-

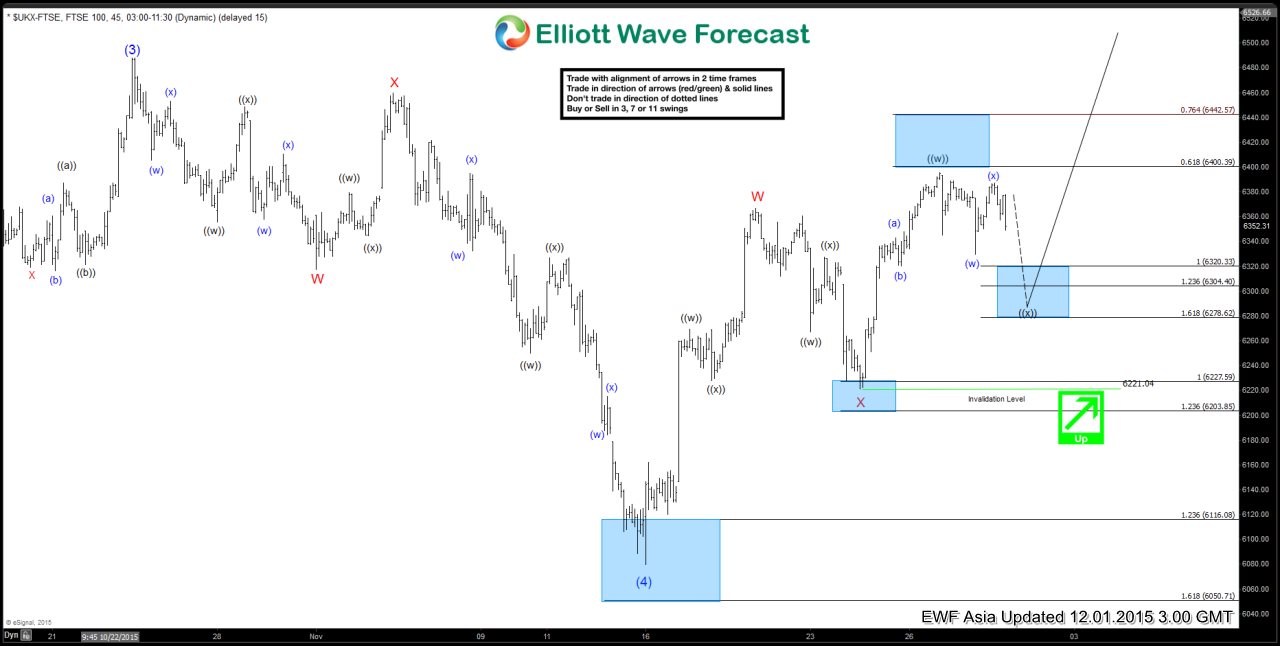

FTSE Short Term Elliott Wave Update 12.1.2015

Read MoreShort term reading of the Elliott Wave cycle suggests the rally from wave (4) low at 6079.8 is unfolding in a double three structure where wave W ended at 6366.8, wave X ended at 6221.04, and wave Y is in progress. Internal of wave Y is unfolding also in a double three where wave ((w)) ended at 6395.3 […]

-

NZDCAD Medium Term Elliottwave Analysis 11.25.2015

Read MoreThis is a medium term Elliottwave Analysis video on $NZDCAD. Pair looks to be correcting the decline from 10/27 peak. So far two swings can be counted and another swing higher is ideal towards 0.88 area before the decline resumes. As far as 0.9015 pivot is holding, pair is expected to resume the weekly move […]

