-

$FTSE Short-term Elliott Wave Analysis 7.12.2016

Read MoreShort term Elliottwave structure suggests Index ended wave X at 5788.7. Rally from there is unfolding as a triple three where wave ((w)) ended at 6229.18, wave ((x)) ended at 5958.66, wave ((y)) ended at 6612.13, and 2nd wave ((x)) ended at 6431.69. Near term, wave (w) is expected to complete at 6702.37 – 6760.55 area, then […]

-

USDPLN Elliottwave Analysis 7.11.2016

Read MoreWeekly chart suggests pair is looking to do a larger pullback to at least correct the cycle from 2014 low, and likely also 2011 low. As far as pair stays below 1/27 peak at 4.158, favor pair to resume lower. For more trading ideas, feel free to check Chart of The Day and take our FREE 14 Day Trial.

-

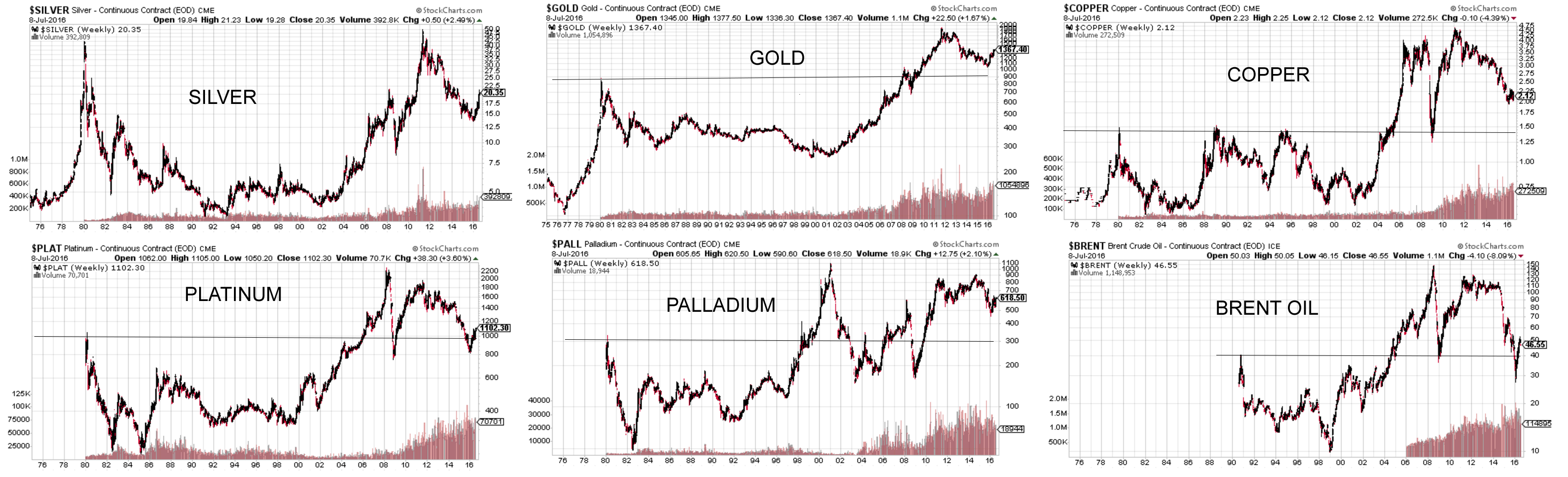

The Bullish Outlook for Silver: Is it the most undervalued metal?

Read MoreSilver’s Intrinsic Monetary Value Silver is a unique metal which belongs to the category of Precious Metal. Along with Gold, Silver has been used as money for thousands of years. It was the Roman Empire in 330 BCE who first used gold and silver in a widespread currency system. Under the Roman currency system, denarius is the name of a […]

