-

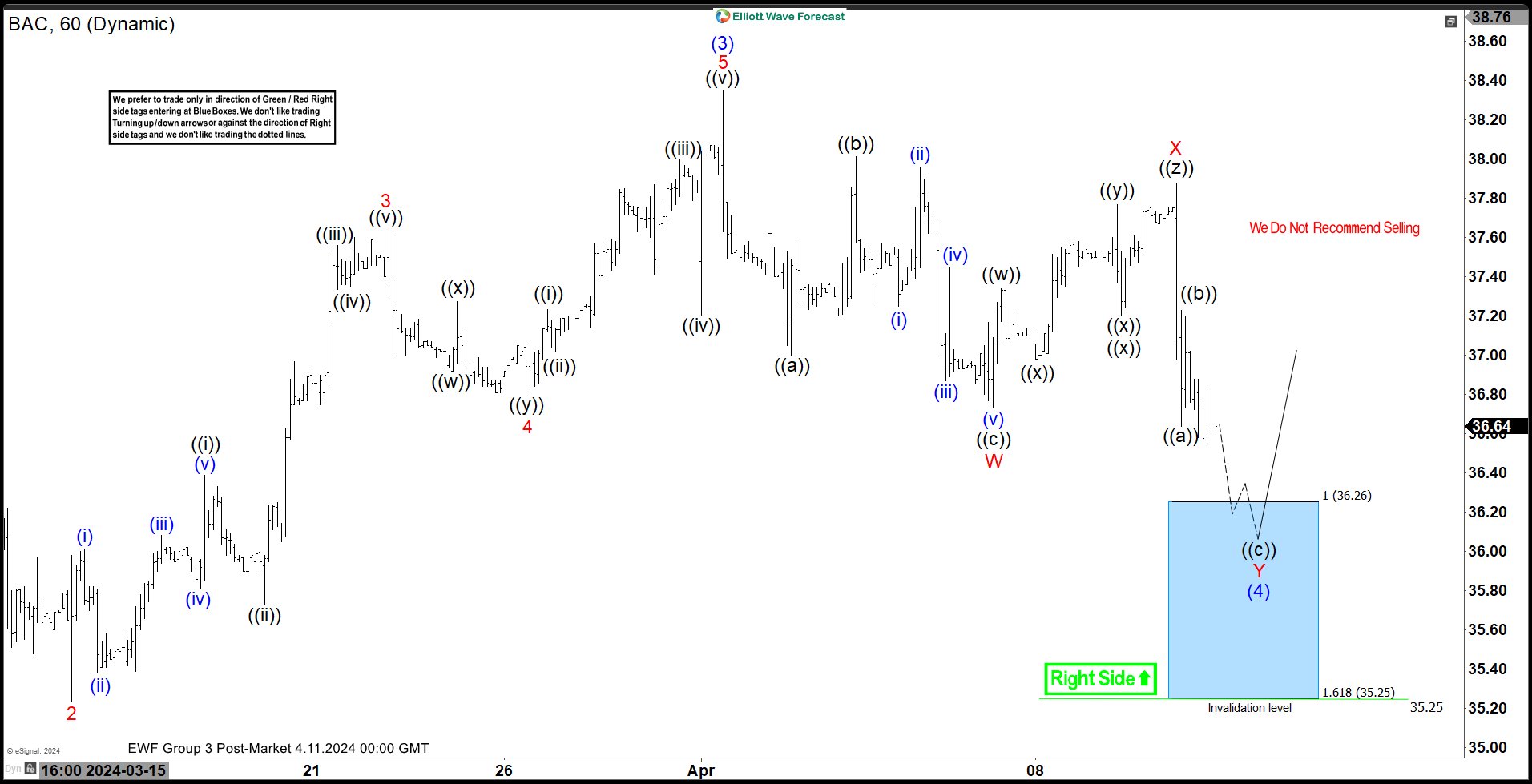

Bank of America ( $BAC) Found Buyers at the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of Bank of America Corp. ($BAC). The rally from 1.17.2024 low at $31.28 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 7 swings and find buyers again. We will explain the […]

-

SPDR Financial ETF ( $XLF) Found Buyers at the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of SPDR Financial ETF ($XLF) . The rally from 1.18.2024 low at $36.95 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the […]

