-

Is WFC Setting Up For A Major Rally?

Read MoreWells Fargo & Company (WFC) provides diversified banking, investment, mortgage, consumer & commercial finance products & services in United States & globally. It operates through four segments; Consumer banking & lending, Commercial banking, Corporate & Investment banking & Wealth management. It comes under Financial services sector & trades as “WFC” ticker at NYSE. WFC is […]

-

Eli Lilly & Company (LLY) Favors Rally Targeting New Weekly High

Read MoreEli Lilly & Company (LLY) discovers, develops & markets human pharmaceuticals worldwide. It comes under Healthcare sector & trades as “LLY” ticket at NYSE. LLY is bullish in weekly sequence from all time low. It favors rally in (V) after double correction ended at $677.09 low in April-2025 low. It favors rally to continue in […]

-

TJX Companies (TJX) Extends Bullish Sequence

Read MoreTJX Companies, Inc., (TJX) operates as an off-price apparel & home fashions retailer in Unites States, Canada, Europe & Australia. It operates through four segments: Marmaxx, HomeGoods, TJX Canada & TJX International. It comes under Consumer Cyclical sector & trades as “TJX” ticker at NYSE. TJX favors rally as discussed in previous article, targeting $137 […]

-

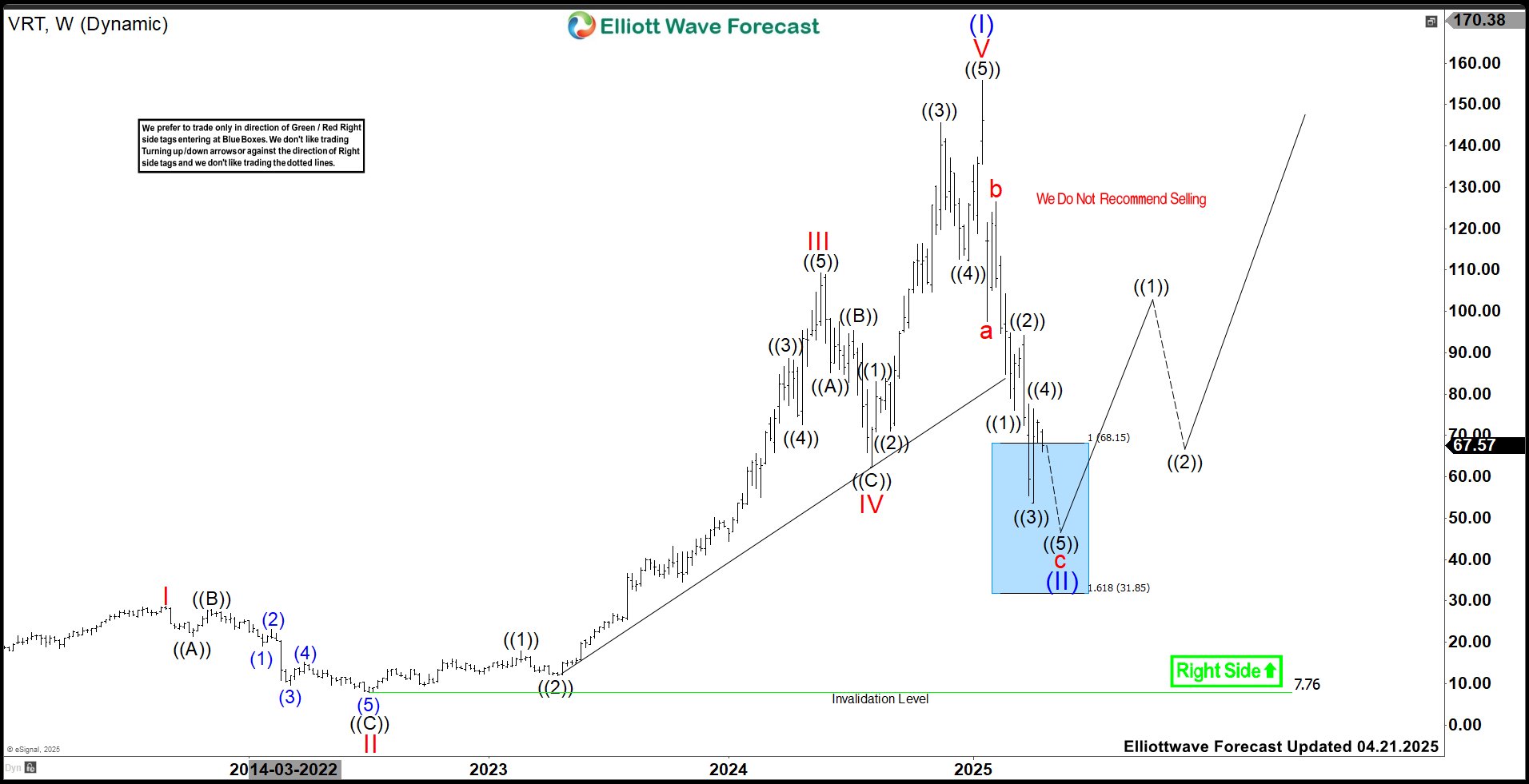

Vertiv Holdings (VRT) Eyes Next Rally From Blue Box Area

Read MoreVertiv Holdings Co., is an American multinational provider of critical infrastructure & services for data centers, communication networks & commercial & industrial environments. It comes under Industrials sector & trades as “VRT” ticket for NYSE. As expected in the previous article, VRT ended impulse sequence (I) at $155.84 high in January-2025. Below there, it favors […]

