-

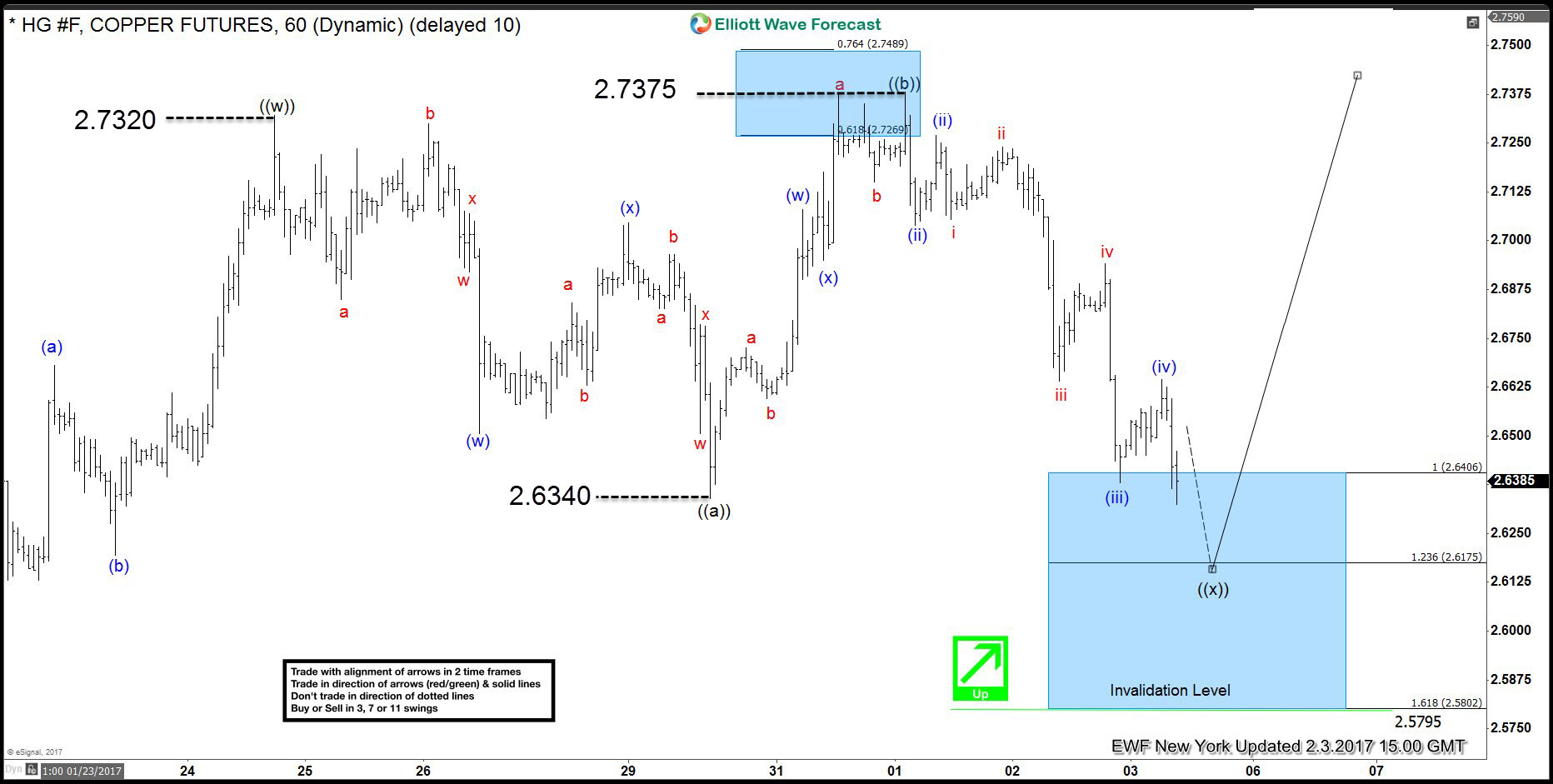

Copper( HG #F) buying the dips after Flat structure

Read MoreHello fellow traders. In this technical blog we’re going to present the past Elliott Wave charts of Copper (HG #F) published in members area of www.elliottwave-forecast.com . As our members know, we were pointing out that Copper is within bullish cycle from the December 23th low. Structure has been calling for more strength once ((x)) […]

