-

Xiaopeng Motors ($XPEV) Correcting in Larger Cycle

Read MoreThe EV sector has has a very lucrative 2020. Xiaopeng stock has risen from a low of 17.11 to a peak of 78.00 and seems to be correcting the cycle from the all time low. This chart has lots of potential for future gains. Lets take a look at the company profile below: “Xpeng was […]

-

Arcimoto ($FUV) Bullish Trend Intact

Read MoreArcimoto off the March 2020 low has been on an amazing rally. With the stock price rallying from $1 to $20, it has enjoyed a 2000% gain in under a year. Arcimoto is an electric vehicle company headquartered in Eugene, Oregon. Arcimoto manufactures and sells the Fun Utility Vehicle, or FUV, a tandem two-seat, three-wheeled electric vehicle. They […]

-

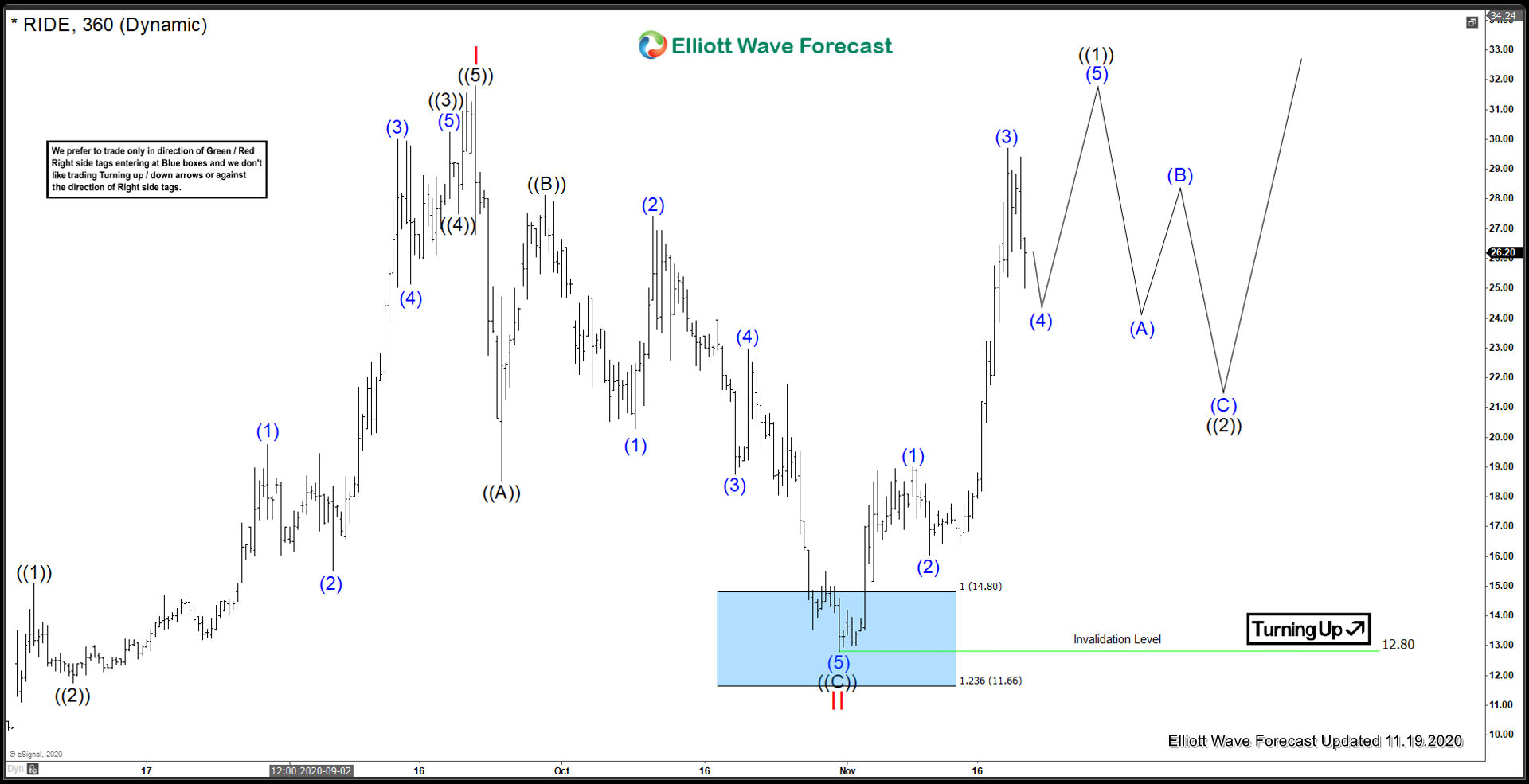

Lordstown Motors Corp. ($RIDE) Priming a Bullish Setup

Read MoreLordstown Motors has had a great start to 2020. With the stock price tripling to a peak in Late September, this company has lots of potential for future gains. Lordstown Motors is in the EV sector, which has been scorching hot all year long. Lets take a look at the company profile below: “Lordstown Motors is […]