-

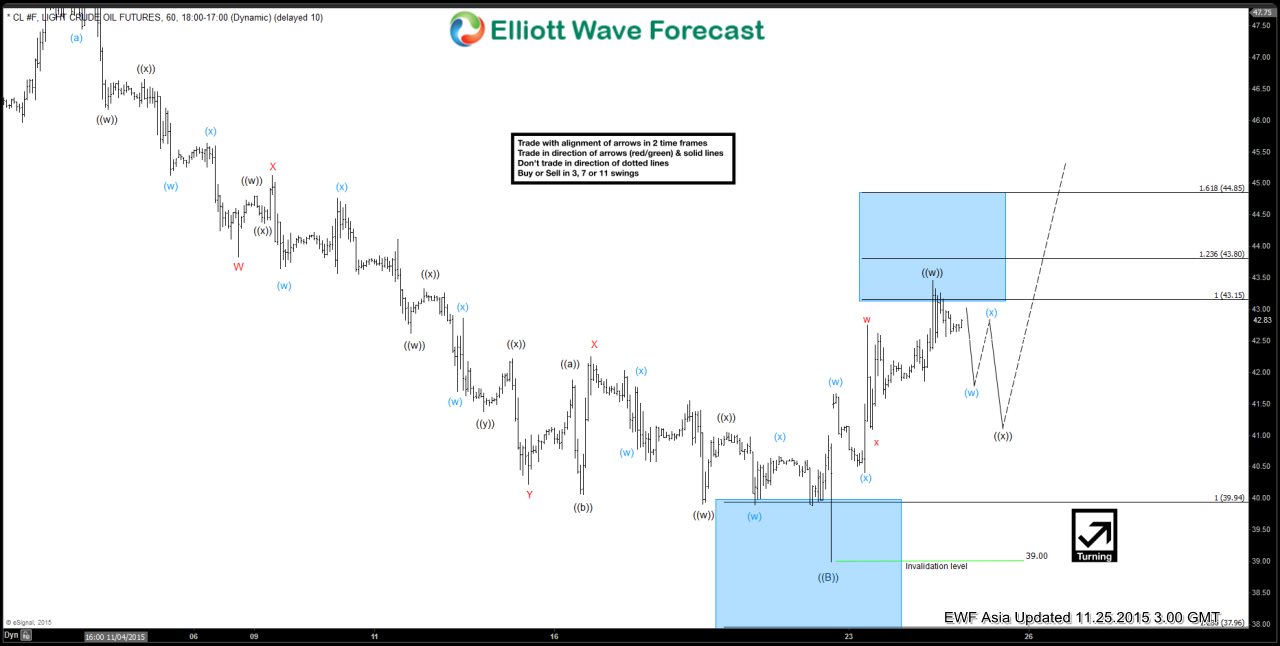

Oil Short Term Elliott Wave Update 11.25.2015

Read MoreShort term reading of the Elliott Wave cycle suggests the decline to 39 at 11/21 ended wave ((B)) and oil has turned higher in a double three structure where wave (w) ended at 41.66, wave (x) ended at 40.41, and wave (y) of ((w)) is proposed complete at 43.46. Wave ((x)) pullback is currently in progress to correct 11/21 cycle in […]

