-

JNJ More Downside Is Expected Before Resume The Rally

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost and JNJ was no exception. Johnson & Johnson did not only recover the lost, but it also reached historic highs. In those days, we were looking for an entry in 155.33 – 156.93 area to reach a target above $176.00 […]

-

Disney ($DIS) Connector Is On Its Way Before Continue With The Drop

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost, and Disney was no exception. Disney did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from the March 2020 lows with a target around $230. Target measured […]

-

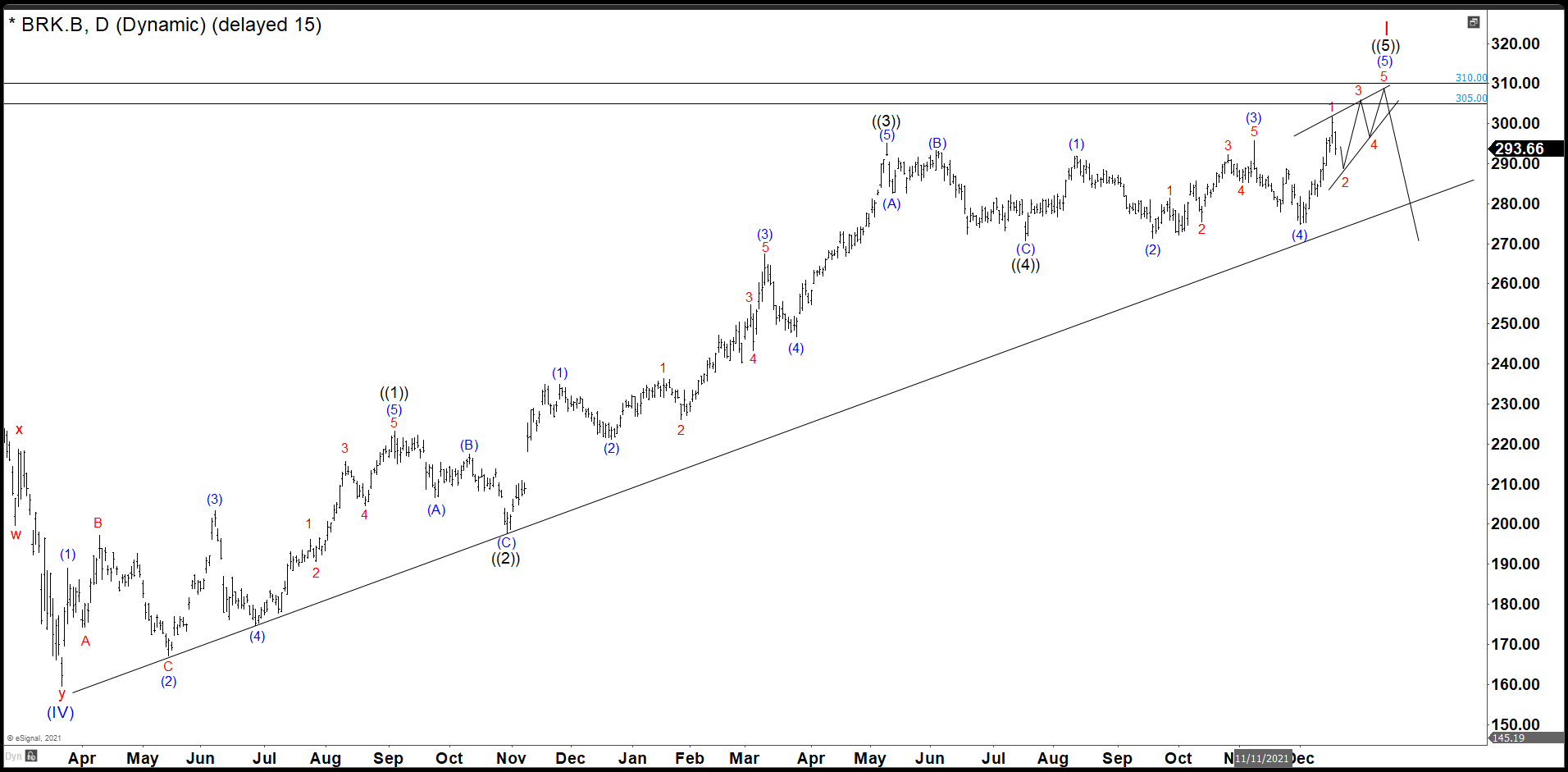

Berkshire Hathaway ($BRK.B) Needs To Break 274.79 To Confirm Pullback

Read MoreAll stocks tried to recover what they lost and Berkshire Hathaway was not exception since the crash of March 2020. BRK.B did not only recover the lost, but It also reached historic highs. Now, it is building an impulse from March 2020 lows and we are going to follow to determinate the best area to […]