-

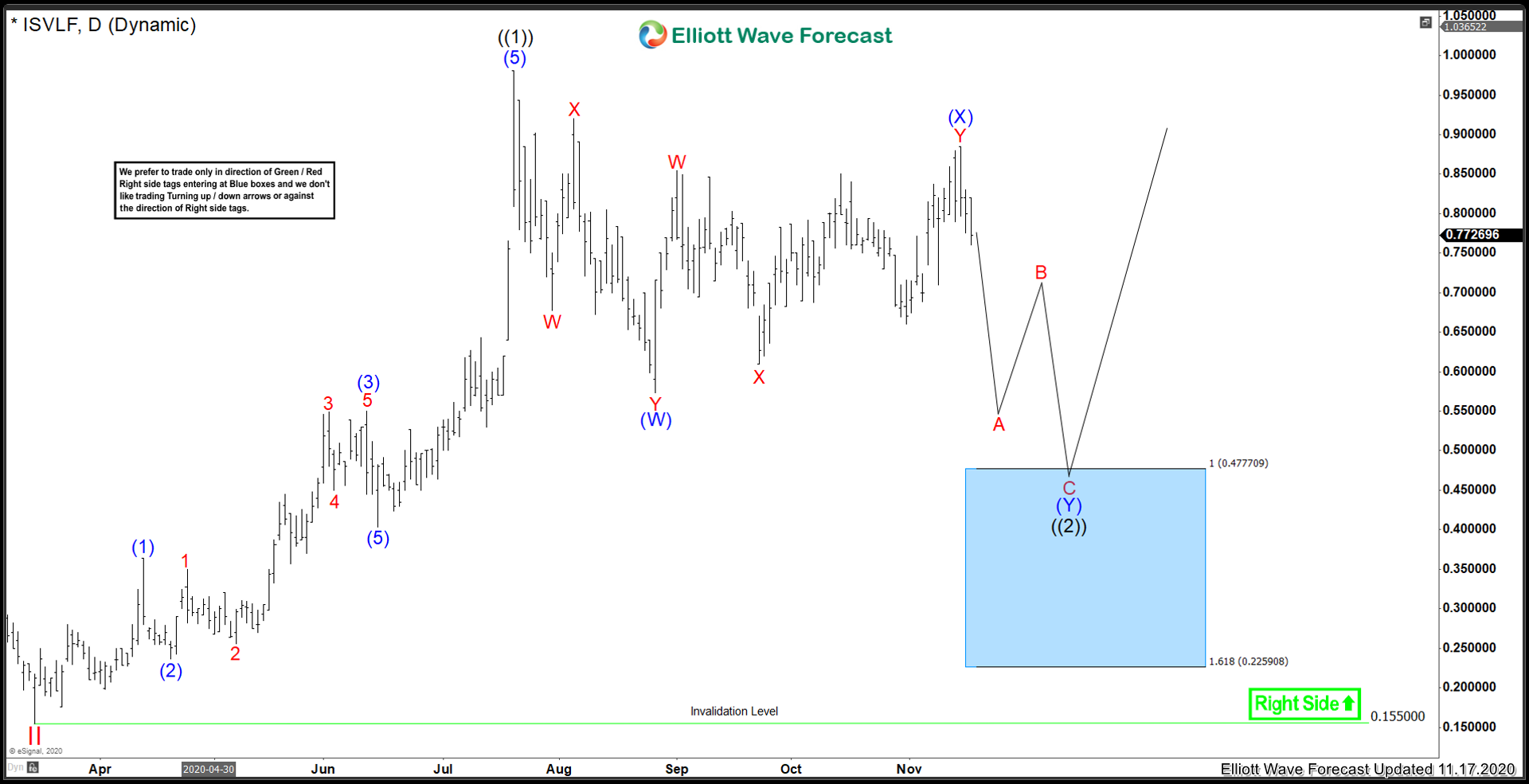

Impact Silver Corp ($ISVLF $IPT.CA) Bullish Nesting Taking Shape

Read MoreImpact Silver. Another Jr metals producer and explorer that has a great looking chart, and what looks like, a triple nest. If the nest is correct, then the upside on this stock may be very lucrative. Impact Silver has a fairly clean chart, but again keep in mind, it is penny stock territory. This chart […]

-

StrikePoint Gold ($STKXF $SKP.CA) Correcting March Cycle

Read MoreMore coverage on the theme of Precious Metals market series that I am doing right now. I am looking for Jr. producers that offer lucrative setups and are technically clean from the March cycle low. StrikePoint has a fairly clean chart, but is in deep penny stock territory. Rallying from a low of 0.01 cents […]

-

Abraplata Resources ($ABBRF OTC, $ABRA.CA) Priming To Rally

Read MoreThe Metals sector has been slowly coming back since the lows in late 2015 and is ready for prime time attention after Gold has recently made new all time highs. Abraplata a Jr. silver, gold, and copper explorer. As such, has a very volatile chart but follows spot silver fairly closely in swings. Abraplata has […]