-

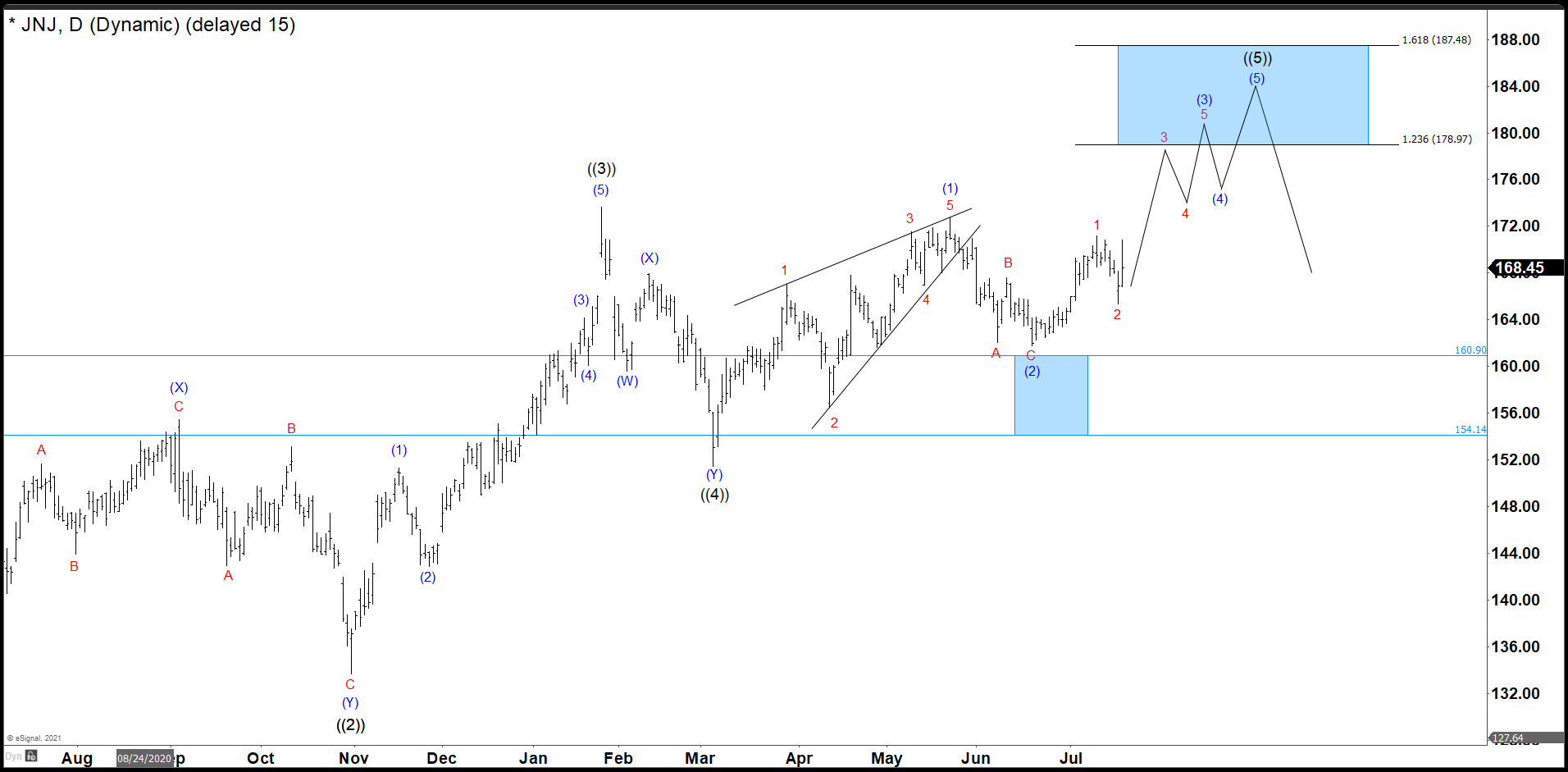

JNJ Rally Has Continued, Denying The Ideal Entry

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost and JNJ was no exception. Johnson & Johnson did not only recover the lost, but It also reached historic highs. Now, we are going to try to build a wedge from the March 2020 lows with a target above $176. […]

