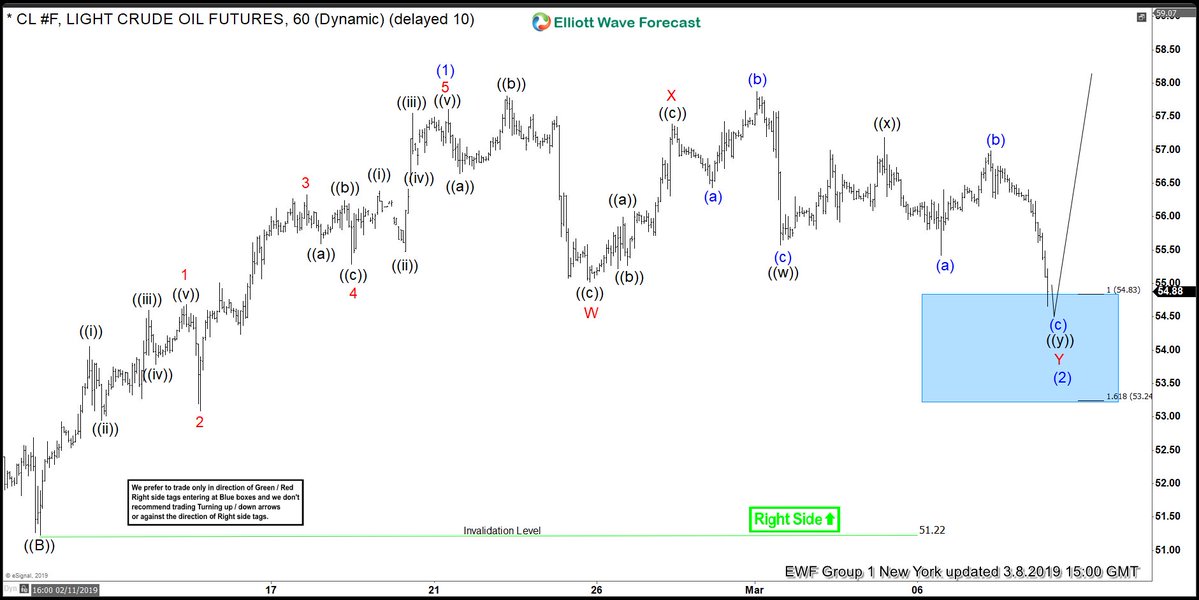

OIL Found Buyers In Blue Box And Rallied

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of OIL . As our members know recently we got pull back that was unfolding as Elliott Wave Double Three Pattern. We expected OIL to find buyers there and trade higher due to incomplete bullish sequences […]

-

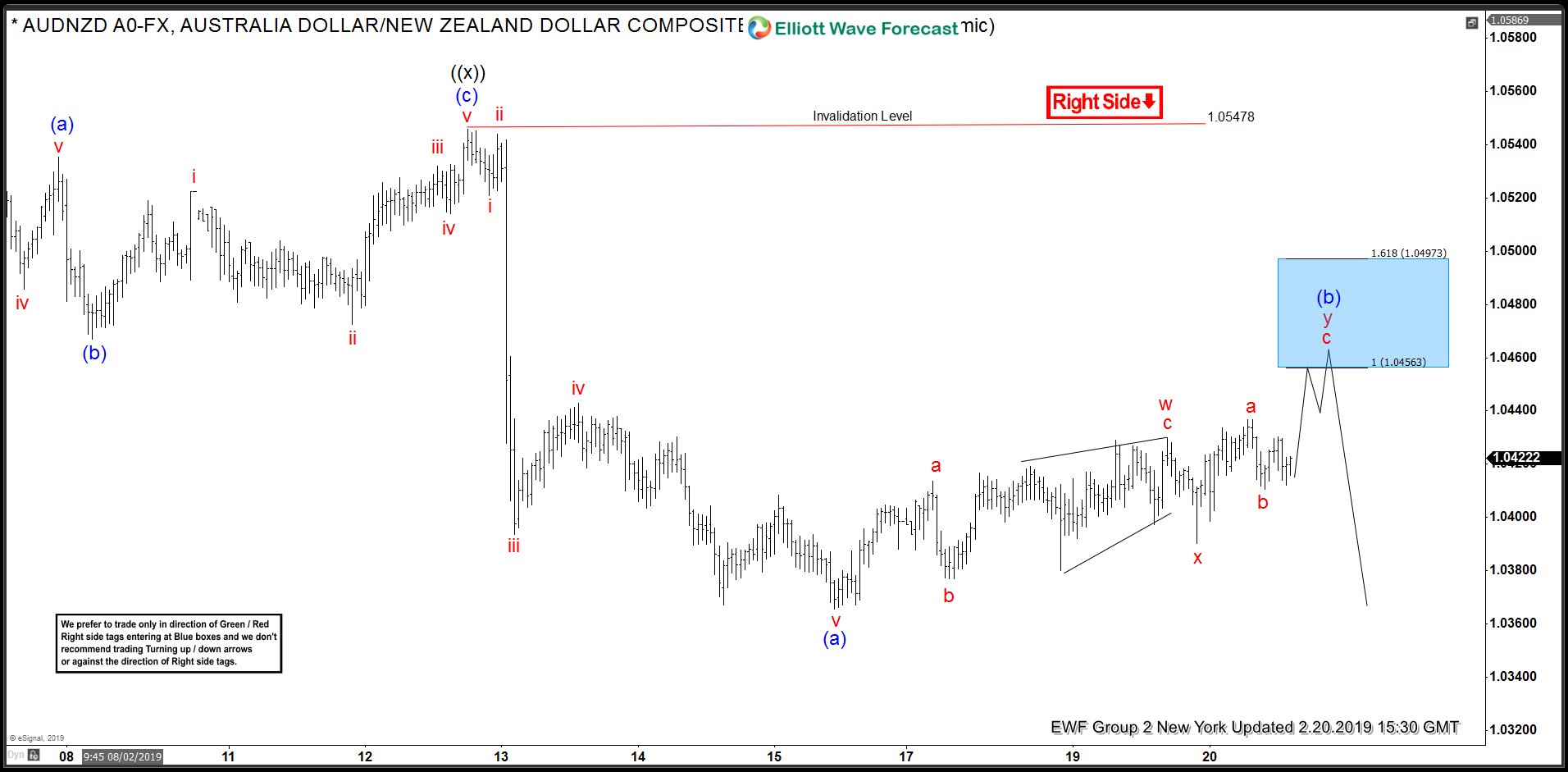

AUDNZD Incomplete Bearish Sequences Calling The Decline

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the charts of AUDNZD published in members area of the website. As our members know, AUDNZD has incomplete sequences in the cycle from the January 21st (1.0673) peak. Break of 02/06 low made January cycle incomplete to the downside, which […]

-

NASDAQ Found Buyers In Blue Box And Rallied

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of NASDAQ. As our members know recently we got pull back that was unfolding as Elliott Wave Double Three Pattern. We expected NASDAQ to find buyers again and trade higher due to incomplete bullish seqeuences in […]