-

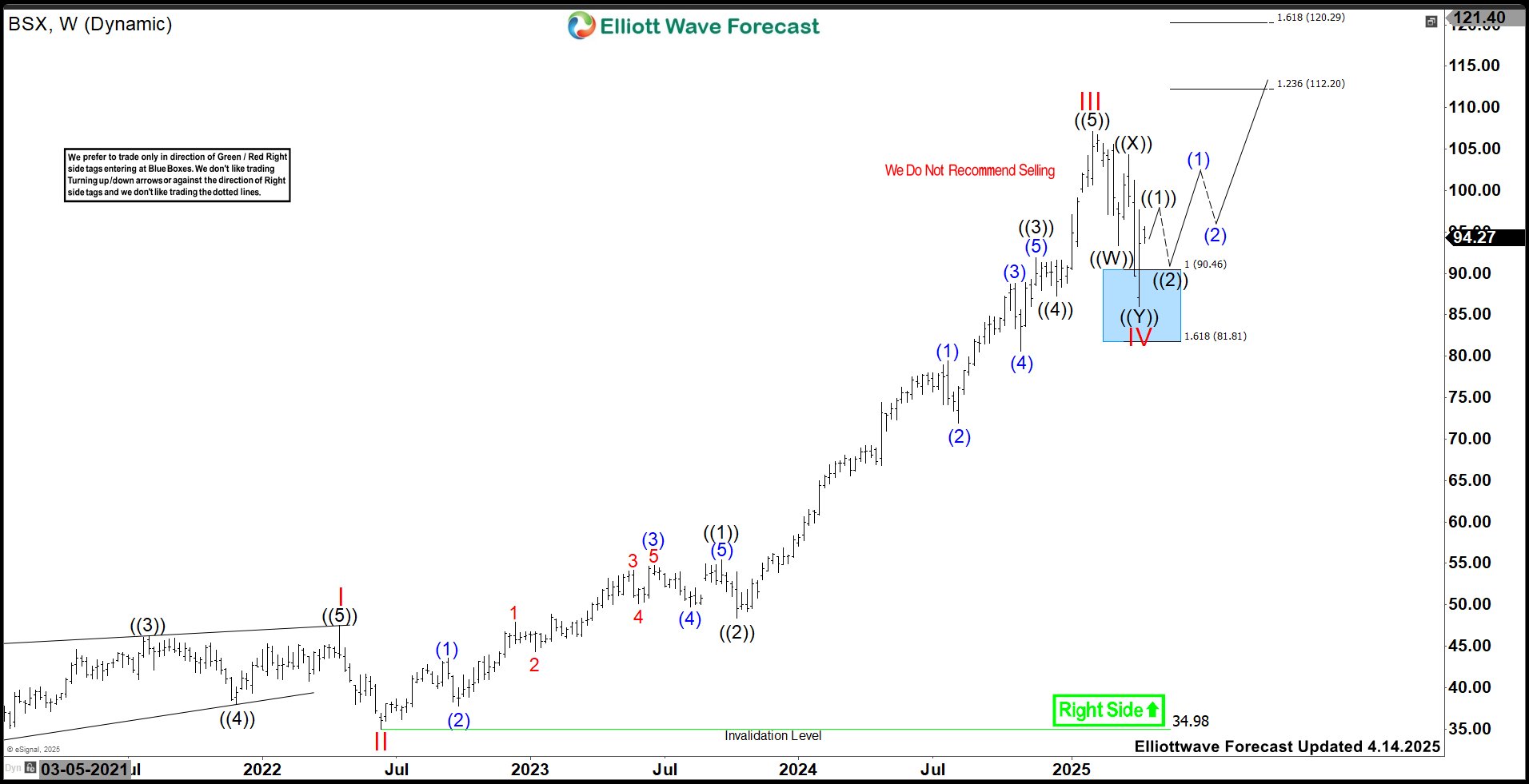

Boston Scientific (BSX) Poised For Rally Targeting $120.3

Read MoreBoston Scientific Corporation (BSX) develops, manufactures & markets medical devices for use in various interventional medical specialties worldwide. It operates through MedSurg & Cardiovascular segments. It offers devices to diagnose & treat different medical conditions & offer remote patient management systems. It comes under Healthcare sector & trades as “BSX” ticker at NYSE. BSX favors […]

-

NextEra Energy (NEE) Continues Potential Downside Towards 56.17

Read MoreNextEra Energy, Inc. (NEE) operates in the Utility sector, generating and distributing electricity to retail and wholesale customers in North America. Its energy portfolio includes wind, solar, nuclear, and natural gas, emphasizing clean energy solutions. The company is listed on NYSE with the ticker “NEE.” NEE – Elliott Wave Latest Weekly View: Based on Elliott […]