-

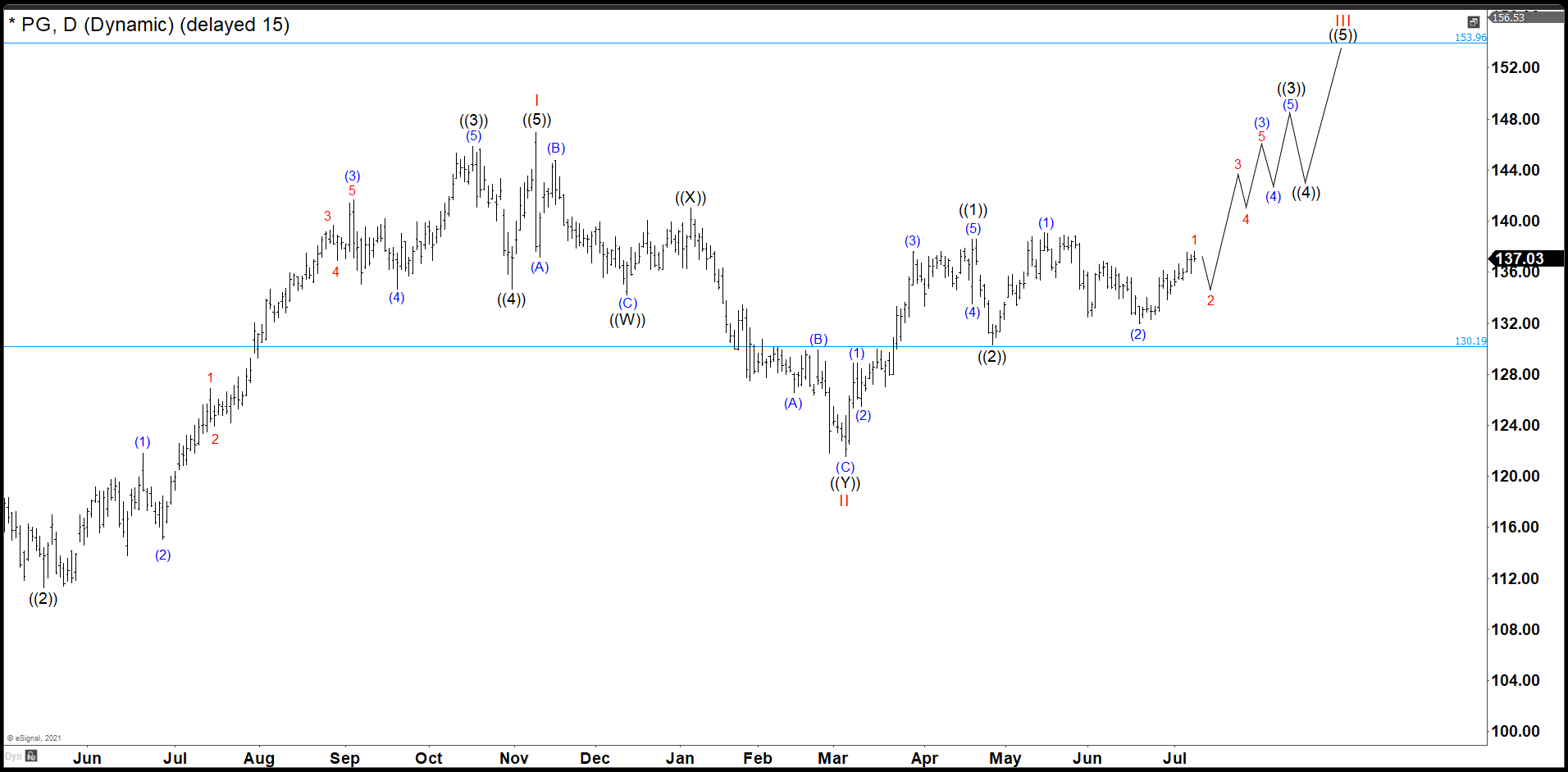

P&G Is In Ranging Mode July Could Be The Rally Month

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost and P&G was no exception. P&G did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from wave II with a first target to $154.00 next $167.50 and […]