-

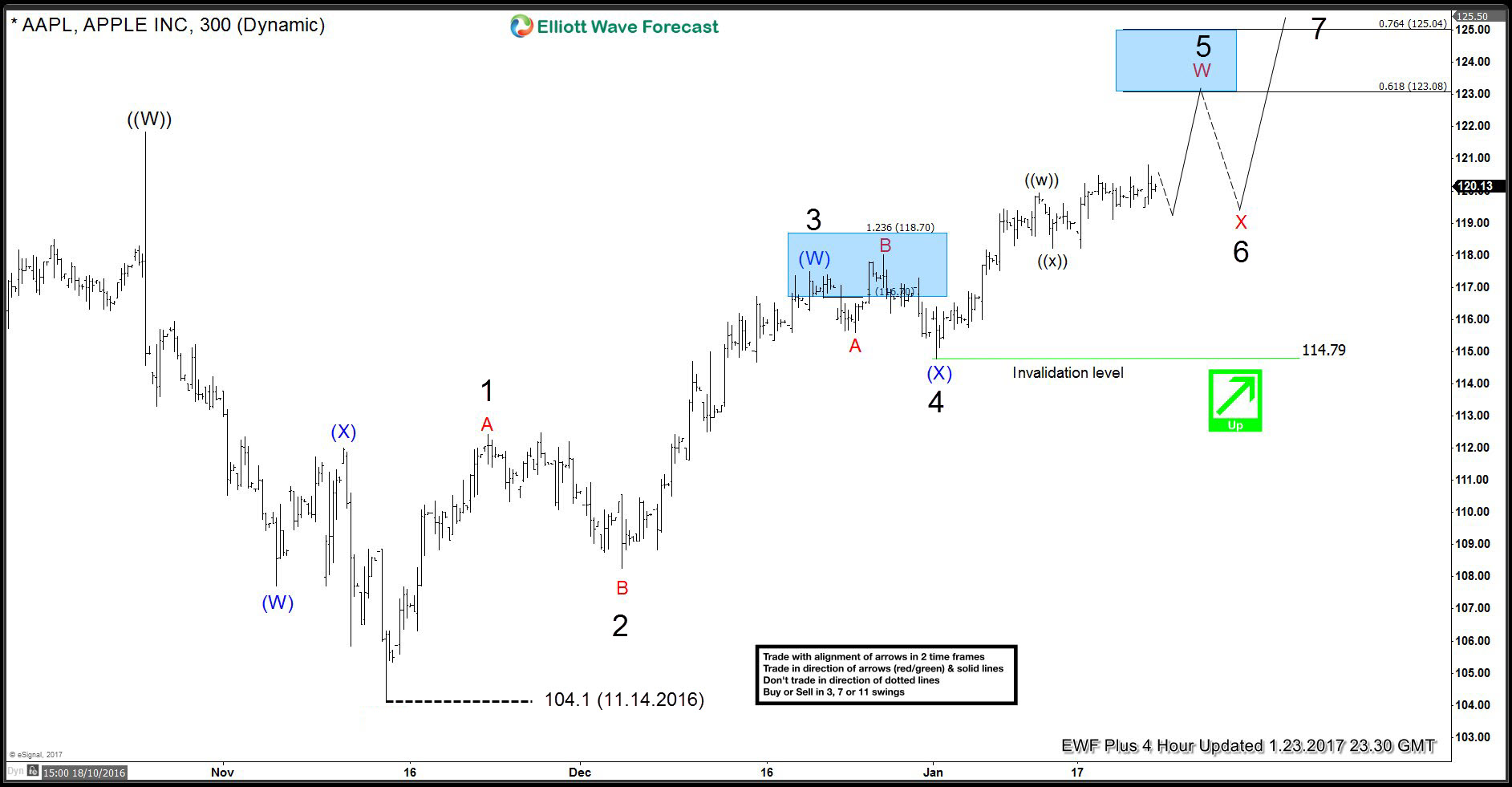

AAPL reached first target area at 128.16-131.34

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of Apple ( AAPL) published in members area of www.elliottwave-forecast.com. We’re going to explain the structure and see how we guided our members through this instrument. AAPL 4 Hour update 01.23.2017 Elliott Wave structure is […]

