-

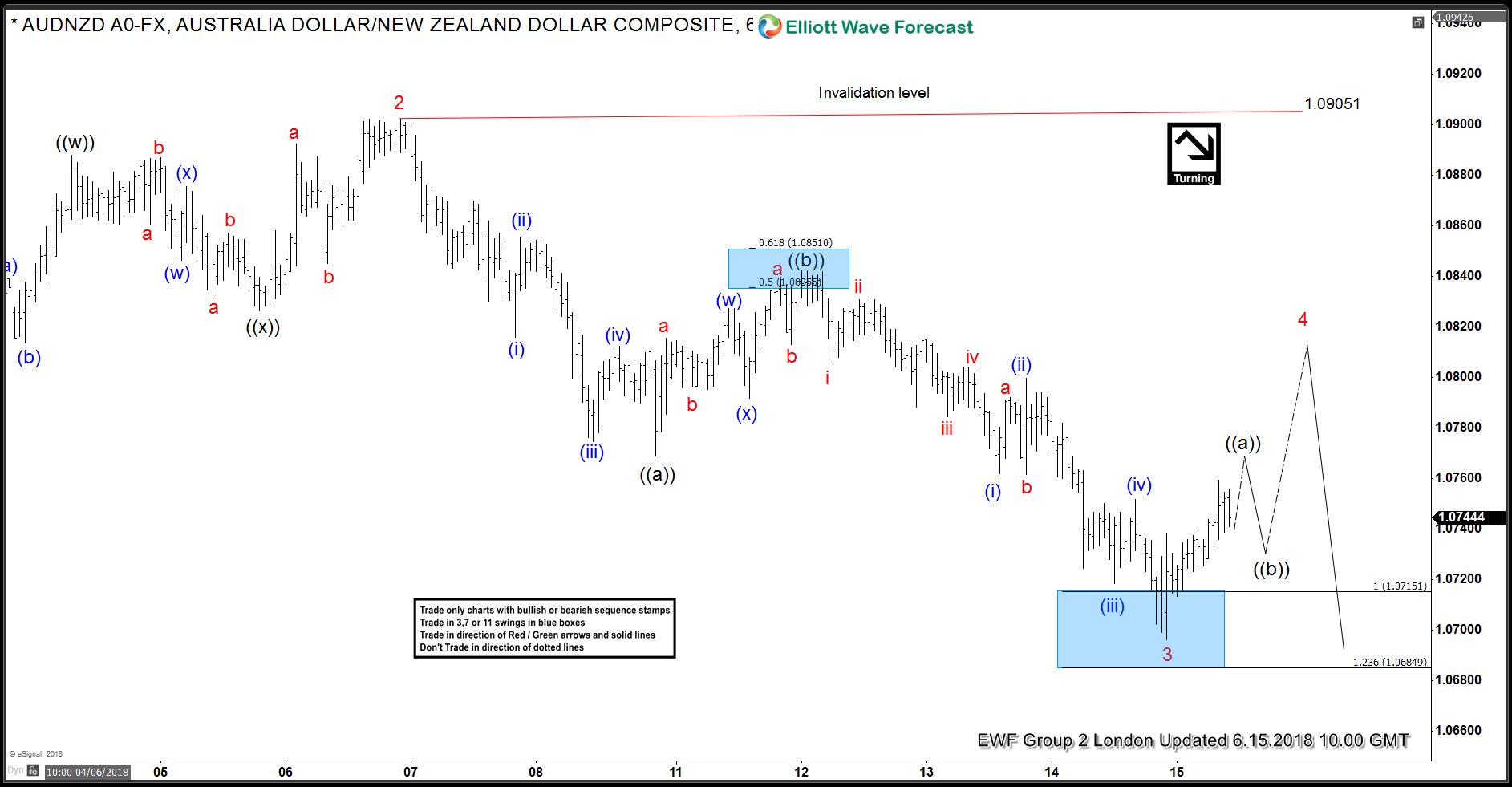

AUDNZD Elliott Wave Analysis: Selling The Rally

Read MoreHello fellow traders. Today, we will have a look at some Elliott Wave charts of the AUDNZD which we presented to our members in the past. Below, you can find our 1-hour updated chart presented to our members on the 06/12/18 calling for more downside after a Double Elliott wave correction in blue wave (w)-(x). AUDNZD had […]