-

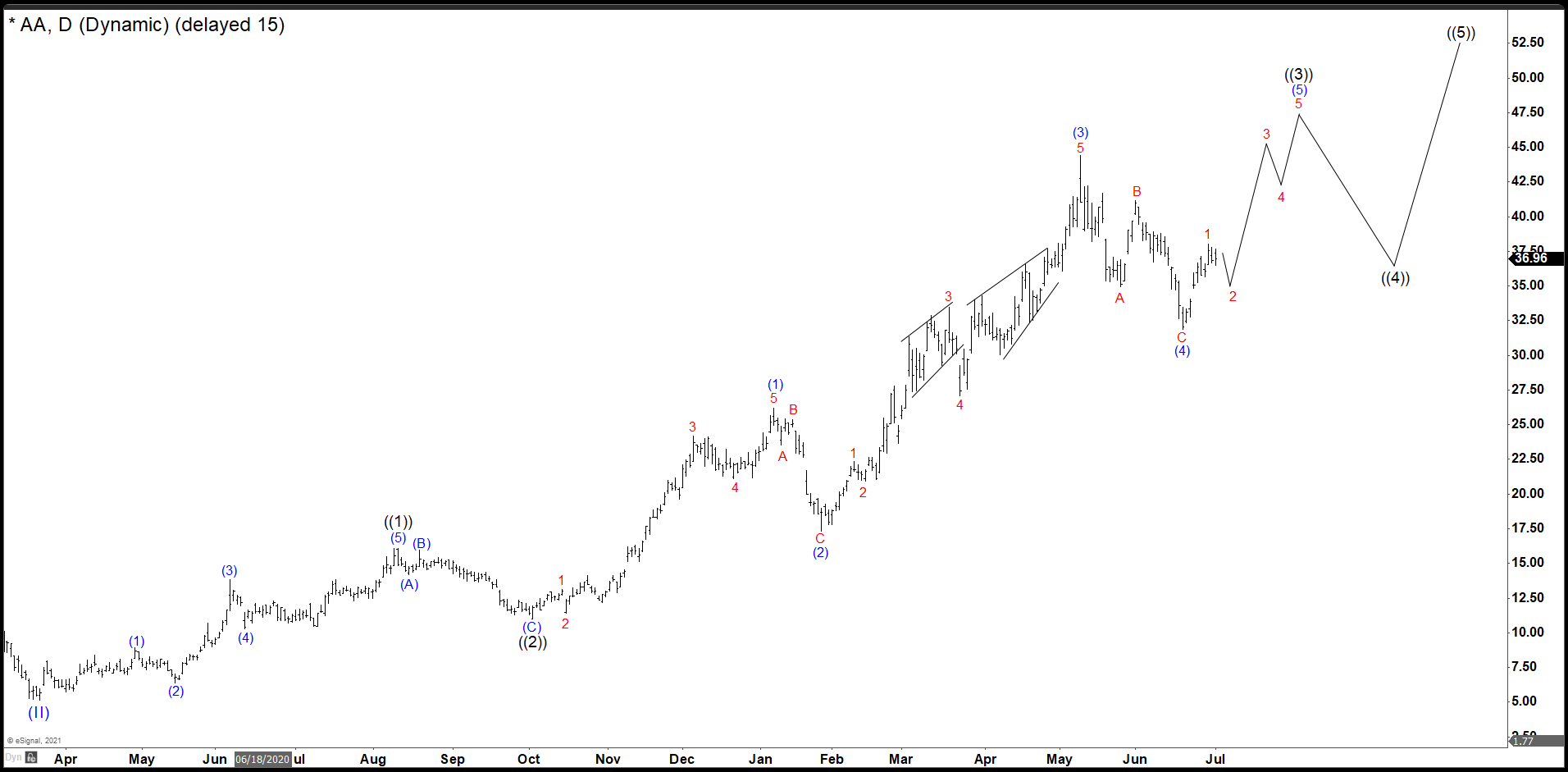

Aluminum Is A Rocket Since March 2020 And Alcoa Knows That

Read MoreSince March 2020 crash, Alcoa (AA) has risen in share value around 800% and with the high prices of the Aluminum it must continue rising its value. Moreover, AA has built an incomplete impulse and it needs to keep the rally to develop the whole structure. We are considering a target above $47.00 dollars in […]