-

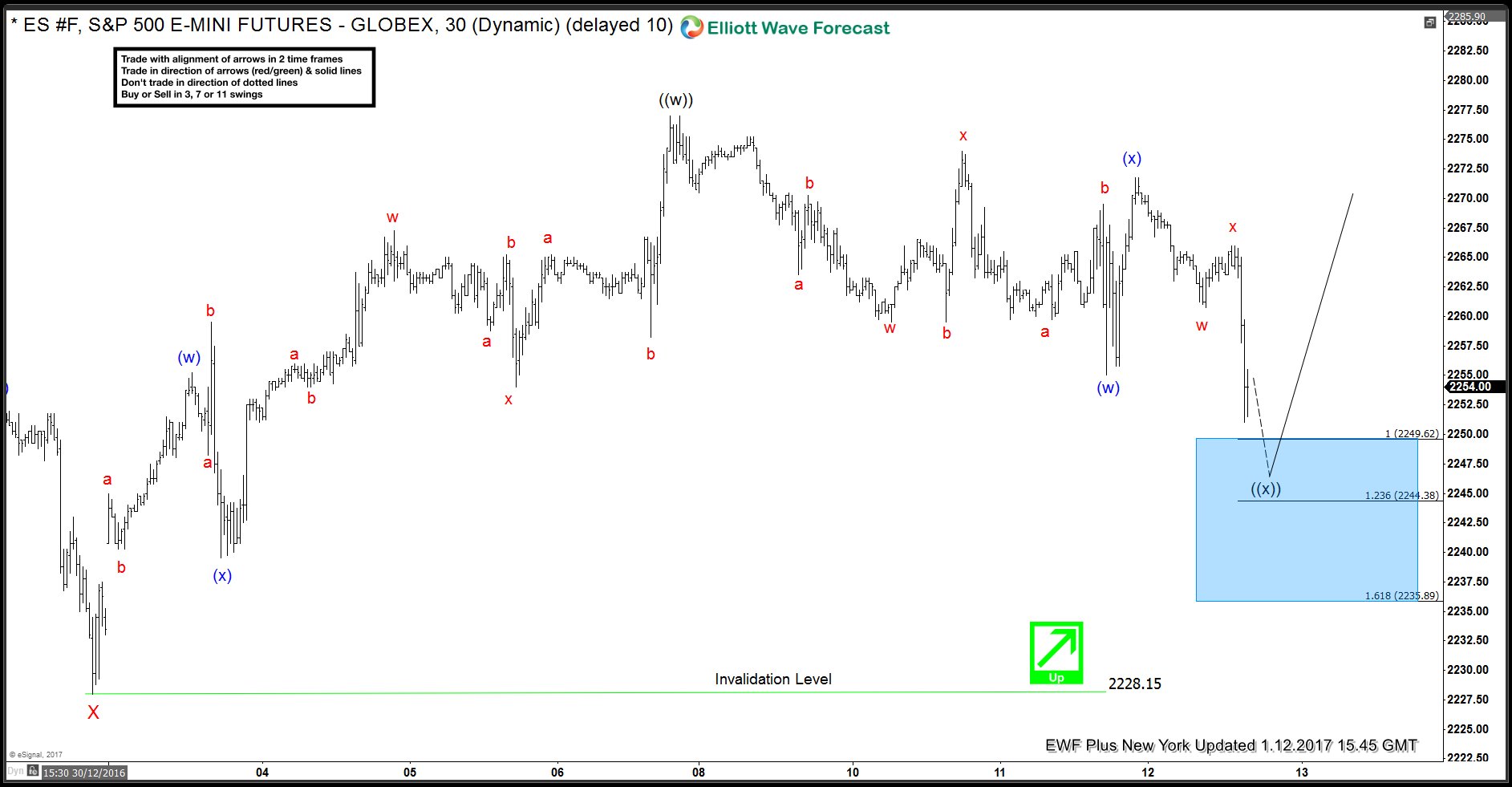

ES_F Strategy of the day, buying the dips

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at another nice trading example of ES_F. The video below is a short capture from the ES_F Strategy of the day video 01/10/2017 published in members area of www.elliottwave-forecast.com ES_F strategy: S&P 500 E-mini futures is showing an incomplete bullish swing […]