-

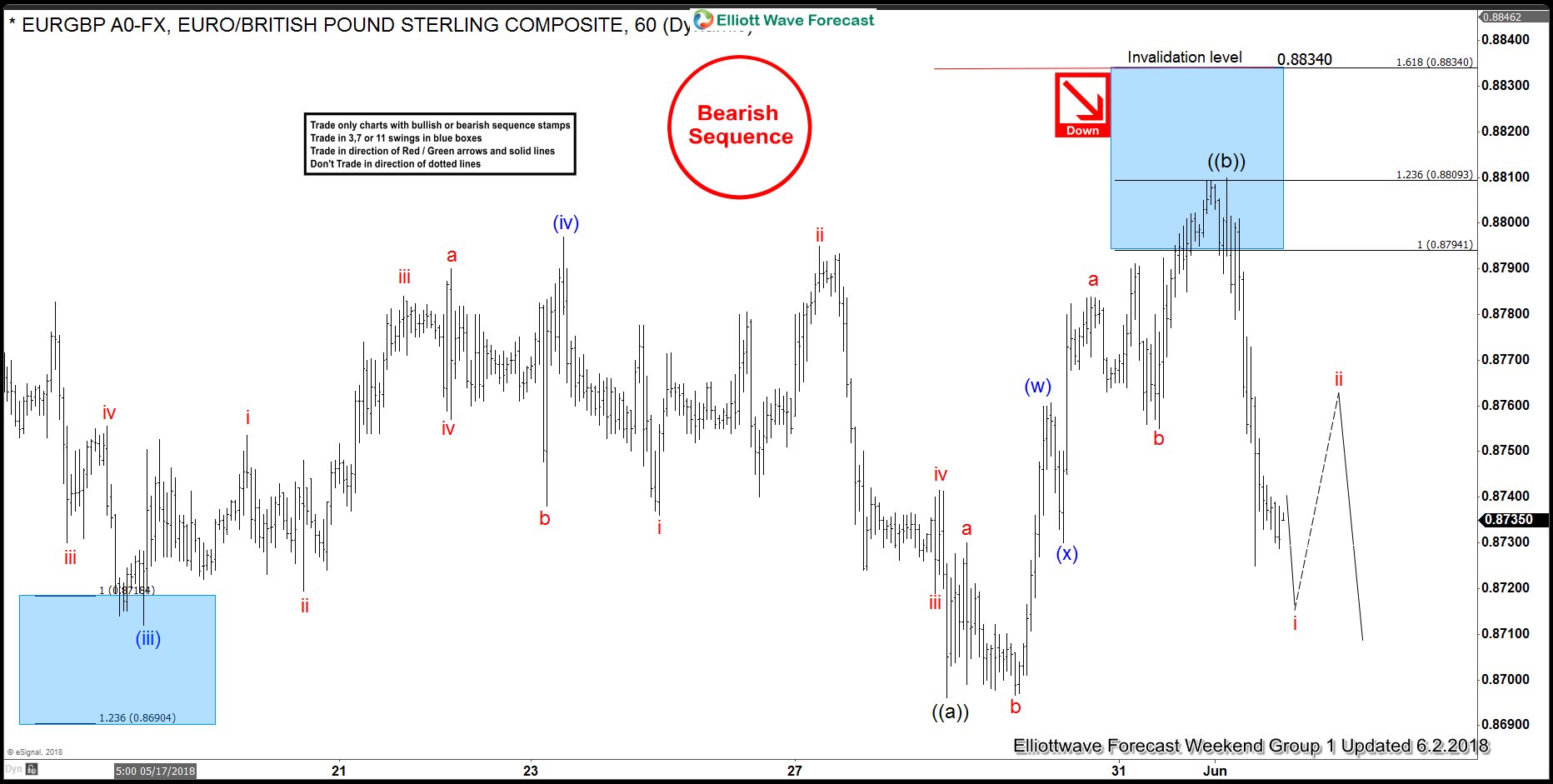

EURGBP Elliott Wave Analysis: Selling The Rally

Read MoreToday, we will have a look at some Elliott Wave charts of the EURGBP which we presented to our members in the past. Below, you can find our 1-hour updated chart presented to our members on the 05/31/18 calling for more downside after a Double Elliott wave correction in blue wave (w)-(x). EURGBP ended the cycle from […]