-

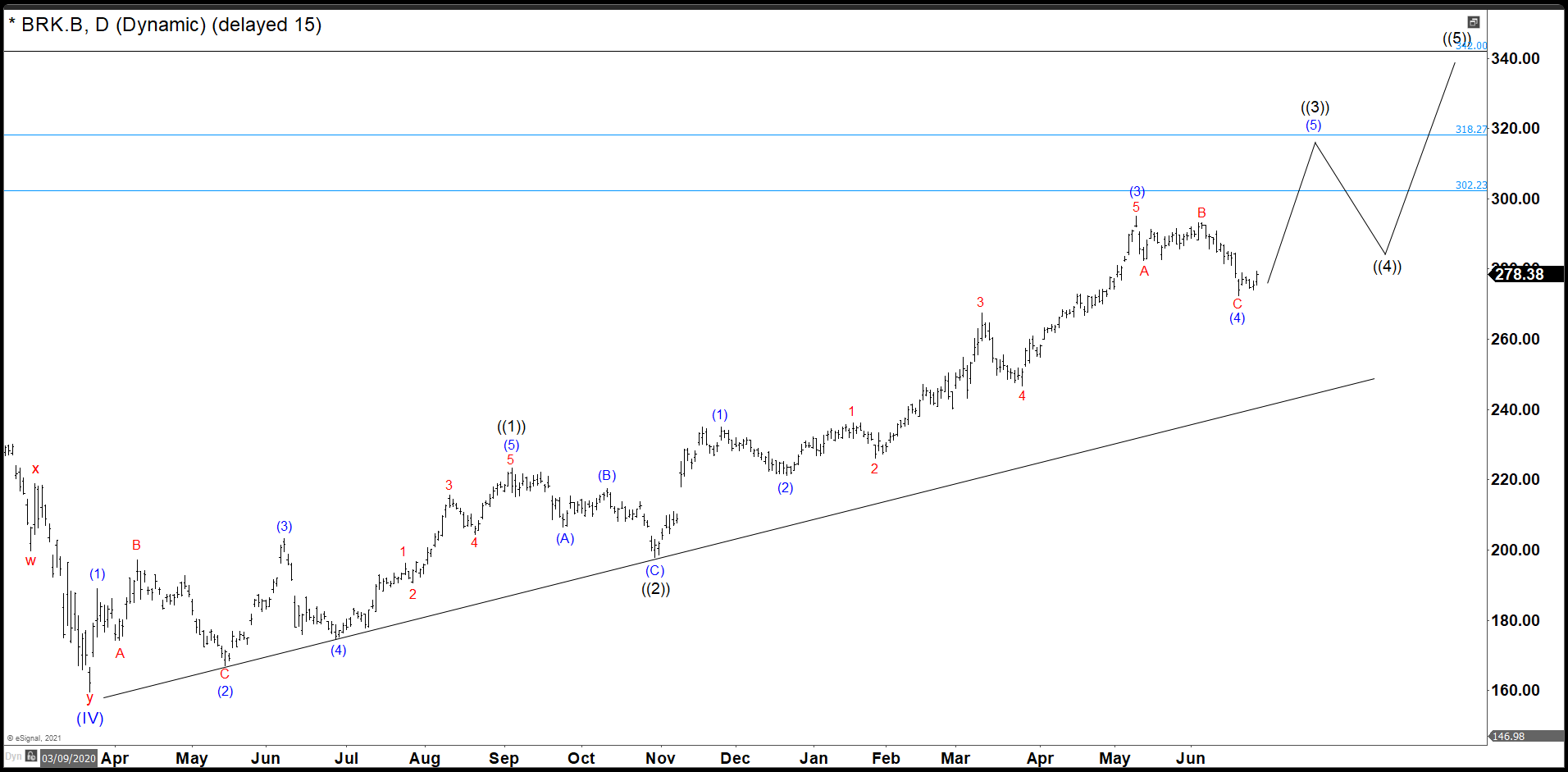

Berkshire Hathaway Needs To Break 295 To End Wave ((3))

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost, and Berkshire Hathaway was no exception. BRK.B did not only recover the lost, but It also reached historic highs. Now, it is building an impulse from March 2020 lows with a target to $318 – $342 area. Target measured from […]

