-

GBPAUD Elliott Wave : Calling the Decline from the Equal Legs Zone

Read MoreHello fellow traders. In this technical article we’re going to look at the Elliott Wave charts of GBPAUD Forex Pair published in members area of the website. As our members know, GBPAUD has recently given us a 3 waves recovery that found sellers precisely at the equal legs area as we expected. In this discussion, we’ll break […]

-

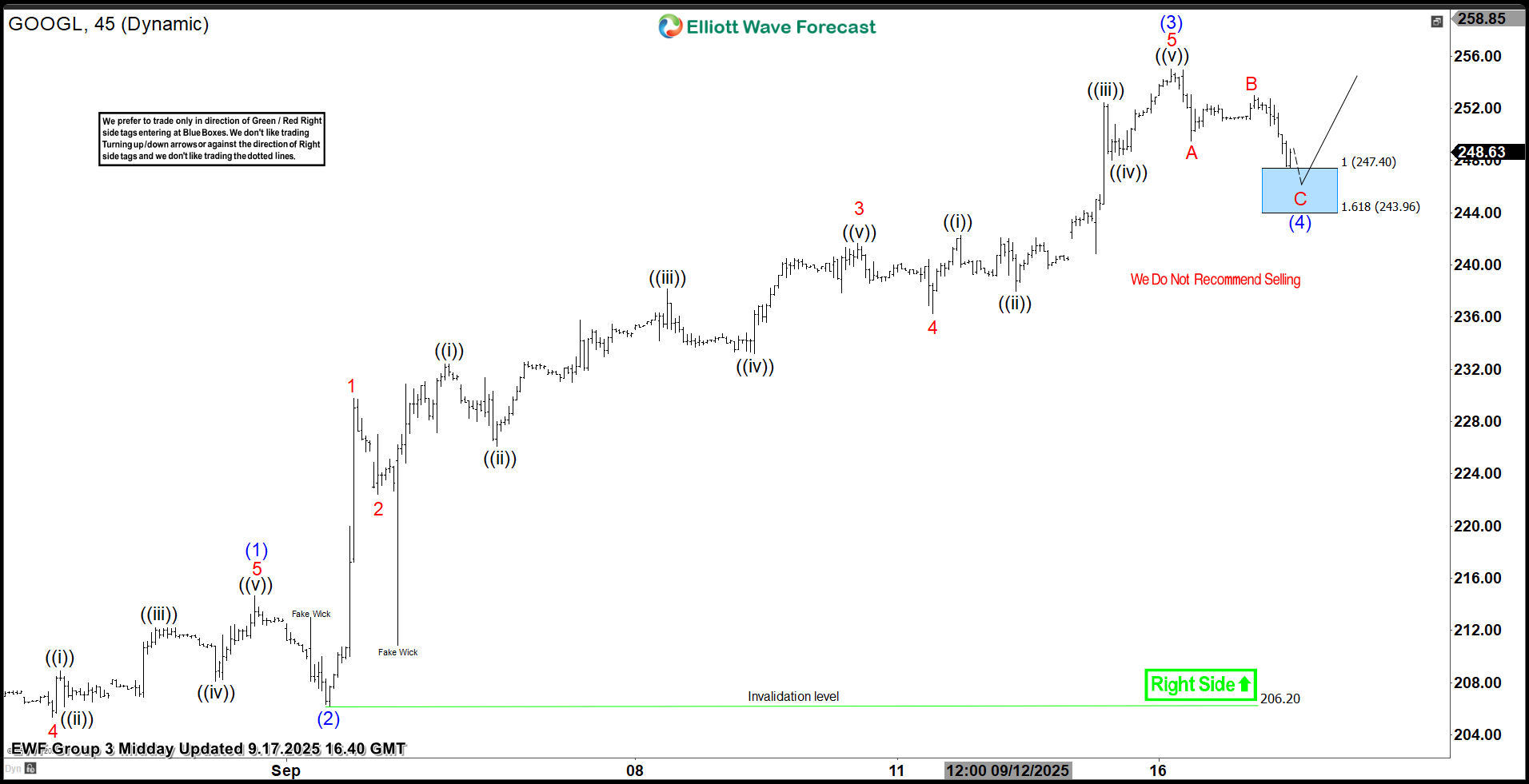

Google Stock (GOOGL) Elliott Wave: Buying the Dips at the Blue Box Area

Read MoreHello fellow traders. In this technical article, we are going to present Elliott Wave trading setup of Google Stock (GOOGL) . The stock completed its corrective decline precisely at the Equal Legs area, also known as the Blue Box. In the following sections, we’ll break down the Elliott Wave structure in detail and explain the setup […]