-

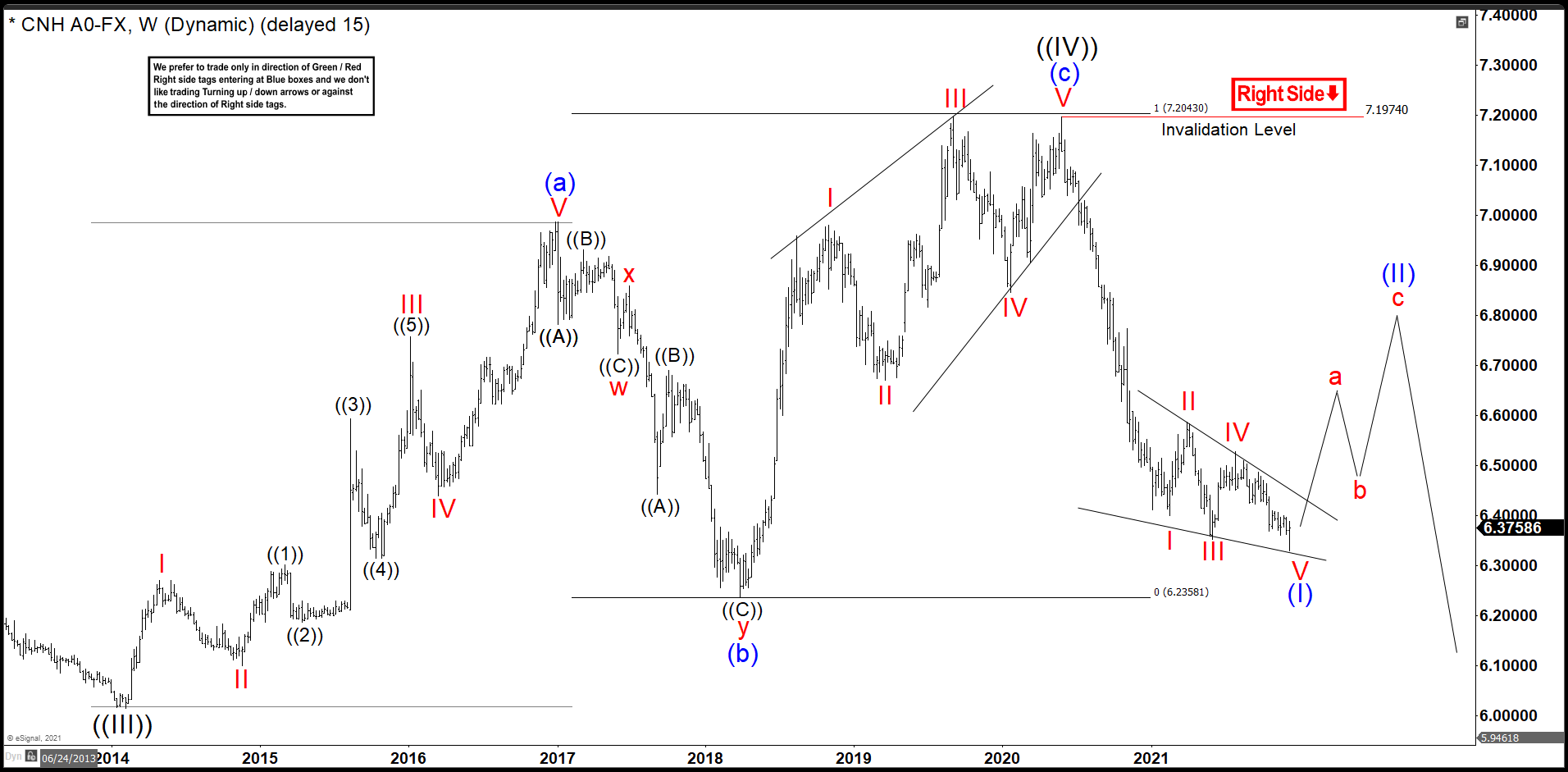

Renminbi Should Continue To Appreciate Against USD In Long Term

Read MoreIn the last years, the renminbi made a pause in his attempt to get stronger against USD dollar. On February 2014, renminbi found support at 6.0153 and from there it made a perfect zig – zag correction structure to the equal legs 7.1964 in June 2020. After that, the USDCNH continue with the downtrend. Renminbi […]

-

Switzerland Index (SMI) Have Completed An Important Market Cycle.

Read MoreThe Swiss Market Index (SMI) is one of the other Capital Markets worldwide that is building motive wave from the lows of March 2020. We can clearly see that it has already completed 3 waves to the upside and we are correcting on wave 4 now. SMI September 16th Daily Chart Wave ((1)) ends at […]

-

SOXX Near To Complete A Market Cycle From December 2018

Read MoreSOXX is semiconductor ETF to provide concentrated exposure to the 30 largest US-listed semiconductor companies. This includes (i) manufacturers of materials with semiconductors that are used in electronic applications or in LED and OLED technology and (ii) providers of services or equipment associated with semiconductors. SOXX Daily Chart The market cycle began on December 2018 […]