-

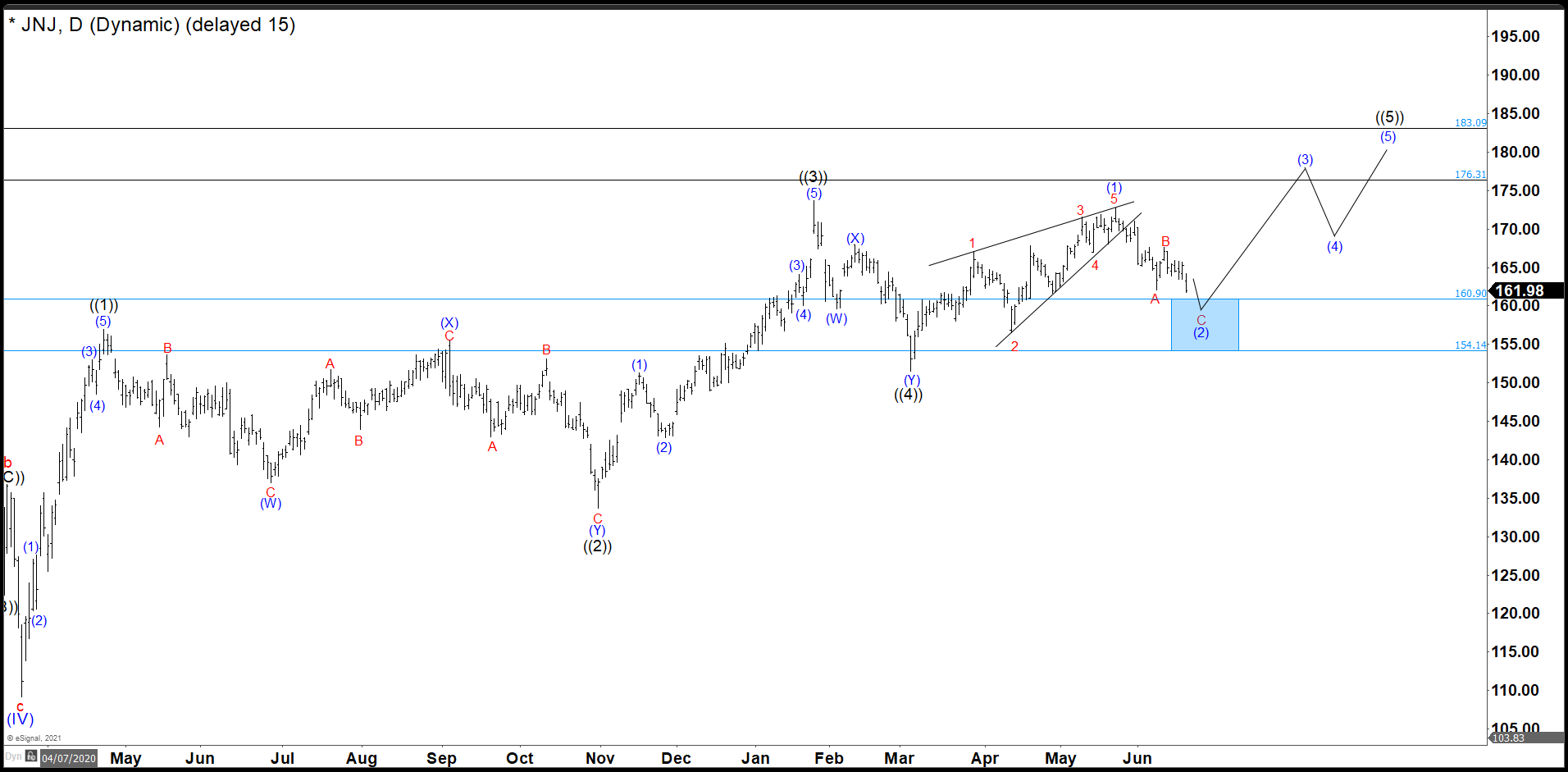

JNJ Is Ending An ABC Correction As Wave (2)

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost and JNJ was no exception. Johnson & Johnson did not only recover the lost, but It also reached historic highs. Now, we are going to try to build a wedge from the March 2020 lows with a target above $176. […]