-

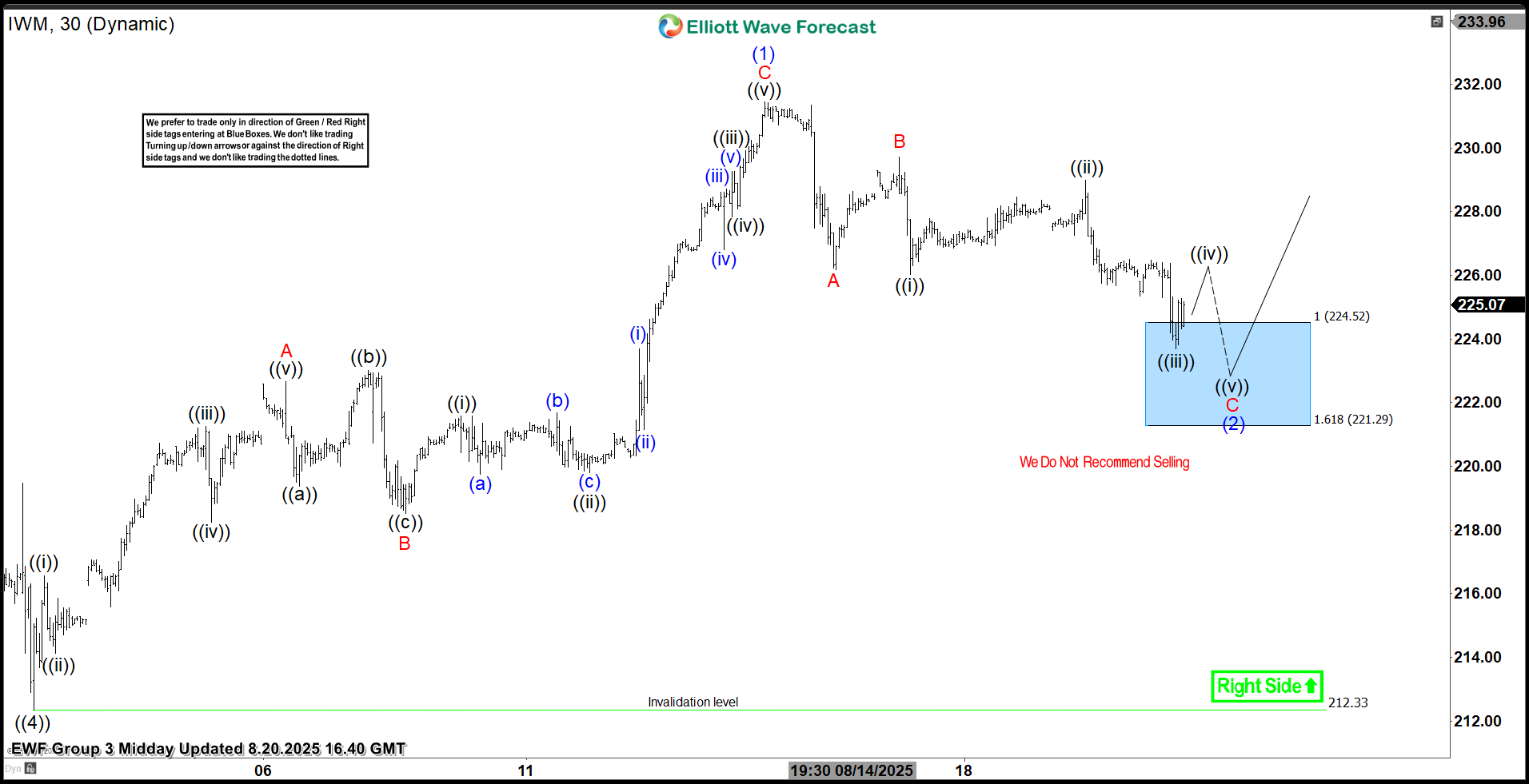

iShares Russell 2000 ETF (IWM)- Elliott Wave Buying the Dips at the Blue Box

Read MoreAs our members know we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in iShares Russell 2000 ETF -IWM . The ETF has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. […]

-

OIL (CL_F) Elliott Wave : Calling the Decline From the Equal Legs Area

Read MoreHello traders. In this technical article we’re going to look at the Elliott Wave charts of Oil commodity (CL_F) published in members area of the website. OIL has recently given us a 3 waves recovery that found sellers precisely at the equal legs area as we expected. In this discussion, we’ll break down the Elliott Wave pattern […]