-

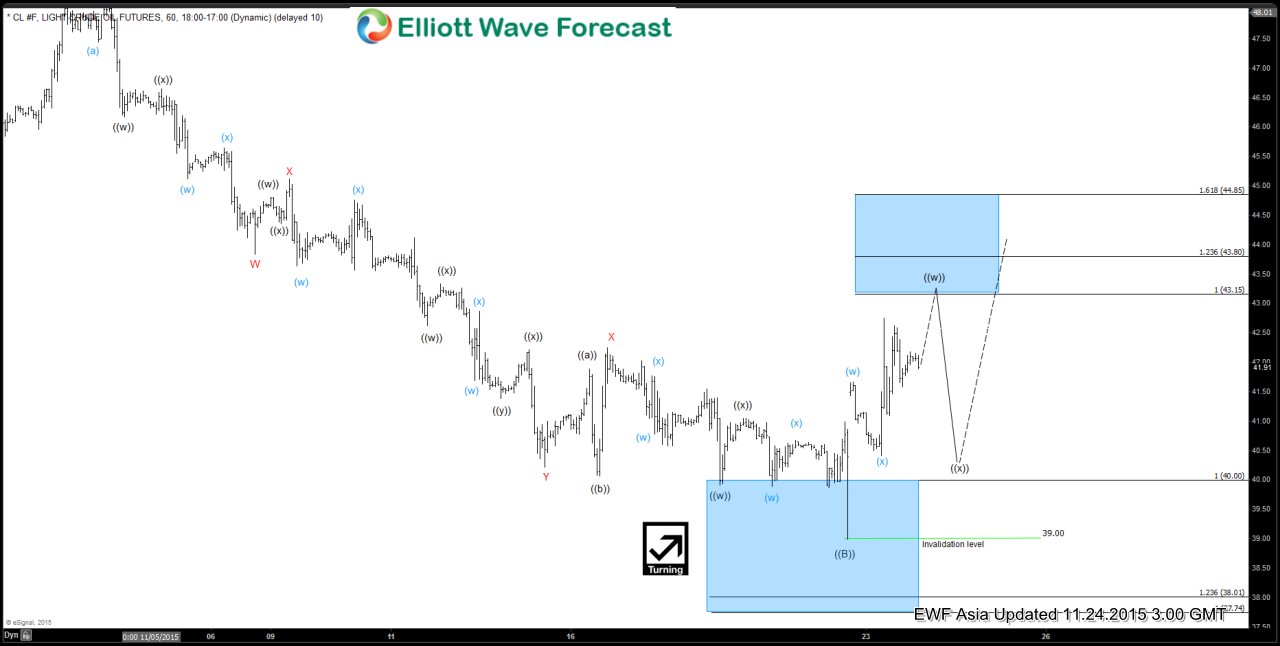

Oil Short Term Elliott Wave Analysis 11.24.2015

Read MoreShort term reading of the Elliott Wave cycle suggests the decline to 39 at 11/21 ended wave ((B)) and oil has turned higher in a double three structure where wave (w) ended at 41.66, wave (x) ended at 40.41, and wave (y) of ((w)) is in progress towards 43.15 – 43.8 to end the cycle from 11/21 low. Once […]

-

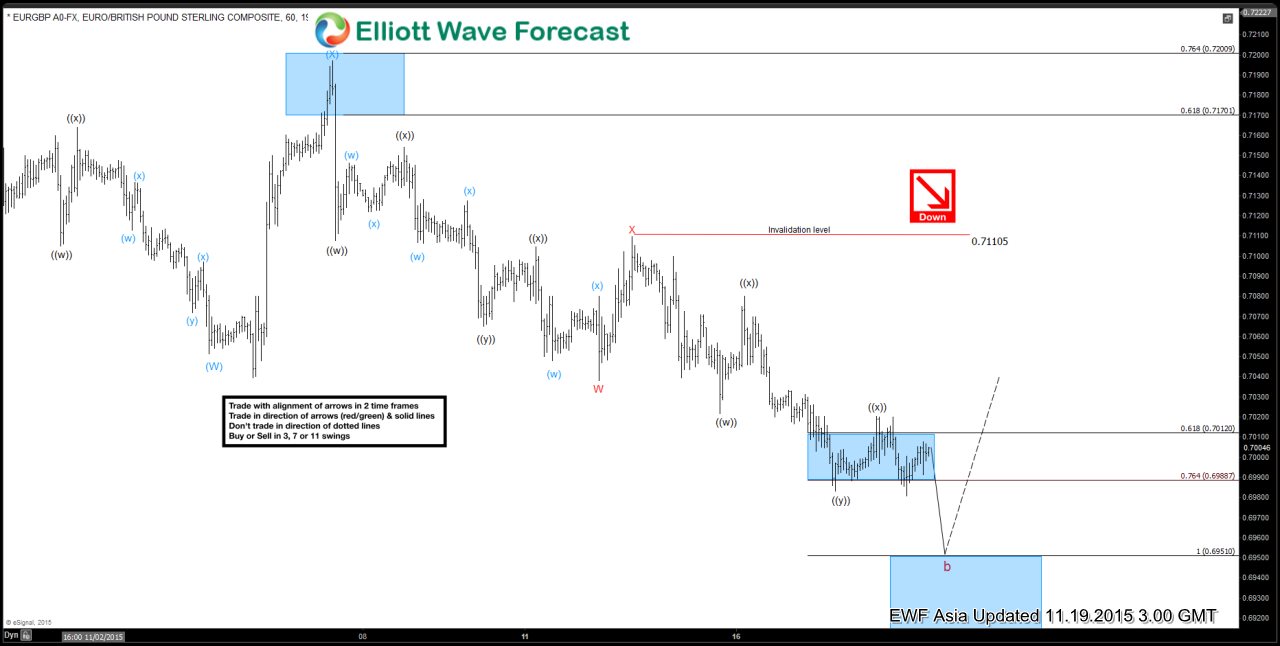

EURGBP Short Term Elliott Wave Update 11.20.2015

Read MoreShort term reading of the Elliott Wave cycle suggests decline to 0.705 ended wave (W) and bounce to 0.7197 ended wave (X). From this level, pair has resumed the decline lower in a double three structure where wave W ended at 0.7038, wave X ended at 0.711, and wave Y is in progress. Internal of wave Y is unfolding as a […]

-

EURGBP Short Term Elliott Wave Update 11.19.2015

Read MoreShort term reading of the Elliott Wave cycle suggests decline to 0.705 ended wave (W) and bounce to 0.7197 ended wave (X). From this level, pair has resumed the decline lower in a double three structure where wave W ended at 0.7038, wave X ended at 0.711, and wave Y is in progress. Internal of wave Y is unfolding as a […]