-

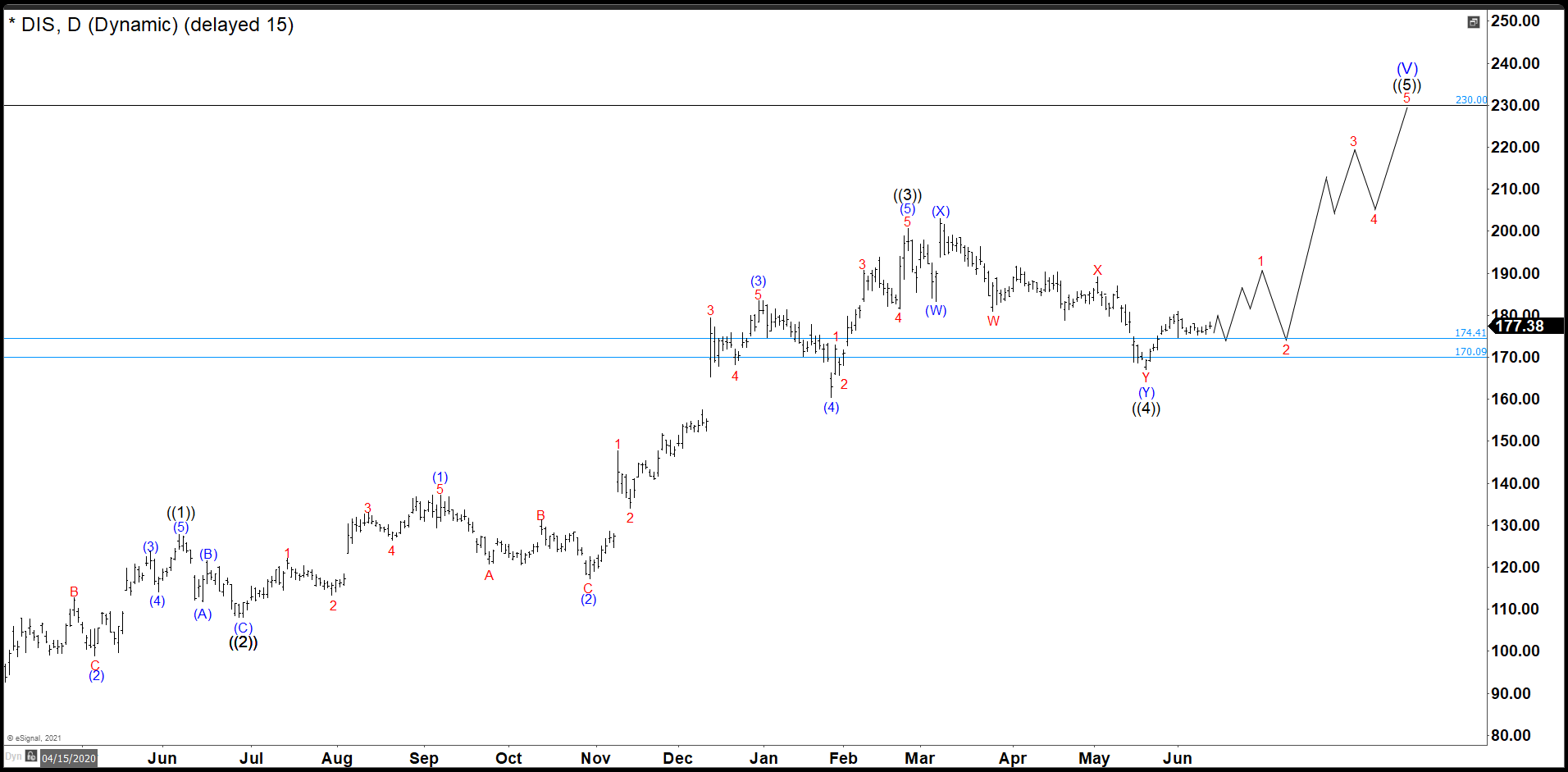

Disney Seems To Have Ended The Wave ((4)) Pullback

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost, and Disney was no exception. Disney did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from the March 2020 lows with a target around $230. Target measured […]