-

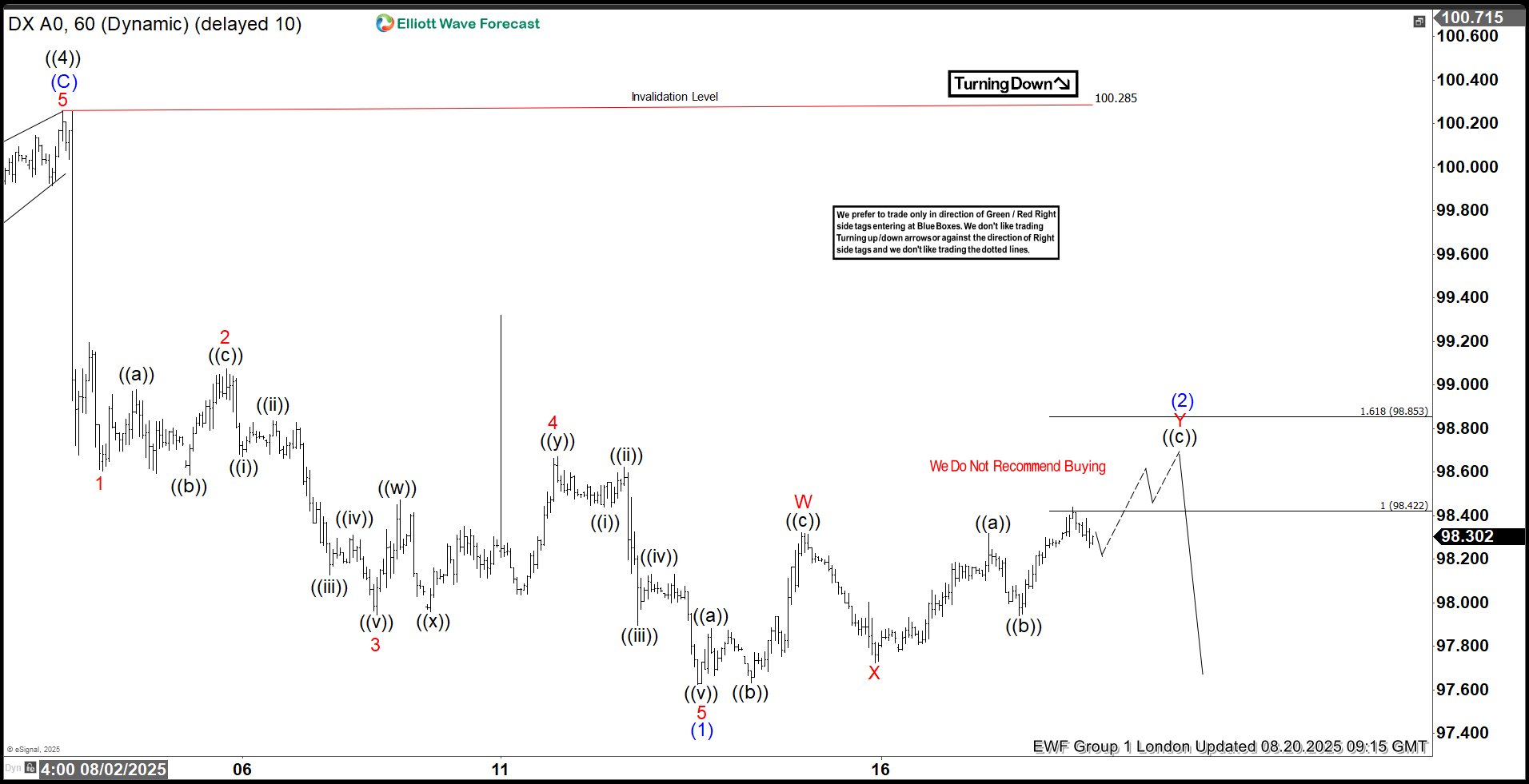

Dollar Index (DXY) : Forecasting the Decline From the Equal Legs Zone

Read MoreIn this technical article we’re going to look at the Elliott Wave charts of Dollar index DXY published in members area of the website. US Dollar has recently given us Double Three pull back and found buyers again precisely at the equal legs area as we expected. In this discussion, we’ll break down the Elliott Wave pattern […]

-

EURUSD : Calling the Rally After Elliott Wave Double Three Pattern

Read MoreHello fellow traders. In this technical article we’re going to look at the Elliott Wave charts of EURUSD forex pair published in members area of the website. The pair has recently given us Double Three pull back and found buyers again precisely at the equal legs area as we expected. In the following text, we’ll explain the […]