-

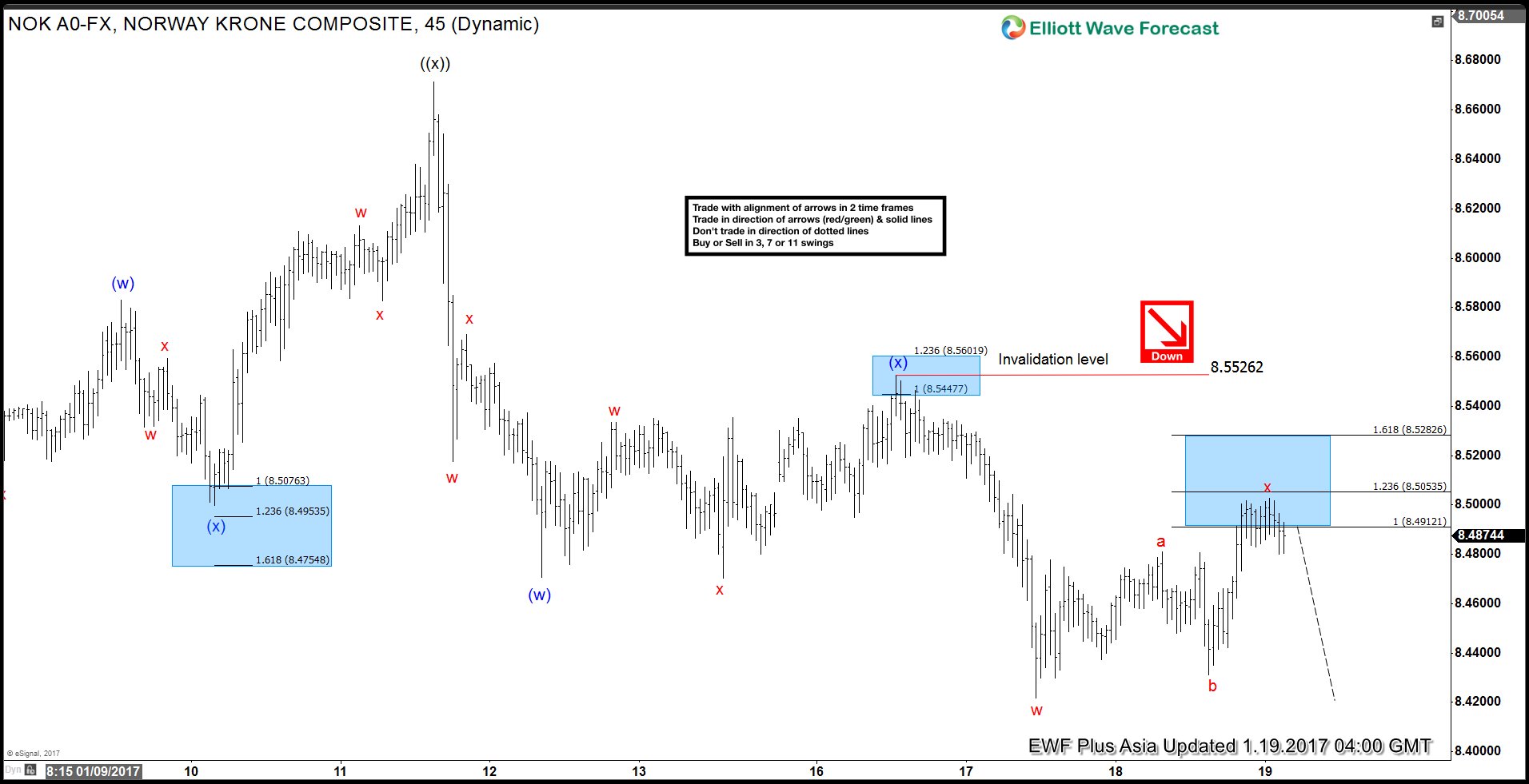

Elliott Wave forecast & market correlation example

Read MoreMarket Correlation Market correlation is one of the powerful techniques we use to forecast the market. Many traders, especially beginners, make mistake by trading and forecasting only one or a few instruments. E.g. the most popular are EURUSD, USDX, SPX, DAX, Gold. Although EURUSD is the most popular forex pair ever, it doesn’t always have […]

-

SPX buying the dips after a Double correction

Read MoreHello fellow traders. The video below is a capture from the SPX Strategy of the day video from 12/19/2016 held by Daud Bhatti. SPX Trading strategy: Our Elliott Wave forecast suggests the index is within bullish cycle from the 2084.6 low. It’s missing a swing to the upside, looking for 2316.85 area. As Daud explained […]