-

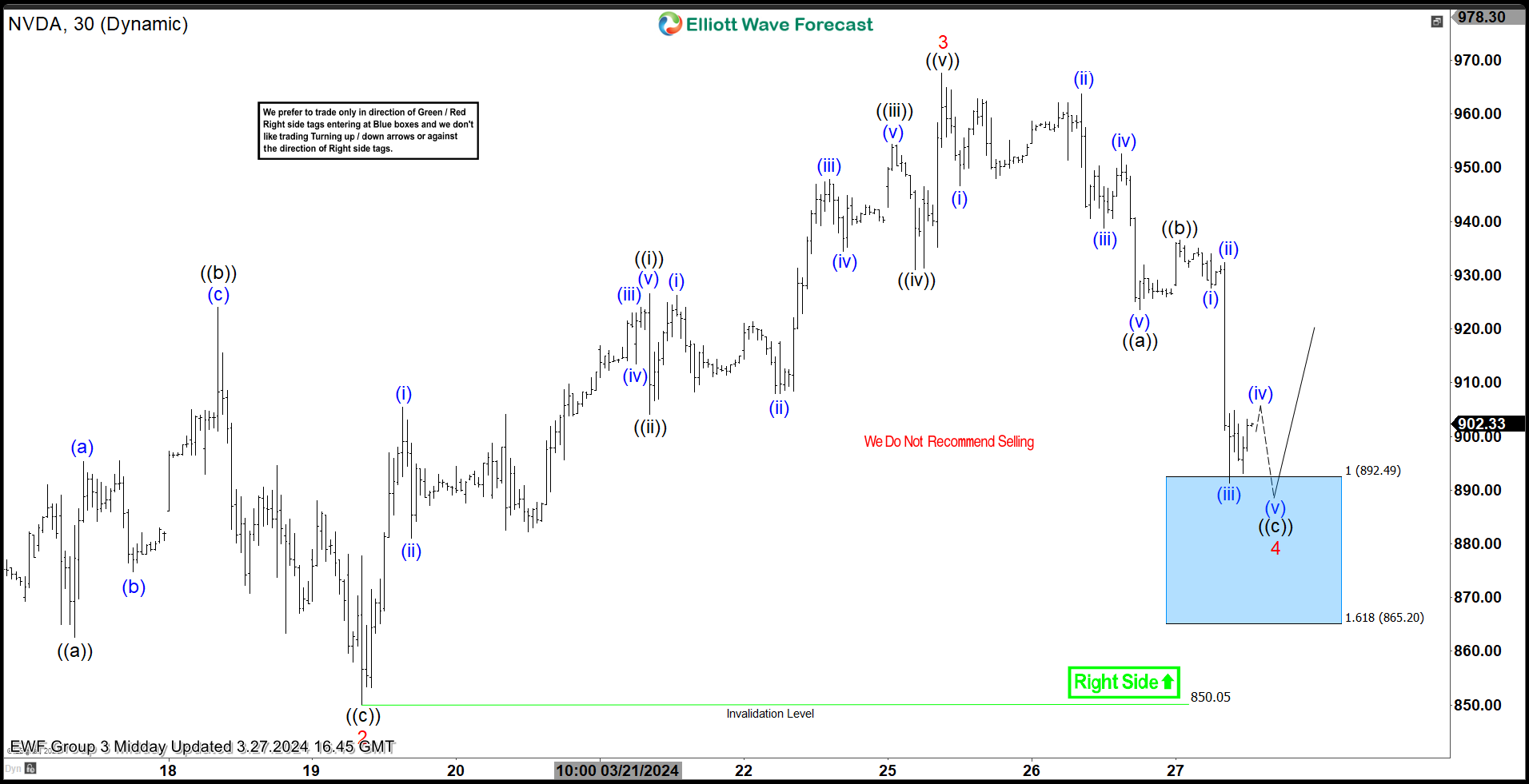

NVIDIA Corp ( $NVDA) Found Buyers at the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of NVIDIA Corp ($NVDA) . The rally from 3.19.2024 low at $850.05 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the structure & […]

-

VanEck Gold Miners ETF ( $GDX ) Found Buyers at the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of VanEck Gold Miners ETF ($GDX) . The rally from 2.28.2024 low at $25.66 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain […]

-

Adobe Inc. ($ADBE) Is Poised To Rally Soon From a Blue Box Area.

Read MoreHello Traders! Today, we will look at the Daily Elliott Wave structure of Adobe Inc. ($ADBE) and explain why the stock should soon reach a Blue Box area and react higher. Adobe Inc. is an American multinational computer software company incorporated in Delaware and headquartered in San Jose, California. It has historically specialized in software for the creation and publication of a […]

-

Alphabet Inc. ($GOOGL) Found Buyers at the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 4H Hour Elliott Wave chart of Alphabet Inc. ($GOOGL). The rally from 10.27.2023 low at $120.25 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the structure & […]