-

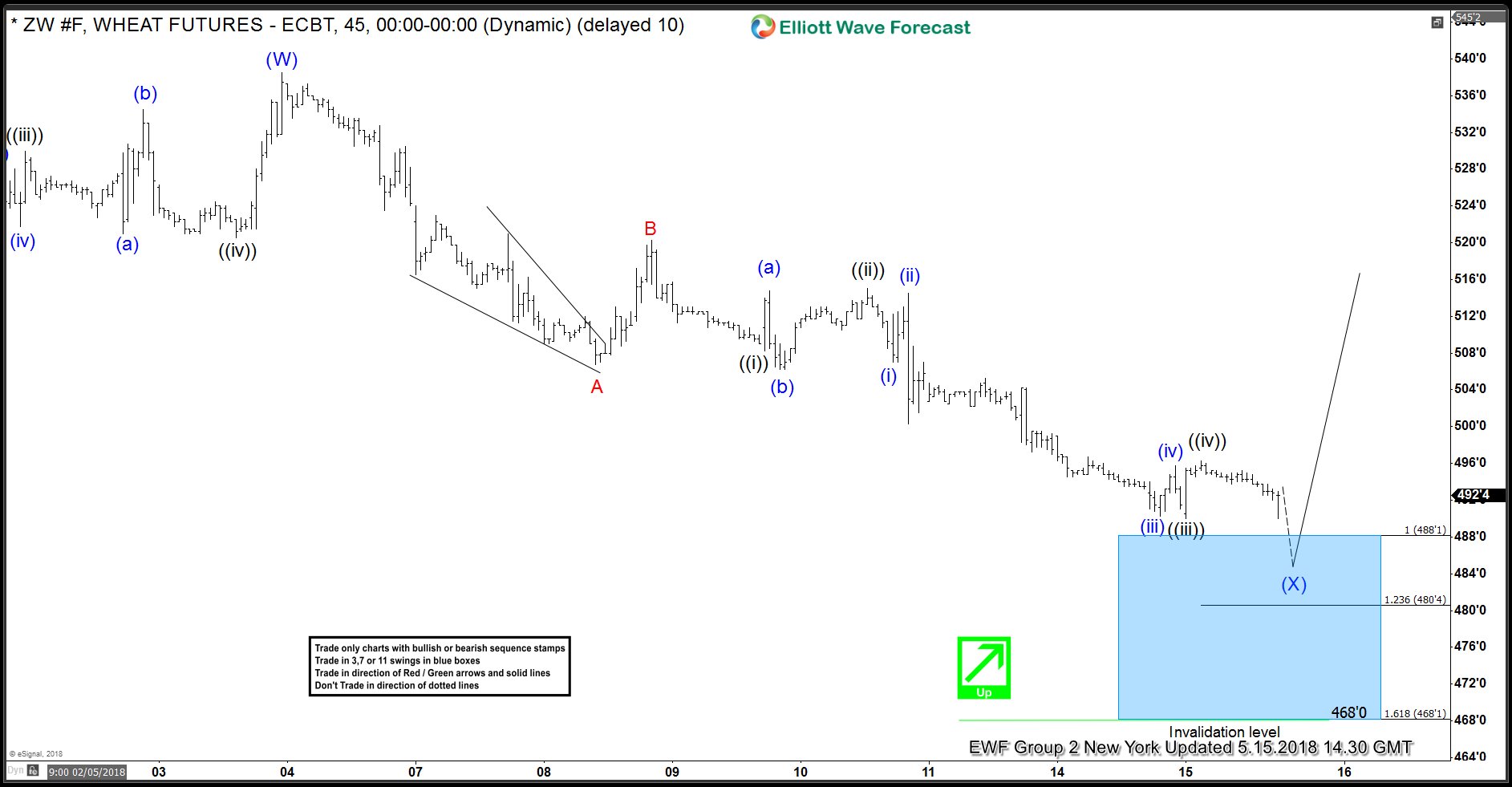

Wheat Elliott Wave Analysis: Forecasting And Buying The Rally

Read MoreIn this blog, I want to share some short-term Elliott Wave charts of Wheat Futures which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 05/15/18 showing Wheat reaching a blue box buying area as a Zig-zag Elliott wave structure. Wheat ended the cycle from […]

-

