-

TD : Should Expect Sideways To Lower Before Upside Resumes

Read MoreThe Toronto-Dominion Bank (TD), together with its subsidiaries, provides various financial products & services in Canada, US & internationally. It operates through three segments: Canadian retail, US retail & Wholesale banking. It is based in Toronto, Canada, comes under Financial services sector & trades as “TD” ticker at NYSE. TD ended wave I at $86.02 […]

-

SUN : Should Bounce Before Continue Correcting Lower

Read MoreSunoco LP (SUN) together with its subsidiaries, distributes & retails motor fuels in the US. It operates in two segments, Fuel distribution & Marketing & all other. The company is based in Dallas, TX, comes under Energy Sector & trades as “SUN” ticker at NYSE. SUN made an all time low at $10.46 in early […]

-

TRGP : Should Expect Bounce Before Further Downside In Correction

Read MoreTarga Resources Corp., (TRGP) together with its subsidiary, Targa Resources Partners LP, owns, operates, acquires, & develops a portfolio of midstream energy assets in North America. The company operate in two segments, gathering – processing, & logistics – transportation. It is based in Houston, Texas, comes under Energy sector & trades as “TRGP” ticket at […]

-

BMO : Expect A Larger Correction Before Rally Resumes

Read MoreBank of Montreal (BMO) provides diversified financial services primarily in North America. The company provides personal banking products & services as well as commercial banking products & services. It is based in Montreal, Canada, comes under Financial services sector & trades as “BMO” at NYSE. BMO started impulse from $38.31 low on 3/18/2022 low & […]

-

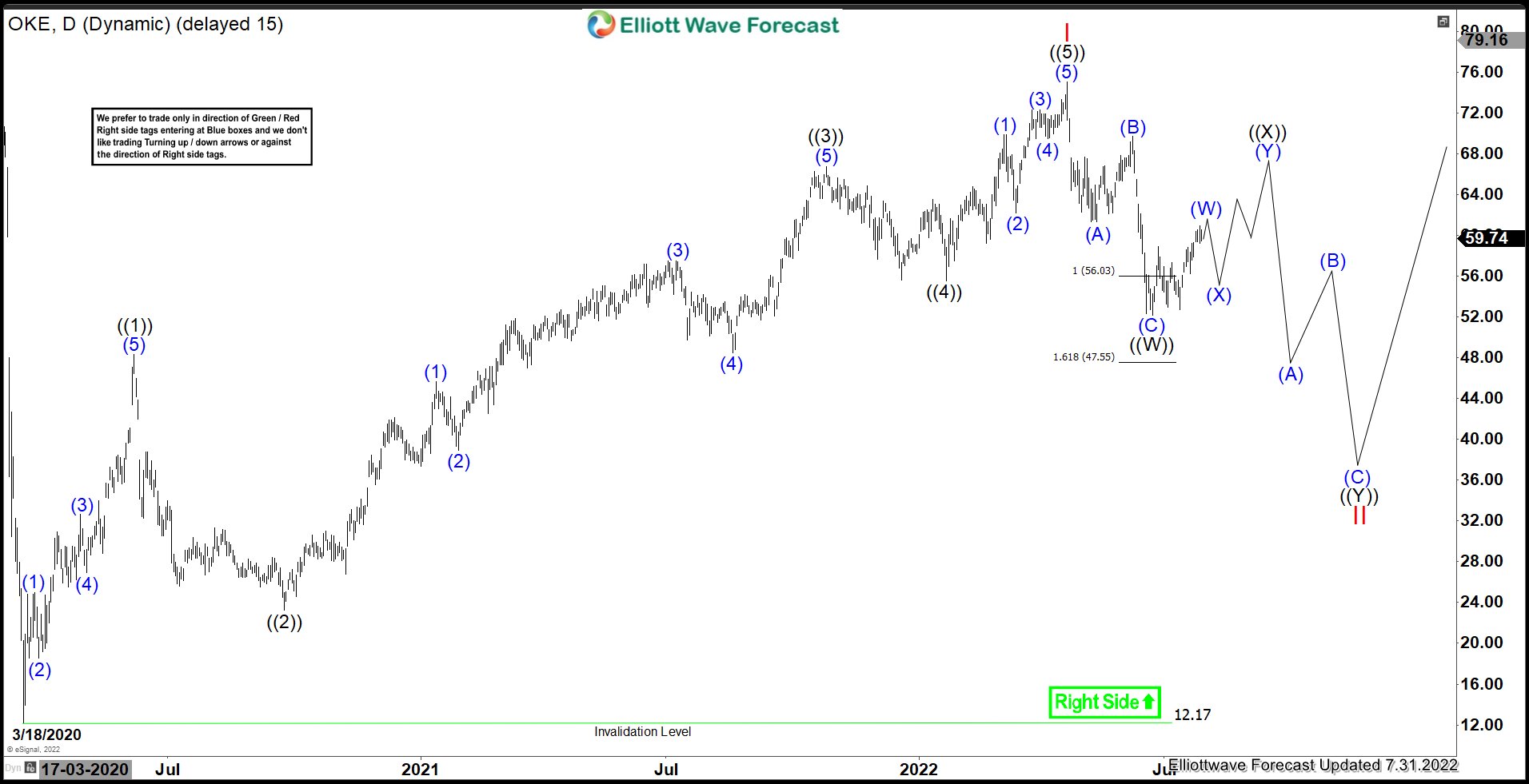

OKE : Should Expect More Weakness After A Corrective Bounce

Read MoreONEOK, Inc., (OKE) together with its subsidiaries, engages in gathering, processing, storage & transportation of natural gas in the United States. It operates through Natural gas gathering & processing, Natural gas liquids & Natural gas pipelines segments. The company has headquartered in Tulsa, Oklahoma, comes under Energy sector and trades as “OKE” ticker at NYSE. […]

-

AMX : Should Expect Short Term Pullback

Read MoreAmerica Movil, S.A.B. de C.V. (AMX) provides telecommunication services in Latin America & internationally. The company offers wireless & fixed voice services, including local, domestic & international long distance services & network interconnection services along with data services. It is based in Mexico, comes under Communication services sector and trades as “AMX” ticket at NYSE. […]