-

TMUS Bullish Outlook: Wave ((4)) Low Holds, Eyes $300 Target

Read MoreTMUS remains in an all-time bullish sequence. The recent dip appears to have found support in the blue box. The resultant bounce could advance to $300 thus, keeping the buyers in control. T-Mobile US (NASDAQ: TMUS) is a leading U.S. wireless carrier, known for its aggressive pricing and nationwide 5G network. Headquartered in Bellevue, Washington, […]

-

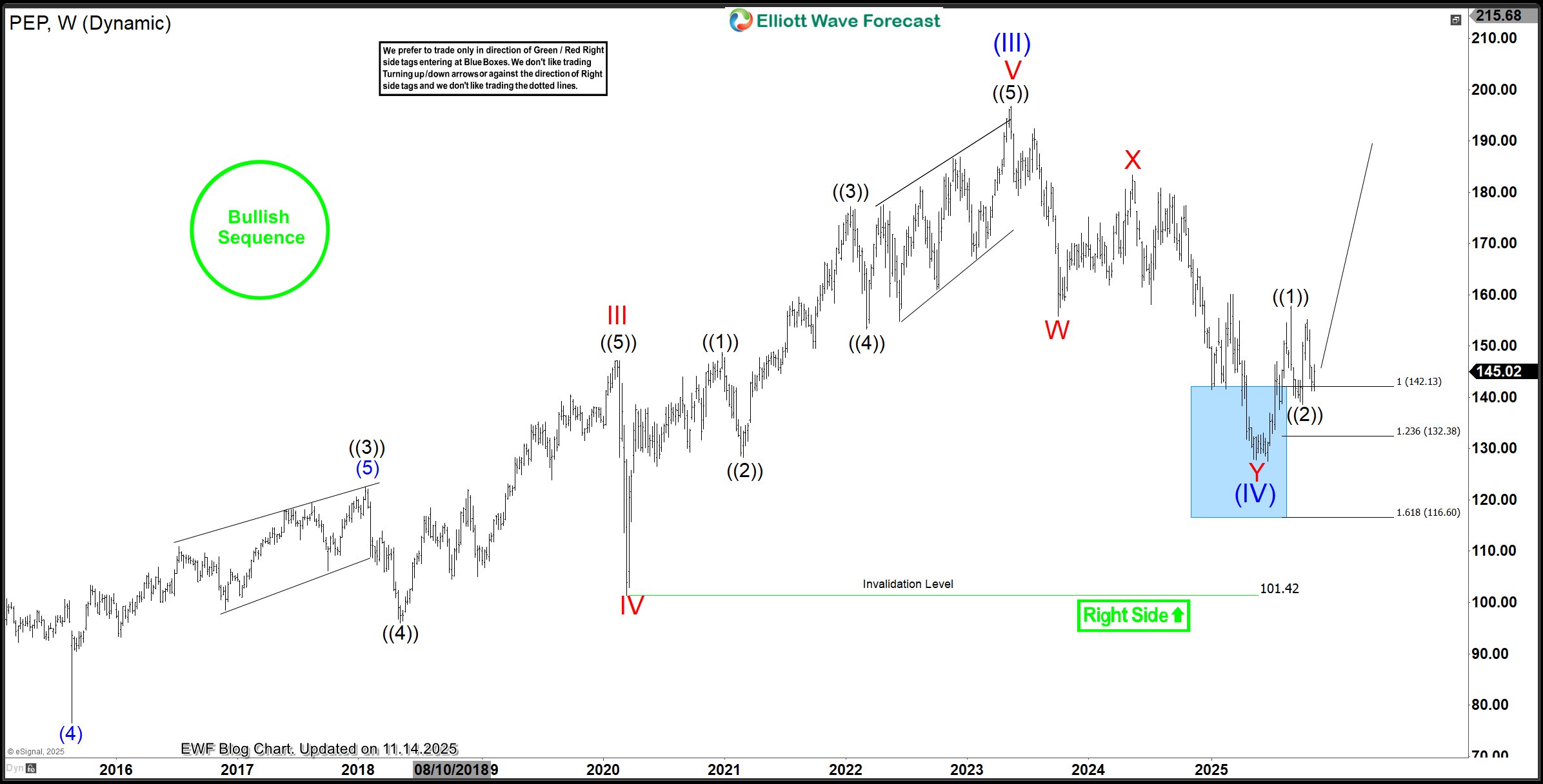

PepsiCo Analysis: Elliott Wave Signals a Possible Rally Toward $215

Read MorePepsiCo appears to have completed the bearish cycle from May 2023. In the coming weeks, price action that supports a new bullish cycle, leading to a new high, could emerge. Meanwhile, in the previous forecast on this stock, we highlighted a high probability buying zone, using the blue box. In this post, we will discuss […]

-

AMZN Extends Bullish Cycle From Blue Box– More Upside Ahead

Read MoreHello traders and welcome to another post where we discuss trade setups from the blue box. With our proprietary blue box trading system, we proffer key turning zone in price action where members can go short or long. In this one, we will discuss a recent long setup on the AMZN. Amazon.com, Inc. is a […]

-

PM Elliott Wave Analysis: Buyers Target $200 from Support Zone

Read MorePhilip Morris International Inc. (PM) is currently trading around a key support zone where buyers could have taken new position. Thus, traders could see this stock skyrocket to $200 and beyond in the coming days. Philip Morris International Inc. (PM) is a leading global tobacco and nicotine company headquartered in Stamford, Connecticut. It manufactures and […]

-

AIZ’s 17-Year Bullish Cycle Attract Buyers From Blue Box

Read MoreAssurant Inc. AIZ has maintained a bullish cycle since November 2008, characterized by higher highs and lows. In such a price action sequence, traders should look to buy dips. This post will analyze the current price position within the trend and potential higher targets for traders. Assurant Inc. (NYSE: AIZ) is a leading global provider […]

-

Natural Gas: How Sellers Booked Profits Amid Imminent Resurgence

Read MoreHello traders. Welcome to another blog post where we discuss trade setups shared with Elliottwave_Forecast members. In this one, the spotlight will be on Natural Gas. On the weekly chart, Natural Gas completed the third wave of a long-term bearish cycle in March 2024, forming an impulse wave that started in August 2022. As a […]