-

$NZDCAD 4 Hour Elliottwave Analysis 2.16.2016

Read MoreThis is a 4 hour Elliottwave Analysis video on $NZDCAD. The pair is looking to go lower in wave (w) to 0.9 to end the cycle from 2/12 peak, then it should bounce in wave (x) to correct 2/12 cycle before lower again towards 0.883. We don’t like buying the proposed bounce. EWF currently covers 50 instrument […]

-

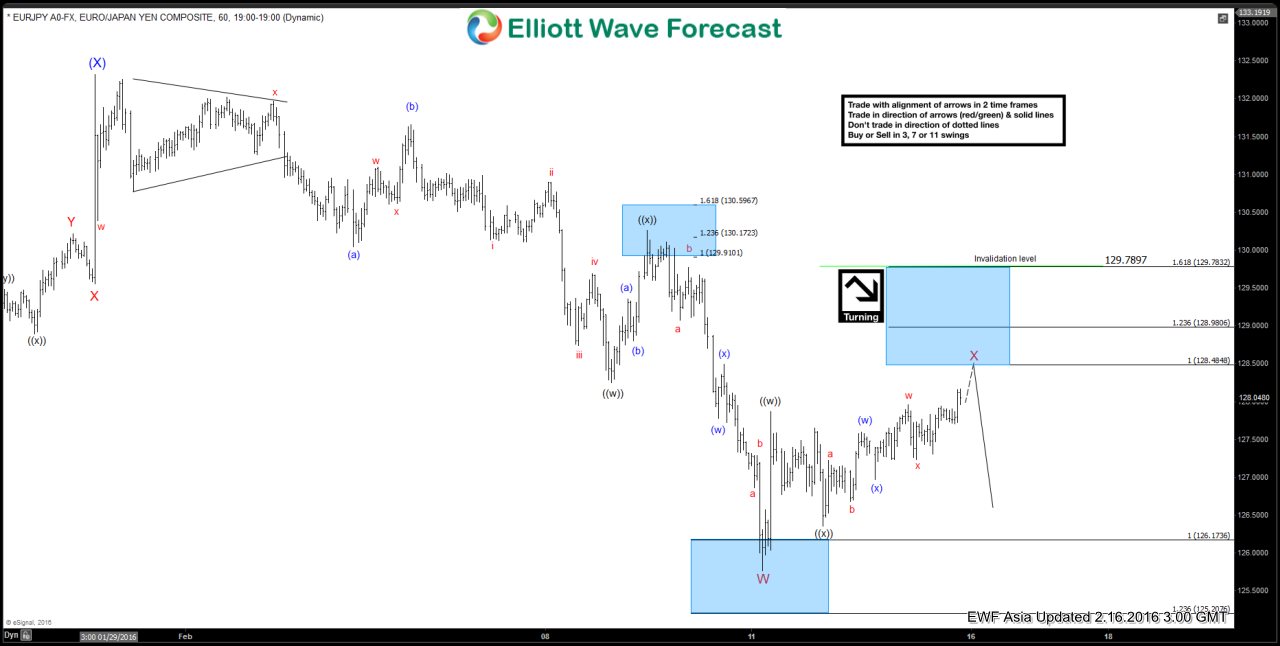

EURJPY Short-term Elliott Wave Analysis 2.16.2016

Read MoreShort term Elliottwave structure suggests decline to 125.76 ended wave W. Up from this level, wave X bounce is unfolding in a double three structure where wave ((w)) ended at 127.87, wave ((x)) ended at 126.358 and wave ((y)) is in progress towards 128.48 – 128.98 area to complete wave X before pair turns lower again. […]