-

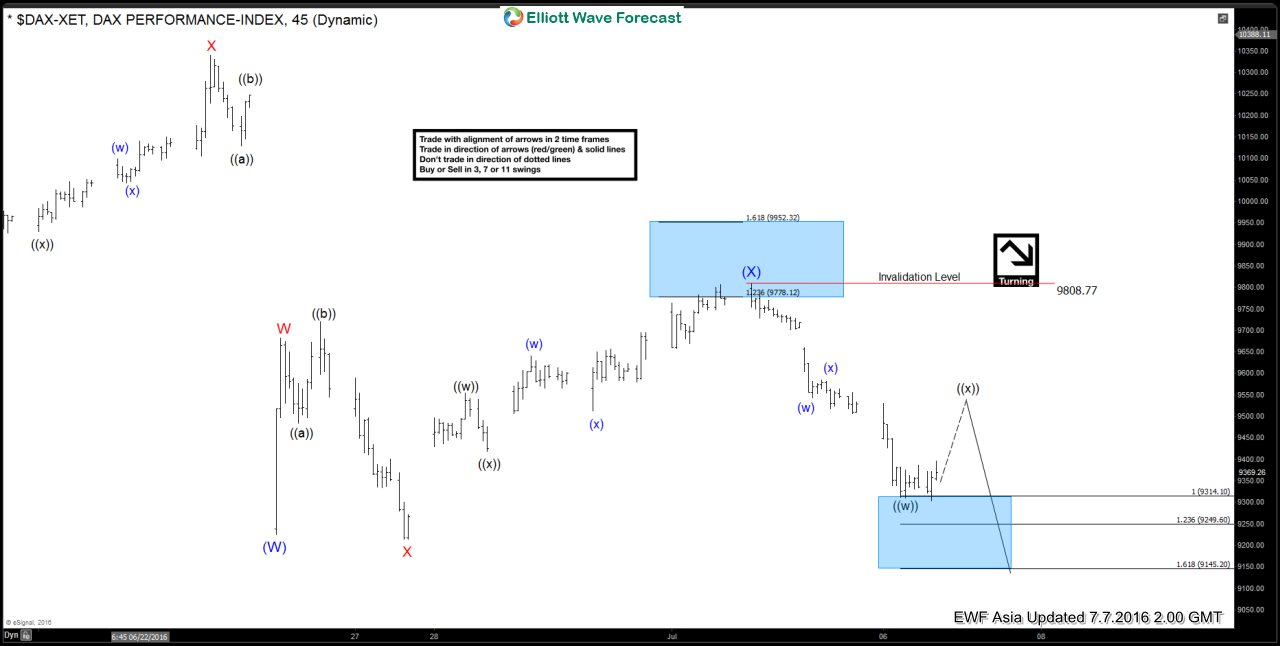

$DAX Short-term Elliott Wave Analysis 7.7.2016

Read MoreShort term Elliottwave structure suggests Index ended wave X bounce at 10340. Decline from there is unfolding as a double correction where wave (W) ended at 9226.15 and wave (X) bounce ended at 9808.77. Near term wave ((w)) is proposed complete at 9310, and wave ((x)) bounce is in progress to correct the decline from 9808.77 in 3, 7, or […]

-

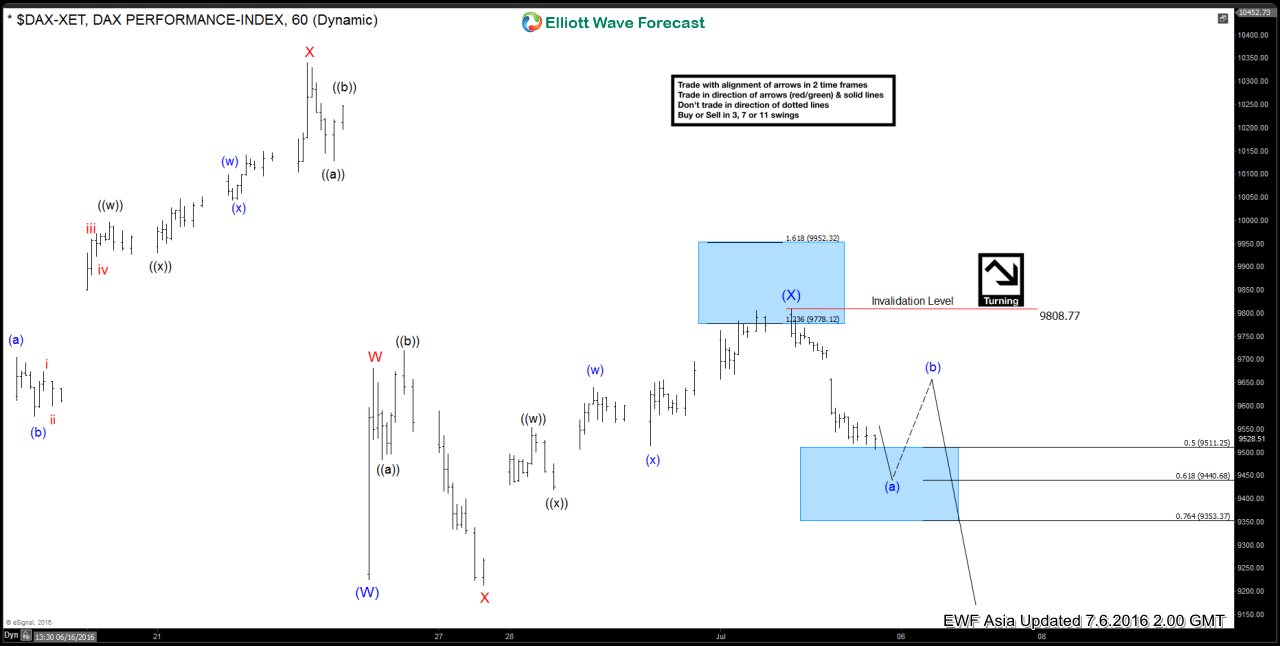

$DAX Short-term Elliott Wave Analysis 7.6.2016

Read MoreShort term Elliottwave structure suggests Index ended wave X bounce at 10340. Decline from there is unfolding as a double correction where wave (W) ended at 9226.15 and wave (X) bounce is proposed complete at 9808.77. Near term wave (a) is expected to complete at 9353 – 9511 area, then it should bounce in wave (b) before […]

-

$DAX Short-term Elliott Wave Analysis 7.5.2016

Read MoreShort term Elliottwave structure suggests Index ended wave X bounce at 10340. Decline from there is unfolding as a double correction where wave (W) ended at 9226.15 and wave (X) bounce is currently in progress as a Flat structure and has scope to extend 1 more leg higher towards as high as 10000 before Index resumes the decline. As […]