-

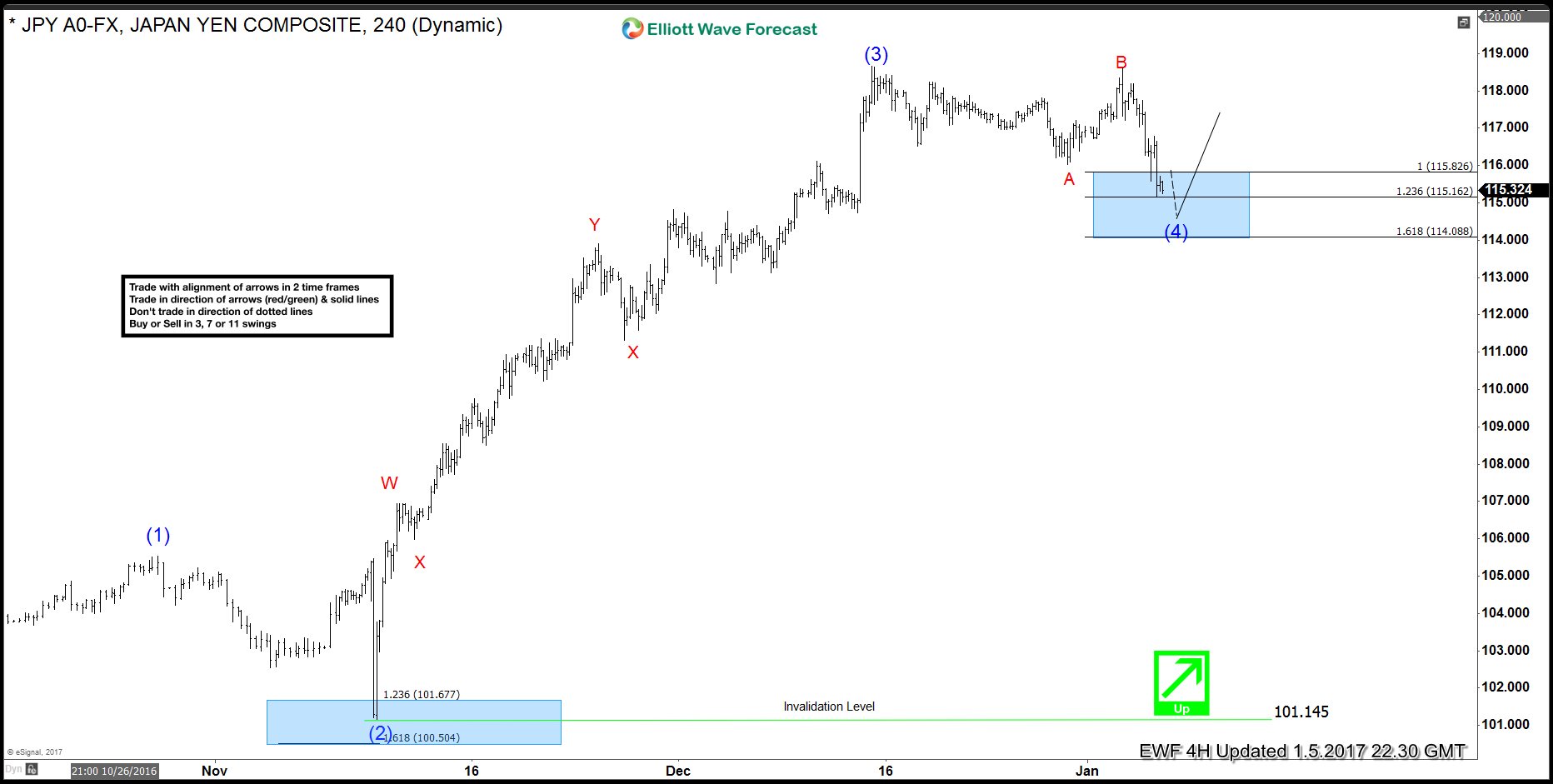

USDJPY buying dips after a FLAT correction

Read MoreHello fellow traders. In this technical blog we’re going to present another nice trading opportunity of USDJPY and we’ll explain the strategy in a few words. The video below is a short capture from the London Live Session 01/05/2017 held by EWF Senior Analyst Daud Bhatti. USDJPY Trading strategy: Our Elliott Wave forecast suggests USDJPY […]