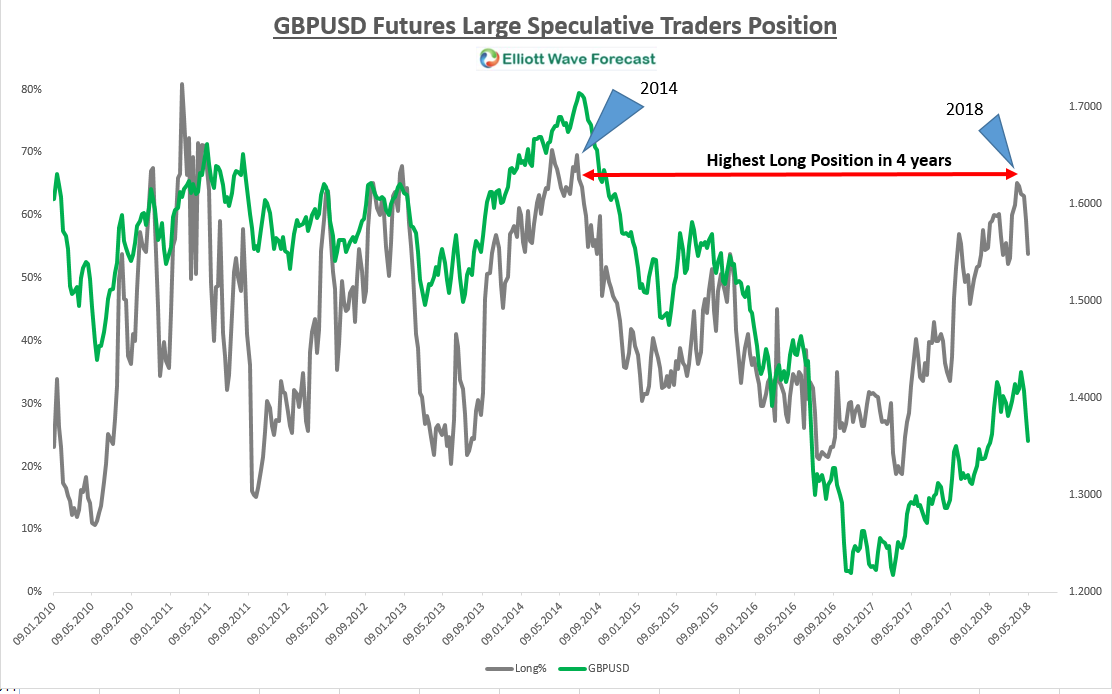

Sentiment Extreme Drags GBPUSD Lower

Read MoreIn this blog, I want to discuss the retreat in the COT Sentiment Net long position in the GBPUSD and what effects it can take. First off let me start explaining what the COT report is all about. The Commitments of Traders Report, short COT is a weekly market report which is issued by the Commodity Futures […]