-

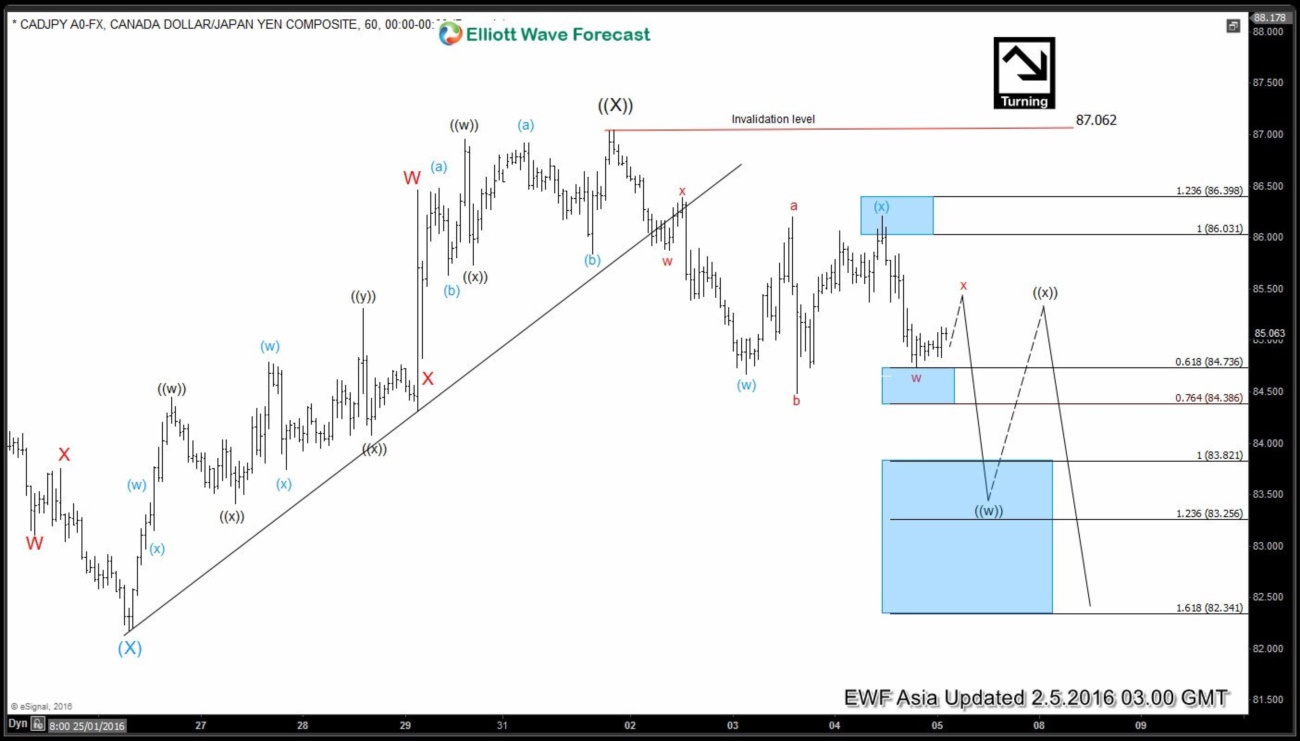

$CADJPY Short Term Elliott Wave Analysis 02.05.2016

Read MoreShort term Elliottwave structure suggests wave ((X)) bounce ended at 87.06. From this level, pair turned lower in a double three structure where wave (w) ended at 84.67, wave (x) FLAT ended at 86.2, and pair has resumed lower in wave (y). Bounces now are expected to stay below 86.2, but more importantly below 87.06, for […]

-

$CADJPY Short Term Elliott Wave Analysis 02.04.2016

Read MoreShort term Elliottwave structure suggests decline to 78.93 at 1/20 ended wave ((W)) and wave ((X)) bounce is unfolding as a double three (W)-(X)-(Y) structure where wave (W) ended at 84.1, wave (X) ended at 82.17, and wave (Y) of ((X)) ended at 87.03. From this level, pair turned lower in a double three where […]

-

$CADJPY Short Term Elliott Wave Analysis 02.03.2016

Read MoreShort term Elliottwave structure suggests decline to 78.93 at 1/20 ended wave ((W)) and wave ((X)) bounce is unfolding as a double three (W)-(X)-(Y) structure where wave (W) ended at 84.1, wave (X) ended at 82.17, and wave (Y) of ((X)) ended at 87.03. Bounces are now expected to stay below 87.03 for at least another […]

-

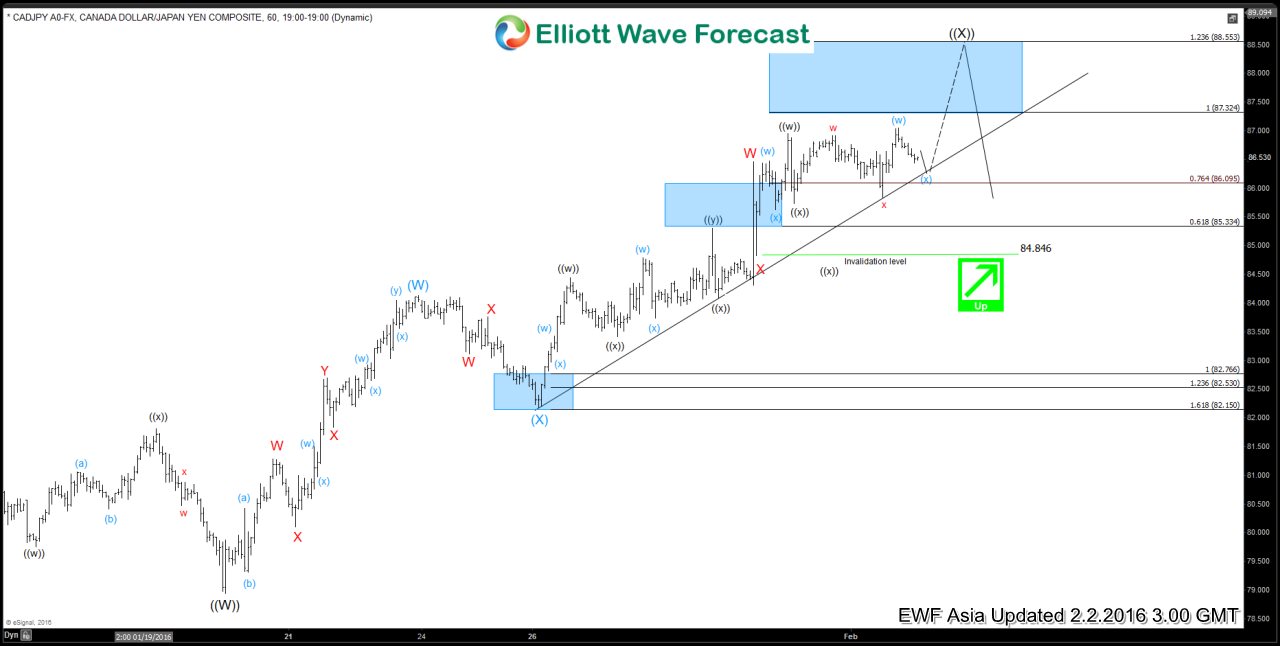

$CADJPY Short Term Elliott Wave Analysis 02.02.2016

Read MoreShort term Elliottwave structure suggests decline to 78.93 at 1/20 ended wave ((W)). From this level, wave ((X)) bounce is unfolding in a double three structure where wave (W) ended at 84.12, wave (X) ended at 82.17, and wave (Y) is in progress towards 87.3 – 88.55 area to end the cycle from 1/20 low. Near term, while pullback stays […]