-

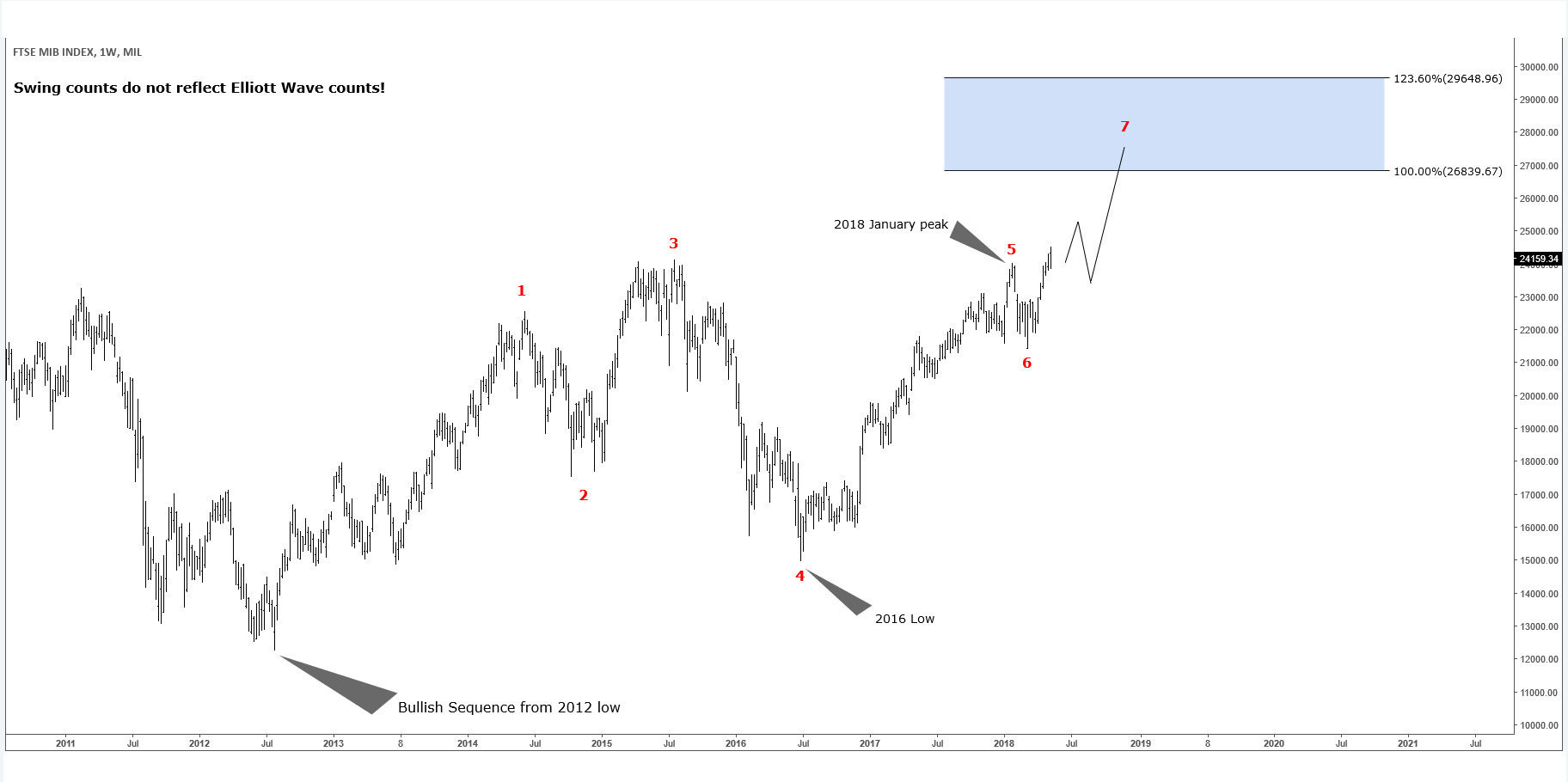

FTSE MIB Index – Bullish Extension Higher Started

Read MoreIn this blog, we will have a look at a European index called FTSE MIB. It is the stock market index for the Borsa Italiana. Which is traded in Italy. It has a market capitalization of around 4 Trillion €. The index consists of the 40 most-traded stocks in Italy. This index has a very interesting swing structure. Having a […]

-

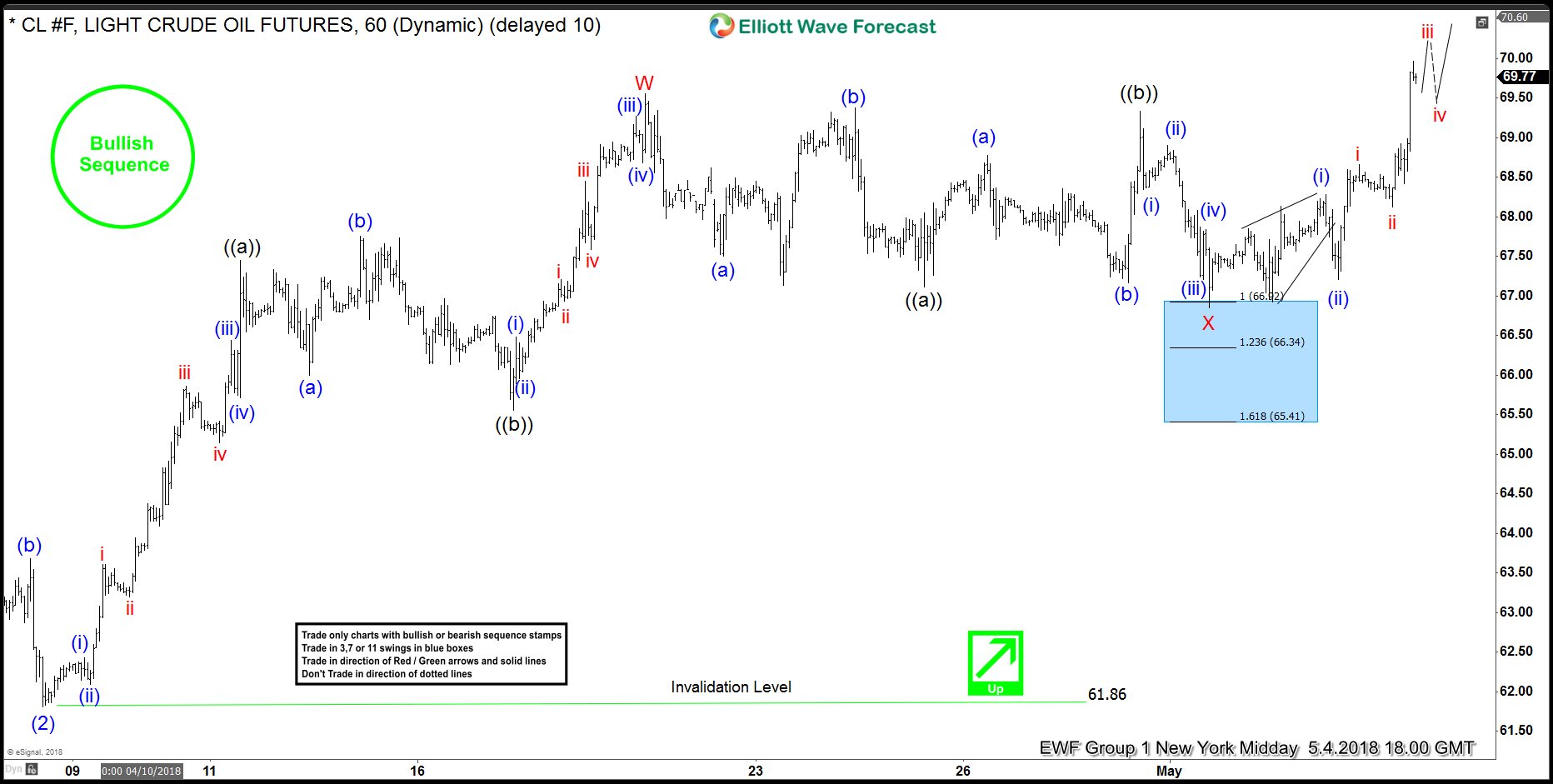

Oil Elliott Wave Analysis: Forecasting And Trading The Rally

Read MoreIn this blog, I want to share some short-term Elliott Wave charts of Crude Oil which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 05/02/18 calling for more upside after ending the correction to the cycle from 09/04/18 in an Elliott Wave Flat correction in […]